Coming out of the pandemic, the classic car market not only strongly recovered, but also accelerated a ground-breaking transformation with new digital auction platforms gaining important market share, new categories of cars becoming “instant classics” and new collectors joining the classic car market.

Collecting cars is often presented as an investment, but for the majority of the collectors, it is first and foremost a passion that takes them to international, national or local events, and to which they dedicate a significant part of their free time toward the maintenance or restoration of their cars. It is rare that true collectors sell one of their cars – normally, their collections only grow in quality and quantity. As a result, the classic car market, although subject to positive and negative trends like other collectibles, tends to be more anti-cyclical than others.

| THE CLASSIC CAR MARKET FROM 2020 TO 2022

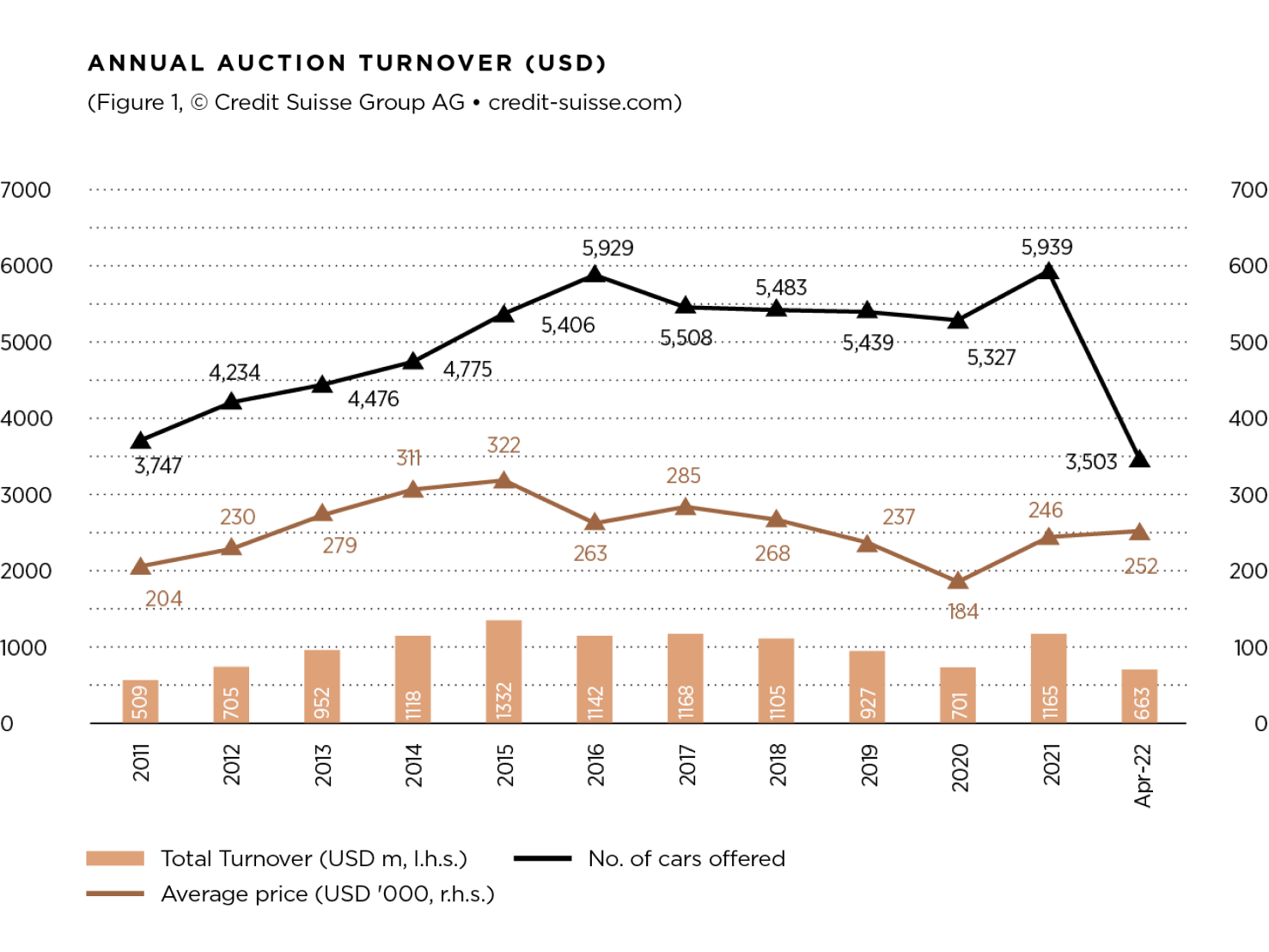

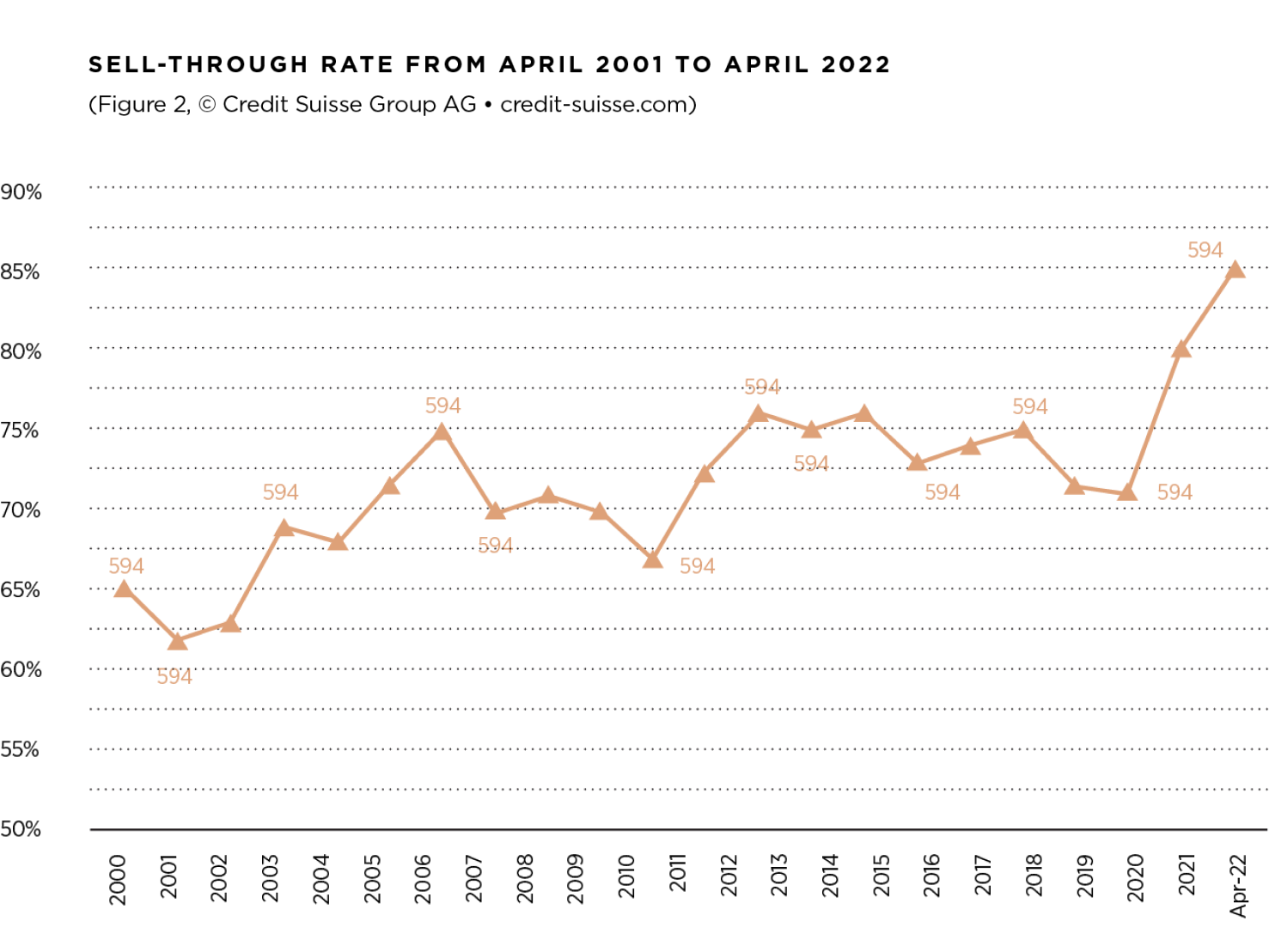

Figure 1 shows the yearly total turnover of classic car auctions (which represent around 20%–25% of total market sales), where we can see a strong increase in classic car prices in 2014 and 2015 peaking in 2016, whereafter prices started to decrease at the same time as total turnover (it is less evident in the turnover because, in the meantime, the number of cars offered has increased). Another important indicator for the auction market is the sellthrough rate (number of cars offered to number of cars sold), where, for the last 20 years, a 70% rate was considered fair, and 75% good (see Figure 2).

In both charts, the 2019 numbers show a weak market in search of a new level – all key market indicators (turnover, average value and sellthrough rate) were lower than the year before. In 2020, the market was affected by the COVID-19 pandemic, which led to the cancellation of the vast majority of classic car events, such as fairs, meetings, Concours d’Elégances and consequently most of the auctions that are often organized during these events. As a result, turnover in 2020 turned out to be the lowest of the last nine years. At the same time, pent-up demand may have prompted collectors, both new and established, to finally purchase the car of their dreams or enhance their collections as the market began to normalize.

This not only led to a growth of online sales, but, when the Pebble Beach Concours d’Elégance and the various auctions were held live again in Monterey (California) – always the most important events of the season – total turnover in the classic car market started to strongly recover. The results of these auctions were higher than the most optimistic expectations, notwithstanding the ban to enter the USA for foreign visitors. Turnover in 2021 returned to over USD 1 billion, the average price was up 35% and the sellthrough rate rose to over 80%, which was a stand-out result. The 2021 Top Lot was the 1995 McLaren F1, the 3-seater streetcar, offered in the Gooding sale in Monterey and sold at USD 20,465,000, which is a record price for this model.

In the first four months of 2022, the most significant auctions have been the 11-day Mecum mega auction in Kissimmee (Florida), the Barrett-Jackson mega auction in Scottsdale (Arizona) together with the RM-Sotheby’s and Bonhams in the same city in January; the RM and Bonhams sales in Paris in February; the RM, Gooding and Bonhams in Amelia Island (Florida) and the Artcurial sale during Retromobile in Paris in March; and the Bonhams sale in Goodwood in April. Market results for the first four months of 2022 year-on-year show a 118% increase in total turnover, a 65% increase in the number of cars offered, a 14% increase in the average price and a stunning 86% sell-through rate – the highest since 2011 and the highest ever recorded.

The two periods are not 100% comparable as, in February 2021, Retromobile in Paris was canceled and consequently their auctions did not take place. The auctions in Amelia Island were delayed until May and internet-based sales organized by new players (see details below) started changing the market.

The Top Lot for the first three months of 2022 was the Talbot-Lago T150C SS “Goutte d’eau” by Figoni & Falaschi, which brought in USD 13,425,000 in the Gooding auction in Amelia Island, making it the most valuable French automobile ever sold at auction. The last Amelia auctions confirmed the strength of the US market, with a total turnover of over USD 127 million and a 90% sell-through rate, with world record figures for many models. Therefore, it would appear that the market strongly rebounded as the world emerged out of the pandemic.

| TRANSFORMATIONAL CHANGES

From 2019 to date, however, the classic car market and the auction scene have gone through a transformational change leading to a market that is very different now compared to the pre-COVID years.

Today the classic car market is made up of:

➊ Traditional auction houses (such as Mecum and Barrett-Jackson in the USA and many other regional companies in Europe and the UK), which still organize only old-style live auctions.

➋ Other traditional auction houses (such as RM-Sotheby’s, Bonhams, Gooding, Artcurial), which organize both live and internet auctions, with a cost of around 10% for both the seller and the buyer.

➌ Dedicated internet platforms, such as Bring a Trailer (BaT) and PCARMarket in the USA, Collecting Cars and The Market (in the UK and Europe). BaT charges a USD 99 fee to the seller and a 5% commission to the buyer, with a maximum of USD 5,000. These auctions have very different rules and represent a significant shift from the “old” auctions as they are much cheaper and more transparent.

The real “game changer” in the last two years was BaT, which surprisingly became the most important auction house in the field in 2021. BaT started as a platform for enthusiasts in California – the US state with the most fuel consumers in the USA and by far the biggest classic car market in the world – which certainly gave the platform the necessary catalyst to grow. BaT’s 2020 turnover was USD 398 million. In 2021, its turnover was USD 828 million (+108%), beating Mecum (USD 578 million) and nearly doubling RM-Sotheby’s turnover (USD 407 million), the two most important traditional auction houses in the field. In the first quarter of 2022, BaT’s turnover was around USD 322 million, of which roughly USD 97 million of sales were cars sold for over USD 200,000.

BaT offers around 100 lots every day (mostly cars, but also some motorcycles and special parts) and the selection goes from USD 3,000 used cars (mostly without a reserve) to multi-million-dollar cars (mostly with a reserve). BaT gives users the opportunity to make comments visible to all subscribers, to ask sellers questions in addition to the car-fax reports that state if the car was involved in a crash or other insurance reimbursement cases, thereby increasing bidders’ trust and confidence. Two actual bidders are always requested (no “chandelier” (phantom) bidding to conceal a reserve price). If a car is offered with a reserve and a second bidder is lacking, the bidding stops and the car is not sold.

After the sale, BaT puts the highest bidder in touch with the seller and often the deal is concluded in this manner.

While old-style classic car collectors often hold the view that BaT is only good for new or modern cars, where the condition of the cars can be seen from photos without the need for an expert assessment of the vehicle’s authenticity and condition, BaT also offered (and sold) multi-million-dollar pre-war cars in the first months of 2022, such as a 1927 Mercedes-Benz 680S Sport for USD 2.8 million and a 1930 Mercedes Benz 770K four-door cabriolet by Voll & Ruhrbeck for USD 2,555,555 – BaT’s highest sales for the period (and during its short history). BaT has also offered and sold classic cars from the fifties and sixties like the Mercedes-Benz 300SL “Gullwing” and Roadster, the Ferrari 365 GTB/4 “Daytona”, Ferrari Dinos, Aston Martins, and not only American “muscle cars” as is sometimes portrayed. This shows that there are online buyers with ample financial resources, and that sellers now know about it, which will likely establish BaT even more as an online portal.

"BaT also offered (and sold) multi-million-dollar pre-war cars in the first months of 2022, such as a 1927 Mercedes-Benz 680S Sport for USD 2.8 million and a 1930 Mercedes Benz 770K four-door cabriolet by Voll & Ruhrbeck for USD 2,555,555 – BaT’s highest sales for the period (and during its short history)”

Like many other activities, the passion for classic cars can now be pursued comfortably from home and online 24/7, 365 days a year. It is as easy today to purchase a collector car online as it is to purchase an airline ticket. This revolution has taken place in the space of only 24 months, accelerated by COVID-19, which has helped to establish auction houses with low commissions.

| INSTANT CLASSICS, THE PORSCHE-FERRARI LEADERSHIP AND GENERATIONAL CHANGES

We are increasingly seeing descriptions of cars such as the “1,300-Kilometer 1987 Porsche 959 Konfort,” “250-Mile 2005 Porsche Carrera GT” or “50-Mile 2019 Ford GT Carbon series” and ”850-mile 2012 Lexus LFA”. Naturally, purchasing nearly new cars at auction does not require any deep check of authenticity or condition – 100+ photos and, most of the time, a video are enough to illustrate the car. Many “instant classics” are offered today on internet platforms, taking advantage of the low commissions. Whereas, in the past, a new car leaving a dealer’s showroom instantly depreciated by 15%–20% at minimum, today they may increase in value, e.g. if they are limited-production cars.

Increasingly, buyers of special cars do not actually drive the cars and enjoy them, but regard them exclusively as investments or stores of value to be sold and converted into cash again over relatively short periods. Some manufacturers (Bugatti, Ferrari and Porsche) have understood this trend and market “special edition cars” every year in limited numbers offered to a selected group of their faithful “platinum” customers. Being on a “lucky few” list gives buyers the option to purchase a new “special edition.” If they decline, there is a waiting list of other eager customers prepared to step in.

| INVESTOR SENTIMENT DRIVING THIS NICHE OF THE MARKET

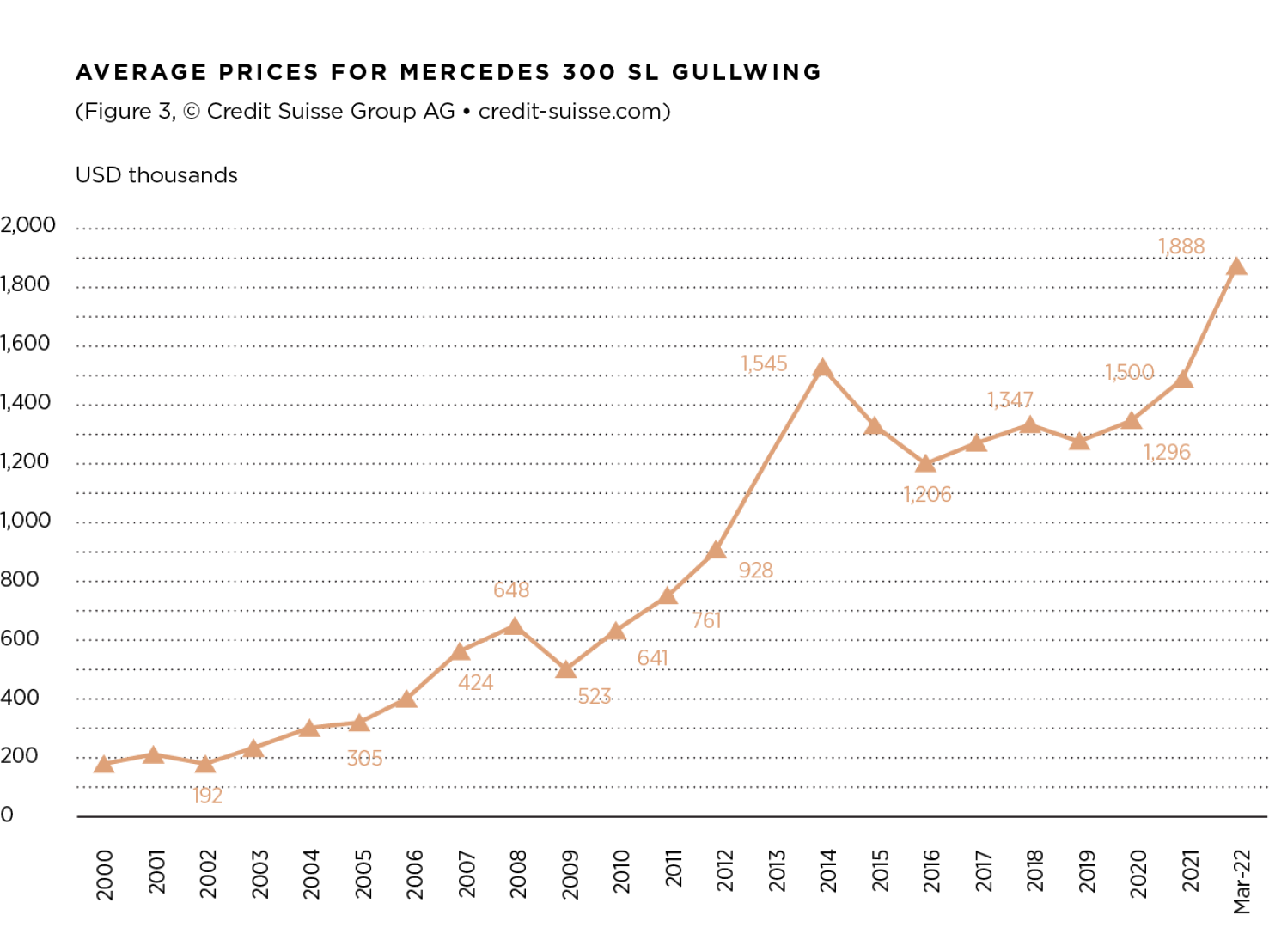

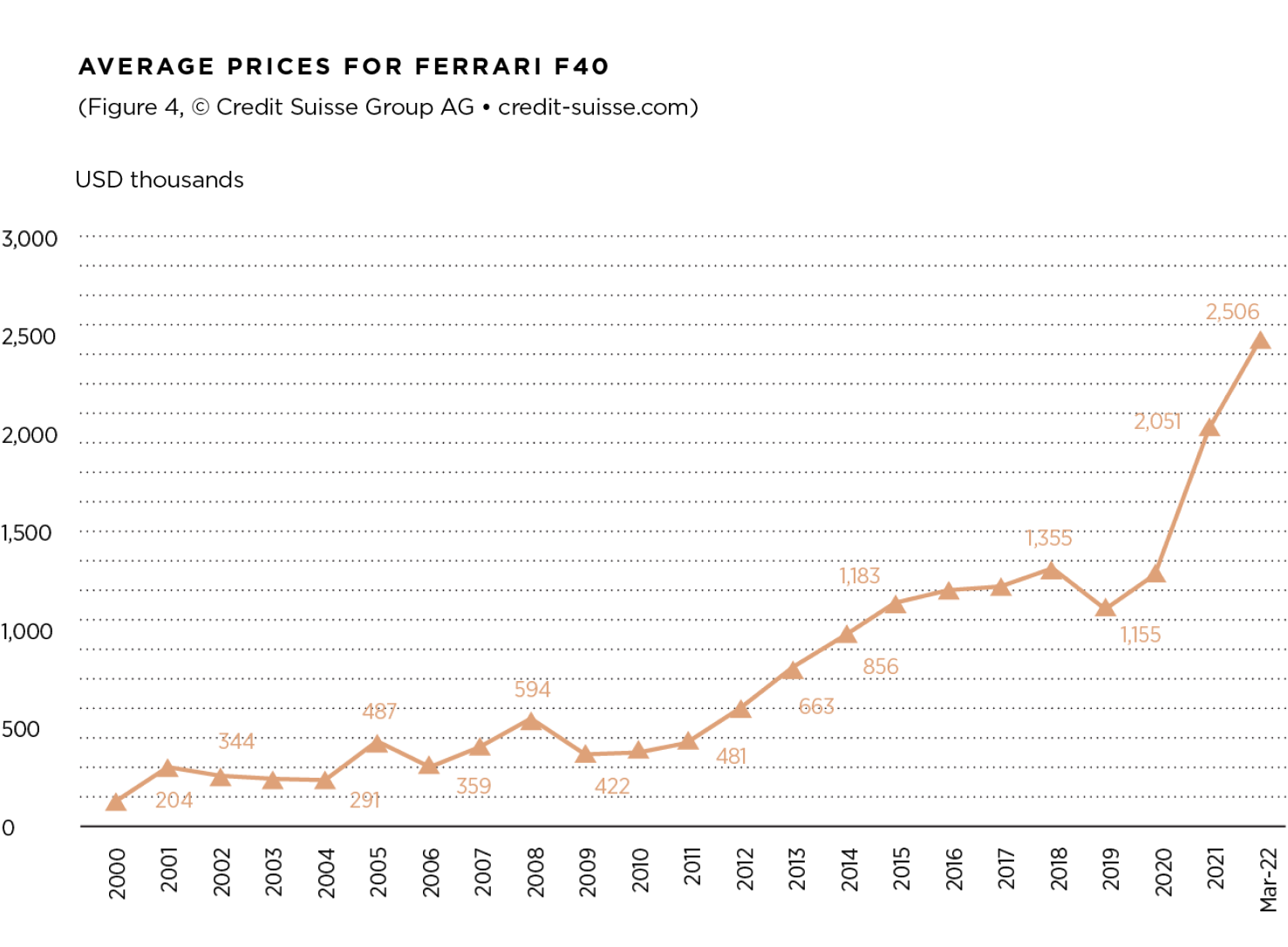

The market for older cars is in general very strong, but selective: iconic cars like the Mercedes-Benz 300SL “Gullwing”, the Ferrari 288, F40, F50, Enzo and La Ferrari, Lamborghini Miura, Porsche Carrera GT and 959 have all achieved record prices recently. Less requested, and hence with more stable prices, are other models of the same brands like the Ferrari 365 GTB/4 “Daytona” or Porsche 911 RS 2.7. The value increase in the medium term can be illustrated by the average prices (final price including buyer’s commission) reached at auction by two iconic models, the Mercedes 300SL “Gullwing” and the Ferrari F40 (see Figures 3 and 4).

Photo by Evgeniyqw / ©Mercedes-Benz.

Ferrari cars have been the trendsetter for years, with a weighting of around 30% in the total turnover of key classic car auctions. In 2021, the company's weighting decreased to 20% of total turnover, while the weighting of Porsche cars increased. In the first quarter of 2022 (including the BaT sales, where Porsche is present with many more cars than Ferrari), the German manufacturer continues to lead. Younger collectors are purchasing younger cars. This generational change is normal because the first classic car in collectors’ lives is generally the car of their dreams as teenagers. Looking at the number and weighting of the cars younger than 20 years offered at auction, the percentage of the cars built in the last 20 years has increased in the last decade to peak in the first quarter of 2022. Whether this is a structural effect of changing demographics or the result of short-term investors will become clearer with the passage of time.

| GEOGRAPHICAL DISTRIBUTION AND INTERMEDIARIES

Since 2020, there has not been any major change in the country distribution of classic collectors. The publication “Key” by TCCT (The Classic Car Trust) compiles a list of the “Top 100 Collectors” in the world. In the 2021 listing, 17 of the largest 20 classic car collectors are from the United States. The USA is not only the most important market, but also the most active. Europeans and the UK are trailing. The current geopolitical events are unlikely to change this distribution greatly. The number of Russian collectors is very low. China, in turn, is the second-biggest market worldwide for very exclusive new cars, but the classic car market is still practically non-existent there. Notwithstanding the expectation of changes in the “status” of classic cars in China (still considered to be used cars and therefore impossible to import and drive on Chinese roads), there have not been any new developments in the last few months.

As in the past, the sale of the rarest and most expensive cars still remains generally the domain of big reputable live auction houses and brokers. Among recent noteworthy developments, Hagerty, the most important US insurance company specialized in classic vehicles, debuted as a publicly traded company on Wall Street in December 2021. Since then, Hagerty has acquired some of the most important US events, such as the Amelia Island, Detroit and Greenwich Concours d’Elégances and the California Mille. Also in December, a group of former RM-Sotheby’s executive managers announced the launch of a new collector car auction company, Broad Arrow Group. Soon after that, they announced a joint venture with Hagerty for a new auction to be held at the Monterey Jet Center next August. The Monterey week is thus likely to see plenty of sales and the key auction houses have already consigned some very important cars for the event.

More recently, the 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupé sold at an RM-Sotheby’s auction in Germany to a private collector for a record EUR 135 million (USD 142.9 million) in May, making it the most valuable car ever sold.

Non-fungible tokens (NFTs) are also making their appearance in the classic car market. For example, Lamborghini and INVNT Group collaborated in February this year to offer the world’s first one-of-one NFT ever to be auctioned with a physical super sports car (the last Lamborghini Aventador LP 780-4 Ultimae Coupé ever produced). The NFT was a 1:1 video produced by media artist Krista Kim and music producer Steve Aoki with a digital replica of the physical car for use in the Metaverse, e.g. racing games. The sale was hosted in a dedicated online auction by RM Sotheby’s and sold for USD 1.6 million.

"...Lamborghini and INVNT Group collaborated in February this year to offer the world’s first one-of-one NFT ever to be auctioned with a physical super sports car (the last Lamborghini Aventador LP 780-4 Ultimae Coupé ever produced)”

| THE FUTURE OF CLASSIC CARS

Europe is moving to electric mobility. Today, most of the new cars are safe and silent, with advanced driver aids and assistance. While they are means of transportation, they may not arouse the kind of feeling sought by passionate drivers. Together with the rarity of classic cars, this may increasingly drive a younger generation of collectors toward analogue cars with turbo chargers, manual gearboxes and roaring V8 or V12 engines to experience the same kind of pleasure felt by mid-20th century drivers with the sounds and smells of authentic, adrenalineinducing motoring.

The Fédération Internationale des Véhicules Anciens (FIVA) is the international federation that groups all the national historic vehicle clubs with the aim of protecting, preserving and promoting “the use of yesterday’s vehicles on today’s roads.” In 2021, FIVA’s Worldwide Historic Vehicle Survey of classic car users found that historic vehicles are used on average 15 times a year and the average distance traveled per annum is around 1,400 km.

Therefore, while classic cars clearly do not meet any prevailing sustainability criterion, the percentage of total emissions they generate is negligible. Moreover, in the future, carbonneutral eFuels (also called synthetic fuels), which are made by mixing hydrogen derived from renewable sources typically with carbon dioxide and have already been tested in racing cars, could solve pollution issues and also permit the use of classic cars in strictly regulated countries, allowing a broader public to enjoy the sight of a historic vehicle on the road and the nostalgia of the old days.

Credit Suisse

Global investment bank and financial services firm, based in Switzerland.

credit-suisse.com