Growing up in a complex family enterprise and desiring to learn about the family business is akin to drinking from a fire hose instead of a water fountain. Somewhere along the way, most families realize there are foundational pieces of knowledge around tax, finance, legal, trusts, business, governance, or investing that are critical to their adult children being able to be full engaged and empowered to understand their unique fact pattern better. But at what age and stage do you teach which pieces of information? What is the right mix of technical information and practical skills?

Rarely do families have this education figured out to teach their rising generation as they come of age. Most hope they will somehow figure it out through osmosis and observation, but every beneficiary knows that is never enough.

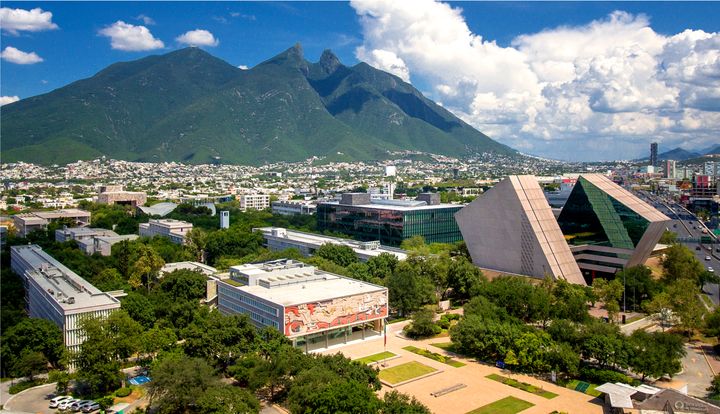

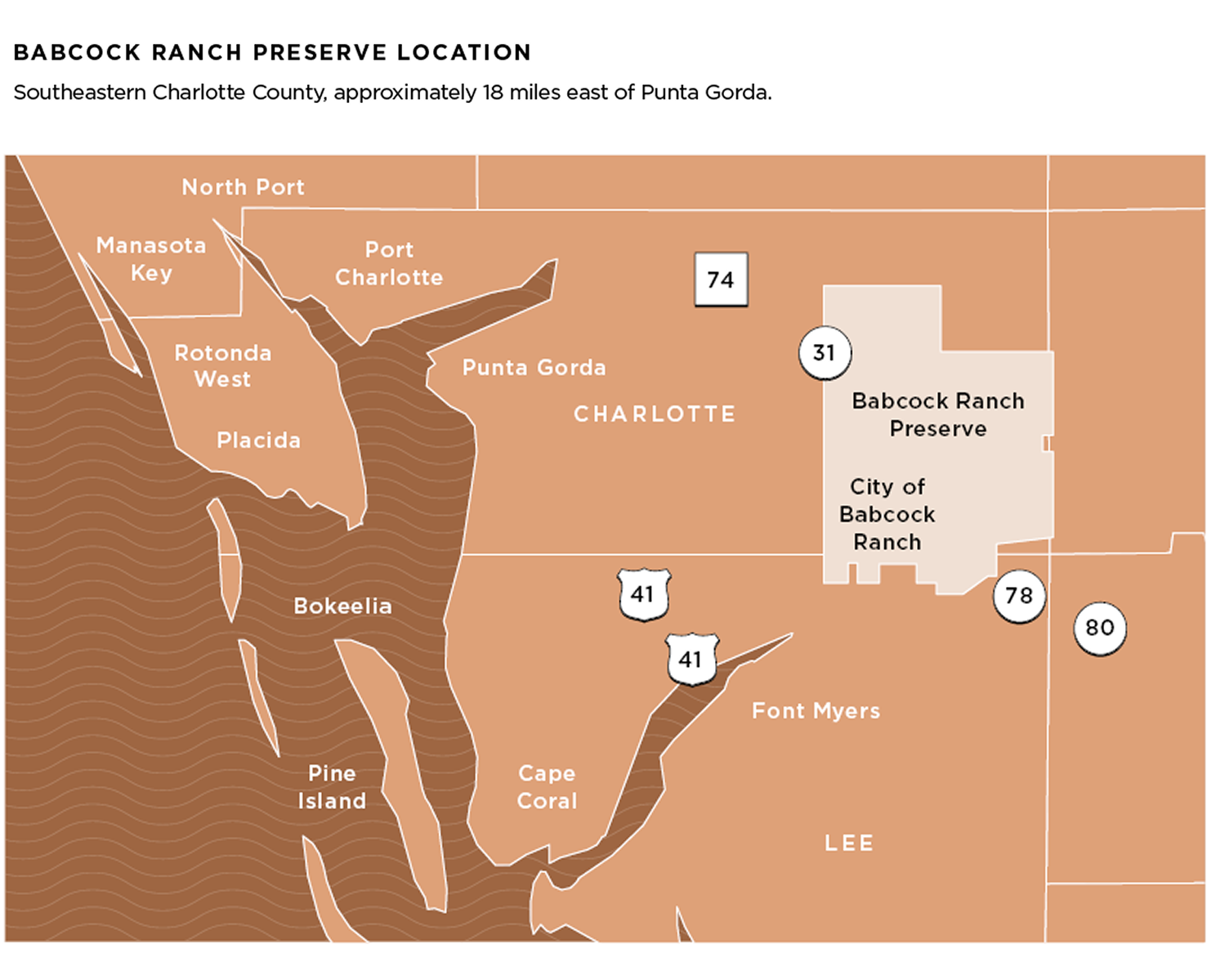

My mother’s family owned a large timber enterprise started in 1887 by her grandfather, E.V. Babcock (Picture 02), and his brothers, Oscar and Fred. Growing up I heard stories of how the ancestors had timbered from upstate New York to Miami around the turn of the century. E.V. purchased approximately 156,000 acres of the southwestern coast of Florida, filled with stands of Florida white pine. Much of that original land was divested or gifted into conservation, and what remained, approximately 91,000 acres, became the Cresent B Ranch, or “Babcock Ranch” (akin to “Yellow Stone,” the TV show). Babcock Ranch was a working ranch and operated a multitude of agribusinesses from organic farming, matt-logging of cypress, a calving operation, a mulching operation, eco-tourism, hunting leases, sod farming, and a base rock mining operation, among others. Sparing all the sale details, it was a significant undertaking involving the local communities and state and federal jurisdictions. For us as a family, it was a pivotal sea change to go from an operating family in 2005, bound together by closely held stock, to a primarily financial family in 2006 after the sale of the ranch.

The Complete Family Office Handbook

Everything you need to know for successful wealth management for families. Although the family office concept is not new, , it is a...

The family’s core green values were a unifying principle to maintain as much of the land for conservation. The ranch was sold to a green developer, Syd Kitson, of Kitson & Partners, a former Green Bay Packer and Dallas Cowboy. He carried the family’s green values and legacy by selling 73,000 acres to the State of Florida for their Florida Forever Program*—the state's premier conservation and recreation lands acquisition program to help replenish the freshwater to the Everglades and concentrate the development of the City of Babcock, named after the family namesake, Babcock, to 19,000 of the 91,000. Kitson stated he was committed to developing only 10% or less of the property. Today, Babcock Ranch is an incredibly innovative green and “smart city” powered by an 8790-acre solar farm, the country’s largest solar-plus-battery storage system, solar tree charging stations, and modern green building and city planning. In 2022, hurricane Ian brought the international television spotlight to Babcock Ranch as a safe haven from the storm, and NBC did a feature on the ranch. More recently, Babcock Ranch was dubbed a “hurricane-proof” city following Hurricane Milton's direct landfall across the property, sustaining only nominal damage. The family’s green legacy is intact, but what new legacies have additional family members continued to leave?

Many of us family members in the fourth generation have gone on to have independent careers and businesses from the origin family enterprise; my sister and brother are successful entrepreneurs, and my cousins are bankers, businessmen, artists, authors, and technicians, operating family offices and philanthropists. I struck out on my career in the wealth management space, working in a broker-dealer, then a multi-family office, and eventually writing two editions of “The Complete Family Office Handbook” (Wiley, 2014/2021), which took me down an entrepreneurial path. Recognizing families’ need for unbiased advice rather than product pitches, I launched Tamarind Partners, a family office consultancy, in 2014. Dubbed a “family office whisperer,” I now help families establish and optimize their offices, navigate ownership and leadership transitions, conduct strategic planning, manage risk, develop organizational structures, and sunset offices when the time comes.

Still, our past shapes us and informs us who we are today. Having just lived through the Pandemic (2019-2022), I recently shared with my daughters how their great, great-grandfather, E.V. Babcock, was the 45th Mayor of Pittsburgh, Pennsylvania (1918-1922) during the Great Influenza pandemic (the Spanish Flu) from 1918-1919. He led that city through highly uncertain times when little was known about this silent-killer H1N1 virus. Additionally, he was an early supporter of the Women’s Suffragist movement (women’s right to vote), which was not secured until Congress ratified the 19th Amendment in 1920. His wife, Marion Babcock, was also among the women leading the Suffragist Movement and is pictured (Picture 04) sitting front row furthest on the left among other women suffragists. E.V. Babcock was the first Pittsburgh mayor to appoint a woman to his cabinet, which was very progressive in that day and age. E.V. was also instrumental in setting up North and South Parks in Pittsburgh, two large parks central to the city dubbed “the people’s country clubs.” He was a visionary well before his time, and one historical document praised him as a “Physical and mental giant; firm of purpose yet tolerant; kind and generous; unostentatious donor of fortunes to charities and municipalities; ...Millionaire manifesting deep-rooted human sympathies.”

What legacy do I want to leave my children and grandchildren? The profound impact of my family heritage, coupled with my love of learning, inspired me to take an innovative and creative approach to look more deeply at the learning gaps facing the rising gen inheritors and beneficial owners while working with many of my family office clients. Did you know that 9 out of 10 family offices have no education curriculum nor do they create annual learning plans for their families? Most (68%) do not have education and an onboarding process for spouses marrying into the family. A similar study found in 2021, that fewer than half of family offices maintain a budget for rising-gen education. Yet, eighty-eight percent of families rely on the family office to supplement learning about financial and wealth education beyond what happens at home. A more recent study found that today, only 1 in 3 offices have a budget for family wealth education, indicating that many families still overlook the critical importance of investing in the human capital of their families.

In 2016, Tamarind Partners worked with a significant, well-known, enterprising family in the U.S. who had highly complex family dynamics and ownership considerations, along with varying levels of knowledge across its beneficial owners. The family was facing a significant ownership transition that required all owners to be knowledgeable and aware of the financial, legal, tax, estate planning, fiduciary, and structural implications of a transfer of stock. But for all owners to sign off, it meant several owners needed more education about these topics to bring them up to par with their other kin, some of whom were attorneys, CPAs and MBAs. Learning in the boardroom was not a safe and comfortable environment for many who felt diminished by their more sophisticated stepsiblings. As their consultant, we recognized the need for a departure from a traditional learning approach that was highly customized. We rapidly prototyped a custom learning solution with custom virtual learning content. This allowed the less knowledgeable side of the family to spend more time on content that was challenging and difficult for them to master and presented an opportunity for the entire family to get to the same level playing field regarding their financial literacy and wealth education knowledge. Now, they were competent and confident beneficial owners, prepared to sit at the boardroom table to make the requisite decision. This client experience inspired what is today, Tamarind Learning.

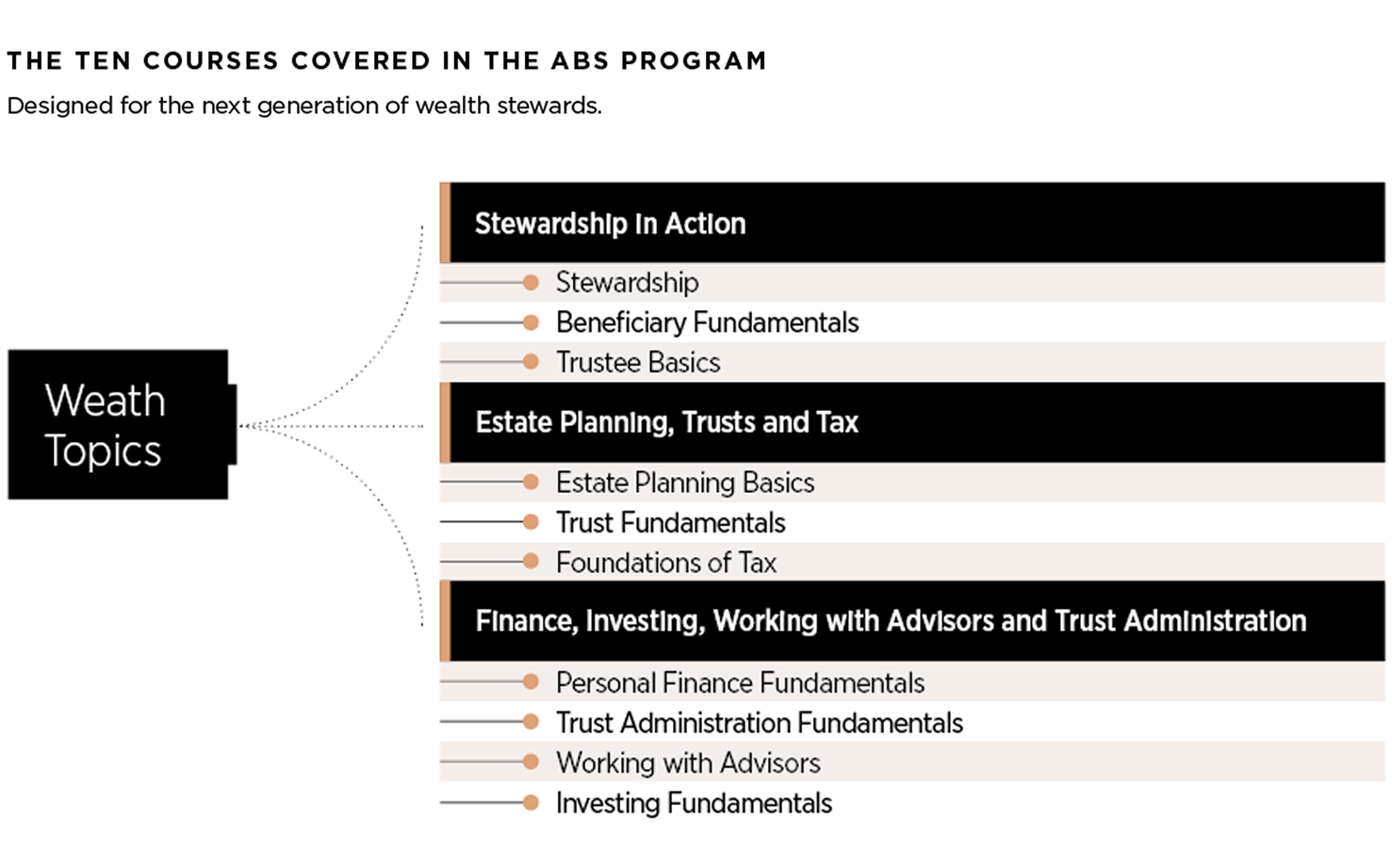

Tamarind Learning, founded in 2020, is an edtech company providing online wealth education courses dedicated to adult learners. Ten courses make up the Accredited Beneficiary Stewardship Designation (ABS), which include Stewardship, Beneficiary Fundamentals, Trustee Basics, Estate Planning Basics, Trust Fundamentals, Foundations of Tax, Personal Finance Fundamentals, Trust Administration Fundamentals, Working with Advisors, and Investing Fundamentals.

The designation is the first of its kind to demonstrate that a family member has completed rigorous coursework across the spectrum of wealth management topics, completed learning checks and quizzes at the end of each module, and a 100-question multiple choice exam. With clear learning objectives, Tamarind Learning provides practical, actionable training that can be applied to real life.

“Did you know that 9 out of 10 family offices have no education curriculum nor do they create annual learning plans for their families?”

Once the senior generation is ready to involve the next generation in shaping the family’s future and vision for the wealth, wealth education is the crucial first step to safeguarding their legacy. By exposing the rising generation to the information and skills they need to act as responsible owners of their wealth, rather than feeling “kept” or “owned by” their wealth, they allow their offspring to flourish and learn by doing.

That was the case for a Canadian family, who empowered their rising-generation family members to learn together as a sibling cohort about what it means to be a trustee in their family. Ten siblings and their spouses committed to learning together and leveraged the courses as a springboard to foster conversations and dialogue on what they wanted in family member trustees for select trusts within their family. By gaining equal footing and knowledge around core legal, investment, financial, tax, estate, and fiduciary concepts, the family could apply it to their bespoke situation.

In another case, a rising-generation family member needed to step up when their father became incapacitated, which was the case for Rebecca P., and she needed to become more financially literate. Rebecca was his power of attorney, and her mother was already deceased. After completing the Accredited Beneficiary Stewardship Designation in five months, Rebecca shared, “The ABS courses have been insanely helpful and have substantially moved the needle on several items related to the administration of my family’s trust. I appreciate the selection of specific chapters from very long books throughout the coursework, as it prevents us [her sister also completed the designation] from doing redundant reading. This was invaluable— what you expect from a college-level course.” Regardless of the situation, Tamarind Learning has met families and their members where they are and can be flexible and adaptable to different cases.

“Once the senior generation is ready to involve the next generation in shaping the family’s future and vision for the wealth, wealth education is the crucial first step to safeguarding their legacy”

Tamarind Learning provides the requisite knowledge and skill-building opportunities to practice and learn from mistakes to feel more prepared when the time comes. Tamarind Learning appeals to all types of curious learners. For those who want to dig deeper, there are more advanced and challenging materials, and for individuals who find the content already difficult, Tamarind makes it accessible, enjoyable, and engaging. Furthermore, Tamarind Learning solves for geographically disparate family members who may be spread around the globe, in different time zones, and who may need to work and learn at different times of the day, which was the case for the Canadian family described above.

Tamarind Learning’s asynchronous format is cost-effective and adaptive, giving busy individuals—like Rebecca, a full-time musician—the flexibility to learn on their own schedule. Whether you’re a caregiver, artist, working professional, on-the-go philanthropist, social worker, or stay-at-home parent, Tamarind Learning serves as a central hub for both individual and group learning. If desired, advisors can also join the learning journey, ensuring a comprehensive, tailored educational experience.

In many ways, our family has come full circle: from being good stewards of our family land to now empowering the next generation of responsible, beneficial owners through Tamarind Learning.

Kirby Rosplock

CEO of Tamarind Partners and Tamarind Learning.

tamarindpartners.com