On the surface, 2022 may have been crypto’s worst year yet. Bitcoin is down more than 75% from its highs the year prior while on the tail end, some applications sit idle with few users and teams have abandoned projects. Unchecked systemic leverage and risk resulted in the collapse of hedge funds, credit facilities and most prominently, FTX, one of the industry’s largest trading exchanges. The proliferation of cryptocurrencies in tandem with the flood of post-COVID central bank liquidity delivered a spectacular bubble which consequently collapsed. It’s not surprising that many onlookers now wonder… has crypto failed?

Bubbles and collapses are certainly not new for crypto, in fact, this is the third one the industry has experienced in just the past decade. If we understand why bubbles occur in markets, it's easy to see why crypto has been through so many of them in such a short period of time. A common theme in bubbles throughout human history is that of an emergent technology, like the internet, the telephone and the railway. Human imagination demands too much from nascent technology, capturing the public psyche. Inflated expectations around short term results in a scarce new asset class with many buyers leads to irrational and euphoric markets.

Another commonality across history’s most spectacular bubbles is that of the emergence of new networks. The discovery of new trade routes led to the Mississippi and South Sea bubbles in the 1700s and that of the railway bubble in the 1800s. The telegraph contributed to the bubble and crash of 1929 as the volume of trading activity ballooned. The internet has arguably been the most significant network that has been created and many believe that crypto is an evolution of it. The tight feedback loops in crypto makes it conducive to shorter and more frequent bubbles. Its decentralized nature and open-source culture means that ‘protocols’ or decentralized applications, or ‘dApps’, can be quickly and aggressively iterated, ‘forked’ (the act of taking source code from an open source software program and developing a new program) and launched to market.

The cryptocurrency industry has come a long way since the creation of Bitcoin in 2009. What started as a niche market for tech enthusiasts has evolved into a global phenomenon with hundreds of billions of dollars in market capitalization. Although the industry has faced its fair share of challenges and controversies it has also shown immense resilience. Bubbles and the massive influx of capital has a tendency to lay down the foundations of a powerful new industry. Much like the fiber optic cables and railways constructed in the internet boom and railway boom respectively.

Despite the large drawdown in liquidity, Decentralized Finance, or ‘DeFi’, still boasts $40B in TVL (Total Value Locked, a metric defined as the total market value of cryptocurrency locked in a smart contract in expectation of yield, utility or governance rights) while decentralized exchanges, or ‘DEXes’, still maintain monthly trading volumes of between $50B and $100B. NFTs, a burgeoning new asset class, experienced more than $24B in organic trading volume in 2022 across blockchain platforms and marketplaces . Influential brands such as Nike, Starbucks, Meta and Disney have all launched new initiatives and products on the blockchain.

| FTX IS NOT DEFI

If there is one word that pessimists can point to in crypto for 2022 it is ‘contagion’. Financial crisis worked its way through the entire system leaving massive liquidations and collapse in its wake. Beginning with the failure of the Terra blockchain, erasing almost $60B of value seemingly overnight leading to the liquidation cascade of institutions, hedge funds, company treasuries, exchanges, and credit facilities. However, these failures occurred as a result of mismanagement of risk, primarily leverage, and fraud by centralized entities. What some in the industry call ‘CeFi’ (Centralized Finance).

Crypto’s 2022 contagion has many similarities to that of the 2008 Global Financial Crisis. Both a result of an intransparent and at times fraudulent, financial system. Leverage ran amok and players in the system had no way to verify how much leverage was actually in the system and if the collateral was in fact what it appeared to be. At the inception of the chain of implosions was 3AC, the crypto hedge fund, and Celsius, a crypto lender and savings product. Both borrowed billions of dollars to invest in Terra’s yield protocol, Anchor, whilst posting the same collateral across multiple loans and being deceitful about the true value of its collateral. In another highly publicized collapse, FTX’s failures were a result of lending out customer assets to another commingled hedge fund, Alameda Research.

Whilst these centralized financial institutions imploded one by one, DeFi performed as per design. Customers had 24/7 access to their decentralized exchanges, lending and borrowing platforms, and other DeFi products. At any given time, you had full and transparent access to exactly how much liquid collateral existed in any protocol and the extent of interconnected leverage in the system. Liquidations happened seamlessly and lenders were made whole (most of DeFi currently operates on over-collateralized loans). Even the collapse of Terra was a result of an oversight of economic mechanisms but operated (and failed) as per design. Thus the common misnomer, 3AC, Celsius and FTX were not DeFi.

The events of 2022 have invigorated the debate about the significance of DeFi and what it enables. Permissionless and immutable smart contracts clearly defining risk in a completely transparent manner. One could argue that the GFC would not have occurred if the financial system, securities, and financial products all existed on the blockchain.

The bull case for DeFi has only strengthened and many of the benefits that were promised remain true. Frictionless movement of assets and capital, self-custody, tenfold efficiency improvements, a limitless set of ways to activate capital and a transparent ledger that exposes pockets of hidden leverage and bad debt. Bitcoin and Ethereum have settled trillions in volume since their inception while stablecoins have reached a market capitalization of more than $150B. They are proof that a global and immutable payments network can be settled on-chain in a matter of seconds without middlemen and available 24/7. Building financial rails more suited for the modern era.

| INSTITUTIONAL ADOPTION, REGULATORY CLARITY AND REAL WORLD ASSETS (RWA)

As DeFi continues to mature, institutional adoption continues to ramp up at a steady pace. Financial institutions are steadily rolling out crypto offerings in asset management, trading and investment banking despite many years of skepticism and resistance. BNY Mellon announced the launch of its digital assets custody platform while Blackrock announced crypto offerings to institutional clients. The lack of crypto-specific regulation has locked many institutions out of the emerging asset class in the past, but many believe the widely publicized collapse of FTX will potentially accelerate the timeline for regulation (similar to new banking regulation that emerged out of the GFC). The historically skeptical JP Morgan wrote the following excerpt in a note in late 2022:

“...we see the news surrounding FTX as one step back, but one that could prove to be the catalyst to move the crypto economy two steps forward (further unlocking the utility value of blockchain). In fact, we see the establishment of a regulatory framework as the needed catalyst to massively ramp the institutional adoption of crypto.”

JPM also states the following, loudly resonating our own beliefs around the strengths of DeFi and the misguided criticism towards it: “Moreover, while the news of the collapse of FTX is empowering crypto skeptics, we would point out that all of the recent collapses in the crypto ecosystem have been from centralized players and not from decentralized protocols.”

A theme that extends from regulatory clarity will be greater opportunities for permissioned or regulated DeFi. The merging of institutional grade compliance standards and the immutability and transparency of code. This is a compelling marriage for real world use cases and may be the foundation for the eventual ‘tokenization of everything’. The tokenization of real world assets (RWA) resolves both the massive inefficiencies in traditional financial settlement rails and access to a global liquidity pool seeking other forms of yield (currently DeFi yield is sourced from unsustainable protocol governance token inflation or borrowing and lending that has fallen far below that of risk-free rates in traditional finance). The largest implementation of the tokenization of RWAs was Societe Generale’s issuance of tokens based on AAA-rated mortgage securities which was used as collateral to borrow up to $30M from a DeFi protocol, MakerDAO. Other institutions have started pilot programs to tokenize financial products and other securities such as Singapore’s DBS Bank and JP Morgan. Many other startups are emerging, looking to resolve the inefficiencies and illiquidity of real estate while others are looking beyond financial instruments into luxury goods and collectibles.

| MAINSTREAM ADOPTION, SOCIAL AND GAMING

Another increasingly compelling theme going forward is in the application layer, in particular, dApps that can effectively abstract away the complexities of blockchain and dramatically improve the user experience. To an extent that most users would not be cognizant of the underlying infrastructure they are operating on, much the same way most users aren’t aware of the intricacies of the internet and the HTTP protocol today. As blockchain infrastructure continues to evolve and mature, adoption at a mainstream level is closer than ever.

We saw glimpses of this in 2021 but use cases were primarily embedded in financial applications or for the purposes of financial speculation. User growth will increasingly come in the form of dApps that engage users in ways that aren’t solely financial in nature such as in the gaming, social and entertainment-based verticals.

NFTs (Non-Fungible Tokens) are fundamental to this emerging use case as they enable new archetypes for how ownership is represented in the digital world and in a virtual economy. In Web2, consumers and brands only exchanged dialogue and information. In Web3 they can now exchange value and companies can empower consumers to share in the value created and participate in a brands’ evolution and growth. Corporations and brands will likely continue to tap into the potential of NFTs and Web3 as completely new modes of engagement with their customers.

"In Web2, consumers and brands only exchanged dialogue and information. In Web3 they can now exchange value and companies can empower consumers to share in the value created and participate in a brands’ evolution and growth”

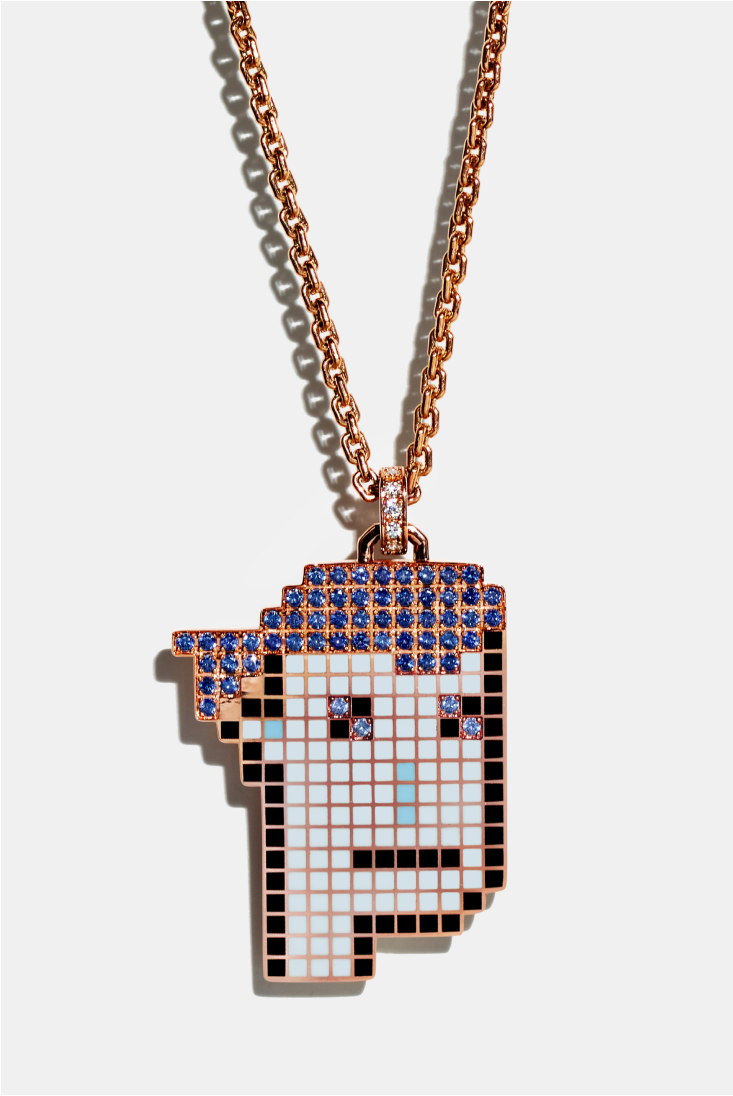

Although NFT adoption is still in its infancy we’re already seeing major brands experiment with utility and opportunities for expanding customer engagement, membership, and rewards. Adidas has collaborated with NFT art collections and paired them with physical merchandise, Starbucks announced their NFT-powered loyalty program , Tiffany & Co. recently collaborated with CryptoPunks to create NFTs paired with real world jewelry.

Gaming is another major vertical that will benefit from what NFTs enable, ownership of items and identity. Blockchain will unlock explosive new growth in gaming and virtual worlds (also known as the ‘metaverse’) with the new concept of digital property rights.

The video game industry is now estimated to be worth more than $240B and is larger than the film, TV and music industry combined. The number of video game players in the world is estimated to be around 3.2B, 40% of the global population. The gaming industry is already becoming a behemoth while a Newzoo study showed that 81% of U.S. gamers suggested they would spend more on in-game items if they could own and sell them for real-world money. NFTs, cryptocurrencies and blockchain have the potential to act as an accelerant to this growth as it unbinds virtual economies stifled by centralization and unfair practices.

We have seen glimpses of a virtual open-world and shared economy in games like Roblox which lets players create and monetize their own content. The game has become one of the biggest apps in the world with 120M people playing it monthly and a report stating that a staggering 67% of 9 to 12-year-olds in the US plays the game . Roblox compensates creators with an in-game currency, Robux, which can be exchanged for real money. In 2021 the community of creators received $110M and the company states that they have “kids making millions of dollars a year on their games”. However, despite sharing value back to its users Roblox has had its share of controversy as many accuse them of not being fair with their profit distributions.

The emergence of creator economies demonstrates that providing ownership and influence on the culture and content of a virtual world can be a powerful concept. Blockchain is a critical part of expanding this vision to unlock greater economic efficiencies and opportunities in the new virtual economic frontier.

In conclusion, despite the depressed sentiment and rumors of the fall of crypto, there is still so much to be excited about. Prices may have fallen but innovation is still happening at breakneck speeds. The themes brought up in this article are only a fraction of the compelling progress that is being made in the space. Blockchain infrastructure continues to mature while frontier technologies like zero-knowledge proofs enable scaling, privacy, and interoperability in new and trustless ways. As Amara’s Law states: “we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Sam Kim

General Partner, Big Brain Holdings.

bigbrain.holdings