In line with our view that the US economy will expand in 2024, albeit at a slower pace, the backdrop for mega-cap information technology stocks remains positive, while defensive and cyclical stocks also warrant a mention. We spoke to Mathieu Racheter, Julius Baer Head of Equity Strategy, who outlines his key calls in the context of the changing economic cycle below.

JULIUS BAER: We expect a soft landing for the economy in 2024. What does this mean in terms of your equity strategy?

MATHIEU RACHETER:

As we enter the new year, we expect neither a boom nor a bust when it comes to economic growth. After last year’s almost unprecedented rise in US Treasury yields, our expectation is for a Goldilocks scenario of a soft landing in the US, shaped by stable growth and stable interest rates. This would allow bond yields to continue to fall and equity prices to rise further, which would be an environment favourable for growth stocks. Accordingly, we are generally constructive on equities, and within equities we maintain a clear preference for US stocks with a quality growth bias.

J B: Following the strong performance of US stocks in 2023, do you still see them in pole position in 2024?

M R:

Our clear regional preference for US over European equities is supported by the fundamentally constructive backdrop for US equities. The US equity market has seen broad-based improvements in recent months, as corporate earnings growth is now back in positive territory and risk appetite has recovered strongly from the shock sequel of events that included inflation spikes, a rate frenzy, geopolitics, and recession fears. The resulting resumption of a secular bull market in US equities could mark the start of a new attempt to push above their highs of 2021. In addition to our fundamental view, the technical picture speaks in favour of US equities relative to their European counterparts. Furthermore, the relative performance of US equities versus safe-haven assets, such as gold and government bonds, continues to strengthen, which is a sign that investor sentiment is improving. As for the US dollar, we expect the greenback to remain rangebound in 2024.

J B: Artificial intelligence stole the show in 2023, and the Magnificent 7 proved themselves worthy of the name. Does this mean that you will maintain your quality growth preference in 2024?

M R:

In terms of styles, we like quality growth, with a particular focus on information technology (IT) and communications companies, which make up approximately 40% of the S&P 500, due to their superior earnings momentum relative to other sectors. At the same time, they benefit from stable or lower yields due to their relatively longer duration profile. The current super cycle of growth and innovation in artificial-intelligence (AI) technology has important implications for asset allocations given that, in the past, it has led to significant shareholder value creation among those companies at the forefront of the movement. Now that we have moved into 2024, it appears as though there will be a continuation of the bull market in the US IT sector, as AI continues to establish itself in industries as diverse as healthcare, automobiles, advertising, and education.

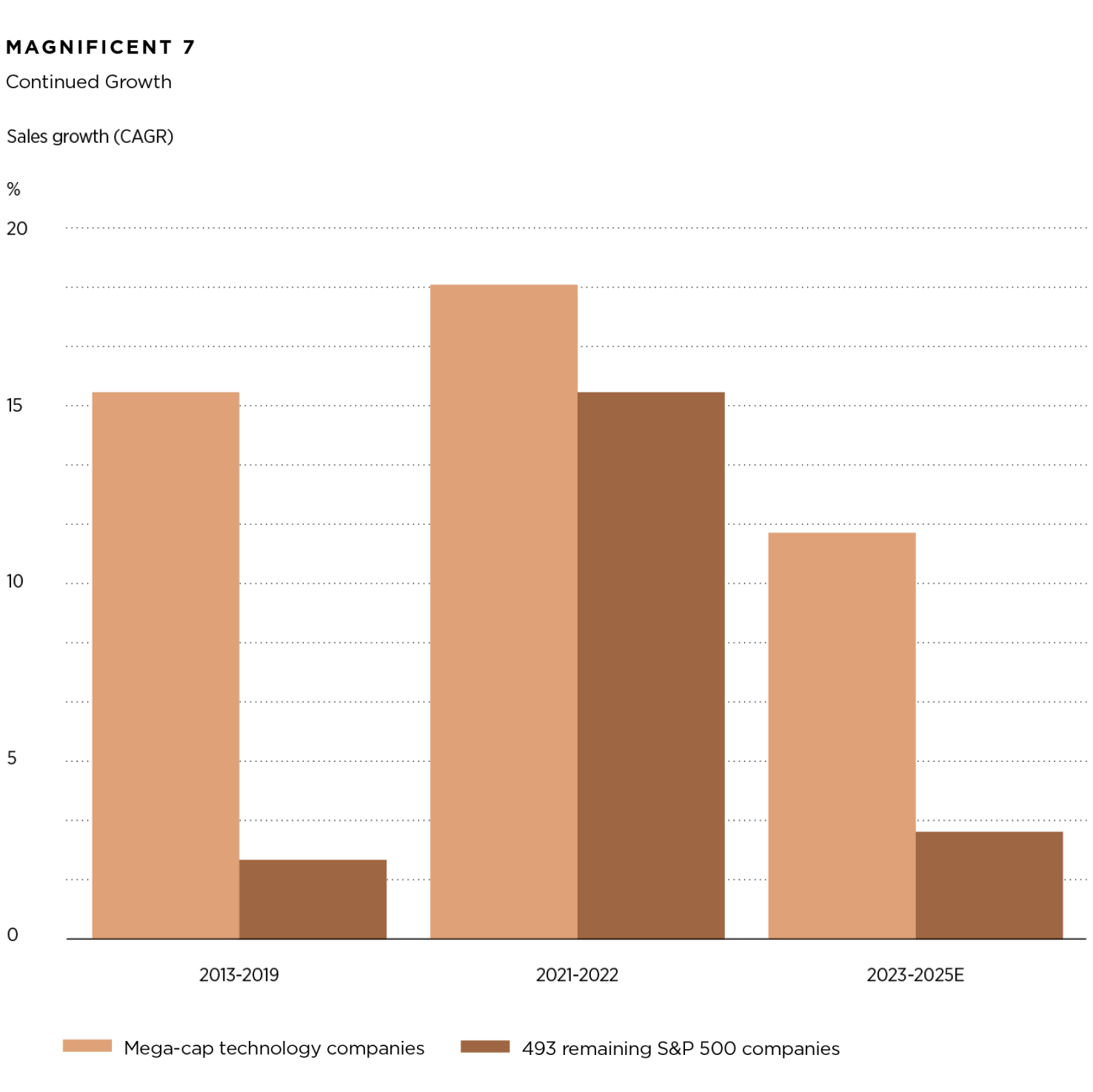

AI has also been the driver of the rise in the Magnificent 7 stocks. This was demonstrated by their phenomenal rally in the first seven months of 2023, when they dominated market returns as their bottom-up fundamentals continued to improve.

Given their outsized impact on US stock market performance and their prevalence in many investment portfolios, their prospects are of particular importance. We still like last year’s winners and see any possible corrections as an opportunity to increase exposure to the group. Their continued strong free-cash-flow generation, coupled with their leading positions in key growth markets, means that they remain front and centre when it comes to value creation.

J B: Given the dominance and outperformance of the IT and communications sectors, many defensive markets were left behind in 2023. Is the outlook for defensives now more attractive?

M R:

Absolutely. The more appealing valuations of defensives now offer an attractive entry point. For investors keen to add a little robustness to portfolios, we advocate building up some defensive exposure, where we see opportunities in the areas of healthcare, Swiss equities, and European utilities. With specific regard to the healthcare sector, we like it due to its inherent defensive characteristics and see opportunities in large-cap biopharmaceutical stocks, in particular. For example, companies offering drugs to combat obesity have been in the news lately, as the demand for their weight-loss treatments far outstrips the supply. As a longstanding outperformer, we believe the healthcare sector offers the best long-term growth prospects among its peers. We also see further value creation potential in the health insurance space, along with attractive investment opportunities in the area of MedTech, as higher costs for more orthopaedic and cardiovascular procedures validate the case for positive MedTech momentum.

The Swiss equity market should also not be overlooked, since it represents one of the most defensive markets within the equity universe. Investors in Swiss stocks not only benefit from exposure to stable and growing companies but also from currency appreciation. The Swiss franc is among the world’s strongest currencies and typically provides a hedge against global growth and geopolitical risks. In the longer term, we expect the Swiss equity market to remain a store of value, offering investors a comparably high degree of stability coupled with the prospect of long-term growth.

"Investors eager to increase their exposure to cyclical markets may consider some of our preferred subsectors, which include automotives, semiconductors, machinery and equipment, and transportation"

— Mathieu Racheter, Head of Equity Strategy

J B: As the year progresses and the new economic cycle emerges, will that finally be the moment when cyclicals make a comeback?

M R:

After a potentially shaky start to 2024, confidence is expected to bounce back later in the year. Once the economy has reached its trough, the prospects for 2025 and beyond should be priced in by the second half of the year. Thereafter, we expect market participation to broaden and would advocate tactically adding cyclical exposure in anticipation of a new economic cycle. Investors eager to increase their exposure to cyclical markets may wish to consider some of our preferred subsectors, which include automotives, semiconductors, machinery and equipment, and transportation.

Julius Baer

International wealth management group, based on a solid Swiss heritage.

infamilyglobex.com