Secondary transactions involve the buying and selling of existing investor stakes in privately held companies. This provides an opportunity for existing shareholders to achieve liquidity, an option that would otherwise not be available. Unlike the more traditional secondary markets that primarily deal with public securities, in the context of venture capital, the secondary market allows investors to sell shares of their privately held portfolio companies before the company has an exit event like an IPO or acquisition. Having access to venture secondaries is a way to potentially participate in the upside of secular trends at a discount. The venture secondaries market has experienced substantial growth, driven by the increasing maturity of startups and the desire for liquidity among early-stage investors, employees, and founders.

● Growing Interest in Venture Secondaries

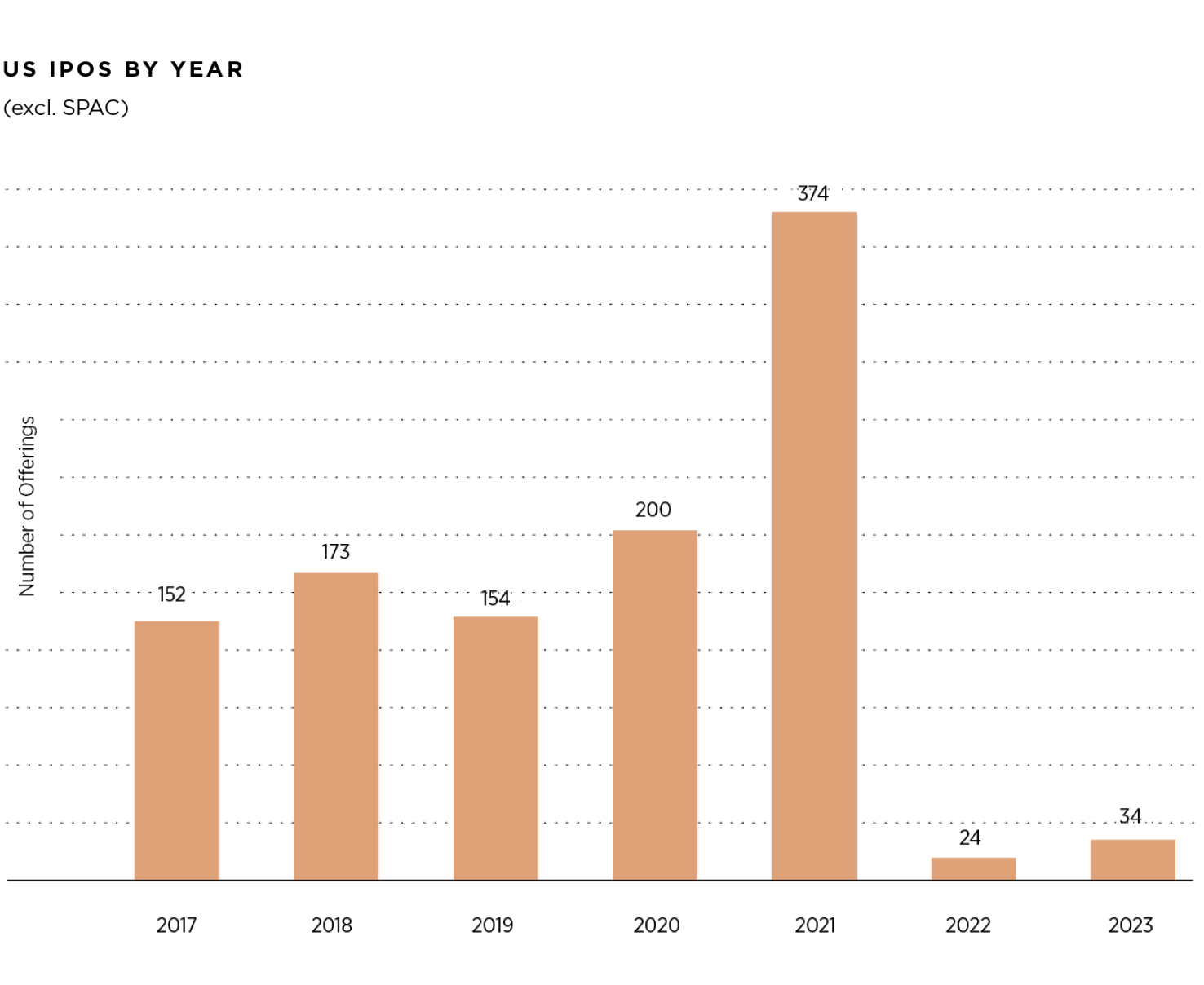

At G Squared, we have observed that investor interest in venture secondaries is reaching cyclical highs. What’s driving the demand? Structural factors disrupting the typical flow of startup investments. Companies once poised for IPOs are now staying private longer to avoid the uncertainties of the public market.

● Rising Volumes Create Opportunity

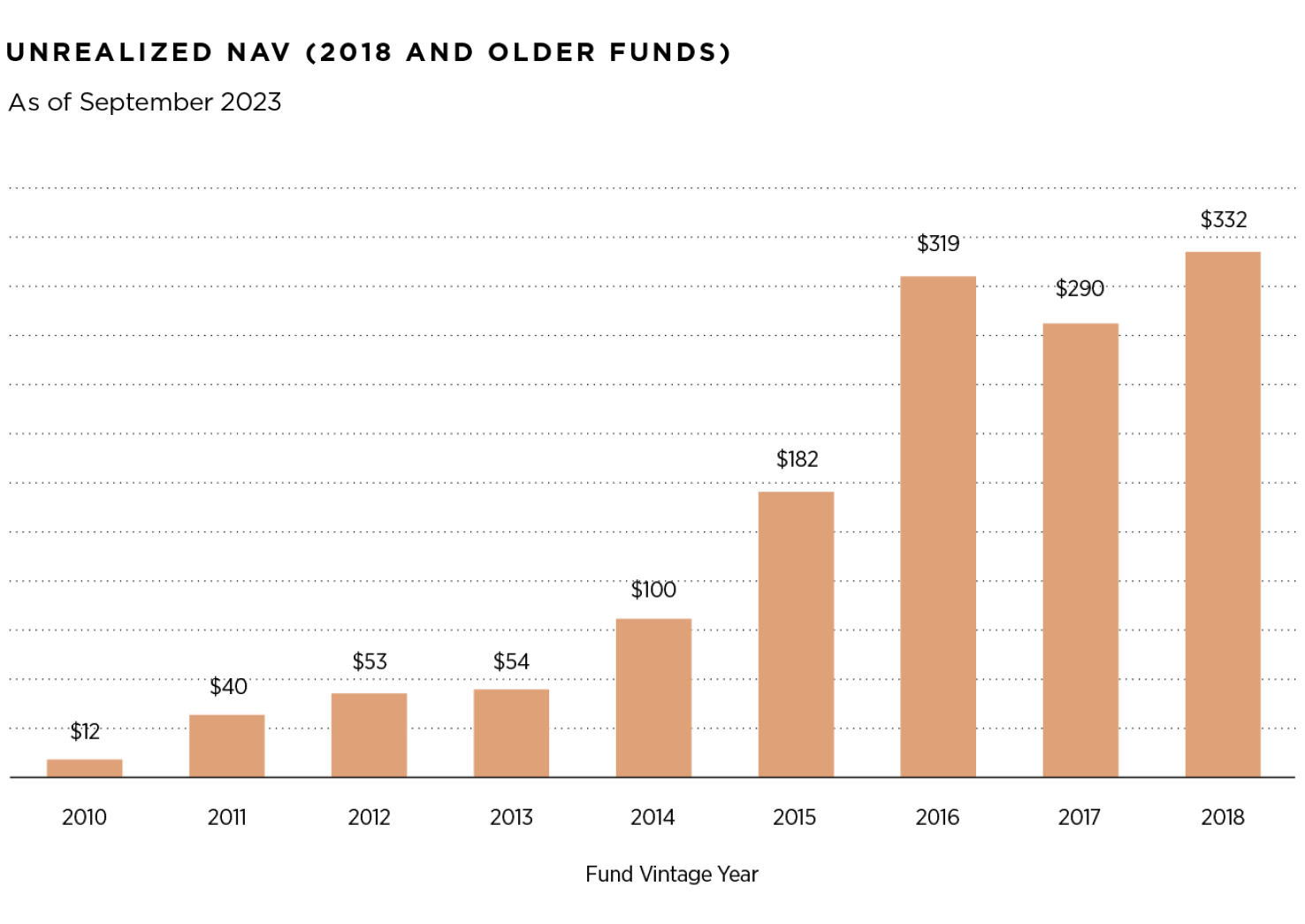

Constrained exit routes are pushing more sellers toward secondary markets. Consider this: data from Preqin indicates an unrealized NAV of about $1.4T from funds dated between 2010 – 2018. Pitchbook data also shows an IPO backlog of around 80 VC-backed companies. Some estimates are as high as 220. This situation creates expansive opportunities for adept secondary investors, as well as some challenges.

● Falling Prices

As secondary markets adjust to changes in public markets, prices reflect real market values better than initial funding rounds. A mix of elements, such as the public-private market disconnect and increased buyer selectivity, has led secondary pricing to fall to levels last seen in the 2008 financial crisis, a 68% discount to NAV in 2022, per the Jefferies Global Secondary Market Review.

● A lengthening liquidity crunch

It’s an exciting time to be a secondary buyer. The expectation of an IPO window that opens in Q4 would trigger substantive VC exits starting in mid-2025. As liquidity needs intensify in approximately the next 18 months, so will the secondary markets' role in delivering relief. Six quarters is not a long time in terms of VC holding periods, but that timeframe does create new pressures on long-term shareholders and startups that have been stretching their runways since late 2021. New company financings, down rounds, bankruptcies, etc., all build on existing pressure. As the private company lifecycle continues to expand, it is crucial for startups to adapt to the changing landscape with a sound liquidity strategy.

● A marketplace built on trust

Supportive cap tables provide startups with the stability necessary to concentrate on building their businesses. The VC ecosystem operates on shared expectations for investment horizon, information, and liquidity that align with stakeholder incentives. However, the entry of new actors seeking to “make a market” can cause mayhem for growing companies and destabilize a system built on trust. Companies that proactively develop a secondary strategy can maintain commercial focus and financing resilience while also facilitating cap table transitions in preparation for IPO.

Those who don’t, however, may end up serving investor-arbitrageurs with little vested interest in the company’s long-term success.

● Dual impacts on pricing

With current macro conditions projecting greater stability, liquidity in the direct secondary market stands to increase as more investors see the light at the end of the tunnel and the window for discounts closing. However, liquidity levels will remain below 2021/H1 2022 levels. At the same time, valuations are generally expected to contract as investors demand lower prices for assets struggling to raise fresh capital or not growing at expected rates. That contraction should be slower than in H2 2023 as risk appetite may reemerge. It will not apply to those top-performing companies that continue to thrive.

"The venture secondaries market has experienced substantial growth, driven by the increasing maturity of startups and the desire for liquidity among early-stage investors, employees, and founders"

● G Squared Expertise

G Squared knows secondary markets. We determine price-value dislocations based on specialized knowledge of a company's private financing history. We pride ourselves on our ability to seize unique opportunities while operating with more ease and transparency than the typical market participant. Many may be tempted by increasingly prevalent discounts, but without a deep understanding of the share structures and other factors, it’s still possible to lose money even on what seems like a great deal.

Our proven ability to navigate this space is a function of our decade-plus commitment to delivering critical liquidity solutions to companies and the VC ecosystem. Our focus is always on creating the conditions for pioneering leaders to shape our future through technology.

G Squared

Growth stage venture capital firm that invests privately in today's most dynamic companies.

gsquared.com