Tesla’s (TSLA) newest home will be in Monterrey, a city also known as the industrial powerhouse of Latin America. Founded as a Spanish settlement in 1596, Monterrey started to produce iron, brass, steel, textiles, beer, and flour during the mid and late 1800s and solidified as the commercial hub for exports during the U.S. Civil War.

Industrial development continued during the 1900s as Monterrey embarked on new industries such as cement, glass, beverages, electronics, petrochemicals, food, telecommunications, auto parts, and household appliances. The city’s privileged location has become the backbone of the U.S.-Mexico trade route. Monterrey is a 2-hour drive to the U.S. border with Laredo and Hidalgo and has two airports (commercial and private) that have direct routes to U.S. airport hubs like Houston, Dallas, Atlanta, New York, Chicago, and Miami, as well as a direct flight to Madrid, among other international routes.

Location, distance, connectivity, its entrepreneurial culture, and talent have been some of the significant factors that have influenced many international companies to settle their operations in Nuevo Leon. The most important and recent investment will be Tesla's new Gigaplant confirmation, where several other states in Mexico competed for the opportunity.

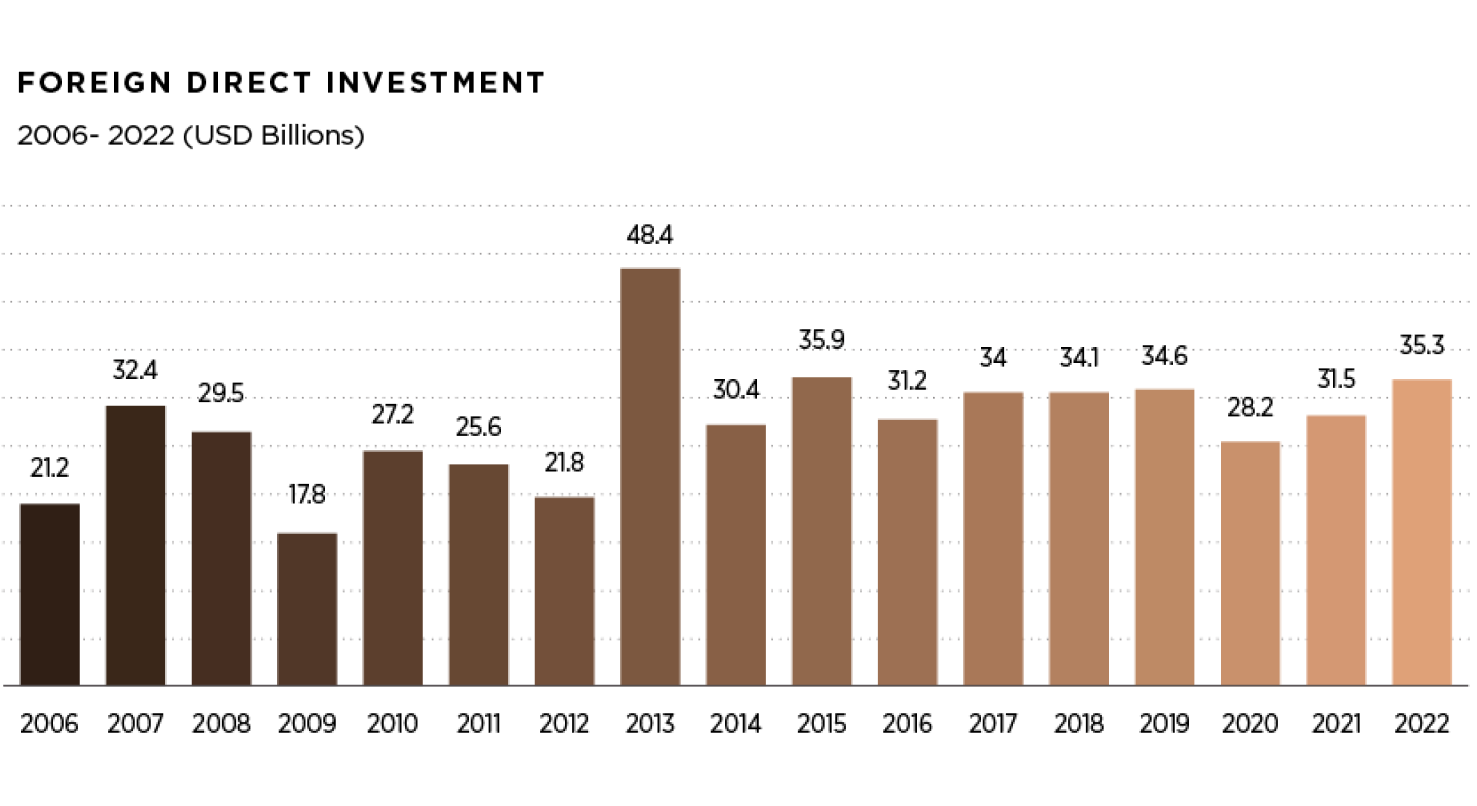

Mexico is the world's seventh-largest vehicle manufacturer and the leading auto parts supplier to the U.S. Also, it is the 15th largest economy in the world, measured by Gross Domestic Product (GDP) in dollar terms. In 2022, total foreign direct investment (FDI) amounted to USD $35.3 billion and is expected to grow 3.0% in 2023 (Secretaría de Economía, 2023). This growth is attributed to nearshoring. “During 2023, Mexico has received more than USD $27 billion in FDI, and Nuevo Leon’s share is estimated at about USD $3.5 billion”, according to Ivan Rivas Rodriguez, Secretary of Economic Development of Nuevo Leon.

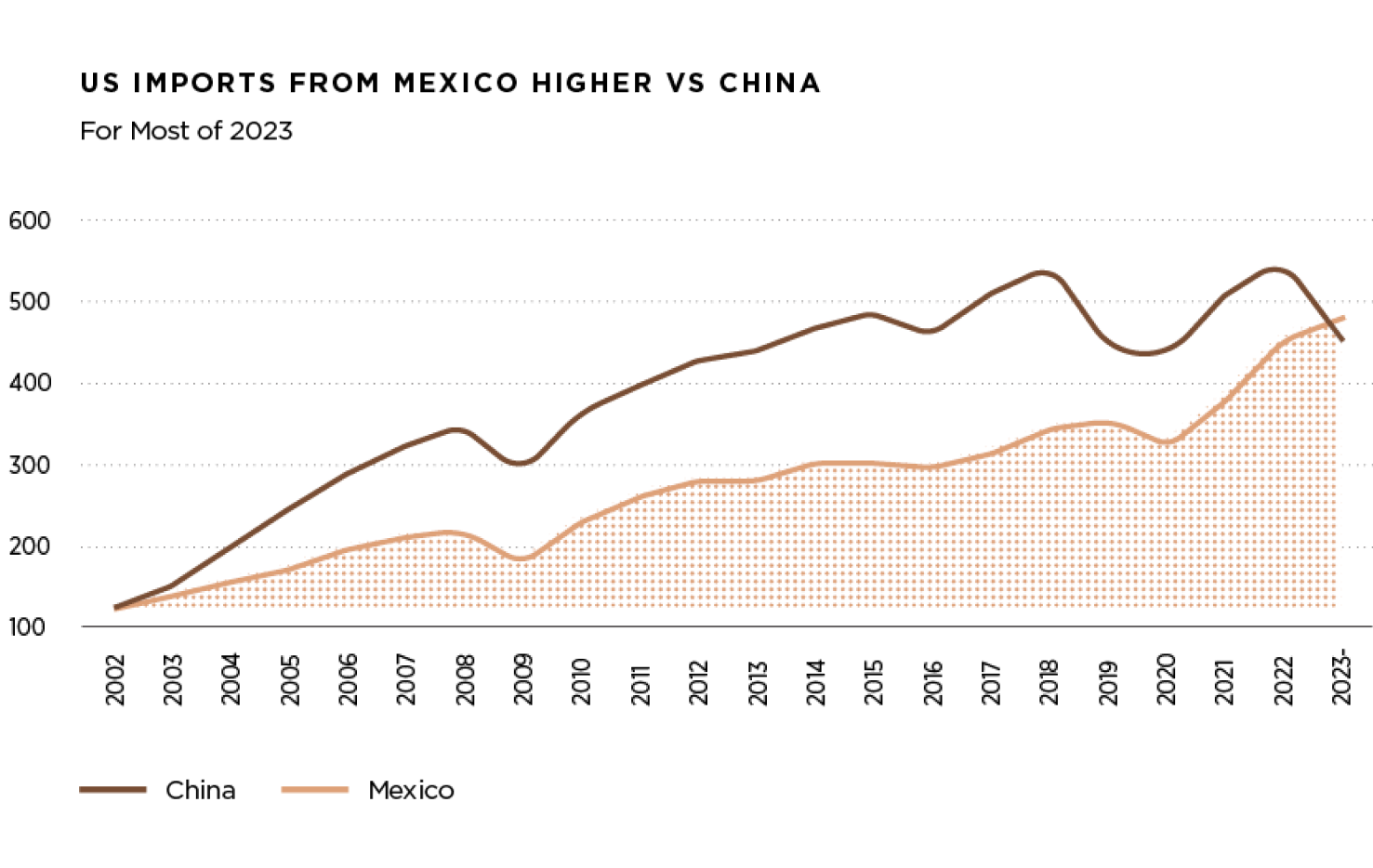

Exports and investment growth is due to several factors, such as deteriorating relations between China and the U.S. and a shift in the supply chains given the effects of the pandemic. The pandemic and geopolitical events have exacerbated trade difficulties and forced market participants to rethink trade and supply chains. U.S. policy has shifted regarding its stance with China, given labor shortages and costs in the U.S. Mexico has gained from these events through investments and an increase in exports. Today, Mexico’s and North America’s trend is nearshoring, which the media has also called, by ideological association, allyshoring or friendshoring.

The Mexican peso has appreciated 9.8% during 2023, largely due to higher central bank interest rates, record remittances inflows (USD $60 billion), and the reallocation of manufacturing companies from China to Mexico. With its long-lasting economic stability, economic openness, and 14 Free Trade Agreements with over 50 countries, Mexico can become the manufacturing hub in the world. These factors, which highlight the country's competitiveness, have kick-started the momentum for “Mexico’s Moment”. In January of this year, Mexico became the U.S.'s main commercial partner (American Industries, 2023). The fact that Mexico has recently surpassed China as the U.S.'s main trade country for the first time in over 20 years highlights the potential to continue integrating the North American economies. Mexico, and especially Monterrey, is a key player in this transition from globalization to regionalization.

| TESLA’S CHOICE

With a staggering initial investment of USD $5 billion, which is expected to double in the coming years, Tesla's presence in Monterrey will boost the local economy and job market. This investment is expected to provide more than 35,000 job opportunities, spark trade with over 100 suppliers, energize local businesses, and further enhance the city's position as an attractive destination for FDI. Monterrey has become synonymous with exponential growth and advanced technology, focusing mainly on sustainability. One-third of all nearshoring in Latin America is directed towards Nuevo Leon, and nearly 72% of Mexico’s nearshoring comes to Monterrey’s industrial market. Monterrey is known as the backbone and gateway of North America.

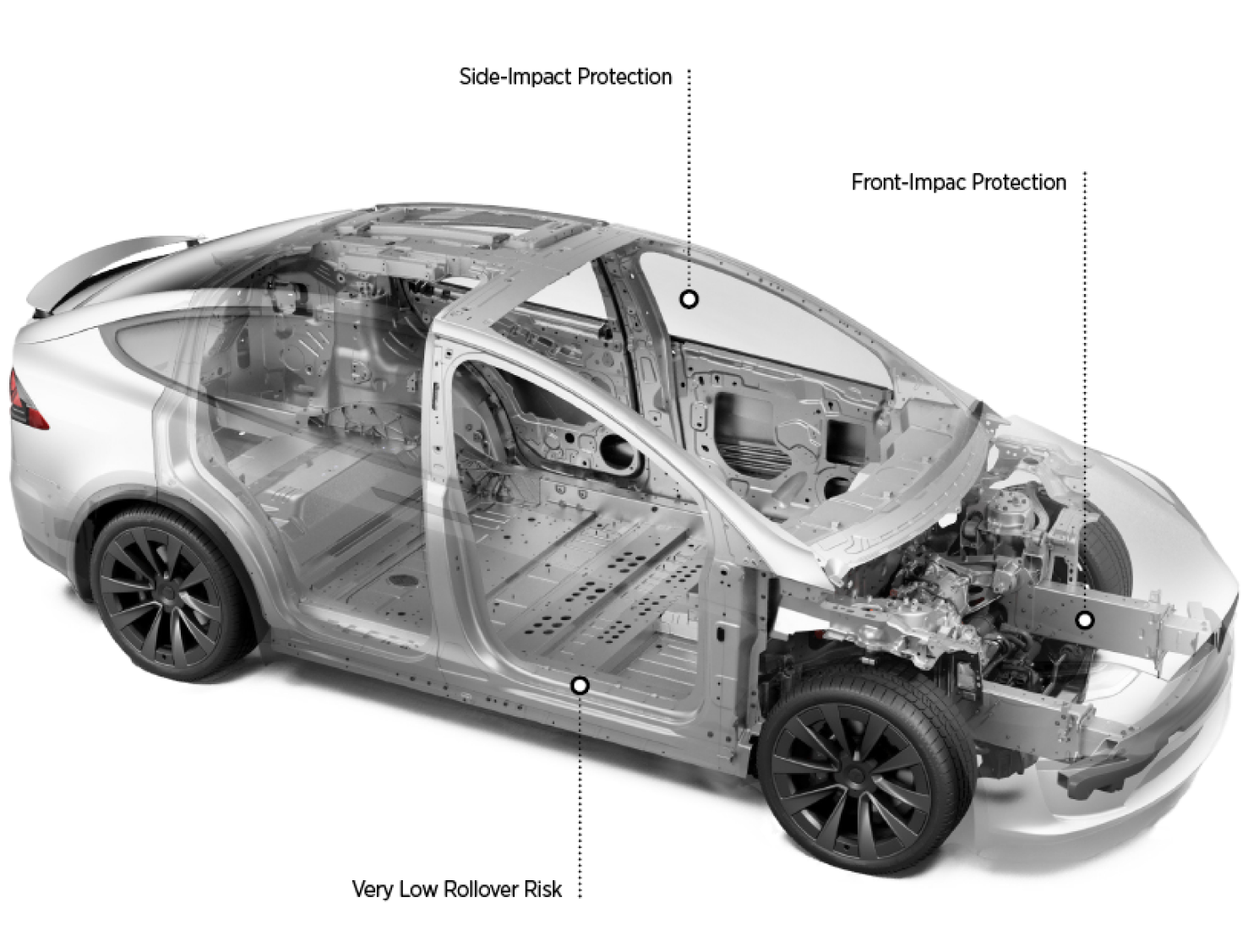

By choosing Monterrey, Tesla is not only expanding its global footprint but also tapping into a manufacturing powerhouse with a labor force that is ready to supply the North American market for electric vehicle adoption. The city boasts a thriving automotive industry and has established itself as a leading player in advanced manufacturing technologies. This synergy between Tesla's innovative vision and Monterrey's industrial prowess creates an ideal setting for growth and collaboration.

Tesla will be able to benefit from Mexico's skilled workforce and its cost-effective production capabilities. Mexico has an average population age of 29 and universities and technical schools that produce highly educated and qualified professionals ready to meet industry demands. This skilled workforce is crucial to a favorable business environment. In comparison to China, U.S., and Europe, Mexico has the youngest median age by at least ten years. China’s average population is 38.4, the U.S. is 39, and Europe is the eldest with 42.2 average years.

To gain deeper insight and understanding of Monterrey’s and the northeastern region of Mexico's role in attracting foreign investment, the “Trade and Investment Center” (T&I Center), of the American Chamber of Commerce of Mexico (AmCham) engaged in conversations with industry experts to gather in-depth insights and perspectives on the nearshoring phenomenon. Below are the highlights of some conversations AmCham had with members. Our aim in these conversations is to shed more light on the opportunities and challenges Monterrey faces and how the “regio” (demonym of the people from Monterrey, Mexico) can take advantage of Mexico’s moment.

"Tesla will be able to benefit from Mexico's skilled workforce and its cost-effective production capabilities. Mexico has an average population age of 29 and universities and technical schools that produce highly educated and qualified professionals ready to meet industry demands"

The insights provided by Market Analysis shed further light on the influential role Nuevo Leon plays in the realm of foreign direct investment. Nuevo Leon’s importance in the global FDI landscape is made apparent by the state’s foreign demand for industrial land. According to Marcos Álvarez – CEO of Market Analysis, an industrial intelligence firm, during 2023, Mexico’s industrial projects will account for over 25 million square feet of national take-up. The firm’s data reported that the Northeast region represents 34% of the total acquisition, the North Central region represents 14%, and the Northwest region represents 9%. The automotive sector accounted for 26.2% of Nuevo Leon’s absorption, amounting to 1.79 million square feet of land. The Northeast region, made up of Saltillo, Monterrey, Reynosa, Nuevo Laredo, La Laguna, and Matamoros, is the most dynamic and will continue to be so for the foreseeable future. Market Analysis also reported that 57 of the deals were recorded within this area; this represents 34% out of 169 total transactions made by the end of the second quarter of 2023. Monterrey comprised 75% of the transactions, followed by Saltillo, with 9 trades. These numbers are essential to understanding the region’s potential and its existing power and growth.

| THE MEXICAN BUSINESS MODEL TODAY

This foreign direct investment movement & activity in the Northeast region has been around for a while, said Francisco Peña, partner at the law firm Cacheaux, Cavazos & Newton (CCN), who mentioned that nearshoring, friendshoring, and offshoring are not recent developments. Peña describes the initial stages in comparison to the reality we face now:

“It's important to remember that when NAFTA initially began, all eyes were on us. Then, China emerged as a dominant force, drawing much of the attention for nearly two decades. However, in recent years, the spotlight has returned to Mexico, driven, mostly by factors, such as escalating labor costs in China, the 'just in case supply chain' strategy, and significant geopolitical changes”.

Paulina González, Regional Director of Monterrey and Saltillo for shelter and site selection at the company American Industries, mentioned that the pandemic highlighted the importance of resilience and stability in supply chains. This period showed the vulnerabilities and challenges in terms of connectivity and frictionless production lines. This is where the “just in case” approach skyrocketed as a strategy for multinational companies. Over 3,500 foreign businesses operate in Nuevo Leon, most of which are concentrated in the municipalities of Apodaca, Santa Catarina, Guadalupe, Pesqueria, Escobedo, Salinas Victoria, and Cienega de Flores. González added that “The presence of associations like the American Chamber of Commerce in Mexico and the thirteen business clusters in Nuevo Leon alone make up this soft landing culture that is open to adapting, receiving new clients, and has become a leader in foreign direct investment attraction". Monterrey is located very close to the US- Mexico border, so historically, investment has been export-oriented. Today, more than 90% of the state's output is meant for export, mainly to the US. Recent trends show supplier companies are coming to Nuevo Leon from Asian countries, attracted by our regional OEMs. American Industries estimates that 49% of all nearshoring in the region comes from Chinese investment. This unprecedented change in the origin of FDI reflects not only the changes in global dynamics but also the appeal of Mexico and Monterrey as manufacturing hubs.

"Nuevo Leon’s importance in the global FDI landscape is made apparent by the state’s foreign demand for industrial land... during 2023, Mexico’s industrial projects will account for over 25 million square feet of national take-up"

| CHALLENGES

Even though Monterrey and the surrounding territory are arguably the most industrially diverse and developed in the country, the way to continue facilitating more and more foreign direct investment is to work through our vulnerable areas: energy infrastructure and public spending.

The regulatory hurdles that influence the approval process for energy supply to industrial spaces may concern some companies. Javier Llaca, COO of Fibra Monterrey, a publicly traded company in Mexico that operates as a real estate investment fund, mentioned a huge need for financing, especially in the energy sector. He stated: “The most important challenge for industrial investment in Mexico is the energy required for these projects. Mexico is also in the middle of a controversy with Canada and the US for not being compliant with the environmental policies,”. This perspective also relates to how Álvarez, from Market Analysis, mentioned being impressed by how energy sources have become a talking point nationwide. He believes energy will be Nuevo Leon and Santa Catarina’s biggest challenge.

Ignacio Castro, VP of Commercial Transactions at renewable energy company Invenergy, expressed that the securing of large projects at this scale (energy or otherwise) with an interconnected system and all the required permits and licenses for clean energy supply is something that can be time-consuming. Fortunately, as Castro stated, Nuevo Leon is particularly well located because of its wind resources. Still, because there is plenty of competitively priced gas, to develop more and more renewables, you need to be able to grow the generation matrix accordingly.

The vacancy rates for industrial space have also reflected an insufficient response to demand. Just last year, in 2022, the vacancy rate in the industrial real estate market of Monterey was 2.0%. Despite the fact that industrial real estate is undergoing strenuous change, Monterrey has shown its readiness to respond. The Monterrey metropolitan area has continued to expand outward. This growth is reflected in the economic development of Cienega de Flores, a municipality recently incorporated into Monterrey's metropolitan area. Álvarez from Market Analysis went as far as to say that Cienega will be the new Apodaca (the municipality where the airport is located and one of the most industrially dense areas in Mexico): “Contrary to the case of many areas in the metropolitan region of Monterrey, in this municipality there’s still a lot of land space and hand labor, which is why many developers like Grupo Tredec have gone there. This municipality will have a boom this year and in the coming years”.

| MONTERREY’S FUTURE WITH TESLA

Monterrey is a recipient of many immigrants from other parts of Mexico looking for job opportunities. Jose María González, partner at international law firm Baker McKenzie, mentioned: “The factor that has captured the manpower coming into the region is the availability of employment, even for highly skilled labor. Traditionally, industrial power has been concentrated in the Northeast region”. The Northeast of Mexico’s strength lies in numbers and resilience; however, as the population grows, so should the infrastructure to accommodate this growth.

"Recent trends show supplier companies are coming to Nuevo Leon from Asian countries, attracted by our regional OEMs. American Industries estimates that 49% of all nearshoring in the region comes from Chinese investment"

Pedro Valdés, CEO of Escala, a company dedicated to project management in real estate, gave his take on how giants like Tesla settling in Monterrey must trigger a change in available resources to meet the needs of the local population:

“The arrival of Tesla will challenge the region's growth, including residential, technological, and infrastructure development (...) it will challenge the way the region does things at the moment, but positively, by evolving the planning, manufacturing, and technological processes”.

With the arrival of quality-minded companies, labor culture will also follow suit. Rafael Amar, General Director of Saltillo Shelter Company Tetakawi, mentioned how we are in the middle of a huge shift characterized by intergenerational cooperation:

“There is a cultural ingredient with any type of business coming to the city: if you have a company that is well renowned in the world and that they have some sort of reputation of being disruptive or doing very bold actions, probably you’ll see that cultural ingredient spread”.

"The factor that has captured the manpower coming into the region is the availability of employment, even for highly skilled labor.Traditionally, industrial power has been concentrated in the Northeast region"

Amar also pointed out the fact that we are a very self-sufficient area. Many companies, when beginning this process of solving sourcing requirements in terms of equipment, maintenance, tooling, etc., find what they’re looking for here. This industrial self-reliance of the Monterrey labor ecosystem has diversified the skills and talent of the workforce and will continue to do so. Upon landing in Monterrey, Tesla will have the unique opportunity to source from locally established companies and businesses that boast homegrown talent.

| WHAT’S NEXT?

The AmCham member experts interviewed for the purpose of this article mentioned the resilience, hard work, and adaptability of Monterrey’s people. Tesla is arriving at a pivotal moment in Mexican history. As summarized by Paulina Gonzalez of American Industries, the implications of this shift in gears are extremely important, pointing out that Tesla’s sustainability plans align with those of the Nuevo Leon government and their commitment to collaborating with academic institutions.

The entry of Tesla into Monterrey marks a milestone towards achieving economic prosperity in the region. Monterrey’s workforce, the community’s pro-investment attitude, and its capabilities are all present and apparent. Though Monterrey’s adaptability to nearshoring is a cause for concern, it is ultimately a “happy problem,” one that reflects prosperity. Internationally renowned companies have placed their trust in the “regio” people, and even after all the impressive progress already achieved, there is still so much more potential yet to be discovered. Francisco Peña of CCN expressed a perspective on this new panorama that makes us see how we can seize the moment in ourway: “Tesla was born to be in Monterrey because the people of Monterrey will take care of Tesla”.

For comments, questions, or more information, please contact AmCham’s Trade & Investment Center: trade@amcham.org.mx

Regina Cantú

Trade Analyst, American Chamber Of Commerce of Mexico.

amcham.org.mx

Rodrigo Reyes

Digital Business Strategist, American Chamber Of Commerce of Mexico.

amcham.org.mx