| HEDGED FUNDS IN A NUTSHELL

A hedge fund is an actively managed fund that generally offers an unconstrained investment mandate and pools capital from accredited investors or institutional investors. Hedge fund managers are actively seeking investment opportunities to generate “alpha” (returns in excess of overall market levels), while also protecting against significant loss. To deliver alpha, hedge funds have to hire some of the most talented professionals in the investment world, from high-profile portfolio managers to skilled research and data scientists. Hedge funds are considered as “alternative investments,” a group that comprises all asset classes outside the traditional categories of stocks, bonds and cash.

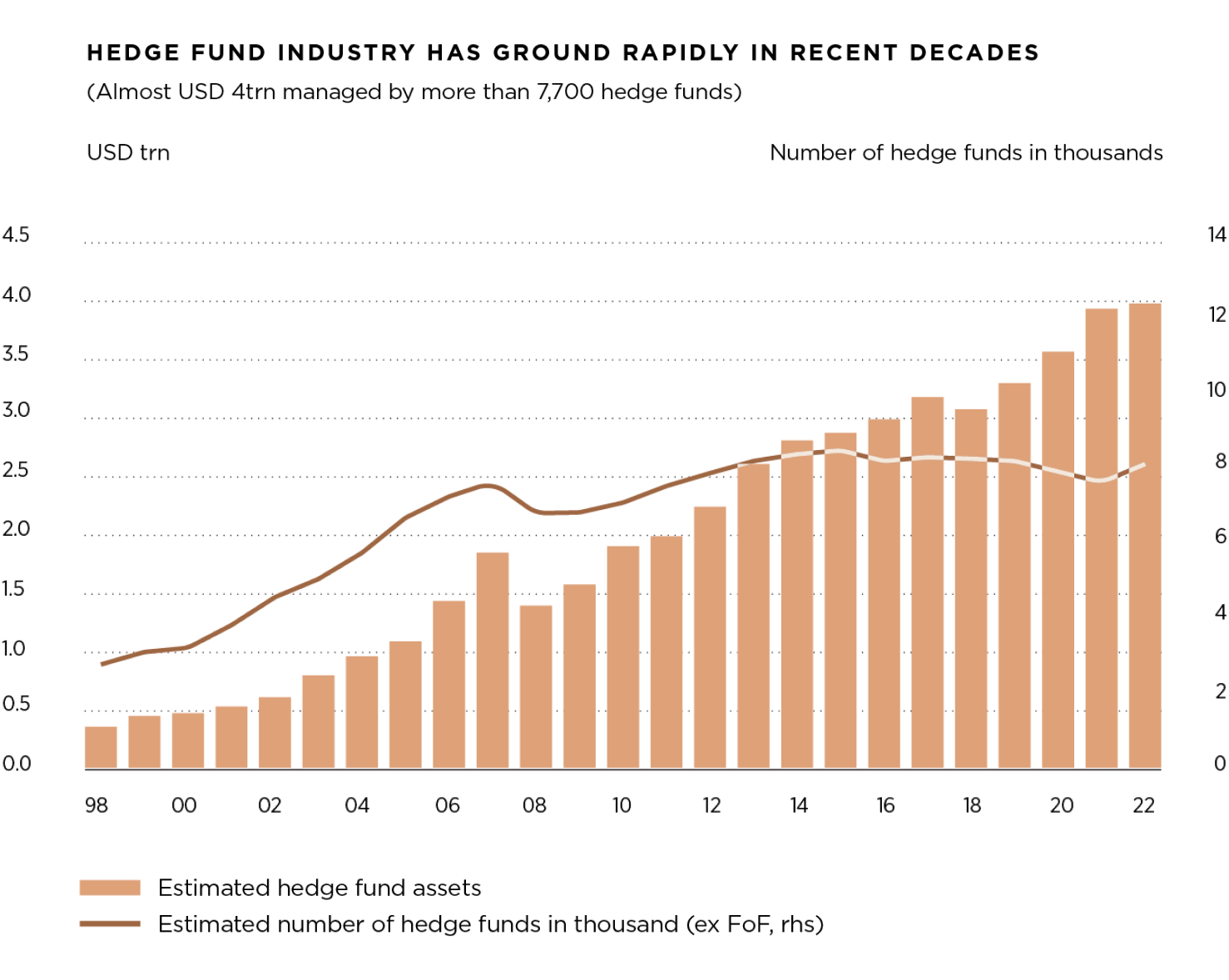

Today hedge funds manage about USD $4 trillion across more than 7,700 firms according to UBS.

| ALLOCATIONS TO HEDGED FUNDS

Uncertain times, like the one we are living now, bring opportunities for institutional investors, family offices and Ultra-High-Net-Worth Individuals (UHNWIs) to review their asset allocation strategy and look beyond traditional markets. In an environment of raising interest rates, persistent inflation, market volatility and unstable geopolitics, investors seek to increase allocations to alternative investments that generate alpha and low correlation to the market.

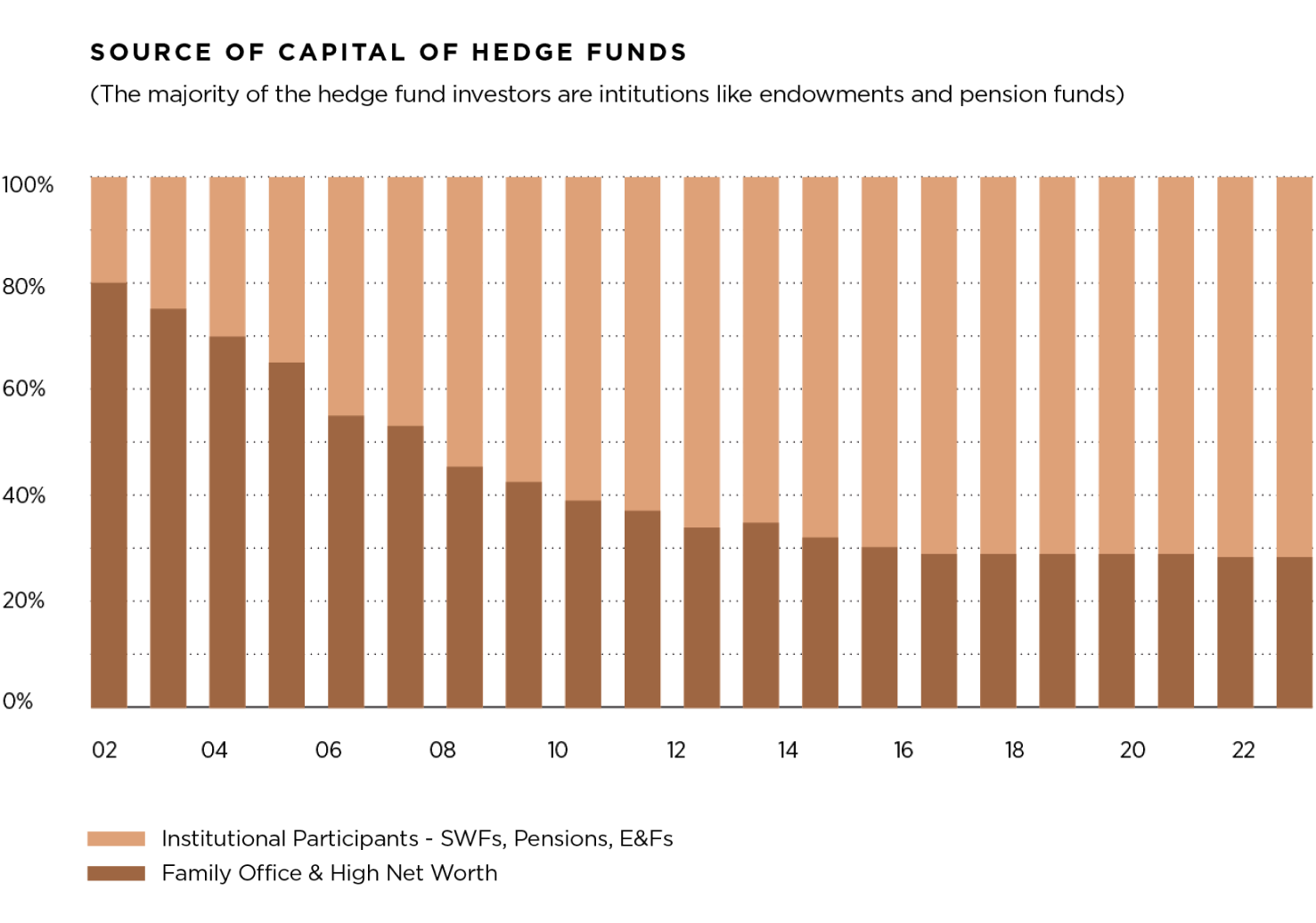

Hedge funds attracts all types of accredited investors of which institutions such as pension funds, endowments, foundations and/or insurers are currently the predominant group.

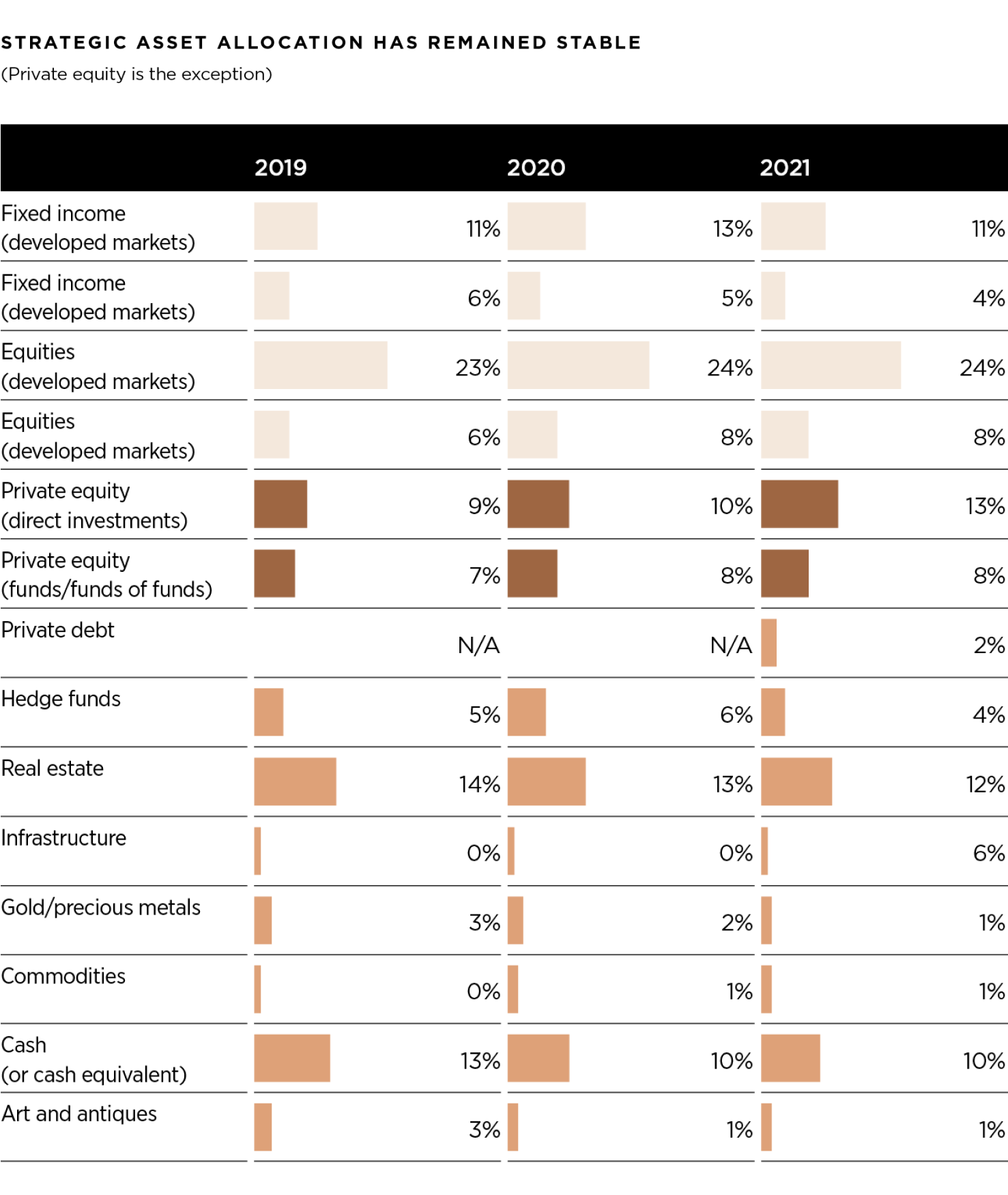

According to the 2022 Global Family Office Report released by UBS, the strategic asset allocation of family offices has largely remained unchanged since 2019. In 2021, family offices allocated 32% to equities, 15% to fixed income, 12% to real estate, 10% to cash, 4% to hedge funds, 2% to private debt and 2% to both gold and commodities. However, the only asset class that has experienced a steady increase is private equity with an allocation of 21% in 2021 vs. 16% in 2019. With some exceptions, hedge fund managers have been humbled over the past decade by lackluster returns that trailed most private equity and venture capital funds.

| A BRIEF HISTORY OF HEDGE FUNDS

The history of hedge funds can be traced back to 1949 when Alfredo Winslow Jones launched the first hedge fund. His strategy is often cited to be the first to combine long and short positions in stocks he believed to be undervalued or overvalued in order to reduce his exposure to general stock market movements and primarily focus on his stock picking skills. However, his strategy got noticed until the 1960s, when an article reveled that Jones had outperformed the best mutual fund over the prior five years by 44% net of fees. After this, many hedge funds were launched and the industry took off. However, the recession of 1969-1970 and the stock market crashes of 1973-1974 resulted in many hedge fund closures as the industry struggled against market risks.

Hedge funds gained popularity again in late 1970s and early 1990s, as they were seen as an attractive alternative to traditional investments, such as stocks and bonds. In 1973 George Soros, known as a pioneer in the hedge fund industry, launched Quantum Fund which in 1992 Soros made USD $1.5 billion in a single month by betting against the British pound and forced the Bank of England to abandon its peg to other European Exchange Rate currencies. In 1975, Ray Dalio launched Bridgewater Associates as currency and bond advisory service for institutional investors. However, it was not until the 1990s that Bridgewater launched portable Alpha strategies. The Hedge Fund industry continued to evolve over the 1980s, with many funds experiencing extraordinary growth due to strong performance and increased interest from wealthy individuals and families. Tiger Management was founded in 1980 by Julian Robertson, with USD $8 million in capital and grew to approximately USD $23 billion in 1997. However, following multiple years of underperformance and disappointing returns, Robertson decided to shut down the firm in 2000. Other prominent hedge funds founded in late 1970s and during the 1980s were Elliot Management (Paul Singer), Duquense Capital (Stanley Druckenmiller), D.E. Shaw (David Shaw), Caxton (Bruce Kovner), Moore Capital (Louis Bacon) and Millennium (Israel Englander).

The early 2000s saw several high-profile hedge fund failures and scandals which led to increase scrutiny of the industry. The near collapse of Long Term Capital Management (1998), Tiger Management (2000), Amaranth Advisors (2006), Chesapeak Capital (2006), Bear Stearns Hedge Funds (2007) and the discovery of the largest private Ponzi scheme in history by Bernard Madoff (2008) and more recently Archegos Capital Management (2021) which lost USD $20 billion in days, marked a new era in the industry. For different reasons including: regulatory considerations, investor pressure, media scrutiny, operational costs and weak performance are some contributing factors in motivating legendary fund managers to morph into a family office structure, some examples are: George Soros, John Paulson, Stanley Drukenmiller, Steve Cohen, Leon Cooperman, Eric Mindich, Jonathon Jacobson and Louis Bacon.

However, the legacy of some fund managers including George Soros and Julian Robertson is still alive today as they provided the backing to a number of former employees that went out on to launch some of the top performing funds in the industry today. Robertson’s so-called “Tiger Cubs” still have the cachet to open doors to the world’s most prestigious banks and investors. Close to 200 hedge fund firms can trace their origins back to Tiger Management, some prominent names are: Maverick (Lee Ainslie), Egerton (William Bollinger), Matrix (David Goel), Blue Ridge (John Griffin), Discovery Global (Robert Citrone), Archegos (Bill Hwang), Lone Pine (Steve Mandel), Viking (Andreas Halvorsen), Coatue (Philippe Laffont) and Tiger Global (Chase Coleman) among others. Only George Soro’s hedge fund comes close to having incubated so many key players in the industry according to LCH Investments. Today hedge funds are evolving with new talent, strategies, products, styles and investor base.

| KEY CHARACTERISTICS OF HEDGE FUNDS

One of the key characteristics of hedge funds is that they employ active management strategies with the goal to outperform the market. Hedge funds aim to generate absolute returns regardless of market conditions. Hedge fund managers invest in a number of assets classes including: debt, equities, real estate, commodities, cryptocurrencies, derivatives, foreign currencies and private companies. They often use leverage to amplify returns and employ short selling strategies to profit from declining prices. Given the lack of transparency and complexity in their investment, operational and risk management activity they are viewed as “Black Boxes.” Hedge funds typically require a minimum investment of USD $5,000,000, making them accessible only to high-net-worth individuals and institutional investors. Another key feature that distinguishes hedge funds from mutual funds for example is the fee structure which generally is 2% management fee and 20% performance fee. Although the 2/20 structure is the standard in the industry, fund managers are facing mounting pressure to reduce fees.

There is a broad range of hedge fund strategies including:

A) Equity long-short.

Focus on buying undervalued stocks while shorting overvalued stocks to profit from market inefficiencies.

B) Event-driven.

Focus on taking positions on companies undergoing specific events such as mergers, acquisitions, reorganizations, bankruptcies or share buyback programs.

C) Global macro.

Focus on taking positions to exploit macroeconomic tends and geo-political developments such as interest rate changes, currency fluctuations, and commodities prices.

D) Global tactical.

Focus on investing in a variety of assets, including: equity, fixed income, commodities and currencies.

E) Credit-distressed debt.

Focus on purchasing bonds at steep discount of their face value in anticipation that the company will successfully emerge from bankruptcy or a sovereign to honor its debt obligations.

Ultimately, the success of a hedge fund strategy depends on the ability of the manager to identify profitable investment opportunities and to effectively execute their investment thesis.

| BENEFITS AND RISK OF INVESTING IN HEDGE FUNDS

Hedge funds offer unique attributers that traditional asset classes don’t including:

➊ Active management.

➋ Expertise.

➌ Diversification.

➍ Flexibility.

➎ Potential for excess returns.

➏ Low market correlation to name a few.

However, no asset class comes without pitfalls, and hedge funds are no exception. Some of the draw backs of investing in hedge funds are:

➊ Key man dependence.

➋ Liquidity risk.

➌ High leverage.

➍ High volatility.

➎ Potential for significant loss.

➏ Lack of transparency.

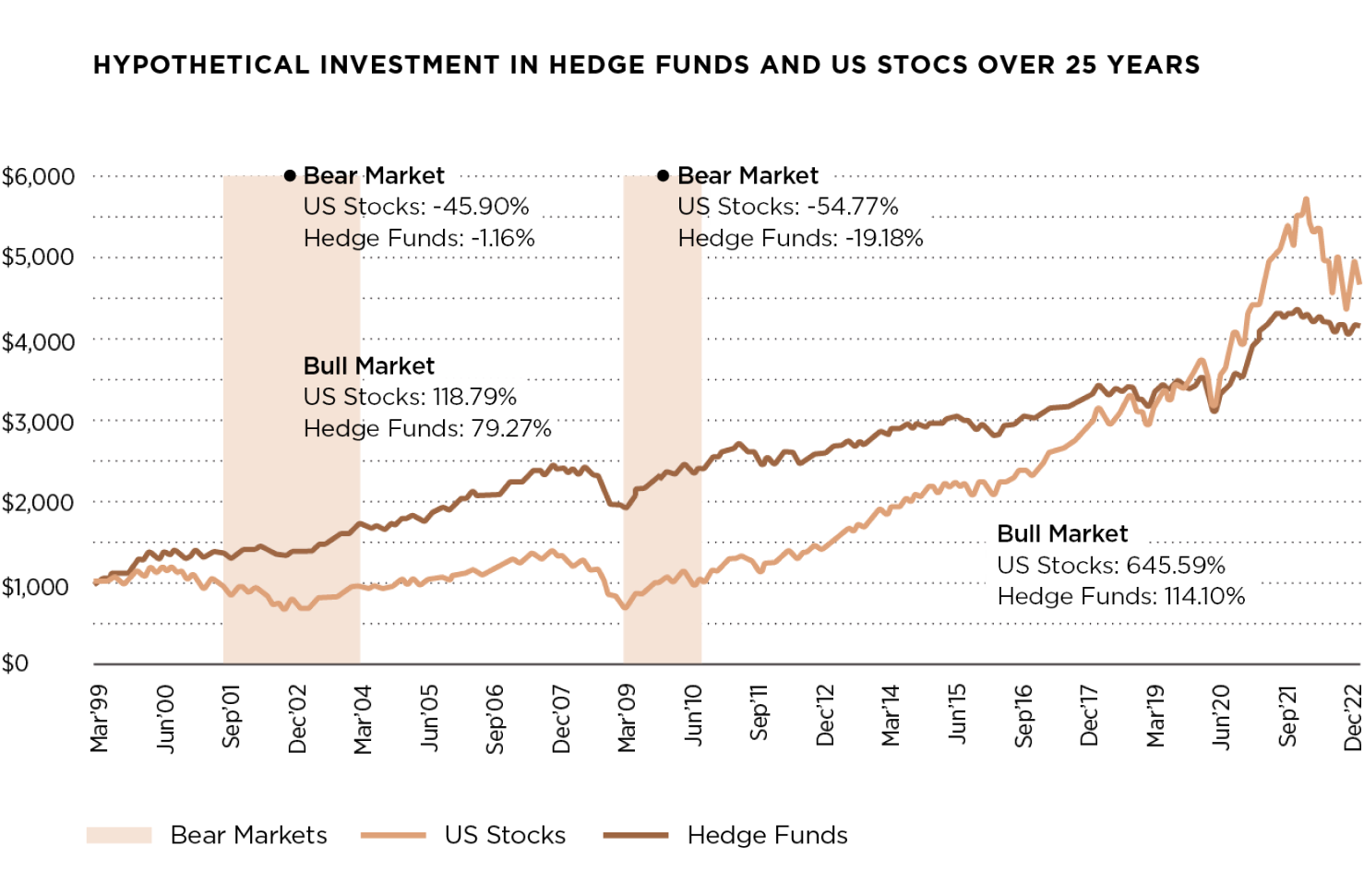

Hedge funds generally focus on protecting against significant capital losses by targeting returns skewed to the upside and limited to the down side. Hedge funds tend to protect against drawdowns in adverse market conditions better than traditional long-only investments, supporting attractive long-term compounded returns and lowering overall volatility.

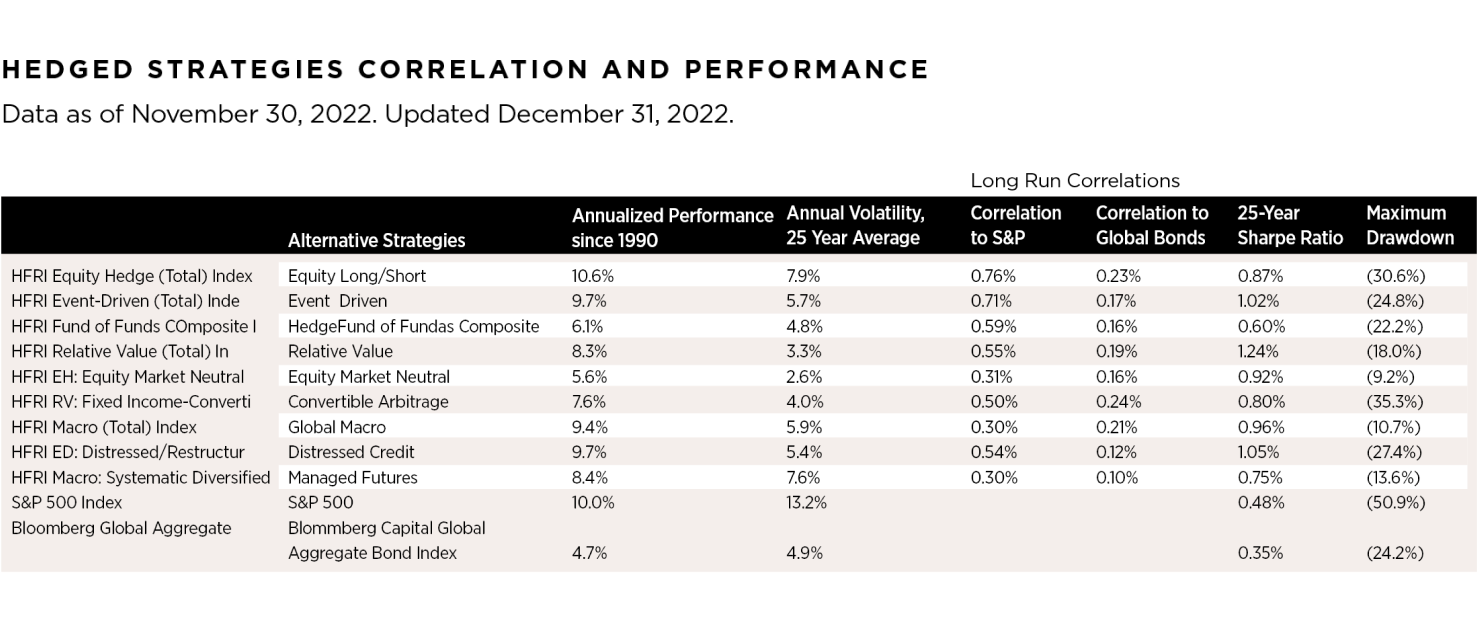

| HEDGE FUND PERFORMANCE SINCE 1990

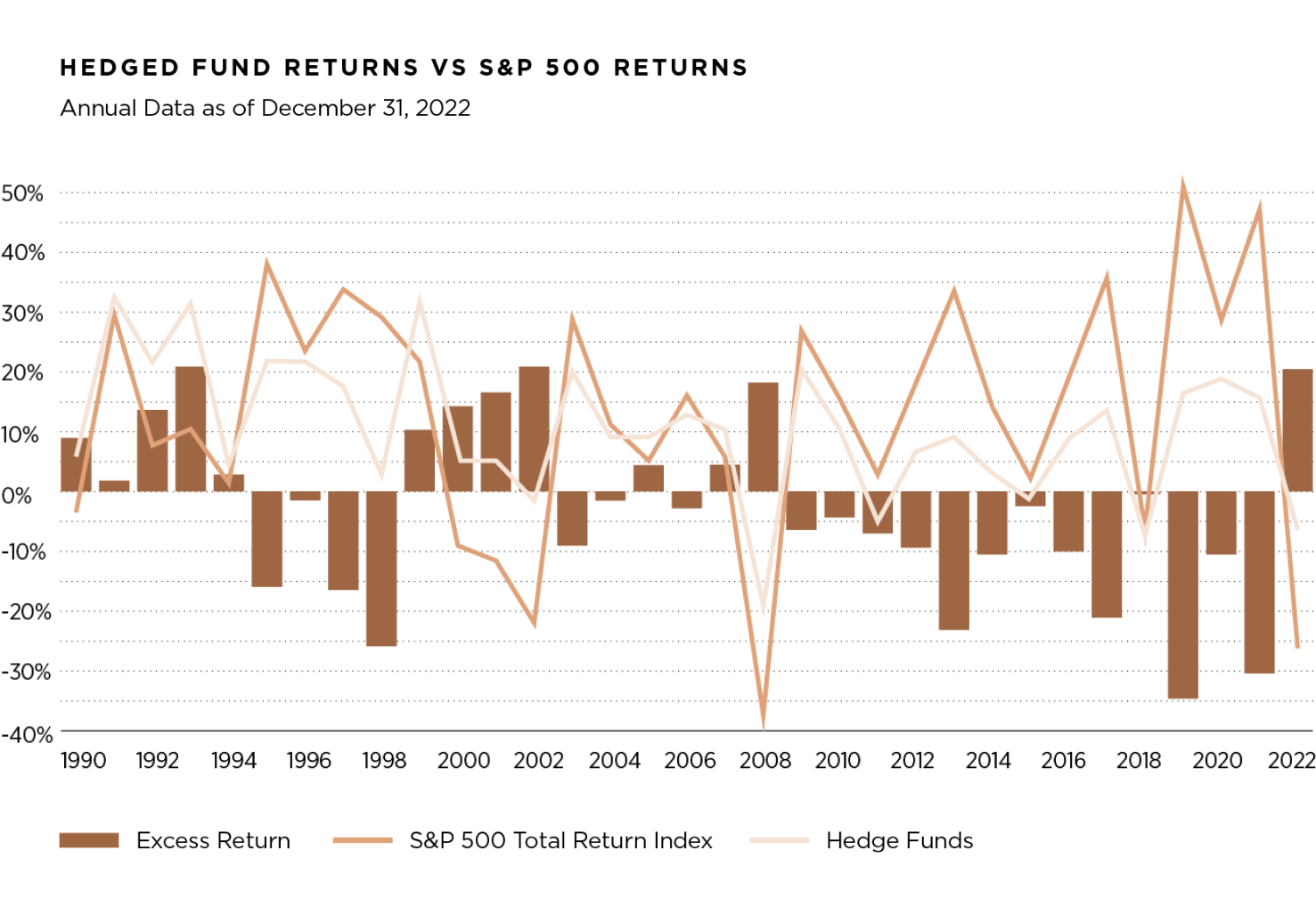

From 1990 to date, the S&P 500 index has historically returned an average of approximately 10% per year. On the other hand, hedge funds have returned an estimated 10.7% during the same period. The following graph illustrates the performance of a hypothetical investment of USD $1,000 in hedge funds and U.S. stocks over 25 years. The key findings are that the S&P 500 has a higher volatility and a lower sharp ratio vis-a-vis hedge funds. However, is important to note that hedge funds have particularly underperformed the S&P 500 during bull markets and have outperformed the S&P 500 during bear markets.

The following graph shows that from 2008 to date, the S&P 500 index has outperformed hedge funds. That is, over the last 12 years (2009 al 2021) hedge funds have not deliver alpha with the exception of a couple of hedge fund outliers that have posted excess returns and historically record profits in 2008 and 2022.

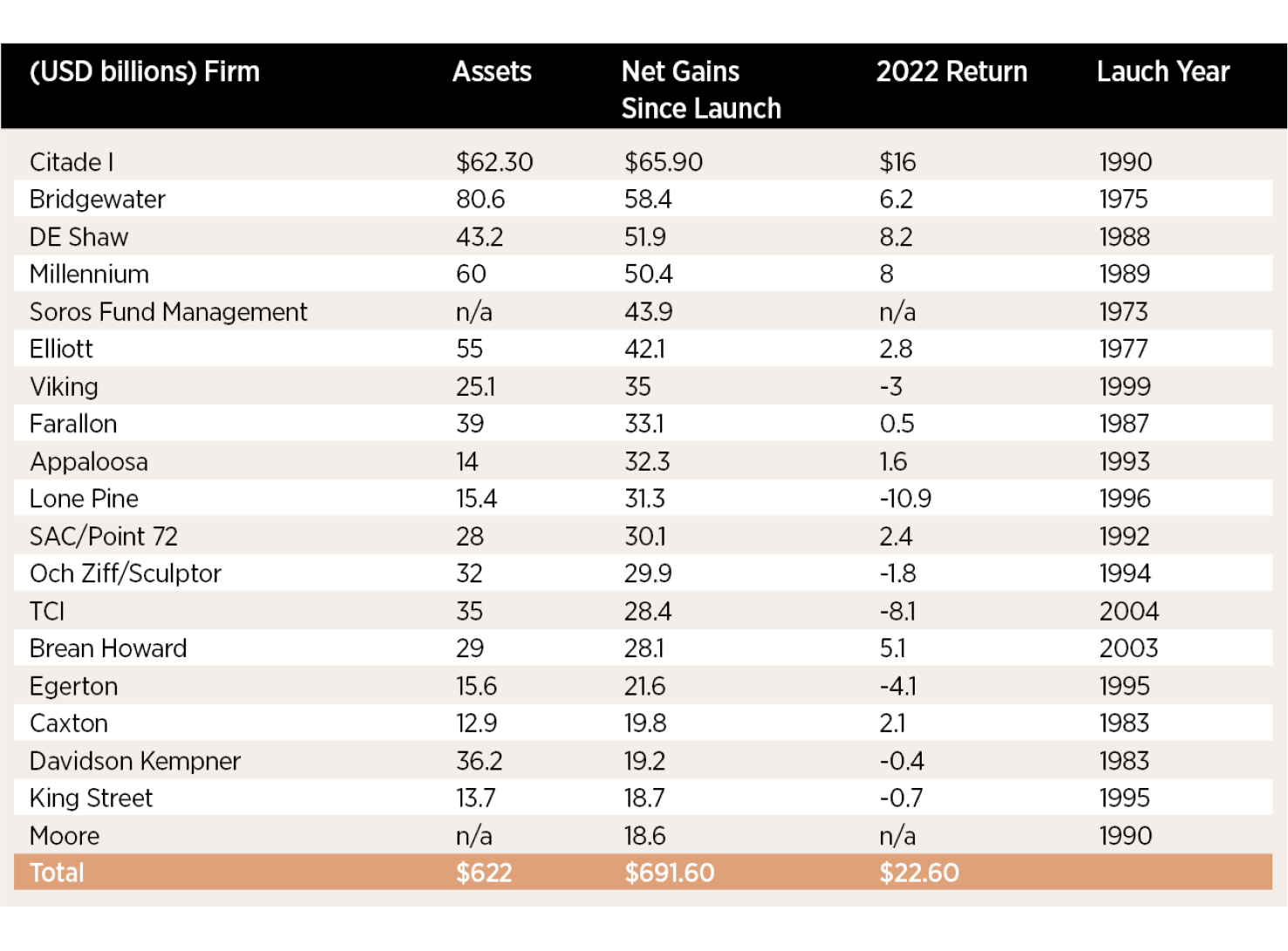

| PERFORMANCE - TOP 20 HEDGE FUNDS

The top 20 hedge funds collectively managed an estimated USD $622 billion and generated USD $22.6 billion in profit after fees according to a report release by LCH Investments. In 2022, the largest gains were made by large multi-strategy hedge funds like Citadel, DE Shaw and Millennium. Ken Griffin’s hedge fund Citadel topped the list by making USD $16 billion in profit after fees, recording the largest annual gain ever by a hedge fund manager. The Citadel return tops the USD $15 billion profit made by John Paulson in 2007 when he bet against subprime mortgages. However, hedge fund managers lost USD $208 billion in 2022. The worst performer among the top 20 managers ranked by net gains was Lone Pine Capital, which lost USD $10.9 billion according to LCH.

| CONCLUSION

The main goal of hedge fund managers is to generate alpha and provide risk-adjusted returns. Historically, hedge funds have performed well in periods of rising rates, market volatility and geopolitical uncertainty. However, hedge funds have been marked by boom and bust cycles - outperformance, underperformance, collapses and scandals.

Investors considering an investment in hedge funds should be aware of the risks inherent in this asset class. For example, investors must accept lower levels of liquidity along with less transparency. In addition, hedge fund returns are not necessarily higher than traditional investments and may differ greatly by fund manager. Despite these challenges, selected hedge funds are likely to remained a helpful source of excess returns with low correlation and continued outperformance against traditional markets. However, before investing in any hedge fund, it is important to conduct in-depth due-diligence, rigorous research and strict investment process to understand the fund strategy, track record, fee structure, risk management and operational capabilities. Selecting and investing with the right manager is paramount for a successful outcome.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com