The year 2022 will be remember as a painful year for investors. It began with optimism and rapidly faded after Russia invaded Ukraine on Feb. 24. The Russia-Ukraine conflict has shaken the post-Cold War geopolitical order and roiled global markets. In the wake of Russia’s illegal annexation of Crimea in 2014, tensions between Russia and NATO allies have escalated since then. NATO allies are reexamining defense doctrines, providing unprecedented levels of military and humanitarian support to Ukraine and monitoring the interlinked security threats in Europe and Asia.

Adding to the geopolitical uncertainty, US relations with China continue to deteriorate further as they are engaging in provocative military drills near Taiwan, balloon surveillance in North America, intelligence exchange and weapon transfers to Russia. Over the past year, Beijing has helped Moscow by buying Russian oil and selling microchips and drones that have military applications. As Moscow is not ready for peace talks and Beijing is increasing hostilities against the West and Taiwan, the war is not deescalating. NATO has warned China against getting more involved in supporting Russia. Since late 2011, when Kim Jong Un inherited power, North Korea has dramatically increased the speed and scope nuclear weapon development. As the US and South Korea are holding their Freedom Shield large-scale military exercises, tensions are also increasing between the US and North Korea.

The geopolitical tensions have led to alterations in the way the global economy and financial markets functions. On January 3rd, 2022, the S&P 500 index hit an all-time high of 4,797 and traded at a P/E of 21x and on October 12, 2022 the index reached a low of 3,577 trading at a P/E of 15x. The 10-year US Treasury Note yield hit a 14-year high of 4.24% in October 24, 2022. The three major US indexes S&P 500, NASDAQ & RUSSELL confirmed a bear market on June 13, 2022 and the DOW confirmed a bear market until September 30, 2022, often a bear market precedes a recession.

After US’s main indexes entered into bear market territory in 2022, most US stocks have rallied in 2023 as signs of easing inflation fueled expectations the FED could slow the pace of rate hike. As of March 23, 2023, S&P 500 index is up 2.8%, the NASDAQ is 12.6%, RUSSELL 3000 is 2.4% and the DOW is negative -3.1%. The 10 year US Treasury Note yielded 3.4%. The US annual inflation rate reached 9.1% in June 2022, the biggest yearly increase since 1981. The annual Consumer Price Index (CPI) in the US reached 7.0% at the end of 2021, 6.4% at the end of 2022 and expected to reach 4.0% at the end of 2023 and 2.6% at the end of 2024, according to the Bureau of Labor Statistics and Goldman Sachs Investment Research.

“After US’s main indexes entered into bear market territory in 2022, most US stocks have rallied in 2023 as signs of easing inflation fueled expectations the FED could slow the pace of rate hike. As of March 23, 2023, S&P 500 index is up 2.8%, the NASDAQ is 12.6%, RUSSELL 3000 is 2.4% and the DOW is negative -3.1%”

The US economy is likely to avoid a recession as the US GDP growth is expected to slow from 2.1% in 2022 to 1.8% in 2023. US data continued on a strong footing with inflation declining, real disposable income recovering, consumer spending increasing and retail sales improving. Workers continue to benefit from very favorable job prospects and a near record low unemployment rate. So far, the US economy has added 311,000 jobs in February and 500,000 in January 2023. However, since October 2022, firms have slashed at least 473,000 jobs. Tech companies has seen the biggest losses, accounting for a third of the total job cuts. The jury is still out on whether or not we are going to have a recession in the US and a higher unemployment rate. Following the early than expected end of Covid lockdowns in China, the economy is expected to grow from 3.0% in 2022 to 6.0% in 2023 and given the warmer winter, the Euro Area is expected to slow from 3.5% in 2022 to 0.7% in 2023 and likely avoid a recession.

However, despite renewed optimism, the outlook for 2023 and beyond, still looks challenging and uncertain. We are living the end of the post-Cold War and this make economies and markets more vulnerable to increasing US-China tensions, below-trend growth, persistent high inflation, hawkish FED and market volatility. FED officials have warned that interest rates could rise further, market participants are forecasting the federal funds target rate to range between 5.0% and 5.5% in 2023. No FED cuts are expected in 2023 as economic resilience increases the risk of cycle extension. On mid-January 2023, the US reached the USD $31.4 trillion federal debt limit imposed by US Congress and the Treasury began use of “extraordinary measures” to avoid default. It is far from clear, whether or not the US government will be able to avoid a default at the end of 2023. The 2011 partisan showdown over the debt ceiling ended with a compromise that averted default, but still sent the S&P 500 down 17%. However, a US default would push up borrowing costs for everything from mortgages and credit card balances to auto loans, etc.

“... despite renewed optimism, the outlook for 2023 and beyond, still looks challenging and uncertain. We are living the end of the post-Cold War and this make economies and markets more vulnerable to increasing US-China tensions, below-trend growth, persistent high inflation, hawkish FED and market volatility”

WTI is trading at USD $69 per barrel, Brent at USD $75 per barrel and natural gas at USD $2.1 per million of BTU. Oil prices are likely to increase on the back of China’s reopening, Russia output cuts, OPEC pricing power (OPEC put) and international travel continues to recover. According to Goldman Sachs estimates, Brent is expected to rise to USD $95 per barrel by the fourth quarter of 2023. Likewise, metal prices are also likely to increase as China growth accelerates into second quarter of 2023. Historically, gold has been a safe haven similar to Treasuries, but its price is hovering around USD$ 1,989 from its record high of USD$ 2,131 on August 6, 2020. Bitcoin showed some sign of “safe haven” during the Covid pandemic as technology stocks soared, yet has lost roughly 60% of its value from its record high of USD $67,000 on November 8, 2021 leading a rout in crypto that has caused pain throughout the industry. Ethereum has shown a similar decline of 63% from an all-time high of $4,735 on November 9, 2021. The pullback in cryptocurrencies triggered a series of bankruptcies, layoffs, failures and highlights that, for now, digital assets are not viewed as the safe heaven asset to store value or hedge against inflation. In times of uncertainty and stress, the US dollar is proving to be the world’s safe haven asset and king. Since we do not expect the FED to embark on easing soon, a US dollar peak may be several quarters away. From stocks to bonds, credit to crypto, investor sentiment is at the low end of its historical range and for now are sitting on an estimated USD $5 trillion in cash.

Rapid rate hikes by the FED and rising real yields are rippling through the economy as investors, corporations and entrepreneurs adjusts to the higher cost of doing business via higher interest rates, labor and cost of capital. Higher cost of capital reduced the valuation of all companies, public and private. Tightening financial conditions are creating stress in debt markets and the financial system by increasing credit spreads, rising default risks and shrinking bond-market liquidity. Personal wealth has declined given lower home and equity prices translating into eventual lower consumer spending.

Repeated rate hikes from the Fed have pushed credit card interest rates to nearly 20% and delinquency rates are surpassing pre-pandemic levels. Credit card debt in the US reached a record high of USD $986 billion at the end of 2022. The average new-car interest rate rose to 6.9% in January 2023 according to Edmunds. The cost of new vehicles has risen 20% since the start of the pandemic, while used cars vehicles are still up 37% even after cooling in the fall of 2022. If household leverage continues to grow at its current pace, consumers may face binding borrowing constrains and be forced to cut back on spending. As interest rates climb, US home purchase applications dropped more than 18% in February 2023, the lowest level since 1995. Soaring mortgage rates have led to the worst housing affordability since 1985 with the average mortgage rate for a 30-year fixed loan continue to march towards 7.0% reaching the highest levels since 2007. Housing affordability in the US both for owners and renters is at the worst levels since 1985. Shelter makes up about a third of the overall basket of consumer prices. Inflation reduced the purchasing power of households and eroded real incomes, particularly those at the bottom of income scale.

Although major banks are much better capitalized today than they were before the Global Financial Crisis, the end of the era of rock-bottom interest rates has caused an abrupt collapse of three banks: Silvergate Corp., Silicon Valley Bank and Signature Bank. While the three cases are unrelated, there were similarities. At Slivergate the issue was a run-on deposits that began in 2022, when clients, mostly cryptocurrency ventures, withdrew cash to weather the collapse of FTX. At Silicon Valley Bank, ill-timed bets on US Treasury Bonds and when clients, mostly ventured backed startups withdrew cash when some members of the venture capital community urged startups to move their funds out of SVB, igniting a run on deposits that forced SVB to sell bonds that had lost a substantial portion of their value. Investors and depositors tried to pull USD $42 billion from SVB in a single day. Signature Bank, a crypto friendly institution failed to provide reliable and consistent data, creating significant crisis of confidence and a run-on deposits from clients.

US regulators are working to avoid a contagion and maintain stability in the financial system. However, there has been some significant sell-off on a number of regional banks including: First Regional Bank, KeyCorp, Western Alliance Bancorp, Ally Financial, Intrust Financial, UMB Financial, Zions Bancorp and Comerica, Inc. On March 12, 2023 US authorities moved fast and took extraordinary steps to bolster confidence in the banking system by guaranteed insured and uninsured deposits by announcing that no losses associated with the resolution of Silicon Valley Bank and Signature Bank will be borne by the taxpayer. The FED also launched a new backstop for lenders and altered the rules at is emergency lending facility to help them meet deposit withdrawals. The stress in the US banking sector has fueled growing concerns about spillover effects through a restriction of new credits.

In Europe, Credit Suisse has been struggling over recent years by a series of blowups, scandals, leadership changes and legal issues. Clients had pulled more than USD $100 billion in assets in the last three months as concerns mounted about its financial health. On Sunday March 19, 2023, UBS Group agreed to buy Credit Suisse Group in a historic, government-brokered deal aimed at containing a crisis of confidence that had started to spread across global financial markets. UBS is paying 3 billion-francs (USD $3.2 billion) in an all-share deal that includes extensive government guarantees and liquidity provisions including a Swiss National Bank offering of 100 billion-franc liquidity assistance plus a 9 billion-franc guarantee for potential losses from assets UBS is taking over. Given the potential global effects due to increases of interest rates by the different central banks, the FED, European Central Bank, Bank of England, Bank of Canada, Central Bank of Japan and Switzerland announced coordinated action to boost liquidity in US dollar swap arrangements to ease growing strains in the global financial system.

For more than 40 years, Silicon Valley Bank played a pivotal role in serving the startup community and supporting the innovation economy in the US. SVB was the trusted partner that has served the startup community unconditionally through tough times. Going forward, VC firms and portfolio companies may have issues accessing new credit. If not addressed, the collapse of Silicon Valley Bank will leave a big hole in the venture capital and startup ecosystem and a lasting impact in the advancement of innovation and technology in the US. The question is who will fill the void and replace SVB in the venture debt business?

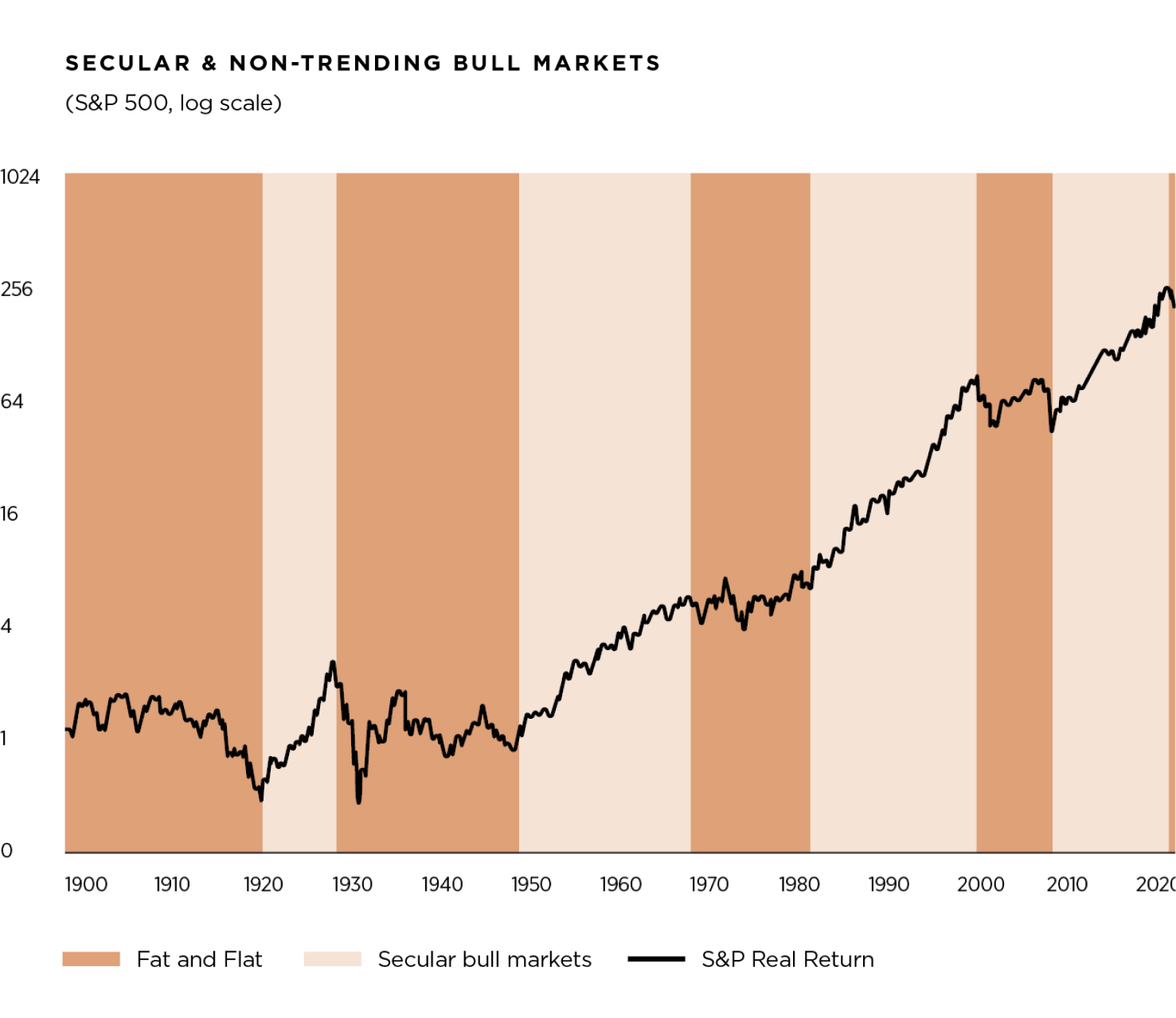

Capital markets are cyclical in nature. Since the 1800s, the S&P 500 has experienced 29 bear markets and on average bear markets in the US last 26 months. Fortunately, as proven by history, for every bear market, a bull market follows. The start of the bull market almost always begins during recessions when the economy is weak and bad news abound. On average recession in the US last 13 months from peak to through. A peak in the FED policy cycle is an important catalyst and part of the recovery puzzle.

For 2023, the year-end S&P 500 soft landing price target is between 4,000 to 4,500 points and the hard landing price target of about 3,000 and 3,200 points. In the current environment, the forward paths of inflation, economic growth, interest rates, earnings, valuations and geopolitical outcomes are difficult to predict.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com

Homero Elizondo

Head of Research, Regius Magazine.

regiusmagazine.com