| FUTURE OF FINANCE

Once at the forefront of digitalisation, financial institutions have fallen behind, still feeling the after-effects of the Great Financial Crisis. Established business models are threatened by the rise of newcomers, such as those in financial technology (FinTech), digital assets, and decentralised finance (DeFi). A new cycle of innovation that is shaping the ‘Future of Finance’ is underway.

A new wave of euphoria

Thus far this year, Bitcoin has topped the performance rankings, outperforming all major asset classes. Prices are up around 85% year to date even though they are still less than half of what they were at the peak in November 2021. In that sense, this year is primarily about undoing part of the damage of last year’s crypto crisis, which weighed heavily on Bitcoin prices even though its underlying blockchain kept on operating as intended. The current rally was triggered by hopes of a rapid reversal of US monetary policy and the turmoil in the US banking industry that swept across financial markets in spring, allowing Bitcoin to show some of its emerging safe-haven characteristics and nourishing the narrative of it becoming a future form ‘digital gold’.

More recently, Bitcoin managed to decouple from gold. While the hopes of a rapid reversal of US monetary policy faded amid a very resilient US economy, Bitcoin prices kept on rallying due to an emerging euphoria about a looming launch of a physically backed exchange-traded fund (ETF) in the United States. Such funds exist already elsewhere, for example in Europe, but they thus far failed to gain regulatory approval in the United States. During the past few years, a number of products were rejected by the Securities and Exchange Commission (SEC) because of concerns about consumer protection and market manipulation. The ETF story has, however, moved back into the focus as iShares, which is part of BlackRock, the world’s largest asset manager, filed for a new product in early summer. The euphoria was further fuelled by the fact that BlackRock’s ETF alleged product approval ratio stands at 575:1, according to Bloomberg. While some say that ‘BlackRock owns the world’, and therefore believe that their products have better chances of approval, we do not think – and hope - that this is driving the decision. Yet we struggle to understand why there are concerns about physically backed ETFs in the United States, while futures-backed ones and leveraged ones already exist.

In this report, we will dive more deeply into what a US-listed physical Bitcoin ETF could mean for the world’s largest crypto. We will draw parallels with the gold market, firstly in terms of the relevance of ETFs, and secondly in terms of mined supply. Finally, we will outline why we see more upside for Bitcoin from current levels, prompting us to shift our view to Constructive.

Assessing the state of Bitcoin supply

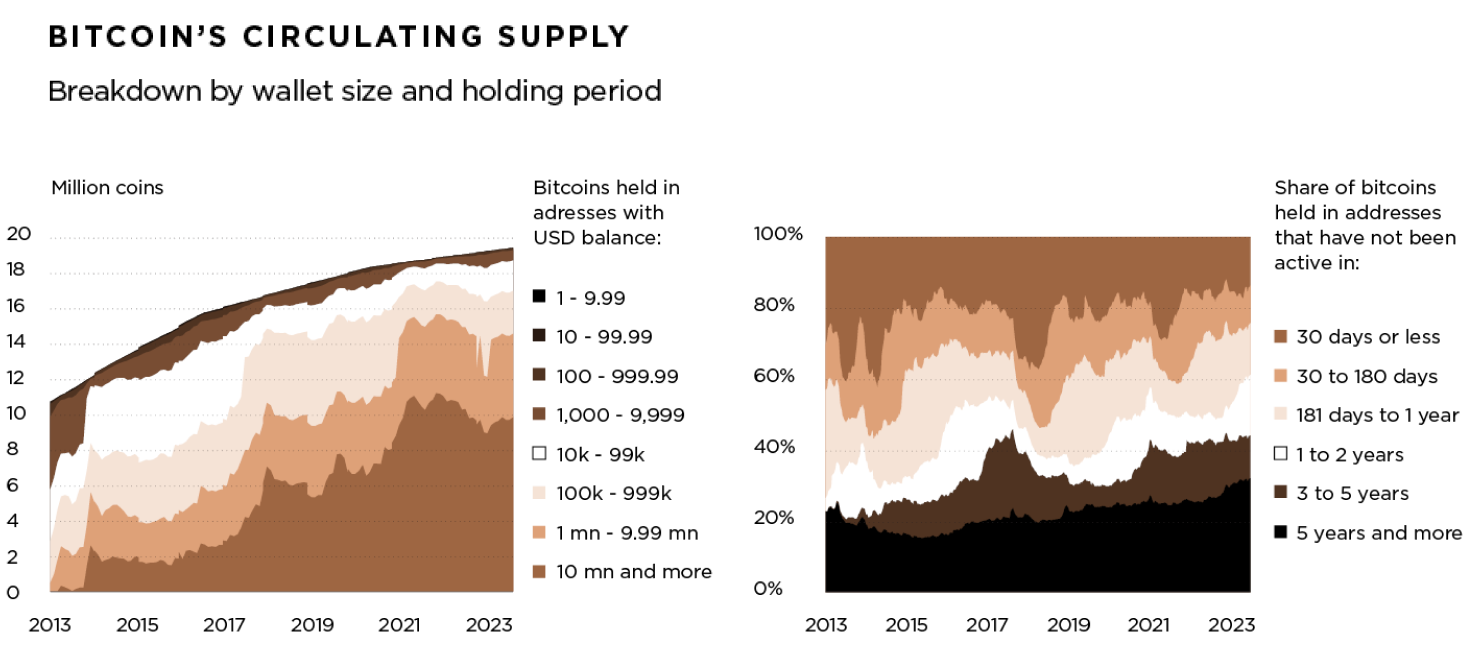

The transparency of the blockchain technology offers very interesting insights into the distribution of all the 19.5 million Bitcoin that have thus far been mined. This amount constitutes around 93% of all coins that will ever be available, even though the final Bitcoin will only be mined at some point in 2140 due to the block-chain special supply mechanisms.

As of today, around half of all Bitcoins, around 9 million, are stored in wallets with a value of USD 10 million or more. These wallets belong to so-called ‘whales’, which are the largest investors in the crypto space. Some of them have been very early investors, reaping mouth-watering returns on their initial investments, while others have been building their positions only more recently. These large wallets also belong to specialised crypto in-vestors, such as hedge funds and asset managers, and centralised exchanges, such as Binance and Coinbase, which are storing the tokens on behalf of their clients. They may also belong to Bitcoin miners, which are keeping their fresh supplies for an eventual sale at a later point in time. Smaller, but still very sizeable wallets that hold values between USD 1 million and USD 10 million represent close to 25% of today’s Bitcoin supply. This suggests that despite all the apparent interest from smaller private investors, Bitcoin supplies are very concentrated in the hands of large holders.

| FEWER AND FEWER BITCOINS ARE CHANGING HANDS

Seen from a different perspective, blockchain data also provides insights into when a Bitcoin has last been moved from one wallet to another. It is very remarkable that the share of Bitcoins that have not moved during the past five years is now approaching 32%, up from around 15% in 2015. Shortening the time horizon, the share of Bitcoins that have not moved in a year has risen to the highest levels on record as of late, reaching 70%. This sug-gests that ‘Buy-and-hold’ investors constitute by far the largest share of market participants. While underpinning Bitcoin’s status as a store of value, this phenomenon also implies that fewer and fewer coins are available for short-term traders.

Meanwhile, the number of Bitcoins that are made available to the market via miners and exchanges seems to have peaked at around 3.5 million in 2021, potentially impacting the ability of providers to purchase the Bitcoins for their products.

Identifying the Bitcoin buyers: Who is in and who is not?

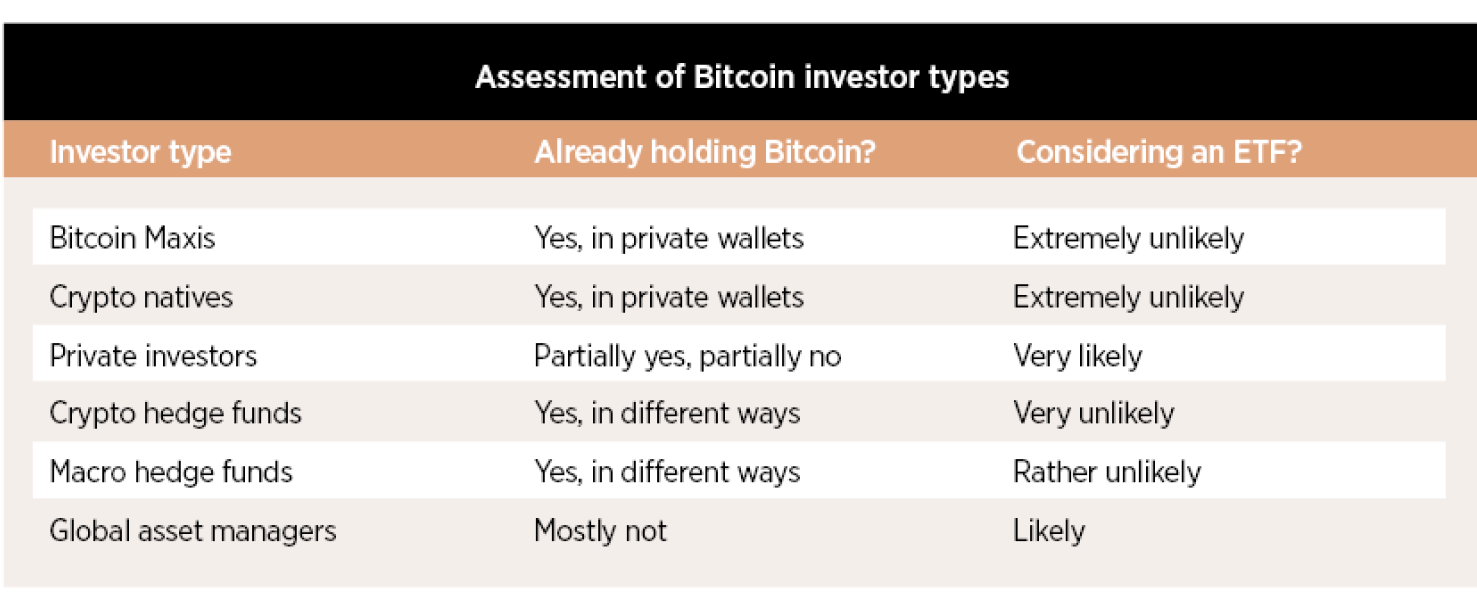

Before diving deeper into the back and forth of Bitcoin’s ETF ap-proval process in the Unites States and assessing the all-im-portant question of how much inflows such products could at-tract, we first want to identify potential investor types. This should help us understand how big the pool of potential buyers is, based on their mindset and their preferences. Specifically, we will answer the question whether these types are already invested in Bitcoin and whether they would use a newly approved ETF.

"A family council can help build the bridge to a family business or complex family wealth. However, strategic decision-making should remain with the entire family to ensure everyone’s involvement"

Bitcoin maximalists see Bitcoin as a currency and believe it is the only one that will be needed in the future. They object to other cryptos, which they view as being at odds with the ideals established by Satoshi Nakamoto, who created Bitcoin in 2009 in reaction to the Great Financial Crisis as a sound form of money. ‘Bitcoin Maxis’, as they are also called, are invested using their own wallets, in most cases for many years. They would never use an ETF, as they would not be in control of their coins, needing to trust a representative of the traditional finance industry instead.

Crypto natives are investors who have gained extensive know-how and experience in cryptos in the past few years. While having a high conviction about the long-term potential of cryptos, they are not as dogmatic as the Bitcoin Maxis. They are open to holding other coins and tokens, as they are primarily motivated by the disruptive potential of blockchain technology rather than by the need for a sound form of money. Crypto natives use their own wallets to keep control of their coins and would not use an ETF.

Private investors might have shied away from investing in Bitcoin because of their lack of know-how. They might be intrigued by the concept but are also deterred by the complexity of setting up a private wallet. Instead, they may have opted for centralised exchanges and custodians, or they might be looking for a more attractive avenue into Bitcoin, such as an ETF. Private investors are thus potential ETF investors, assuming that they are willing and able to bear the risks of a Bitcoin investment.

Crypto hedge funds are specialised institutional investors focussing on digital assets. While strategies may vary, including arbitrage, relative value, and options, these investors possess a high degree of know-how and experience. By nature, they are already invested in cryptos, using a mix of centralised and decentralised wallets, as well as futures and options exchanges. It is very un-likely that they will invest in an ETF.

Global macro hedge funds are specialised institutional investors with a wider scope than crypto hedge funds. They are also combining various strategies, but for a multitude of asset classes, including equities, bonds, commodities, and cryptos. They typically take a large number of bets, both on rising and falling asset prices. This makes a cost-efficient implementation key, which is why futures and options are preferred investment vehicles. While they may or may not be invested in Bitcoin, they are rather unlikely to use an ETF to build their exposure.

Global asset managers such as private banks and pension funds offer various products in various asset classes to their clients, most notably equities and bonds but also alternative investments. While some of them started to venture into crypto already, this is the exception rather than the norm. Some asset managers are clearly intrigued by the prospects of including cryptos in their asset allocation, but they might have been deterred either by regulatory constraints or the complexity involved in setting up a private wallet. Because of the easy access, we see asset managers as possible ETF buyers, potentially putting significant amounts into a Bitcoin product, depending on their views of the market.

We thus see two types of investors who could be potential buyers of a US-listed Bitcoin ETF: private investors and global asset managers. Quantifying the amounts of money these two groups could invest into the market is almost impossible. Private investors are not a homogenous group, but the past has shown that from time to time they move in sync, allowing them to influence markets or segments of markets. Examples include the 2010/11 silver spike and the 2021 meme coin craze. Global asset managers, mean-while, are a more homogenous group in terms of how they act and how they analyse markets. According to the Boston Consulting Group, they are managing more than USD 100 trillion of assets, of which 20% are currently allocated to alternative assets, the bracket into which Bitcoin would fall. If, on average, global asset managers allocated 1% of the alternative investments’ quota to Bitcoin, this would represent USD 200 billion, equivalent to one-third of today’s market capitalisation. While this does not sound much from a portfolio-share perspective, it would be massive for the Bitcoin market.

That said, we do not believe that such strong buying is very likely. First, some asset managers may already be invested, especially those that have a high conviction in Bitcoin. Second, those that seek exposure to Bitcoin could still opt for a futures-based product, which would not require any physical Bitcoin buying. Third, a rapid move does not appear very likely, as investment guidelines need to be adjusted. And fourth, the conviction in a short-term price appreciation would need to be high as well.

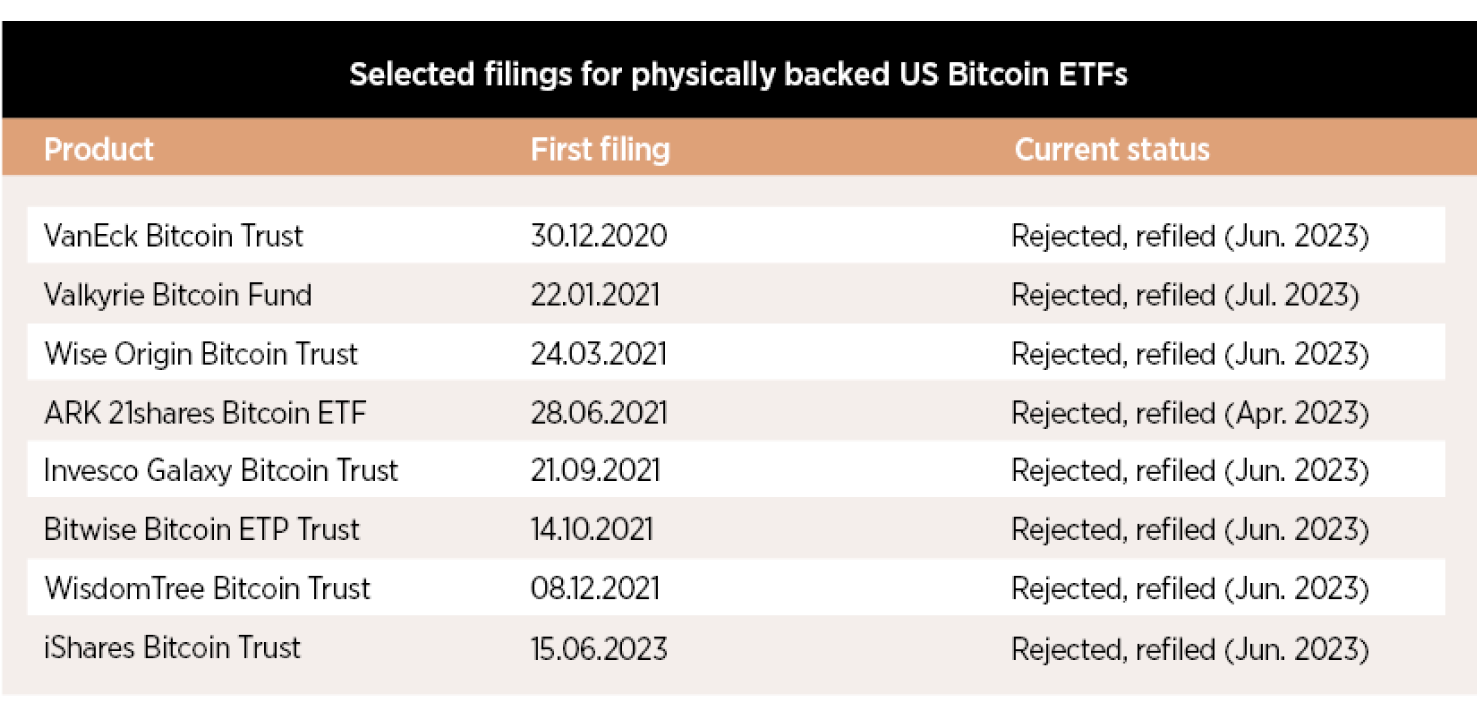

| BITCOIN’S ETF SAGA: PUTTING THINGS INTO PERSPECTIVE

The current debate about physically backed Bitcoin ETFs is solely about the US, even though at least 11 often-overlooked products have been available for a while, in Switzerland and Germany, with total assets of ca USD 1.8 billion. In the US, there has been a lot of back and forth during the past few years. Since 2016, almost 30 filings for spot crypto ETFs have been made, none of which have been approved by the SEC thus far. While the main reasons for rejection were consumer protection and potential for market ma-nipulation, the latest batch of ETFs, which includes products from providers such as ARK, iShares, and WisdomTree, were primarily criticised for their lack of clarity and comprehension.

Shortly after their rejection, most products were refiled, addressing the relevant concerns while also including a surveillance-sharing agreement (SSA), which is intended to alleviate the concerns about market manipulation. It should include a regulated US-based spot trading platform as a counterparty, orchestrated in collaboration with the exchanges where the assets are primarily going to be traded in (the Nasdaq and CBOE Global Markets in this case). At the moment, Nasdaq has registered Coinbase as the partner for the SSA, which fulfils the criteria of moving a rep-resentative tranche of the spot market volume, whilst being sub-ject to US regulation. Coinbase shares benefited from the announcement, rallying more than 20% since the filing, not just be-cause of Coinbase’s role as the SSA counterparty but also because it is likely to store some – if not the majority – of the assets. From the day of the refiling, the SEC has 15 days to send it out for public comment and can return it after a week to the exchange that filed for the application. Thereafter, the SEC has 240 days to ei-ther approve or reject the filing, suggesting that the approval process is unlikely to be quick and that the risk of rejection remains despite the inclusion of the SSA.

Taking a bit of a broader perspective, the first US-listed and SEC-approved Bitcoin ETF was the Pro Shares Bitcoin Strategy Fund (BITO), which is futures-based and started trading in October 2021. A potential reason for its approval is that futures are estab-lished in the realm of US financial regulation, while Bitcoin spot exchanges are not, allegedly making the latter more prone to price manipulation. The SEC has been highly criticised for approving ProShares Bitcoin Strategy Fund ahead of all the competitors’ and crowning the product as the largest Bitcoin ETF. As of today, it captures around 98% of the total volume of Bitcoin ETFs. Since then, several futures-based Bitcoin ETFs have made it to the open market. We believe this precedent makes it rather unlikely that in case the SEC decides to greenlight physically backed Bitcoin ETFs, it will just go with one provider. Instead, we would expect a simultaneous approval of several products (or a simulta-neous rejection).

The largest proponent of bitcoin spot ETFs is a company called Grayscale, which is currently also one of the largest holders of Bitcoin. Grayscale initially filed to convert their trust into a physically backed ETF, a petition that was denied numerous times by the SEC. At the time of writing, the trust continues to operate without a clear redemption mechanism, leaving liquidity-deprived holders with the only option to sell in the open market at the current discount levels. The Grayscale Bitcoin Trust is considerably more complex than a physically backed ETF. Essentially, the trust works as follows. Accredited investors participate in Grayscale’s private placing, which uses the funding to purchase the Bitcoins in the open market, subsequently creating shares of the trust. Investors then receive the shares and, after a lock-up period, they are eligible to sell the shares in the open market, where private investors can purchase them just as equities, bearing in mind the 2% per annum management fee and the fact that the trust normally trades at a discount against the underlying asset. Due to the emerging euphoria around the ETF, Grayscale considerably narrowed its net asset value discount, which now sits at 20%, a big increase from the all-time lows of almost 50%. This might as well reflect the fact that the appeals court that handles Grayscale’s case to convert the trust into a spot ETF believes that futures prices are derived from spot prices, and therefore stated that allowing futures-based ETFs and not spot ETFs is absurd – and we fully agree.

| WHAT IS THE DIFFERENCE? PHYSICALLY BACKED OR FUTURES-BASED

The current debate around the approval of new Bitcoin ETFs is about so-called ‘spot products’, which are physically backed. These products require the actual purchase of the Bitcoins by the provider, as opposed to a replication of the performance with derivatives, as is the case with futures-based products. From a performance perspective, there should be a significant difference as the cost of carry for Bitcoin futures is very low and the potential for price arbitrage is high. Whether the physically backed or futures-based product is preferred very much depends on personal preferences. Some investors take comfort in the fact of owning the actual asset over the derivative.

There should be no significant difference in terms of performance between the two product types, but there is an important difference in terms of market impact. As outlined above, a physically backed product requires the actual purchase of Bitcoins, i.e. a certain share of the currently available 19.5 million coins is stored in the provider’s wallet, limiting the available supply. By contrast, there is no limited supply of futures for a futures-based product. Furthermore, for every person buying a futures, there is one selling a futures, implying that one person’s gain is the other person’s loss. Futures are a zero-sum game, very much like a sports bet. Thus, the futures-based variety does not impact the supply and demand balance of Bitcoin and, theoretically, should not move the price either. That said, big waves of futures buying and selling tend to move the underlying markets, albeit typically only in the short term. For this reason, we consider the futures market and the positioning of more speculative and short-term traders as a key gauge of the market mood as opposed to a fundamental driver of the market.

Guidance from the gold market: The role of ETFs.

As outlined in previous publications, we see quite some parallels between Bitcoin and gold. In fact, we believe that Bitcoin could – indeed should – become a form of ‘digital gold’ in the future. As of today, we still see Bitcoin as a risk-on asset, which means that in tends to move much more with equities than gold does, especially during risk-off periods in financial markets. These periods typically lead to large losses for Bitcoin. That said, Bitcoin shares some of gold’s characteristics already today. Most importantly, it is also seen as another ‘anti-US-dollar’, which is why it should perform well in times of a weaker US dollar. Bitcoin also showed its potential to protect against systemic shocks in financial markets as it rallied during this year’s US banking turmoil, as did gold. Finally, Bitcoin serves as a store of value for those who live in countries with structurally high levels of inflation and structurally low levels of trust in their institutions.

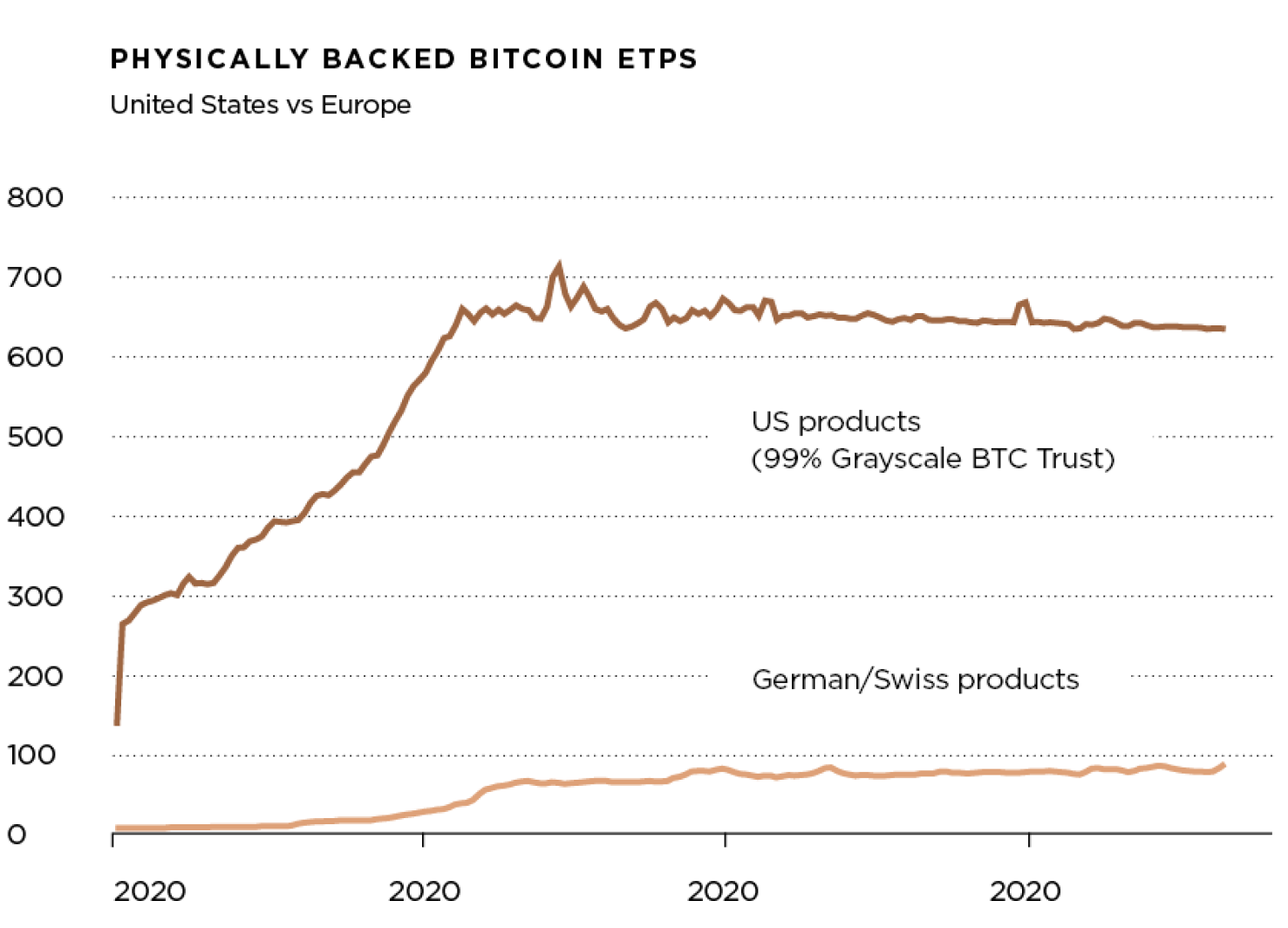

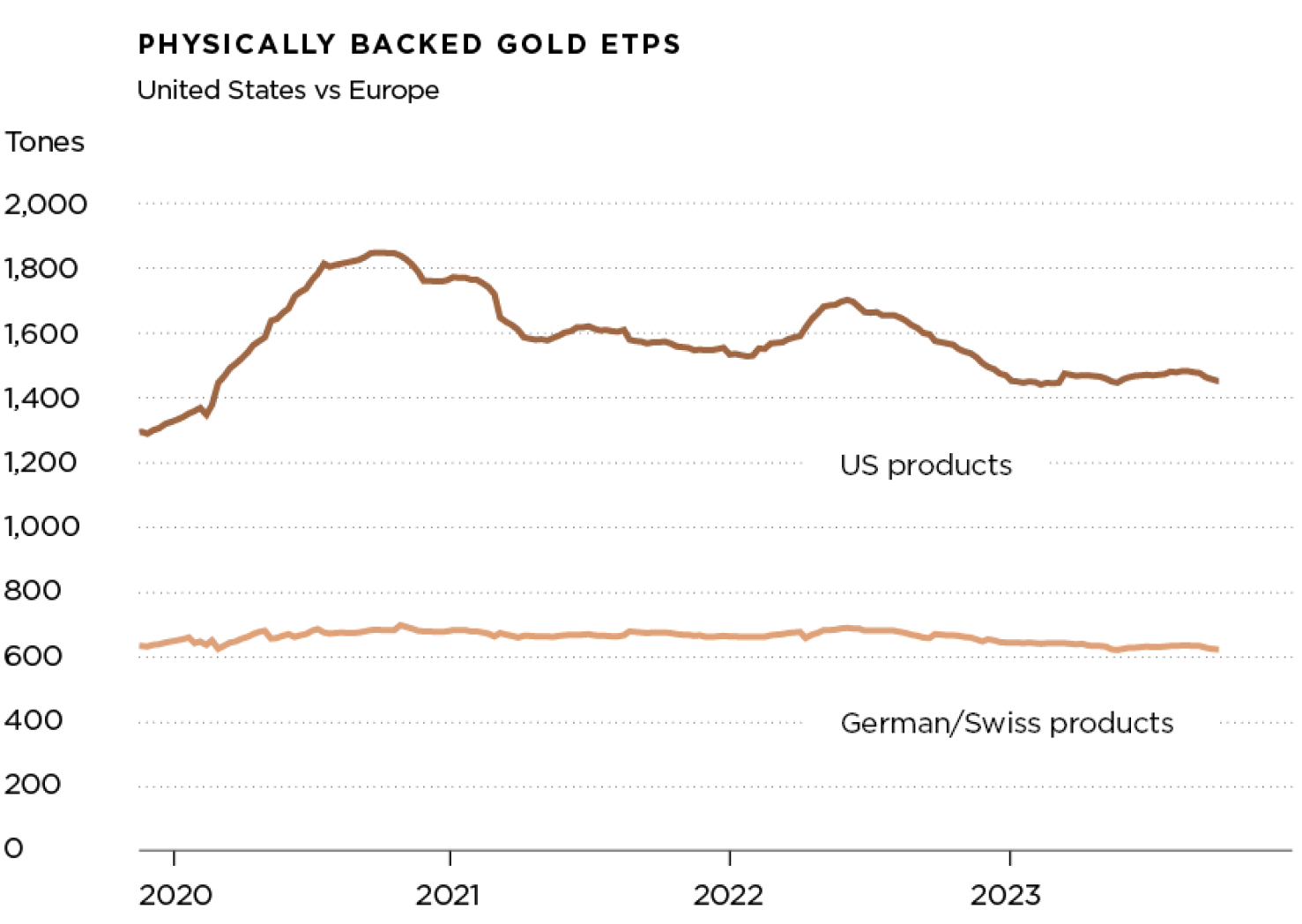

With all this in mind, we would like to use the gold market, where physically backed products were introduced almost 20 years ago already and have become an important building block of the mar-ket since, to get some guidance for Bitcoin. Today’s status quo is as follows. While no physically backed Bitcoin ETFs are available in the US yet, there are two physically backed trusts. We will refer to both types of products as ETPs (exchange-traded products), rather than distinguishing between ETFs and trusts. In total, US ETPs hold an estimated 700,000 Bitcoins, of which 99% are owned by the Grayscale Bitcoin Trust. At the same time, there are more than ten physically backed products in Germany and Switzerland, holding around 60,000 Bitcoins. In the gold market, meanwhile, US-listed ETPs currently hold around 1,450 tonnes compared to 620 tonnes for German- and Swiss-listed ones, suggesting that the dominance of US products is actually bigger for Bitcoin than for gold. This assumes, of course, that the Grayscale Bitcoin Trust resumes its status as a viable alternative for investors interested in US-listed products.

Taking another perspective, US-listed physically backed gold ETPs hold around two-and-a-half times as much metal as their Swiss and German counterparts. Assuming that gold and Bitcoin investors share the same convictions, we could see the same ratio between the United States and Switzerland/Germany, implying inflows of around 150,000 into newly listed US products – beyond what is already held by the Grayscale Bitcoin Trust. This would be equivalent to around 5% of the combined supply from Bitcoin miners and exchanges, potentially disappointing market expectations. One wild card we see that could boost demand for the yetto-be-approved products is a potential switch from existing futures-based ETPs into the physically backed equivalents.

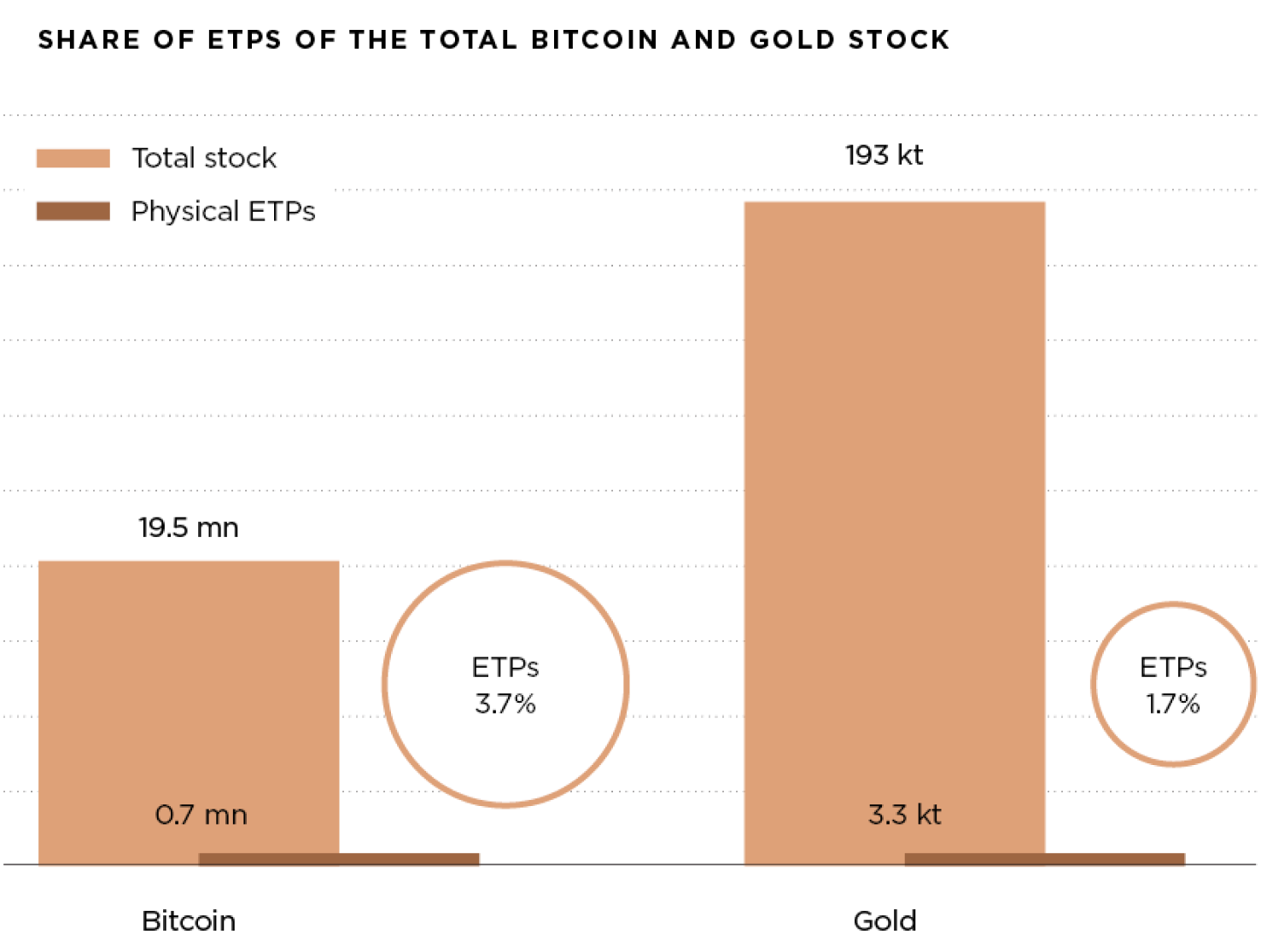

As a third perspective, we calculated the share of Bitcoin and gold that is currently held in physically backed ETPs in relation to the total stock of 19.5 million Bitcoins and 193,000 tonnes of gold, respectively. For Bitcoin, the share of ETPs (including Grayscale) is equivalent to around 3.7% of the total, while for gold it is around 1.7%. This again assumes that the Grayscale Bitcoin Trust is once again seen as a viable alternative to gain exposure to Bitcoin. If we remove it from the sample, the ETP share for Bitcoin drops to less than 0.5%, leaving upside compared to gold.

Based on this comparison, Bitcoin in not necessarily underinvested relative to gold, but the comparison does not consider the value of the ETP stock. The Bitcoin stock of around 0.7 million coins is worth around USD 21 billion, a tenth of the USD 210 billion valuation of the gold stock. The difference is even bigger for the total stock of both assets: USD 585 billion for Bitcoin and USD 12.1 trillion for gold. Hence, Bitcoin is a much smaller market than gold, implying that it needs much less money to move it. This is an important consideration in terms of the potential impact of new products.

Bitcoin and gold: Supply-side perspectives

While we see demand as the dominant driver of prices for both Bitcoin and gold, we nevertheless want to provide a supply-side assessment – not least as the production process of both assets is referred to as ‘mining’. The difference between the respective processes could not in fact be starker, with the computer-based solving of complex cryptographic puzzles on the one side, and the machinery-based extraction of ore-containing rocks, on the other. The commonalities include the capital intensity of the processes, which both require specialised expensive equipment and are very energy intensive. In our view, it is exactly this intensity and the related costs that underpin the values of both Bitcoin and gold. This is, not least, because in both cases mining has become increasingly difficult over time.

For Bitcoin, this is a result of the code that has been included in the blockchain, which makes the cryptographic puzzles ever more complicated while at the same time reducing the so-called ‘block rewards’ the miners can earn over time. This reduction of the rewards is referred to as ‘halving’, with the next one being due at some point next year, most likely around April. Instead of 6.25 Bitcoins, the miners will then only be rewarded with 3.125 Bitcoins for the successful completion of one block. Due to the halving feature, it will take an estimated 117 more years until the last of all 21 million Bitcoins is mined. Today’s supply count stands at around 19.4 million coins, mined since Bitcoin’s creation in 2009.

For gold, the increasing difficulty is a result of geology, as most high-grade deposits have already been discovered and exploited. The ore grade, i.e. how much gold is contained in a tonne of rock, has been constantly declining during the past few decades. All else equal, a halving of the ore grade leads to a doubling of the amount of rock that needs to be mined and treated, resulting in a doubling of the production costs, while driving up the incentive prices that are required to develop a new mine.

Both assets, Bitcoin, and gold, are therefore underpinned by an element of scarcity. They are thus classified as ‘real assets’, for which the supply cannot be increased indefinitely, and which are supposed to provide some sort of long-term inflation protection. This contrasts with cash or bonds, which are classified as ‘nominal assets’ and whose purchasing power is eroded by inflation.

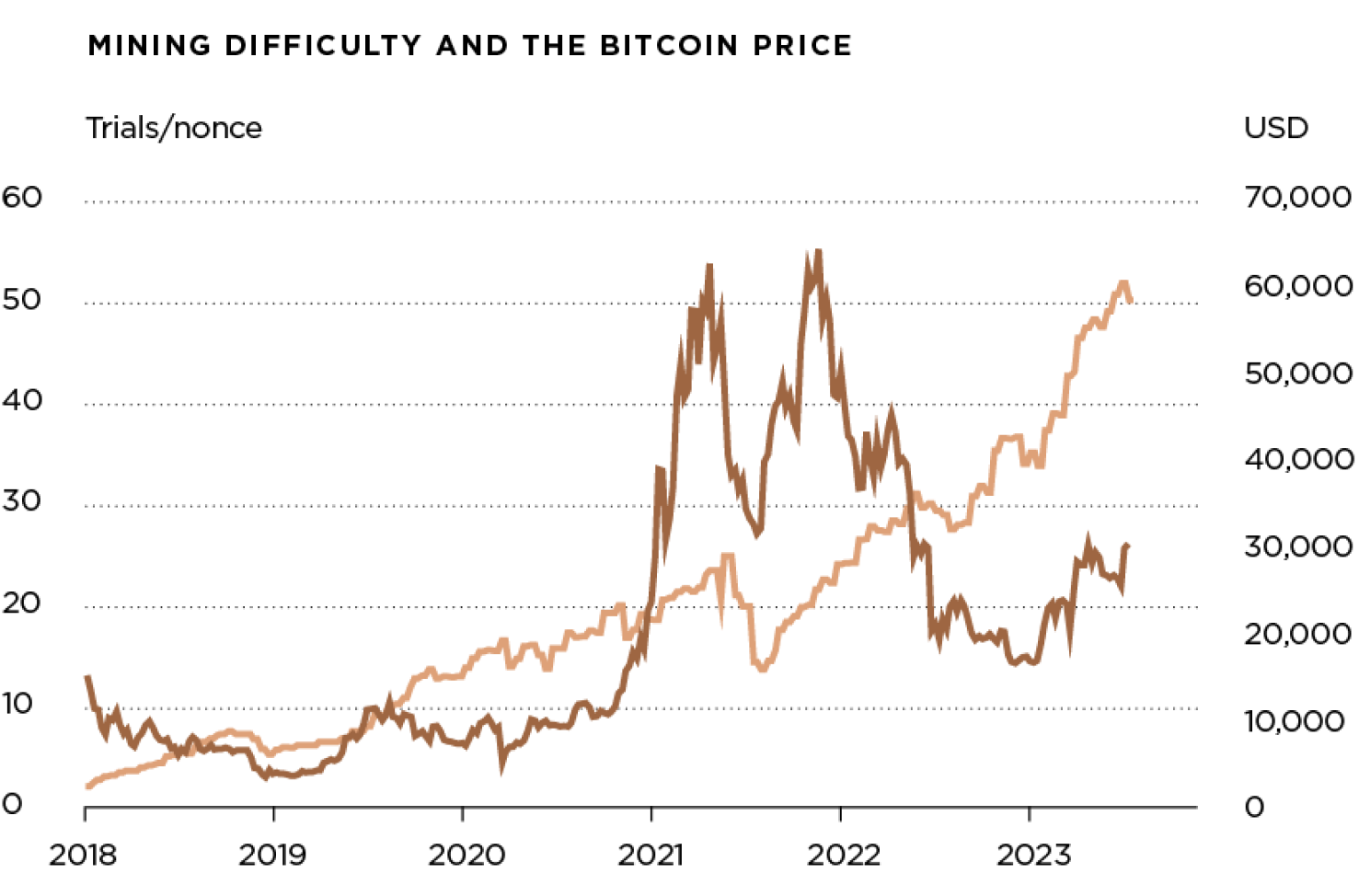

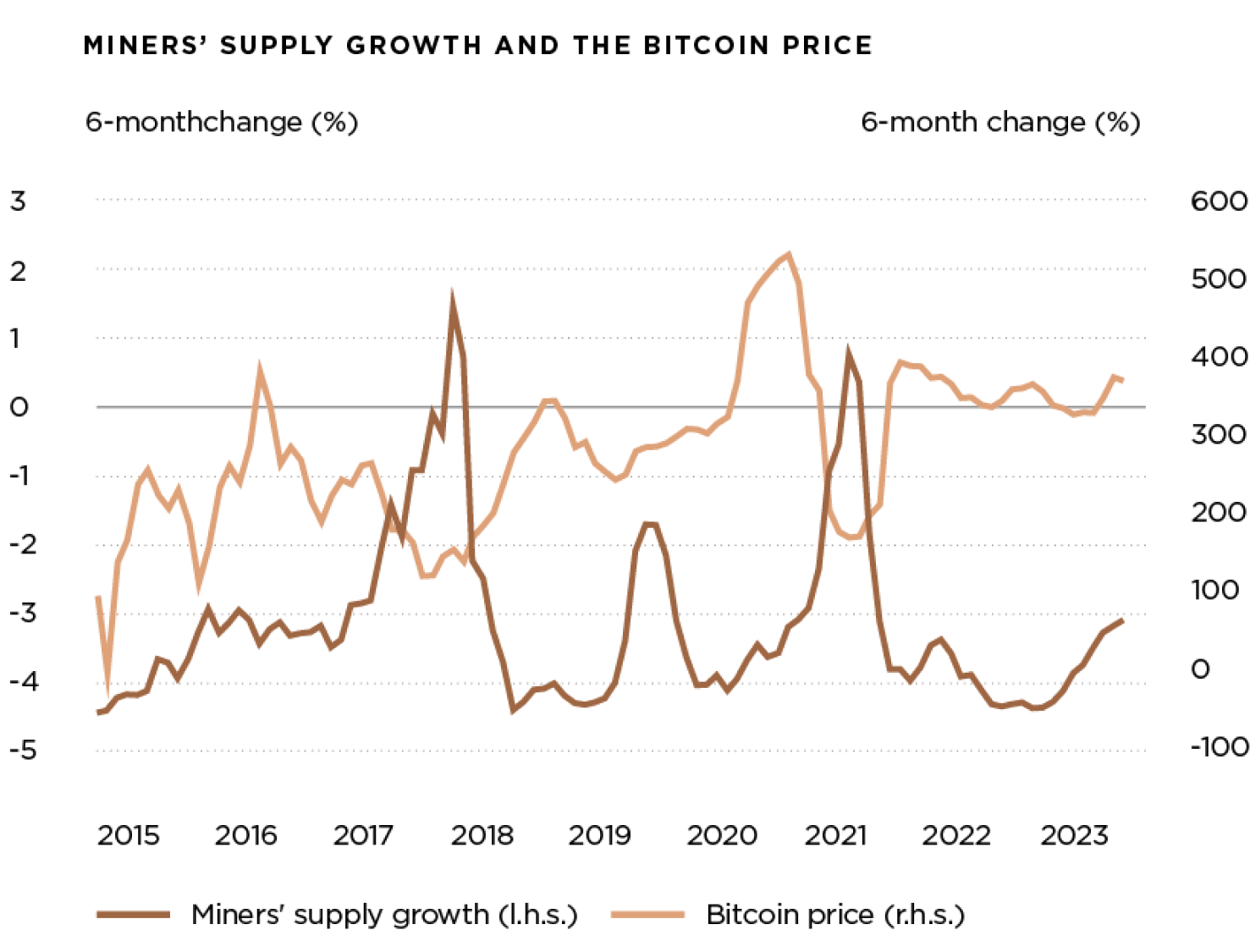

Historically, the halving of the block rewards has been followed by a stellar performance of the Bitcoin price. After the first halving in November 2012, Bitcoin rallied from around USD 12 to USD 1,130 one year later. After the second halving in July 2016, it rallied from USD 630 to USD 2,880, and after the third one in May 2020 from USD 9,500 to USD 36,700. Such a strong price performance in reaction to supply-side adjustments is not at all typical for a currency but can be rather related to a commodity. That said, as shown in the Chart 08, the halving episodes never resulted in a collapse of mined supply growth but rather in a slowdown. Hence, we believe that the rapid rallies cannot be explained by the supply side alone; they require an additional demand boost, i.e. a simultaneous pickup in buying by those who are attracted by Bitcoin’s apparent scarcity. In that sense, the halving rallies can be seen as a form of self-fulfilling prophecy.

| BITCOIN’S HALVING RALLIES SEEM LIKE A SELF-FULFILLING PROPHECY

Another supply-side observation is the procyclical behaviour of the Bitcoin miners. Their necessity to sell Bitcoins to cover their costs is much higher in times of falling prices than in times of rising prices. Put differently, when prices go down, they become forced sellers, aggravating the downward move in the market. When prices go up, they sell as few Bitcoins as possible to increase their own holdings and thus profit from further rising prices. All in all, they are thus aggravating the price swings in the market until another turning point is reached. This boom-and-bust nature of their business is likewise reflected in their share price performance, again drawing parallels with ‘classical’ mining companies. Following losses of between 85% and 90% over the course of 2022, Bitcoin miners are up between 425% and 500% since the start of 2023, massively outperforming the Bitcoin price and other crypto-related companies.

Conclusion: ETFs as the next big thing?

It is utterly strange that ETFs should be at all considered as possibly the next big thing for Bitcoin. By design, this was not supposed to happen, and it would be the worst possible nightmare for Bitcoin maximalists. Leaving ideology aside, the most important concerns, however, would be the further aggravation of the long-debated concentration risks in Bitcoin. Around three-fourths of the total supply is concentrated amongst whales or institutional holders, which keep a balance above the equivalent of USD 1 million in Bitcoins. The physically backed ETFs would entail that some asset managers, i.e. representatives of the traditional financial industry, could become some of the largest Bitcoin holders out there. A successful launch would support our theory of Bitcoin becoming a future form of ‘digital gold’, as it would share more and more characteristics with gold. Bitcoin would become a universally accepted store of value and/or safe haven but less of a payment network, a value proposition that we have in any case always doubted because of its lack of speed and scalability.

So will the potential approval of US-listed physically backed ETFs be the next big thing for the Bitcoin market? Not necessarily. First and foremost, there remains a risk that the products will not be approved, despite the providers’ efforts. We put this risk at less than 50%, as the rejection of the recent filings was rather soft, cit-ing inadequacies of the applications in the sense that they were not ‘sufficiently clear and comprehensive’. To our ears, this does not sound like a harsh ‘no’ from the SEC and leaves the door open for a successful refiling. The latter, however, might take some time. According to Bloomberg, the earliest point in time for either an approval or a rejection would be in September 2023 and the latest in March 2024.

| BITCOIN SHOULD BREAK BACK ABOVE USD 40,000

Even in case of approval of one or more products, we would not expect a big wave of Bitcoin-ETF buying based on the potential investor types we have singled out and the parallels we have drawn with the gold market. Beyond the direct impact from the potential approval, however, we believe that some investors will jump on the bandwagon as they believe that physically backed Bitcoin ETFs are the next big thing, increasing the demand for other types of investors while boosting the market mood. Despite our very defensive assessment of the situation and our belief that today’s Bitcoin prices already partly reflect the expectation of the ETF approval, we would expect the recent rally to continue in case of an actual approval.

We also see the supply-side dynamics shaping up favourably for Bitcoin, including both the miners’ pro-cyclical behaviour and next year’s halving. While there could be a short-term setback to around USD 25,000 in case the ETFs remain unapproved, we would consider this as a medium-to-longer-term buying opportunity for investors willing and able to bear the related risks. We now see more upside than downside for Bitcoin on a one-to-two-year horizon and shift our rating to Constructive. We expect an upside of at least 30% from current levels and thus believe that Bitcoin should break back above USD 40,000. Volatility is set to persist, reflecting the drying-up of centralised exchange liquidity due to the regulatory crackdown in the US, on the one hand, and the shrinking of active supplies, on the other.

Julius Baer

International wealth management group, based on a solid Swiss heritage. Special thanks to Carsten Menke & Manuel Villegas.

juliusbaer.com