For three years in a row, Regius Magazine has been asking the ultimate investment questions to ChatGPT and published the results in past edtions. For our 9th Edition, Regius Magazine asked the very same five questions to ChatGPT.

Here are the results:

RMAG: Define MegaTrends:

CGPT:

Megatrends are large-scale, long-term shifts that significantly impact societies, economies, industries, and cultures worldwide. These trends typically develop over decades and shape the future by influencing government policies, business strategies, and individual behaviors.

Key Characteristics of Megatrends:

● Global Impact

They affect multiple regions and industries.

● Long-Term Influence

They unfold over decades rather than short-term fads.

● Structural Change

They reshape economies, societies, and institutions.

● Multidimensional

They involve economic, technological, social, environmental, and political factors.

Examples of Megatrends:

➊ Technological Advancement (e.g., Artificial Intelligence, Automation, Blockchain)

➋ Demographic Shifts (e.g., Aging Populations, Urbanization, Migration Patterns)

➌ Climate Change & Sustainability (e.g., Renewable Energy, ESG Investing, Green Technologies)

➍ Geopolitical Shifts (e.g., Global Power Transitions, Supply Chain Reconfiguration)

➎ Future of Work & Education (e.g., Remote Work, Lifelong Learning, Gig Economy)

Megatrends help businesses, governments, and individuals anticipate and prepare for the future.

RMAG: Define Alpha in Investments:

CGPT:

Alpha in investments refers to the measure of an investment's outperformance or underperformance relative to a benchmark index, after adjusting for its risk. It is used to assess the skill of a fund manager or the effectiveness of an investment strategy in generating returns beyond what would be expected based on the market's overall performance and the level of risk involved.

● Positive Alpha (>0)

The investment has outperformed its benchmark, indicating good management or investment decisions.

● Negative Alpha (<0)

The investment has underperformed relative to its benchmark, suggesting poor performance or ineffective management.

● Alpha of Zero (0)

The investment performed exactly in line with its benchmark, given its risk level.

Alpha is commonly used in active management, where investors or fund managers seek to generate higher returns than passive strategies (which simply follow market indices) by making specific investment choices that outperform the broader market.

Formula for Alpha:

α=Ri−[Rf+β(Rm−Rf)]

Where:

➊ Ri = Actual return of the investment.

➋ Rf = Risk-free rate (e.g., yield on U.S. Treasury bonds)

➌ β = Investment's sensitivity to market movements (i.e., how volatile it is relative to the market)

➍ Rm = Market return (e.g., return of a benchmark like the S&P 500)

In summary, alpha measures how well an investment or portfolio has performed compared to its expected performance based on its risk.

“Alpha is commonly used in active management, where investors or fund managers seek to generate higher returns than passive strategies (which simply follow market indices) by making specific investment choices that outperform the broader market”

RMAG: Design and Construct the Ideal Equity Portfolio that can Generate Alpha and take Advantage of MegaTrends:

CGPT:

Designing an ideal equity portfolio to generate alpha (excess return relative to the market) while taking advantage of mega-trends involves a deep understanding of current global shifts in technology, demographics, consumer behavior, and sustainability. Mega-trends are long-term, structural changes that can shape industries and create opportunities for growth over time. Here’s a structured approach to designing this portfolio:

1 Identify Key Mega-Trends

Focus on long-term, transformative trends that have the potential to reshape economies, industries, and markets over the next 10 to 20 years. Here are some of the current prominent mega-trends:

● Artificial Intelligence and Automation

AI is transforming industries ranging from healthcare to manufacturing. Companies at the forefront of AI development and integration will be prime candidates.

● Clean Energy and Sustainability

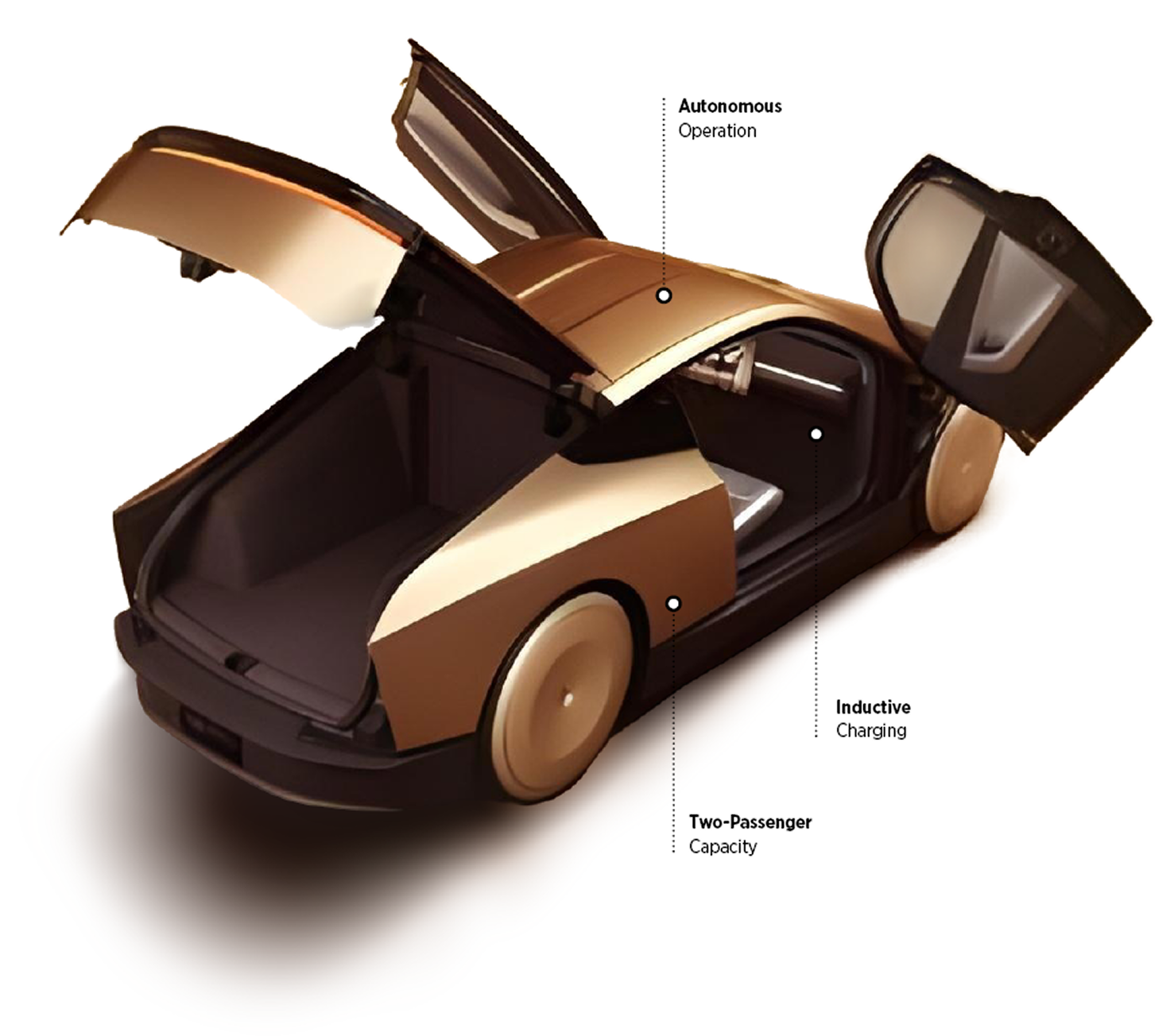

With the world shifting toward renewable energy and sustainability, companies involved in clean energy production, electric vehicles (EVs), and carbon-neutral technologies will be crucial.

● Digital Transformation

The transition to cloud computing, 5G, and digital solutions in various sectors (financial services, retail, etc.) is reshaping industries.

● Healthcare Innovation

Advances in genomics, biotechnology, and healthcare IT offer opportunities in personalized medicine and life sciences.

● Aging Populations

Demographic shifts, especially in developed countries, mean growing demand for healthcare services, eldercare, and innovations in longevity.

● Urbanization and Smart Cities

As the global population urbanizes, there's an increasing demand for infrastructure, housing, and smart city technologies.

“Mega-trends are long-term, structural changes... that have the potential to reshape economies, industries, and markets and create opportunities for growth over time”

2 Portfolio Allocation

Equity Exposure:

● Growth Stocks (50%)

Focus on sectors with strong future growth potential. These will typically be companies in the AI, clean energy, and digital transformation sectors.

● Value Stocks (20%)

These are typically undervalued stocks with solid fundamentals that will benefit from structural shifts in the economy, such as established players in healthcare, infrastructure, or finance that are undergoing transformation.

● Dividend Stocks (10%)

Focus on companies with strong cash flows and sustainable dividend yields, particularly in sectors like utilities, consumer staples, or energy. These provide income stability while benefiting from mega-trends like energy transition or urbanization.

● Thematic ETFs (15%)

Invest in thematic exchange-traded funds (ETFs) that target specific trends such as AI, clean energy, or healthcare innovation. This adds diversification while capitalizing on future-focused industries.

● Emerging Markets (5%)

Exposure to emerging economies, particularly in Asia and Africa, where growth in sectors like infrastructure, consumer technology, and financial services is expected to boom due to urbanization and demographic trends.

3 Stock Selection

🅐 AI and Automation:

● NVIDIA (NVDA)

Leading player in AI chips, essential for machine learning, deep learning, and autonomous vehicles.

● Microsoft (MSFT)

Heavy investments in AI, cloud computing, and automation.

● Tesla (TSLA)

Autonomous driving technology, AI in manufacturing and EVs.

🅑 Clean Energy:

● NextEra Energy (NEE)

A leader in renewable energy with substantial wind and solar projects.

● Plug Power (PLUG)

A key player in hydrogen fuel cell technology for clean energy and transportation.

● Enphase Energy (ENPH)

Solar energy solutions that complement the global shift toward clean power.

🅒 Digital Transformation:

● Alphabet (GOOGL)

Investments in AI, cloud computing, autonomous vehicles, and quantum computing.

● Amazon (AMZN)

E-commerce giant transitioning to AI and cloud, as well as supply chain automation.

🅓 Healthcare Innovation:

● Illumina (ILMN)

Pioneering genomic sequencing technology.

● AbbVie (ABBV)

Strong pipeline in biotechnology and a leader in immunology.

● Teladoc Health (TDOC)

Leading telemedicine provider, capitalizing on the remote healthcare trend.

🅔 Urbanization/Smart Cities:

● Honeywell (HON)

Provides smart building technologies, energy-efficient solutions, and automation.

● Caterpillar (CAT)

Infrastructure and construction equipment leader, benefiting from global urbanization trends.

🅕 Emerging Markets:

● Tencent (TCEHY)

A tech giant in China with a massive footprint in social media, gaming, and AI.

● Mercado Libre (MELI)

Latin America’s leading e-commerce and fintech company.

4 Risk Management and Diversification

● Geographic Diversification

Ensure the portfolio is diversified across multiple regions, including North America, Europe, and emerging markets.

● Sectoral Diversification

Within growth sectors, balance between disruptive tech (AI, automation) and stability (clean energy, infrastructure).

● Hedging

Use put options or inverse ETFs for key positions to protect against volatility in the short term.

● Rebalancing

Review portfolio every 6-12 months, adjusting positions based on evolving trends and performance.

5 Continuous Monitoring and Adaptation

Mega-trends evolve, so continuous research and monitoring are essential. Stay informed about policy shifts (e.g., tax incentives for clean energy), new technologies (e.g., breakthroughs in AI), and demographic trends (e.g., aging population and healthcare needs).

“Mega-trends evolve, so continuous research and monitoring are essential. Stay informed about policy shifts (e.g., tax incentives for clean energy), new technologies (e.g., breakthroughs in AI), and demographic trends (e.g., aging population and healthcare needs)”

6 Performance Measurement and Alpha Generation.

Track the portfolio’s performance against relevant benchmarks, such as the S&P 500, Nasdaq-100, or a custom index based on the selected sectors.

Focus on long-term returns rather than short-term volatility, as mega-trends generally require patience.

This portfolio aims to capitalize on high-growth, structural changes in the market while managing risk and achieving above-market returns (alpha). By staying aligned with key mega-trends, it positions itself for long-term success in an evolving world.

RMAG: Name the Top Stocks that Generate Alpha and can take Advantage of MegaTrends:

CGPT:

Identifying top stocks that generate alpha and take advantage of mega-trends involves looking at companies that are positioned to benefit from long-term, transformational shifts in the economy, technology, and society. Here are some sectors and stocks that are often considered as potential candidates for these types of trends:

1 Technology and Artificial Intelligence (AI)

● Nvidia (NVDA)

A leader in graphics processing units (GPUs), Nvidia is heavily involved in the AI revolution, particularly in machine learning and autonomous systems.

● Alphabet (GOOGL)

The parent company of Google is deeply embedded in AI, cloud computing, and data analytics.

● Microsoft (MSFT)

With its Azure cloud platform and AI integrations (e.g., OpenAI partnership), Microsoft is capitalizing on the AI trend.

● Tesla (TSLA)

Tesla is a front-runner in electric vehicles (EVs) and autonomous driving technology, making it a key player in the shift toward cleaner transportation.

2 Renewable Energy and Sustainability

● NextEra Energy (NEE)

A major player in renewable energy, particularly solar and wind power.

● Brookfield Renewable Partners (BEP)

A global leader in renewable energy infrastructure with a focus on hydropower, wind, and solar.

● Enphase Energy (ENPH)

Specializes in solar energy and energy storage systems, making it well-positioned to benefit from the clean energy shift.

3 Healthcare and Biotechnology

● Thermo Fisher Scientific (TMO)

A leader in laboratory equipment, diagnostics, and biotechnology tools, poised to benefit from healthcare innovation and aging populations.

● Illumina (ILMN)

A leader in genomics, Illumina is well-positioned to take advantage of advancements in personalized medicine and gene therapy.

● Moderna (MRNA)

Known for its mRNA technology, Moderna is at the forefront of vaccine development and could benefit from future breakthroughs in treatments.

4 Electric Vehicles and Autonomous Driving

● Rivian (RIVN)

A growing competitor in the electric vehicle market, focusing on trucks and SUVs with advanced technology.

● Lucid Motors (LCID)

A luxury EV manufacturer with a focus on long-range electric vehicles.

● General Motors (GM)

Transitioning towards EVs with heavy investments in electric and autonomous vehicles.

5 E-commerce and Digital Payments

● Amazon (AMZN)

A dominant force in e-commerce, cloud computing (AWS), and digital advertising.

● Square (SQ)

Now known as Block, Square is a leader in digital payments and cryptocurrency innovations.

● Shopify (SHOP)

Provides e-commerce solutions to small businesses, benefiting from the growing trend of online shopping and entrepreneurship.

6 Cloud Computing and Cybersecurity

● Amazon (AMZN)

As the leader in cloud computing via AWS, Amazon continues to benefit from the shift to cloud services.

● Cloudflare (NET)

Specializes in cybersecurity and content delivery, capitalizing on the increasing demand for internet security.

● CrowdStrike (CRWD)

A cybersecurity firm focusing on endpoint protection, benefiting from the increasing risks in the digital space.

7 Blockchain and Cryptocurrency

● Coinbase (COIN)

A leading platform for buying, selling, and storing cryptocurrencies, benefiting from the growing adoption of blockchain technology.

● MicroStrategy (MSTR)

Known for its large Bitcoin holdings, it stands to benefit from the rise of digital assets.

● Ethereum (ETH) & Bitcoin (BTC) (via ETF or trusts)

While not stocks, investing in Bitcoin or Ethereum via ETFs or trusts could provide exposure to the blockchain megatrend.

8 Semiconductors

● Taiwan Semiconductor Manufacturing Company (TSM)

As a major player in semiconductor manufacturing, TSMC is positioned to benefit from the global chip shortage and increasing demand for technology.

● Advanced Micro Devices (AMD)

A leader in semiconductor chips for gaming, PCs, and data centers, with strong growth potential.

9 Metaverse and Augmented Reality (AR)/Virtual Reality (VR)

● Meta Platforms (META)

Focused on the Metaverse and AR/VR technology, Meta is working to shape the future of digital interaction.

● Unity Software (U)

A leader in real-time 3D content development, essential for the Metaverse and AR/VR experiences.

These companies span multiple sectors that are benefitting from major long-term trends, and they have the potential to deliver alpha by tapping into these emerging opportunities. However, it’s important to do your own research or consult with a financial advisor before making investment decisions.

RMAG: Name the Top Stocks that will Benefit from AI:

CGPT:

Here are some of the top stocks that are well-positioned to benefit from the growing influence of Artificial Intelligence (AI) across various industries:

Nvidia (NVDA)

➊ Nvidia is the leader in GPU (Graphics Processing Unit) technology, which is crucial for AI, machine learning, and data processing. The company’s GPUs are widely used in AI training and inference models, particularly in deep learning applications.

“Nvidia is the leader in GPU (Graphics Processing Unit) technology, which is crucial for AI, machine learning, and data processing. The company’s GPUs are widely used in AI training and inference models, particularly in deep learning applications”

Alphabet (GOOGL)

Google's parent company, Alphabet, is heavily invested in AI research, with projects ranging from Google Search algorithms to self-driving cars (Waymo). The company's AI-driven cloud services, such as Google Cloud AI, also position it for future growth in this space.

Microsoft (MSFT)

Microsoft has embraced AI across its product suite, particularly with its Azure cloud platform, which offers AI services to businesses. Microsoft's partnership with OpenAI (the company behind ChatGPT) further solidifies its position in the AI sector.

Tesla (TSLA)

Tesla is known for using AI in autonomous driving technology. The company continues to develop and refine its Full Self-Driving (FSD) technology, which heavily relies on AI to improve vehicle automation and decision-making.

Meta Platforms (META)

Formerly Facebook, Meta is investing heavily in AI and machine learning to enhance its social media platforms and advertisements. Additionally, AI plays a central role in the development of the Metaverse, where Meta is focusing much of its innovation.

Amazon (AMZN)

Amazon leverages AI in a variety of ways, from its recommendation algorithms in e-commerce to its powerful cloud services via Amazon Web Services (AWS). AWS offers AI services like machine learning tools, predictive analytics, and AI-driven insights to businesses.

Palantir Technologies (PLTR)

Palantir specializes in big data analytics, and AI is central to its data processing and predictive analysis tools. Palantir works with governments and private enterprises to implement AI in decision-making and resource management.

IBM (IBM)

IBM is a pioneer in AI, with its Watson platform being used across a variety of industries, including healthcare, finance, and customer service. IBM continues to develop AI-driven solutions for enterprise clients, particularly through its cloud and AI services.

Advanced Micro Devices (AMD)

AMD is a major competitor to Nvidia in the semiconductor space, producing CPUs and GPUs that power AI workloads, particularly for gaming, cloud computing, and data centers. The company is poised to benefit from increasing demand for AI hardware.

Qualcomm (QCOM)

Qualcomm is a leader in mobile processing chips and is pushing into AI-enabled 5G technologies. The company’s chips are used in smartphones and other connected devices that increasingly rely on AI for improved performance.

Salesforce (CRM)

Salesforce is integrating AI into its CRM (Customer Relationship Management) software through Salesforce Einstein, which offers AI-driven insights, predictive analytics, and automation to improve customer service and sales operations.

UiPath (PATH)

UiPath is a leader in robotic process automation (RPA), which uses AI to automate business processes. Its AI-driven solutions help businesses streamline workflows and increase efficiency.

C3.ai (AI)

C3.ai is a pure-play AI company that provides software solutions to businesses for AI, machine learning, and IoT (Internet of Things) applications. Its platform helps companies optimize operations through predictive analytics and data-driven insights.

Adobe (ADBE)

Adobe is incorporating AI into its creative software suite through Adobe Sensei, which automates design and content creation processes. The use of AI enhances Adobe’s products in areas like image recognition, content editing, and marketing.

Baidu (BIDU)

Often referred to as the "Google of China," Baidu is a leader in AI research and development. The company is investing in autonomous driving and AI-powered internet services, and its AI platform is being used across various sectors in China.

These companies span different sectors, but each is leveraging AI to enhance its products, services, and overall business strategies, making them well-positioned to benefit from AI advancements over the coming years.

We have to warn our readers that ChatGPT has limitations and as a result its responses to our questions may be inaccurate. The information provided by ChatGPT may be outdated, ambiguous, subjective and may reflect unintentional biases.

“These companies span different sectors, but each is leveraging AI to enhance its products, services, and overall business strategies, making them well-positioned to benefit from AI advancements over the coming years”

The content in these materials should not be considered investment advice to buy, sell or hold any security and does not constitute any offer, solicitation or recommendation of any investment. The aim of Regius Magazine is to conduct an informal experiment to learn more about the developments of ChatGPT. It took less than five minutes to Regius Magazine to get the answers from ChatGPT. Readers must know that ChatGPT it is not a tool designed to pick stocks or predict markets. In choosing stocks for a portfolio, investors must understand that is a time-consuming process, considers multiple financial factors and should be backed by rigorous due-dilligence in making any investment decision. Investors should consult their trusted financial advisors and discuss their goals including: risk tolerance, investment horizon and diversification needs. This article is for illustration purposes only.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com