We believe Artificial Intelligence will give rise to an evolution in software, not an extinction.

| THE ARTIFICIAL INTELLIGENCE ARMS RACE

Two years ago, the launch of ChatGPT provided one of the first glimpses of the possibilities of generative artificial intelligence (GenAI) for consumer use, sparking a global spending boom as demand for foundational AI hardware surged. Like previous technological innovation cycles—most notably, the late 1990s internet boom—certain tech hardware and infrastructure companies have emerged as the early beneficiaries of the AI gold rush, with semiconductor manufacturers at the epicenter of AI-enablement among the biggest winners.

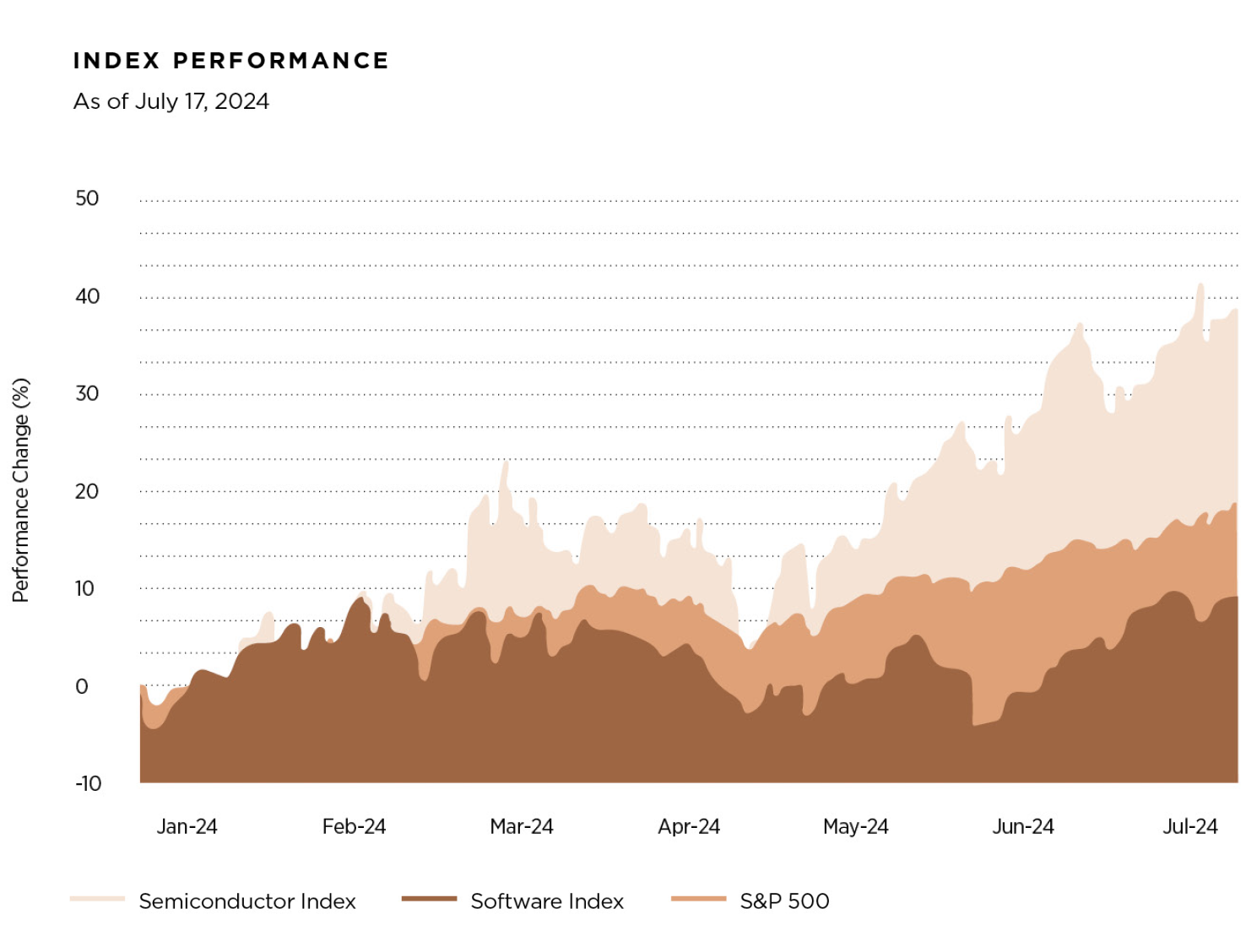

In our view, this trend was one of the main drivers of U.S. equity market performance during the first half of the year. Share prices of semiconductor stocks rallied significantly, particularly compared to those of software companies, many of which have recently reported slower-than-expected growth (see Chart 01).

"...certain tech hardware and infrastructure companies have emerged as the early beneficiaries of the AI gold rush, with semiconductor manufacturers at the epicenter of AI-enablement among the biggest winners."

With spending on tech infrastructure being prioritized amid this AI arms race, software businesses have lagged even though nearly all of the large-cap software companies in our research coverage are integrating gen-AI functionality into their solutions, which could ultimately be accretive to their revenue growth over the next several years.

This year, the divergence in performance between semiconductor stocks and software stocks has raised concerns that the software companies, far from being GenAI beneficiaries, could actually be GenAI victims. Our view is that the current malaise in software is likely more a result of macroeconomic weakness and not symptomatic of a deeper structural issue.

| THE POWER OF SOFTWARE-AS-A-SERVICE

Before GenAI emerged, Software as a Service (SaaS) was among the fastest-growing business models. SaaS businesses grew more than 300% during the 2010s, around five times faster than the revenues of the S&P 500 over the same period. In our view, SaaS companies disrupted the legacy software model, which relied on floppy disks, CDs, and cumbersome on-the-ground installations with solutions that could be accessed via the cloud anytime and at often more reasonable prices.

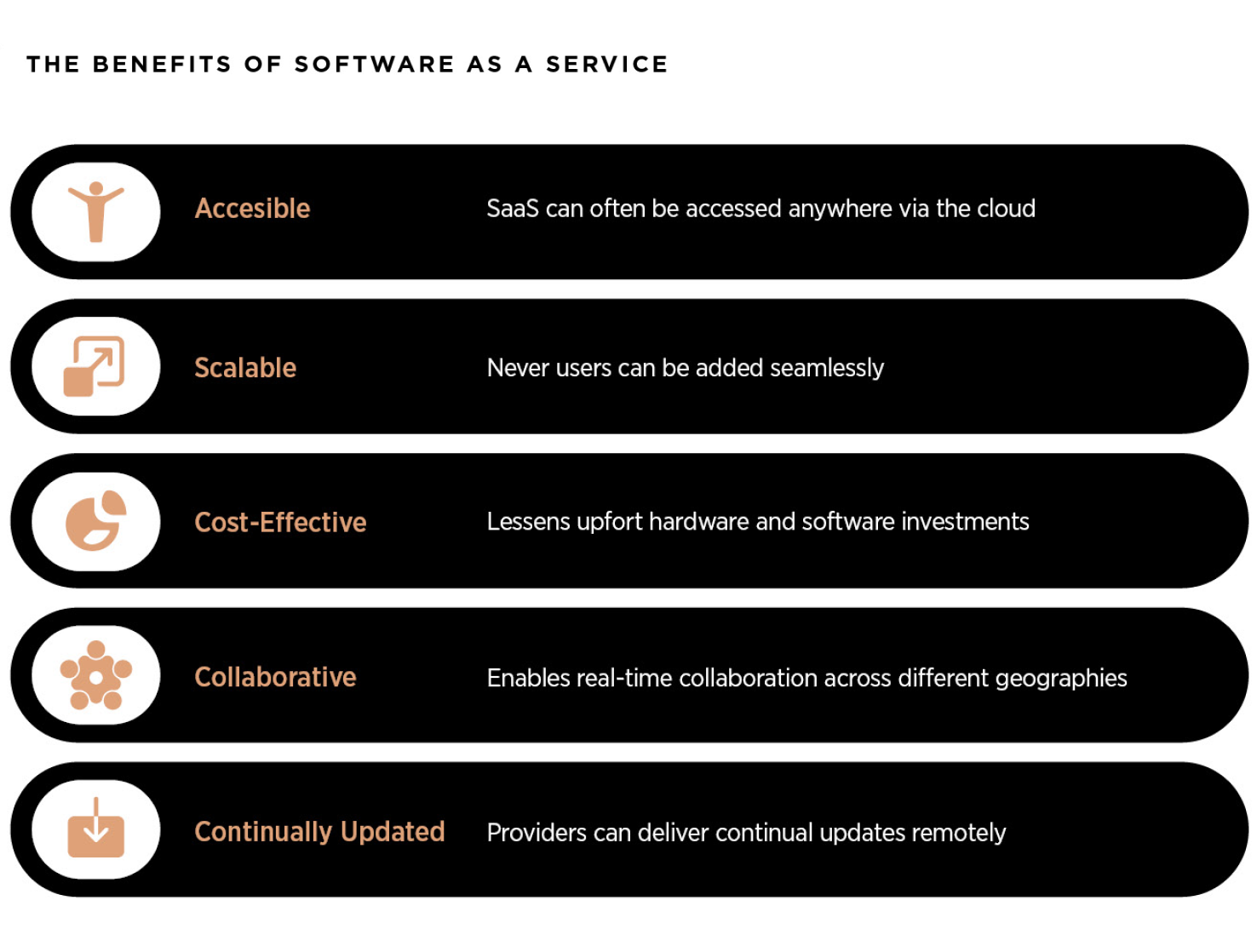

As seen in Chart 02, the proliferation of SaaS companies yielded several benefits for businesses seeking to digitize their operations. It also brought forward new pricing models such as Per-Seat-Pricing to the forefront, which enabled companies to pay a subscription price for each user. This model made it easier for customers to manage their subscription expenses and granted SaaS providers the ability to generate predictable revenues.

Yet, the rapid evolution of GenAI tools has led some market participants to believe that GenAI will help companies automate many jobs, reducing the number of workers needed. According to this narrative, a reduction in employee headcount could translate into fewer software subscriptions, resulting in lower revenues for SaaS companies over the following years. Within this narrative, we believe there are some elements of truth.

Based on the research of some of our software holdings, there appears to be an increased recognition that the current software pricing models may need to be reconfigured. Still, even in this scenario, mission-critical software solutions should effectively be able to price for the value they provide to their customers.

Beyond this, what is evident from our research is that large enterprises are currently scrutinizing their IT spending due to macro pressures, and this has prompted many of them to be more cautious about their software dollars. In our opinion, a good example is human capital management (HCM) software provider Workday's most recent earnings commentary.

| STAYING GROUNDED: DRAWING PARALLELS

In many ways, we see parallels between the emergence of GenAI and its effect on software companies and the breakthrough of glucagon-like peptide-1 medications (commonly known as GLP-1s), which treat diabetes but have been found in medical trials to suppress appetite and induce weight loss, in addition to appearing effective in combating heart disease.

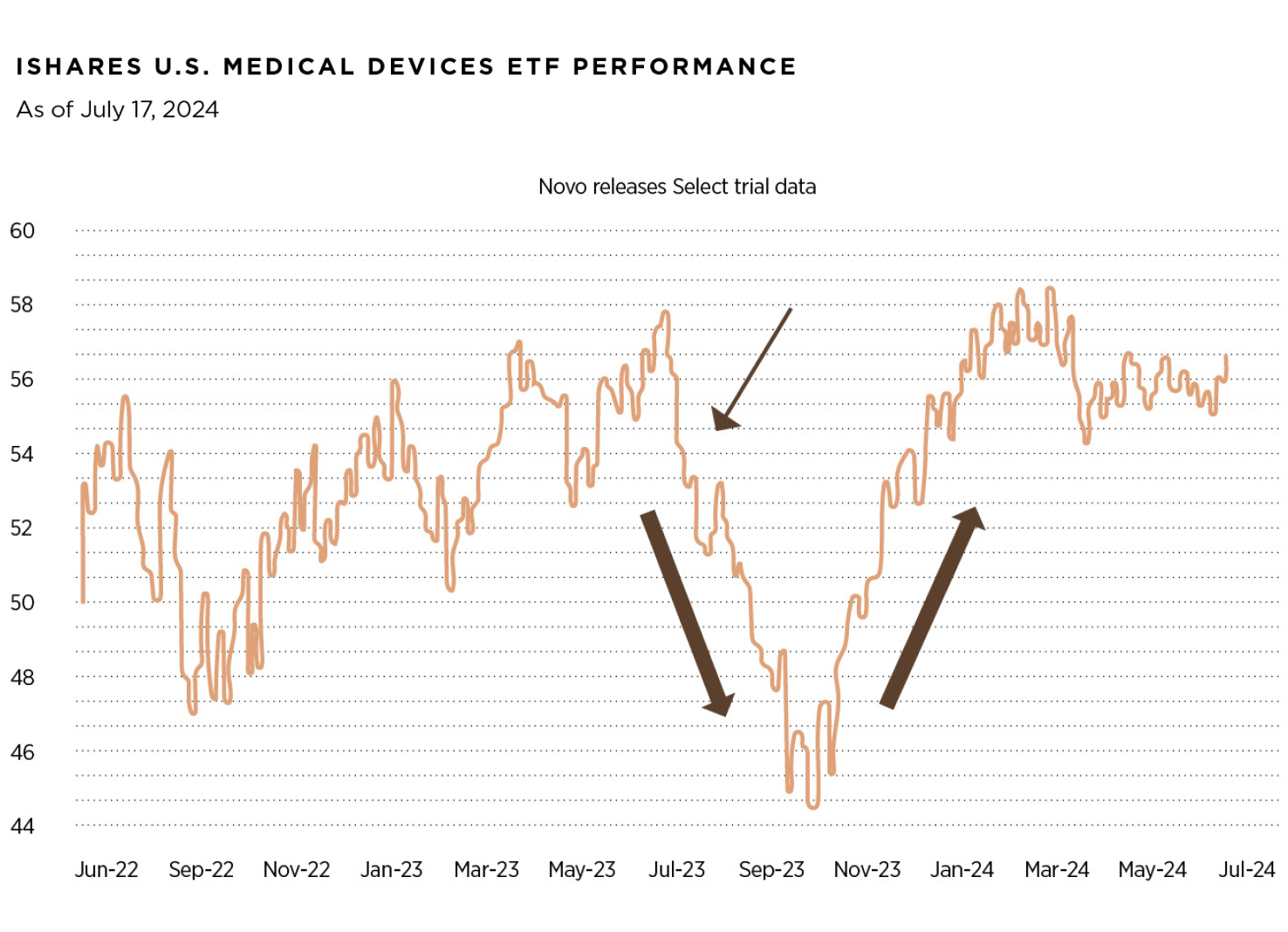

Last year, shares of medical device manufacturers sold off after clinical trial data showed that GLP-1s could have beneficial effects not just on obesity but on other related diseases such as cardiovascular and chronic kidney disorders. Investors speculated that the potential benefits of GLP-1s could reduce the need for various medical devices, ranging from glucose monitors to kidney dialysis treatments.

The resulting "GLP-1 effect" cast a pall over medical stocks last year, and the industry saw a rapid drawdown between July and October, as seen in Chart 03. Nevertheless, a report by Reuters noted that the high prices of weight-loss drugs, uncertainty about the long-term benefits, possible side effects, and the potential lack of insurance coverage for the costs could lessen the impact on medical device manufacturers' revenue.

After the initial selloff of healthcare stocks, the group has staged a comeback, signaling that the initial wave of fear may have been an overreaction. Since then, a new narrative has emerged, stating that a healthier customer base may be a boon for medical device manufacturers since healthier patients may be more active in tracking their well-being and continue buying medical products to monitor their progress.

| EVOLUTION, NOT EXTINCTION

At Polen Capital, we do not believe that the arrival of GenAI will spell the end for SaaS companies. And, even if GenAI leads to fewer "seats," software companies that provide mission-critical solutions should remain in high demand. Throughout the more than three decades since our inception, we have seen similar dynamics in other subscription businesses when there was customer captivity for essential products and services.

Furthermore, innovative software companies are already exploring new revenue models to combat the risk of declining user numbers and better monetize AI-driven productivity gains. Salesforce, for example, has introduced three tier-based subscriptions offering GenAI features. The company is currently testing a usage-based model, where customers are charged based on use volume. Since GenAI relies heavily on computer power, this new model would enable them to profit from their customers' use of AI rather than suffer from it.

Meanwhile, other software companies like Adobe are leading the development of novel GenAI solutions, which we believe will add to their revenue growth. Adobe's Firefly tool uses GenAI to streamline the content creation process, eliminating manual and repetitive tasks and creating value for customers by boosting productivity. Though some software companies are experiencing modest slowdowns in their businesses, as noted previously, we believe this dynamic has more to do with a softer macroeconomic backdrop and technology budget reprioritizations than a structural downturn across the industry.

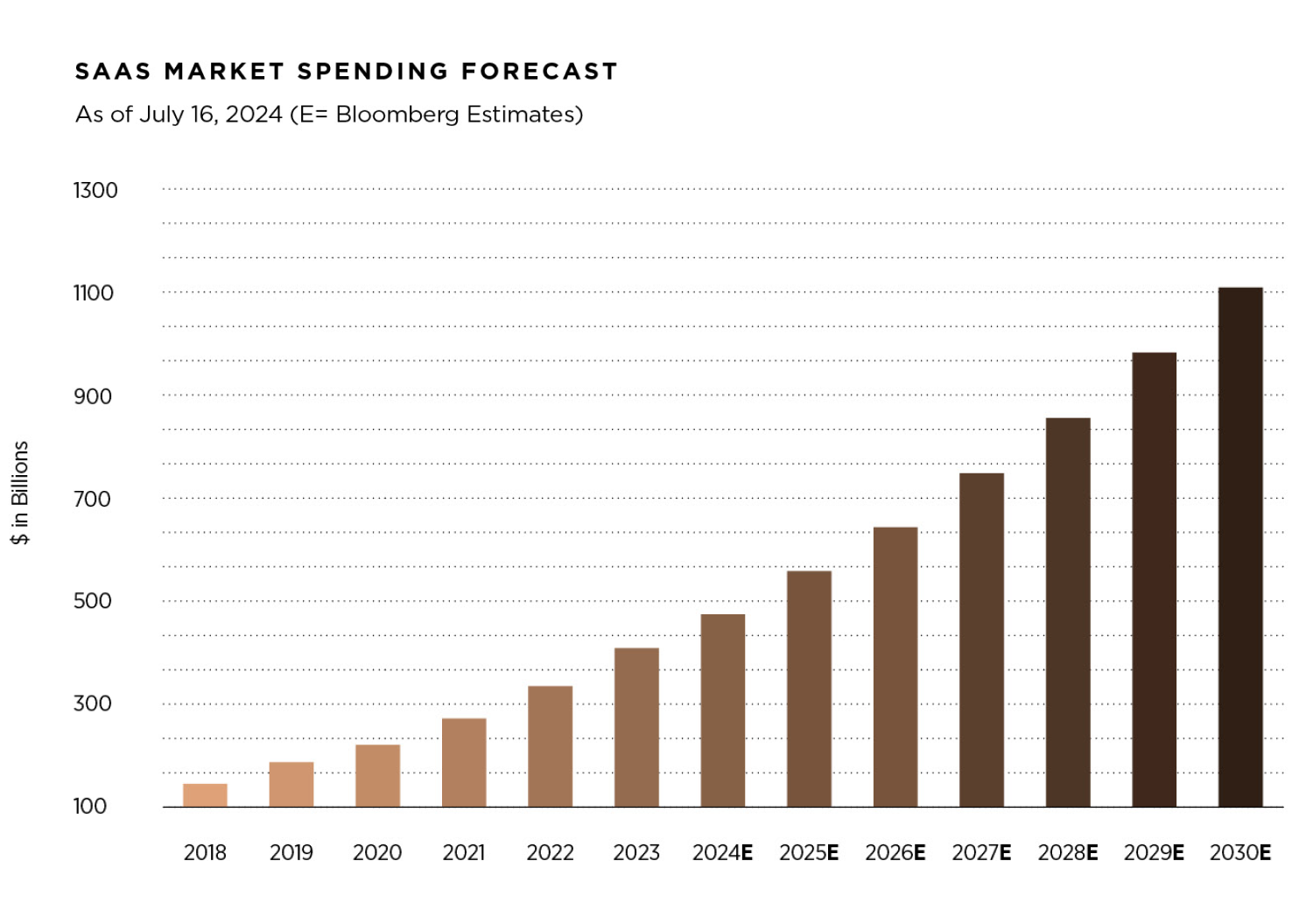

In fact, Bloomberg forecasts total SaaS spending to grow 15-16% annually to more than $1.1 trillion by the end of the decade, as shown in Chart 04. Moreover, Bloomberg estimates that the development of GenAI solutions could add about $280 billion to new software revenue, representing a significant opportunity for those companies able to gain market share.

| INVESTOR TAKEAWAYS: A SYMBIOTIC RELATIONSHIP

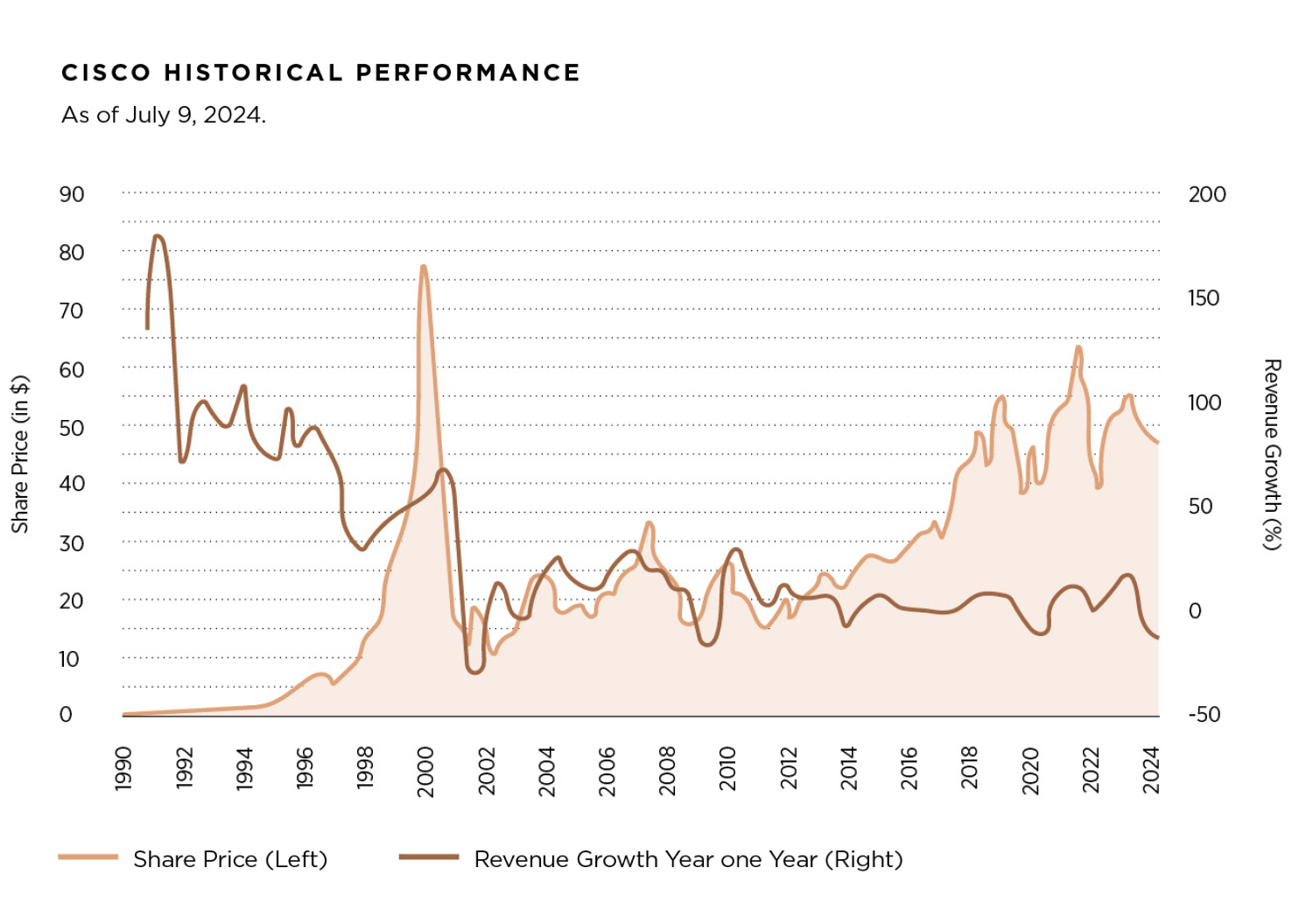

In the early innings of technologically driven landscape shifts, we believe it is logical that hardware and semiconductor companies lead the charge. We saw this dynamic play out in the lead-up to the dot-com boom with companies like Corning—then with a monopoly on the production of fiber optic cable—Cisco Systems—at the time the dominant supplier of routers and switches to move data across the internet—and Sun Microsystems—a former maker of servers and workstations—experiencing sharp price gains.

With time, though, we saw that the massive tech infrastructure buildout turned out to be overdone, and some of the early winners ended up experiencing sharp declines, as illustrated by Cisco's performance below in Chart 05.

Therefore, we believe investors should exercise caution amid the rally in hardware companies, given that, as we have seen previously, market participants tend to extrapolate this kind of hypergrowth into the future. In our view, the nature of hardware is that customers order a lot to build upfront capacity but then pause to evaluate the need for more and then add incrementally, but typically not in the same magnitude as during the initial arms race. In our experience, this causes the boom-and-bust cycles we have seen in cyclical industries in previous years.

Despite our constructive outlook on the software sector, we believe that not all software companies are created equal. While we believe that in the long-term, most of the economic benefit of GenAI—which remains largely untapped—will accrue to services and software businesses, our view is that the divergence of winners and losers across these industries will widen as some become AI champions and others may be displaced by competitors.

Therefore, we recommend a selective approach for investors seeking opportunities in the SaaS space, targeting competitively advantaged companies with high customer retention rates and mission-critical enterprise software products. From our perspective, these companies will be able to weather future headwinds by leaning on pricing power and effectively monetizing GenAI in their product suite, supporting our view that GenAI will spark an evolution in software, not extinction.

Polen Capital

Global leader in quality growth and high yield investing.

polencapital.com