Thus far, 2023 has proven to be a resilient year with better than expected economic growth and positive market returns across developed equity markets, but the outlook is getting cloudier. Consumer spending in the US continues to be robust, business investment remains relatively strong, inflation is declining, but remains above FEDs 2.0% objective, and labor market continues to expand at a strong pace without a notable rise in unemployment. The 11 FED rate hikes (525bps) since March 2022 have put the US economy on track for a Goldilocks scenario of a soft-landing. However, the jury is still out on whether or not the US will enter into recession in 2024. The threat of inflation resurgence, a downshift in consumer spending, rising geopolitical risks, and oil price increases cannot be ignored. Jaime Dimon, CEO of JP Morgan, recently noted: “This may be the most dangerous time the world has seen in decades”.

Rapid rate hikes and rising yields are rippling through the economy as investors, corporations and entrepreneurs adjust to the higher cost of doing business via higher interest rates, labor, and cost of capital. Higher cost of capital reduced the valuation of all companies, public and private. Higher bond yields are attracting households and intuitional investors and is likely to result in a pullback on stocks. In addition, heightened geopolitical uncertainty can drive rapid and sharp drawdowns in assets as investors demand higher risk premium. However, long-term equity investors are likely to find attractive buying opportunities as headwinds to valuations and the economic outlook persist. Equities typically fare poorly when yields rise sharply and when yields stop rising, equities get some relief.

Tightening financial conditions are creating stress in debt markets and caught some lenders off guard that lead to a wave of regional bank collapses in March 2023. Despite that three of the biggest Wall Street banks have posted a record third-quarter result, US banks continue to face funding pressures and regulatory challenges. According with Bloomberg, number of US banks have sizable positions on low yielding bond holdings (around 2.4%) in a 5% world. The value of those holding can continue to erode if the Fed follows through on more rate hikes. In addition, US banks are also exposed to higher capital requirements estimated at 19% increase in common equity as the possibility of raising defaults could damper lending in the future.

The surge in rates and pullback in bank lending has led to substantial stress in US office and commercial real estate. MSCI identified USD $215 billions of properties that are potentially troubled and given the relative opacity of private real estate, it is not clear when will it reach the bottom. Investors around the globe are now reevaluating the rational to allocate capital into an asset class that is exposed to repricing risks and increasing cost of capital.

More companies may go out of business if they are having greater difficulty in finding financing. More households are falling behind on their car loan and credit card payments than at any time in more than a decade. Mortgage rates continued to climb toward 8%, resulting in affordability issues and slowed home purchase activity. Potential sellers are sitting on their homes rather than give up low mortgage rates and there is a persistent lack of supply in both housing for sale and for rent.

The US economy is still facing risks with ongoing weight of monetary policy tightening, an unsustainable fiscal path, government dysfunction, increasing odds of government shutdown, UAW strike, consumer spending slowdown, rising geopolitical risks and increasing crude oil prices. Since June 2023, oil prices have increased by about 21% on the back of an extended supply cuts from OPEC+.

The Middle East has long been one of the most unstable regions in the world. The conflict between Arabs and Jews over ownership of the Holy Land dates back more than a century and has given rise to seven major wars. On Oct 7th of this year, the Islamist Palestinian group Hamas, which has ruled Gaza since 2007 and both the US and EU have designated a terrorist organization, mounted an unprecedented attack against innocents in Israel including babies, children, women and men. US President Joe Biden vowed to provide Israel with full support, calling the Hamas attack on Israel, “an act of sheer evil.” His priority is to use all the diplomatic means to prevent the Israel-Hamas war from spiraling into a broader conflict. Twelve days after the conflict broke out, China’s President Xi Jinping called for an immediate ceasefire to prevent the conflict from expanding and creating a serious humanitarian crisis.

For years, Israel and Iran has have engaged in a shadow war. Iran has supported militant groups that regularly fight Israel, notably Hamas in Palestine and Hezbollah in Lebanon. According to the Washington Institute for Near East Policy, Hamas has had ties to Iran for decades and according to the Wilson Center research, Iran has provided funding, training, military hardware and missiles to Hamas. However, a spoke person for Iran’s Foreign Affairs Ministry said on Monday Oct 9th that Theran had played no role in the attack. Likewise, US National Security Advisor, Jake Sullivan said the US has no confirmation that Iran planned or directed the Hamas attacks. However, at the UN Security Council on Oct 24th, the Secretary of State Antony Blinken warned that the US would respond “swiftly and decisively” if Iran or its proxies attack Americans. At the same time, Iran’s foreign minister warned that new fronts would open against the US if it keeps up unequivocal support for Israel.

"Rising geopolitical tensions have led to alterations in the way the global economy and financial markets functions. On January 3rd, 2022, the S&P 500 index hit an all-time high of 4,797 and traded at a P/E of 21x and on October 12, 2022 the index reached a low of 3,577 trading at a P/E of 15x"

Rising geopolitical tensions have led to alterations in the way the global economy and financial markets functions. On January 3rd, 2022, the S&P 500 index hit an all-time high of 4,797 and traded at a P/E of 21x and on October 12, 2022 the index reached a low of 3,577 trading at a P/E of 15x. The 10-year US Treasury Note yield hit a 16-year high of 4.99% in October 19, 2023. The three major US indexes S&P 500, NASDAQ & RUSSELL confirmed a bear market on June 13, 2022 and the DOW confirmed a bear market until September 30, 2022, often a bear market precedes a recession.

However, after US’s main indexes entered into bear market territory in 2022, most US stocks have rallied in 2023 as signs of easing inflation fueled expectations the FED could slow the pace of rate hike. As of Oct 27, 2023, the S&P 500 index is up 7.2%, the NASDAQ is 20.8%, RUSSELL 3000 is 6.1%, the DOW is negative -2.2% and the 10 year US Treasury Note yielded 4.83%. The S&P 500 index closed in correction territory at around 4,117 points down 10.3% from previous cyclical high of 4,588 reached in July 31, 2023. Since 1928, the S&P 500 rose on average 9.1% a year following a correction. According to Bloomberg, the US annual inflation rate reached 9.1% in June 2022, the biggest yearly increase since 1981. The annual Consumer Price Index (CPI) in the US reached 7.0% at the end of 2021, 6.5% at the end of 2022 and expected to reach 3.0% at the end of 2023 and 2.4% at the end of 2024, according to Goldman Sachs.

The US, the world’s largest economy, is likely to avoid a recession as the US GDP growth rate is expected to reach 2.4% in 2023 and 2.2% in 2024. Workers continue to benefit from very favorable job prospects and a near record low unemployment rate. As of September 2023, the US labor market added 2,339,000 jobs, average hourly earnings grew at a moderate pace and the unemployment rate remained unchanged at 3.8%.

According to Goldman Sachs the outlook for global growth will slow from 3.0% in 2022 to 2.7% in 2023 and 2.6% in 2024, well below the 3.8% historic average of the past two decades. Global inflation is forecast to decline, from 6.5% in 2022 to 4.5% in 2023 and 3.6% in 2024. The main factors holding back the expansion include the long-term consequences of the pandemic, two ongoing wars and central bank policy tightening. The growth rate forecast for China, the world’s second-largest economy, is expected to reach 5.3% in 2023 and 4.5% in 2024. China’s economy is facing growing headwinds because of declines in real estate investment, housing prices, weak consumer sentiment and ongoing demographic deterioration. If balance sheets of banks and households worsen as a result of the credit-driven real estate model of growth, China is likely to pose an important risk to the global economy. The Euro Area is expected to slow from 3.4% in 2022 to 0.5% in 2023, yet the growth rate forecast for 2024 is 1.0% and as a result is likely to avoid a recession.

However, the outlook for 2023 and beyond, looks challenging and uncertain. FED officials have warned that interest rates could rise further, market participants are forecasting the federal funds target rate to range between 5.25% and 5.75% in 2023. No FED cuts are expected in 2023 and market participants are expecting rates to stay higher for longer, with rate cuts forecast until the end of 2024. The ECB hiking cycle is now complete and is likely to remain on hold at 4.00% into 2024, though growth weakness or labor market deterioration could prompt early rate cuts. At the end of October 2023, the US debt reached USD $33.5 trillion dollars and according to Bloomberg forecast debt/GDP will exceed 120% by fiscal year 2023 and will continue to rise over the next decade. Marketable US government debt has more than doubled over the past decade to USD $25.8 trillion. According to Goldman Sachs, fiscal deficit is expected to reach USD $1.9 trillion by 2025, nearly double the USD $984 billon level in 2019. The US debt limit debate in 2011 ended with a compromise that averted default but prompted downgrades by S&P Global Ratings and sent the S&P 500 down 17%. In August 2023, Fitch Ratings downgrade the US debt to AA+ from AAA, leaving Moody’s Investors Service as the only major credit-rating firm applying its top credit ratings to the US. US policy-making has become less stable, less effective and less predictable as intensifying polarization and dysfunction in the decision-making process is evident among US elected officials. While the US government has avoided a shutdown for now, the leadership vacuum in the House raises the odds of a shutdown when funding extensions expires on November 2023.

WTI is trading at USD $85.5 per barrel, Brent at USD $90.5 per barrel and natural gas at USD $3.5 per million of BTU. Oil prices are likely to increase on the back of China’s reopening, Russia output cuts, OPEC pricing power (OPEC put) and international travel continues to recover. According to Goldman Sachs estimates, Brent is expected to rise to USD $100 per barrel by the second quarter of 2024. The dollar, gold and Treasuries will likely gain from further safe-haven flows in more adverse escalation scenarios in the Middle East. Gold price is around USD$ 2,000 from its record high of USD$ 2,131 on August 6, 2020. Bitcoin showed some sign of “safe haven” during the Covid pandemic as technology stocks soared, yet has lost roughly 50% of its value from its record high of USD $67,000 on November 8, 2021 leading a rout in crypto that has caused pain throughout the industry.

"China’s economy is facing growing headwinds because of declines in real estate investment, housing prices, weak consumer sentiment and ongoing demographic deterioration. If balance sheets of banks and households worsen as a result of the credit-driven real estate model of growth, China is likely to pose an important risk to the global economy"

While Bitcoin is topping the performance ranking in 2023, its rally is primarily about undoing last year’s damage. This year’s rally was triggered by market participant hopes of rapid reversal in US monetary policy, the turmoil in the US banking industry and the recent euphoria about the looming launch of a physically backed Bitcoin ETF in the US. Ethereum has shown a similar decline of 60% from an all-time high of $4,735 on November 9, 2021. The pullback in cryptocurrencies triggered a series of bankruptcies, layoffs, failures and highlights that, for now, digital assets are not viewed as the safe heaven asset to store value or hedge against inflation. The crypto asset sector remains starved for cash and companies are cutting jobs to stay afloat. According to Bloomberg, “MKR’s rally this year stems from a 2022 decision by MakerDAO to convert up to USD $6 billion of their funds backing its stablecoin DAI into assets like short-term US Treasuries and corporate bonds to seek more stable yields as crypto markets tumbled”.

In times of uncertainty and stress, the US dollar is proving to be the world’s safe haven asset and king. However, is important to acknowledge that a new cycle of innovation is shaping the future of finance in the aftermath of the Great Financial Crisis in 2008-2009. Traditional financial institutions are increasingly vulnerable to the rise of newcomers in the financial technology (FinTech), digital assets and decentralized finance (DeFi).

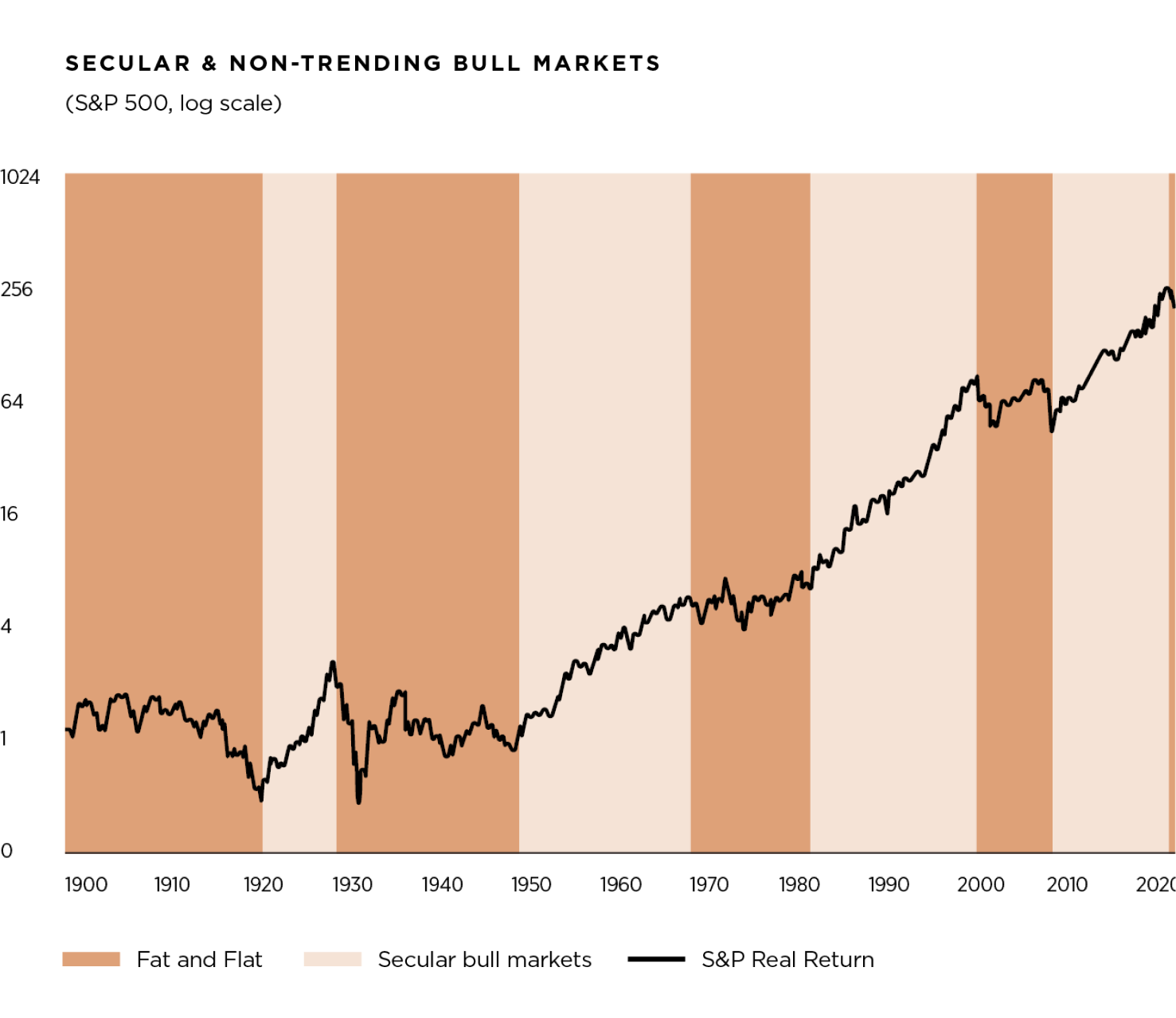

Capital markets are cyclical in nature. Since the 1800s, the S&P 500 has experienced 29 bear markets and on average bear markets in the US last 26 months. Fortunately, as proven by history, for every bear market, a bull market follows. The start of the bull market almost always begins during recessions when the economy is weak and bad news abound. On average recession in the US last 13 months from peak to through. A peak in the FED policy cycle is an important catalyst and part of the recovery puzzle.

For end of 2024, the S&P 500 base case is 4,800, bull case is 5,000 points and bear case 3,800. In the current environment, the forward paths of inflation, economic growth, interest rates, earnings, valuations and geopolitical outcomes are difficult to predict.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com

Homero Elizondo

Head of Research, Regius Magazine.

regiusmagazine.com