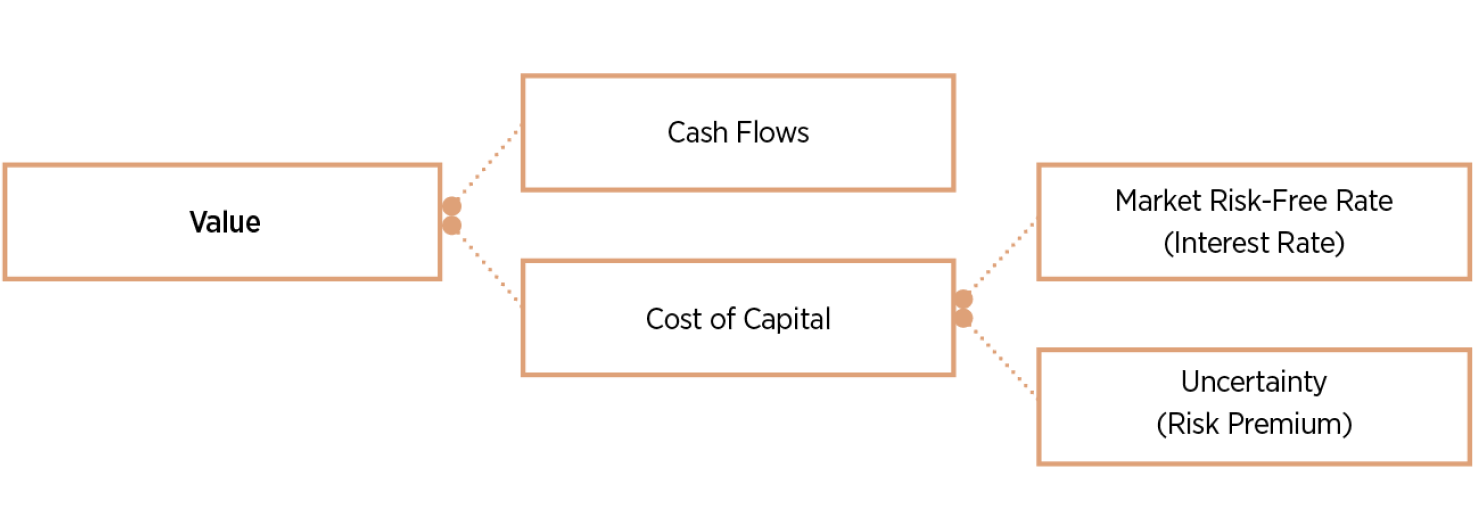

In the current global landscape, the expected cash flow of an asset is always considered the most important value driver, but there are two drivers that also play an important role in determining the change of the value of an asset – these are (I) changes of uncertainty (risk premium) and (II) changes of interest rates. These two elements are what constitutes the expected return on investment, also known as the cost of capital of an asset (Chart 01).

| SECTION I. UNDERSTANDING VALUE SENSITIVITY

Measuring variations in cost of capital: how can we determine which asset classes are more affected than others when the cost of capital changes?

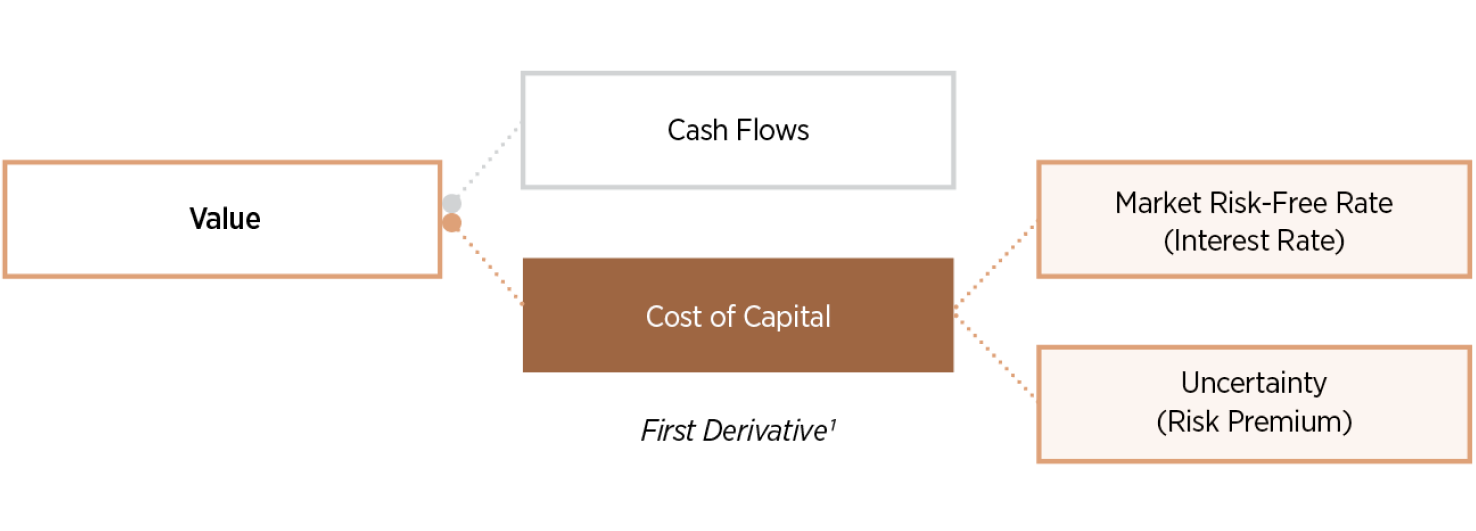

Since an asset’s cost of capital is based on the market risk-free rate and its specific risk premium, changes in either variable have an equal effect on the combined figure. Studying interest rate changes (often in the form of duration analysis) is fundamental in fixed income portfolio management, yet a similar exploration of how an asset’s value reacts to cost of capital changes is seldom used in equity analysis. Enter first derivative sensitivity (or modified duration) – the measure of how an asset’s value reacts to changes in the applied cost of capital. Both sensitivity and duration allow for enhanced comparability across financial instruments, particularly when evaluating their exposure to interest rate risk (Chart 02).

Factors influencing the first derivative sensitivity: what do changes in cost of capital drive?

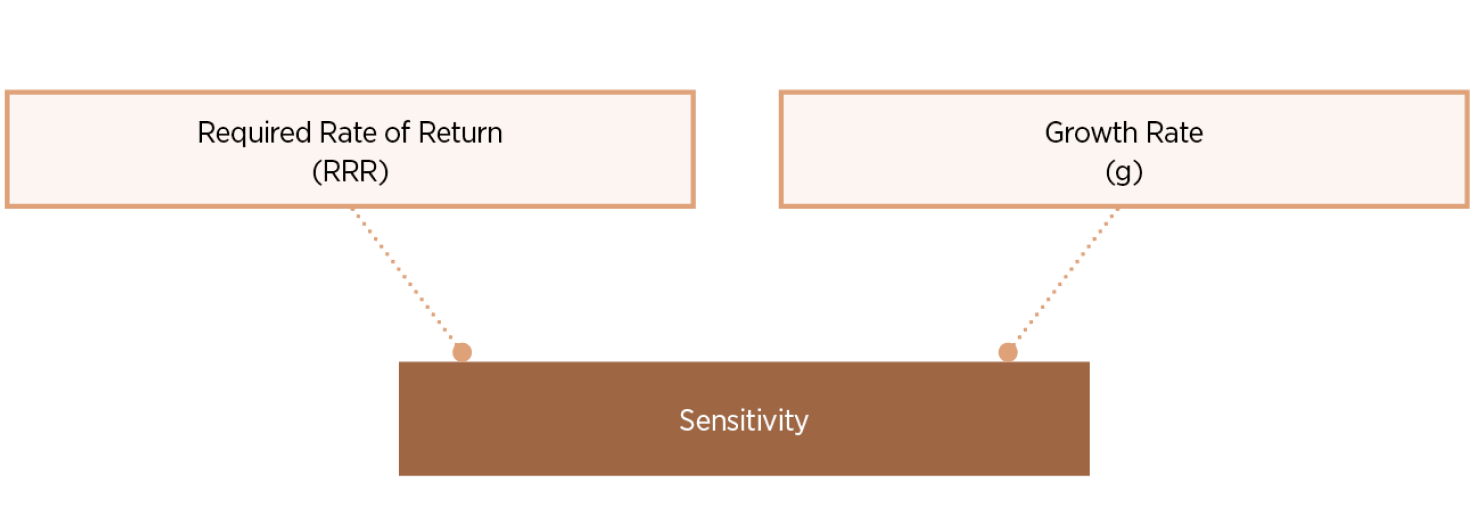

Delving deeper, the key factors that determine how sensitive an asset’s value is to cost of capital changes are (a) the required rate of return (RRR) and (b) the expected growth rate (g). RRR is the minimum return expected from an asset, whereas growth rate represents future asset expectations. Notice that changes in cost of capital affect all assets, not only those that use financial leverage (Chart 03).

History shows that, as RRR decreases, the present value of an asset’s future cash flows increases (i.e., representing a negative correlation), with those farther in the future increasing exponentially (due to the compounding effect: the basis for financial discounting). This leads to a greater contribution by those distant cash flows to the present value of an asset and, thus, to a larger duration. Ultimately, this effect shows that companies with low risk will be more sensitive to changes in the required rate of return than those companies which face higher uncertainty within their cost of capital (↓ RRR = ↑ Sensitivity, ↑ RRR = ↓ Sensitivity).

Conversely, and following the same underlying principle, the greater the expected growth rate and the greater the contribution of distant future cash flows to present value, consequently, the higher the sensitivity of that company’s present value to changes in the discount rate (i.e., representing a negative correlation). Therefore, companies with higher growth expectations will suffer from higher sensitivity (↓ g = ↓ Sensitivity, ↑ g = ↑ Sensitivity).

Estimating an asset’s first derivative sensitivity with one tool: how can we determine sensitivity using the P/E ratio?

Since it is affected by both the required rate of return and the expected growth rate, the P/E ratio can be used to estimate sensitivity. Consequently, companies with a high P/E ratio (irrespective of whether it’s due to a low RRR or high growth) will have higher sensitivity than their low P/E ratio counterparts (↑ P/E Ratio = ↑ Sensitivity, ↓ P/E Ratio = ↓ Sensitivity).

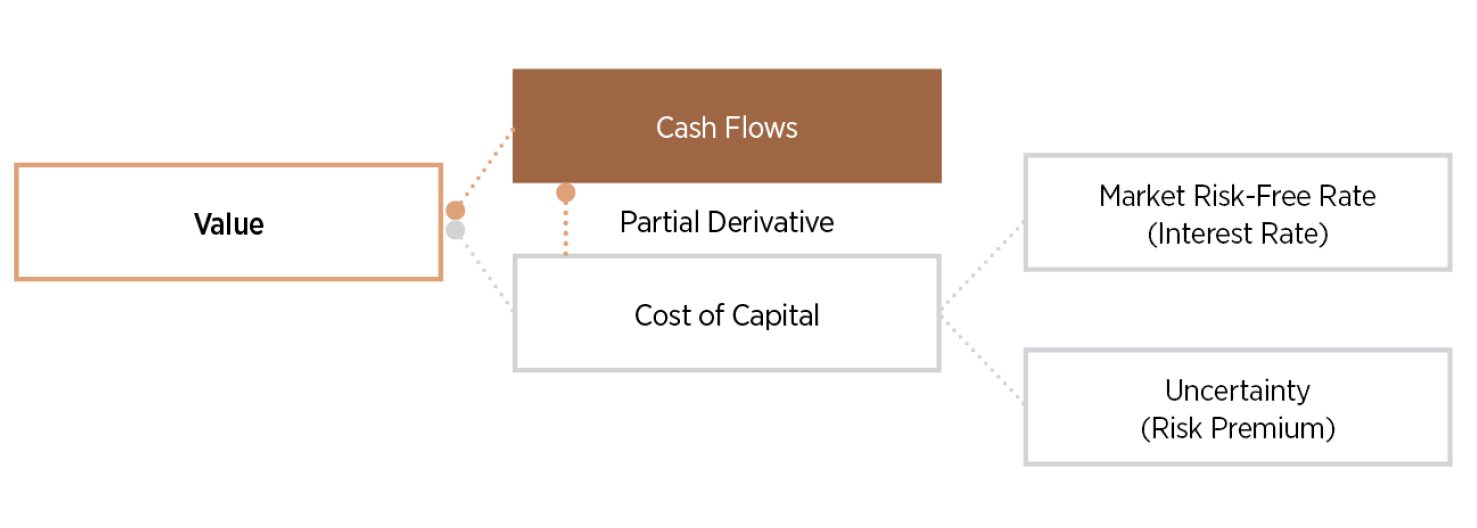

What many don’t consider is that a partial derivative also exists: how can changes in the applied cost of capital influence an asset’s future cash flows?

Another factor to take into consideration is the symbiotic relationship between cost of capital and expected cash flows. The expected inflation, a pivotal driver of monetary policy, is one of the primary measures used to determine a market’s risk-free rate. Any shift in inflation expectations is positively correlated with changes to interest rates, which, as determined above with the first derivative sensitivity, has a direct impact on changes on an asset’s cost of capital. Yet it also directly impacts future cash flows - here's how (Chart 04).

For example, on a general basis we know that increases in interest rates tend to directly translate to lower spending, which leads to decreased economic growth, hence lower future cash flows. The same mechanism exists when we observe changes on the risk premium (↑ Inflation = ↑ Interest Rate = ↓ Spending = ↓ Economic Growth = ↓ Future Clash Flows).

"...the greater the expected growth rate and the greater the contribution of distant future cash flows to present value, consequently, the higher the sensitivity of that company’s present value to changes in the discount rate. Therefore, companies with higher growth expectations will suffer from higher sensitivity"

Moreover, by following the variations in an asset’s applied cost of capital through the underlying impact of either the market’s expected inflation or risk premium, we can equally follow variations in an asset’s future cash flows. This is what we call the partial derivative.

To summarise, the sensitivity of changes of an asset’s value when its cost of capital varies has been profoundly analysed and used by traders daily in fixed income (Macaulay Duration). The same approach can be applied to equity analysis. The P/E ratio is a perfect tool to estimate the sensitivity of this first derivative – how both changes in the required rate of return and the expected growth rate influence an asset’s cost of capital. What’s more, we can also estimate the sensitivity of a partial derivative – how the same changes influence an asset’s future cash flows.

| SECTION II. LEVERAGING THIS KNOWLEDGE IN BUSINESS

Applying academia into real-life business: how does the partial derivative work in Real Estate, world’s largest asset class?

In the case of fixed assets, future cash flows are fixed and hence not affected by changes on the expected inflation. For the rest of the assets, a change of the expected inflation will vary future cash flows. Let’s take a detailed look at Real Estate.

Real Estate is the equity asset class with lower risk that, as per definition, receives a pre-determined cash flow. Is it safe to say that owning a Real Estate asset carries no risk? The answer is no. The risk of assets depends on the underlying business: in this case, rent payments. For that reason, we cannot talk about Real Estate as a whole asset class in a time when investors are expressing a greater demand for “pure stocks”. The behaviour of residential, office buildings, hospitality, retail, and logistics real estate significantly varies and can be impacted very differently, as demonstrated by the COVID-19 crisis and by the interest rate surges exposing spending variability in recent years.

Even the Residential segment of Real Estate needs to be analysed differently, depending on whether we are referring to “prime”, middle-class, or social housing.

It turns out that middle-class residential real estate risk is perfectly correlated with the risk of the economy as it is fully diversified. Even if we invest in just one building, the rent will be paid by doctors, taxi drivers, accountants, and individuals of all types of professions, thus showing that the underlying business represents the entire economy itself. That diversification is even more profound if we also diversify geographically with different buildings.

My path to unlocking value of the partial derivative: ADVERO Properties

I have devoted all my life to the study and business application of the partial derivative. Not only to the sensitivity of an asset’s value when its cost of capital varies, but to how future cash flows are also affected by the same movement. It is for this reason, to unlock the value of this partial derivative, that in 2017 we founded ADVERO Properties Socimi, S.A. (BME:YADV, www.adveroproperties.com).

In brief, ADVERO Properties is a real estate investment trust (known as a socimi in Spain) that focuses on providing quality residential rental homes to the middle-income sector of the population. Considering the fundamental theory explained herein, here’s how the partial derivative applies to ADVERO.

Firstly, ADVERO targets the lower spectrum of the largest segment of the Spanish population, thus fully diversifying its risk in line with the economy. This allows ADVERO to minimise uncertainty within its cost of capital and align growth expectations to the market’s sensitivity.

Secondly, we know that this first derivative sensitivity (i.e. impact of changes in the cost of capital on an asset’s value) also has a direct impact on ADVERO’s cash flows. However, it’s not as you would expect. It turns out that, as high inflation expectations push the market’s risk-free rate up, instead of decreasing, the partial derivative has a positive effect on ADVERO’s future cash flows as the cost of capital increases. This is because ADVERO’s residents attribute a conservative portion of their disposal income to rental payments, therefore not moving out in situations of increased prices. For ADVERO, this represents a natural hedge in periods of high cost of capital: the higher the inflation, the higher the rent increases, the higher the future cash flows. Furthermore, these increases in cost of capital additionally benefit ADVERO by channelling a larger portion of the population into rental housing, increasing demand for its product offering.

"ADVERO Properties is a real estate investment trust (known as a socimi in Spain) that focuses on providing quality residential rental homes to the middle-income sector of the population. Considering the fundamental theory explained herein, here’s how the partial derivative applies to ADVERO"

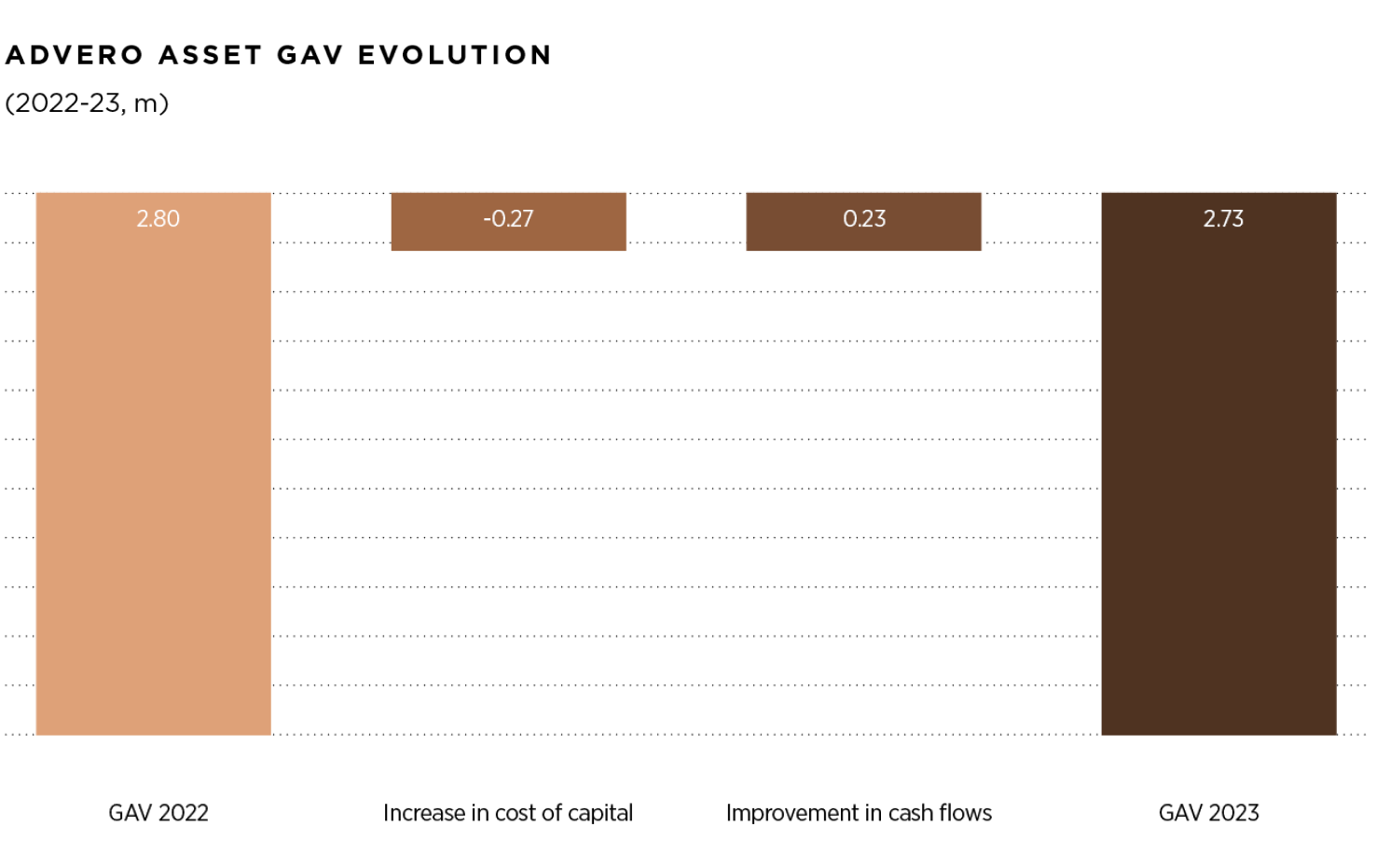

An example of how the above directly translates for one of ADVERO asset’s gross asset value (GAV) between 2022 and 2023 (Chart 05).

In line with the fundamentals of value sensitivity, this is how ADVERO Properties (currently with a portfolio of 25 buildings and +400 apartments) has proven to be a resilient asset class throughout the COVID-19 pandemic and the strong post-COVID inflationary environments, thanks to its naturally hedged cash flows and asset value, as explained by the effects of the first and the partial derivative.

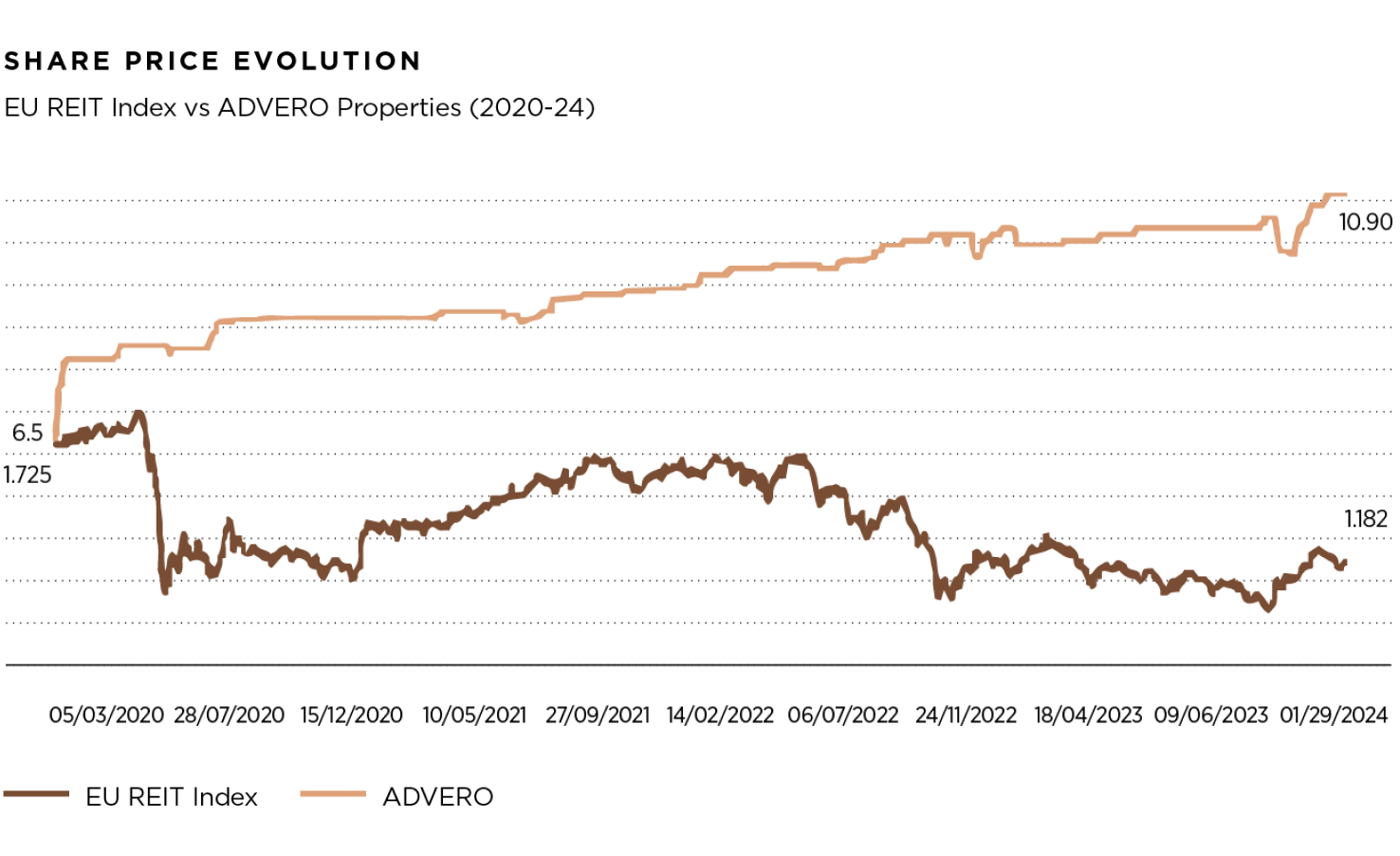

These stable cash flows and sustained portfolio value are ultimately reflected in ADVERO’s share price, which has enabled it to trade in line with the fundamental value of the business, not affected by the aforementioned “black swan” events. As seen in Chart 2, ADVERO’s share price has remained steady over this time, achieving an increase in share price value of 9% in 2021, 5% in 2022 and 9% in 2023, unlike the EU REIT index which saw a downturn over this period.

All of the above shows that fundamentally ADVERO was well positioned to face the economic turbulence and increases in cost of capital over the last few years because of how the expected cash flows of middle-class residential real estate is affected by the same factors that its cost of capital, producing a natural hedge and ultimately preserving shareholder value and returns.

I encourage everyone reading this article to evaluate the theoretical foundations above when making personal investment and management decisions across asset classes, to find the best solutions to maximise value.

Xavier Adserà

Founder & CEO, Adequita Capital, a private family office and investment bank.

adequita.co.uk