President Donald Trump’s second term, commencing on January 20, 2025, has been characterizd by a series of assertive policy shifts and initiatives aimed at ushering in what he terms a “Golden Age” of America. Since Trump took office, the world has changed in a very short period of time. The key question is whether this America First policy will lead to a US cyclical expansion with lasting peace or contraction with ongoing conficts and new enemies “Golden Age vs Chaos”?

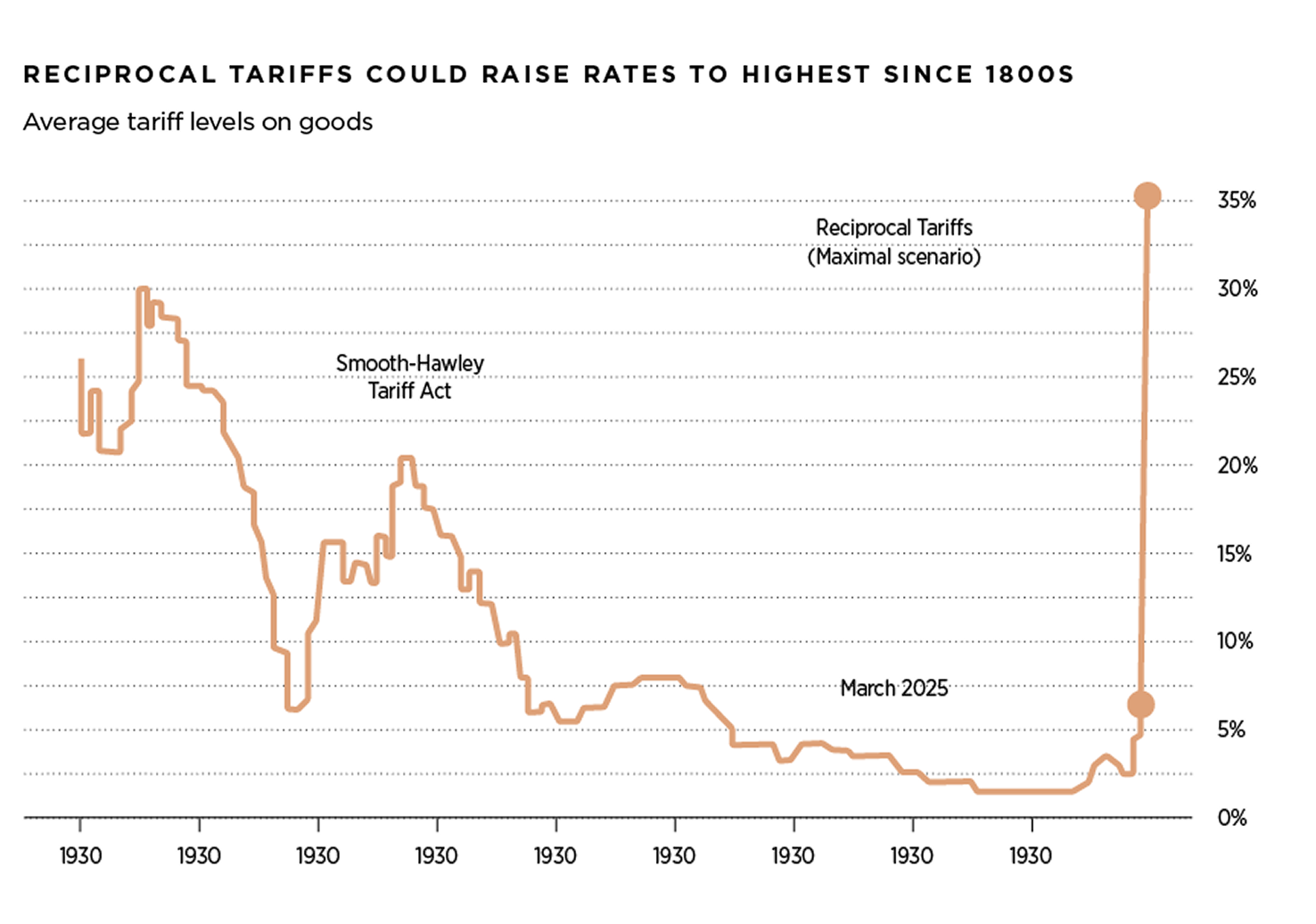

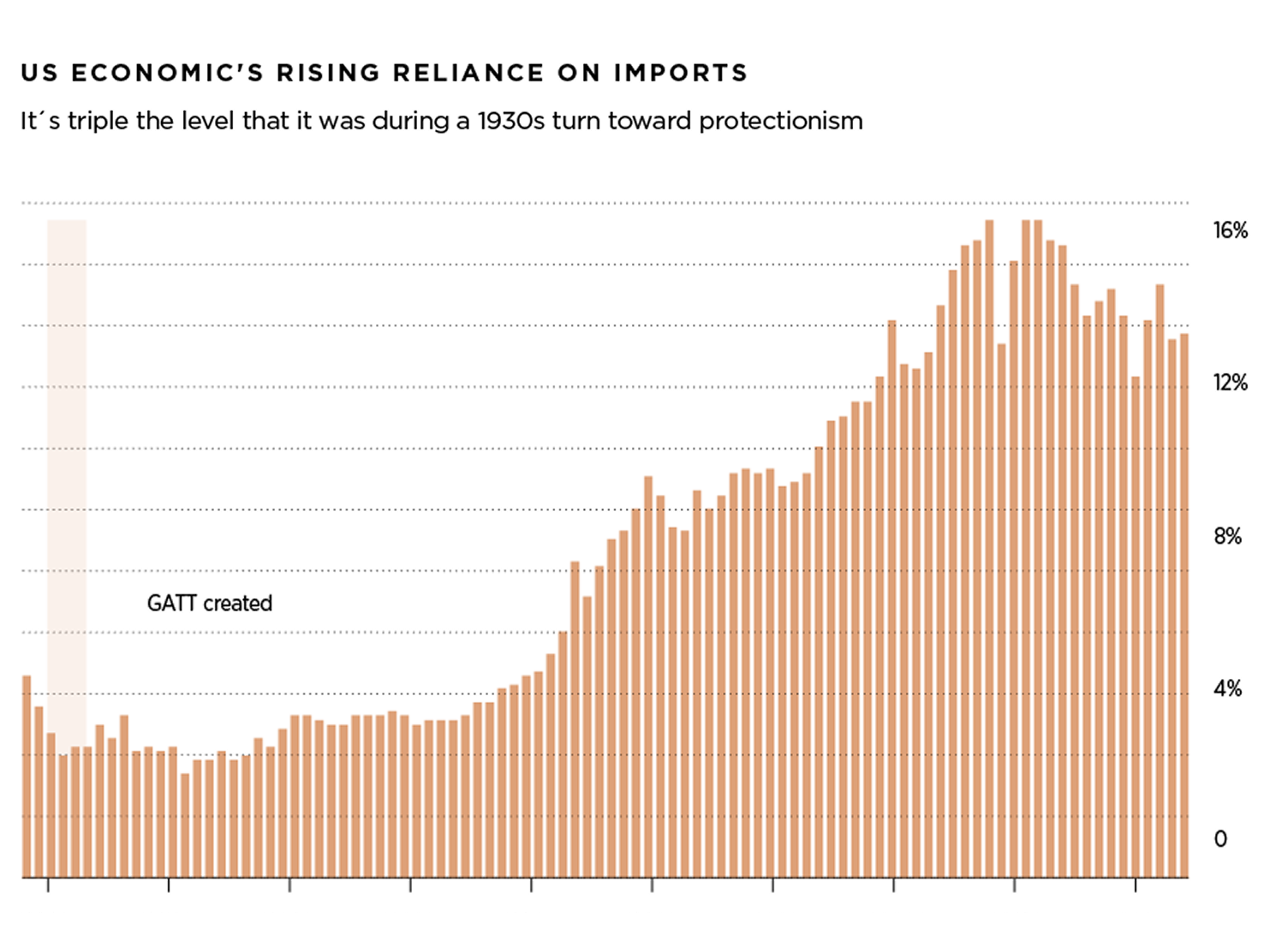

Trade has been a fundamental aspect of human civilization, driving economic growth, cultural exchange and technological advancement. From the ancient barter system to modern global trade agreements, the exchange of goods and services has shaped societes and economies. One of the most significant moments in trade history was when the Smoot-Hawley Tarrif Act was signed into law in 1930 by President Herbert Hoover, aimed to protect American farmers and manufacturers by imposing high tariffs on imported goods. However, instead of reviving the US economy, it exacerbated the economic downturn during the Great Depression and restricted international trade.

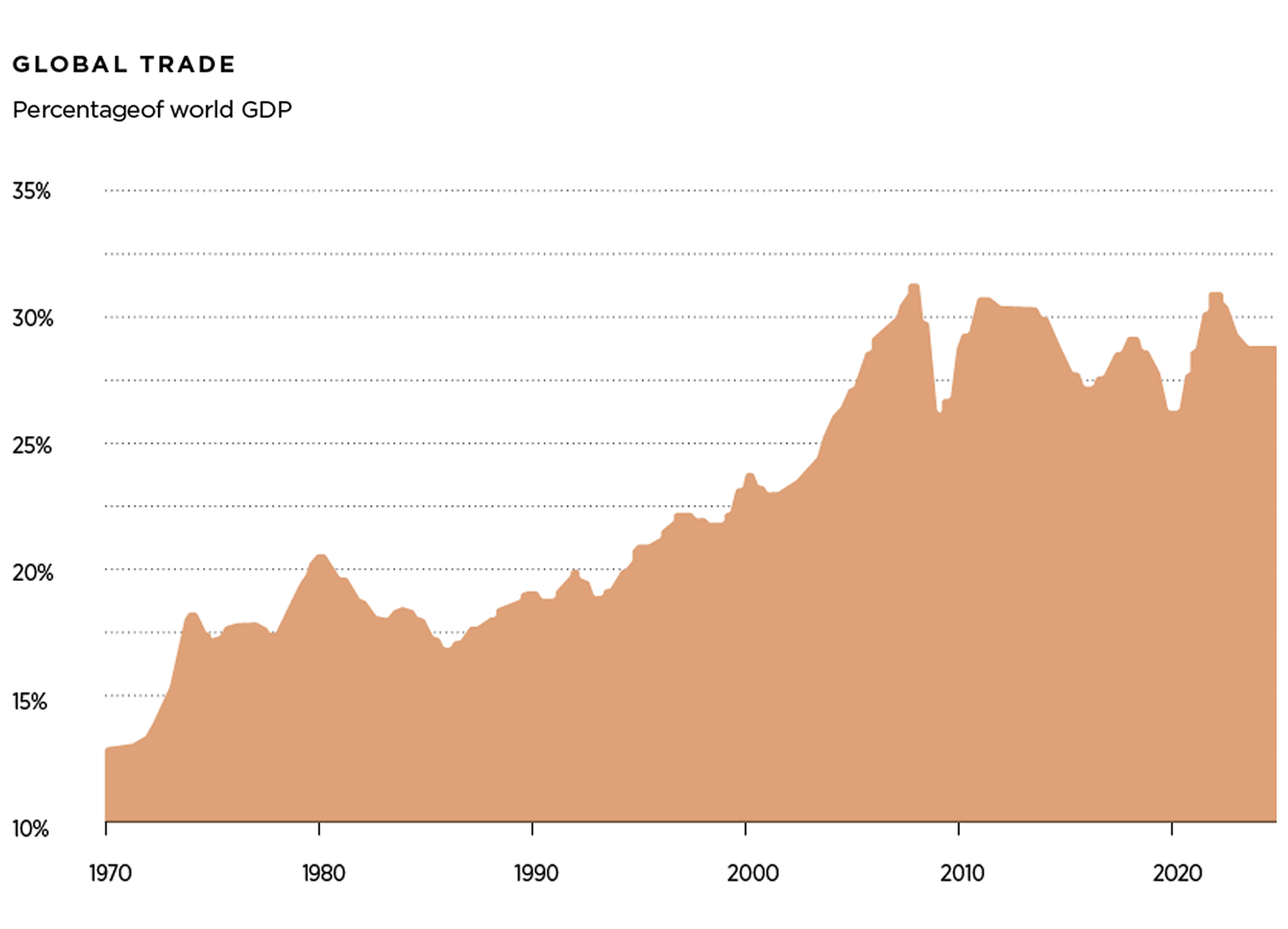

After the end of World War II, the US has led the way to create the General Agreement on Tariffs and Trade (GATT) in 1947 and its successor the World Trade Organization (WTO) in 1995 to reduce tariffs, embrace trade liberalization and foster international cooperation. As a result, global trade boomed in the 1990s and early 2000s as WTO helped facilitated multilateral trade agreements and dispute settlement mechanisms for unfair trade practices. President Clinton signed the US-China Relations Act of 2000, granting Beijing permanent normal trade relations with the US and paving the way for China to join the WTO in 2001. However, trade openness has been slowing following the Global Financial Crisis (2007-2009), the outbreak of COVID-19 (2020-2022) and now with Liberation Day (April 2, 2025) where President’s Trump tariff shock is pushing the US toward a full decoupling from China and a new unilateral world order.

On April 2, 2025, a day labaled by President Donald Tump “Liberation Day”, his administration unveiled a 10% universal baseline tariff on all imports and a country-specific tariffs that are much higher, including 104% on China, Vietnam 46%, Thailand 36%, India 26% and 20% on European Union. Imports from Mexico and Canada that comply with the USMCA trade agreement will largerly remain exempt from tariffs, except for auto, steel and aluminium imports which fall under separate tariff policies and will be subject to 25% tariff effective March 12, 2025. Non-USMCA complaint imports from Mexico and Canada will be subject to a 10% reciprocal tariff. However, when it comes to tariff policy, the situation is stil fluid and can change anytime.

Days of pressure from fellow Republicans, business executives and even his close friends had not appeared to move Trump, who insisted “My Policies Will Never Change”. However, after a sharp sell-off in US government bond markets – usually a safe corner for investors – the 10-year and 30-year Treasury saw the biggest three day jump since 2001. As a result, on April 9, 2025, President Donald Trump execute one of the biggest economic reversals in modern presidential history by dropping the tariff rates approved few days ago on imports from most US trade partners to 10% for 90 days to allow trade negotiations with those countries. At the same time, President Trump announced a further increase in the tariff rate on imports from China to 125% “effective immediately” following the Chinese government’s increase of tariffs on US goods to 84% and the “lack of respect that China has shown to the World’s Markets.”

Policy uncertainty on tariffs, spending cuts, immigration and international alliances weighs on investment, markets sentiment, inflation, employment, earnings, valuations, growth expectations and geopolitical affairs. Unwinding the postwar global trading system the US helped build over the past 80 years entails a significant deal of costs and consequences beyond economics. A breakdown in the bond market could be an even more sever shock to the monetary system than the cancellation of the gold standard in 1971 and the global financial crisis in 2008. The key question is what will be the extent of the damage? There is no doubt that we are at a fork in the road and given the level uncertantiy of the path forward, it is inevitable that volatility will continue as capital allocators question historic overweight in US assets. Exceptional US asset return prospects are responsible for the US dollar’s strong valuation. If tariffs weigh on US firms’ profit margins and US consumers’ real income, they can erode that exceptionalism and, in turn, crack a pilar of the strong US dollar. The narrative of US Preeminence is under assult as a result of the US trade policy shift. However, if there is a reversal or more reasonable trade policy, US Preeminence is likely to endure over the long-term as preeminence does not equate to US assets outperformance at all times or exempt of short-term uncertainty and volatility. The best thing the Trump administration can do to calm markets is to show progress on trade deals and it is essential the US preserve its democracy, rule of law, education, check & balances, military and global economic alliances.

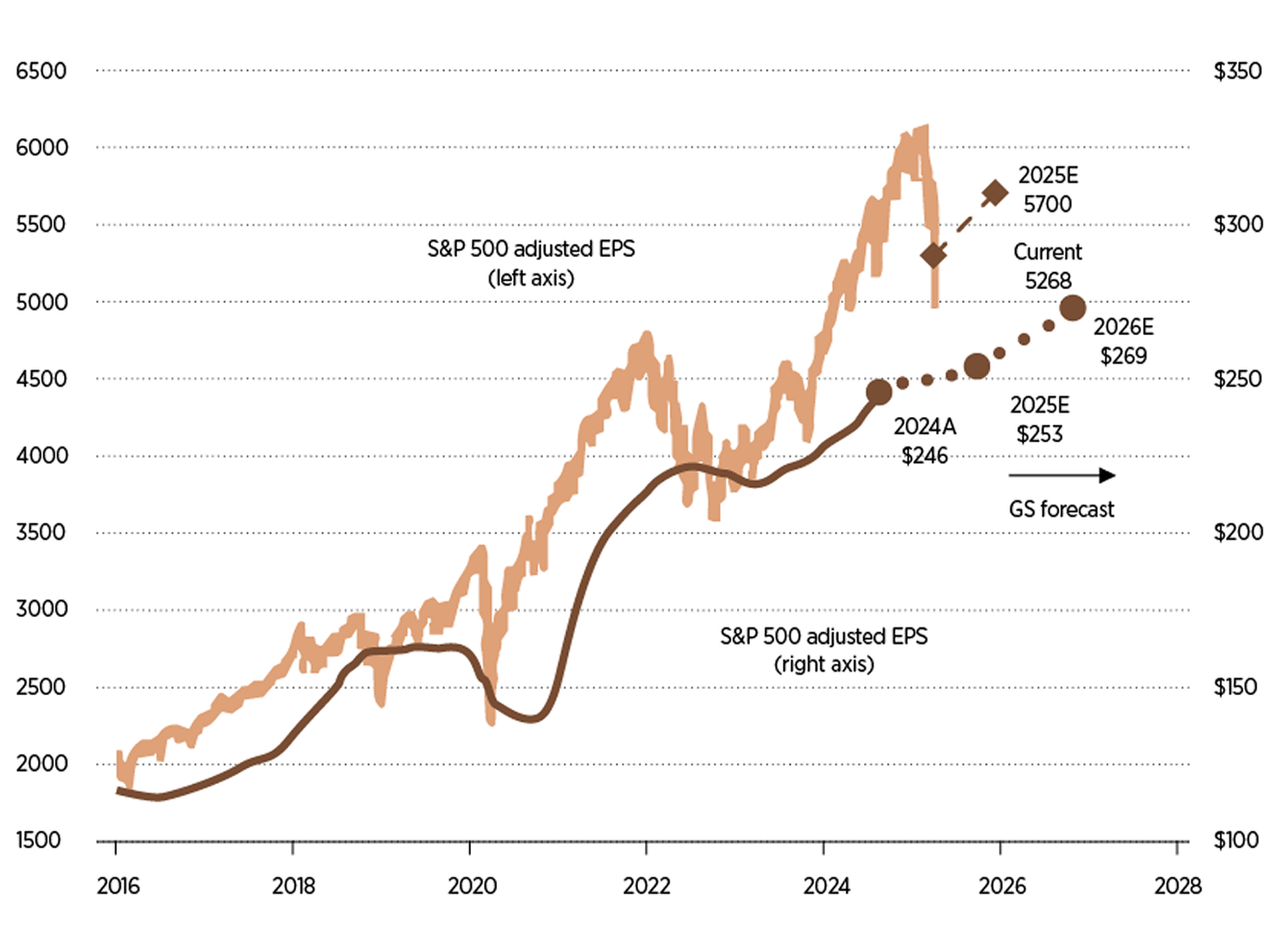

For end of 2025, the S&P 500 base case is 5,800, bear case 4,800 and bull case 6,500 points. The economic effects of tariffs are likely to generate a temporary rise in inflation and as a result divert the FED’s 2% target. Navigating this path requires a cautious investment approach as macroeconomic imbalances, protectionism and two ongoing wars are building up tail risks. If tariffs become broad and permanent, the range of outcomes would be wide as they can have widespread economic, geopolitical and social consequences.

In 2022, the US GDP grew 2.5%, 2.9% in 2023, 2.8% in 2024 and is expected to grow 1.3% in 2025 and 1.3% in 2026 according to Goldman Sachs. If President Trump does not negotiate and the tariff war escalates, a recession in the US will be imminent.

The FED cut short-term rates by 50 basis points (bps) at the September 2024 FOMC meeting, in light of the good inflation news and the risk of further labor market softening. The rationale for the bold cut was the shift in focus from inflation risks to employment risks, and the FED determination not to fall behind the curve in the easing cycle. The annual Consumer Price Index (CPI) in the US reached 7.0% at the end of 2021, 6.4% at the end of 2022, 3.3% at the end of 2023, 2.9% at the end of 2024, and expected to reach 3.4% in 2025 and 2.4% in 2026, according to the US Bureau of Labor Statistics & Goldman Sachs.

The FED Dot Plot indicates that the median of the FOMC voting members is expected to cut 50 bps in 2025 and 100 bps in 2026, forecasting the terminal federal funds target rate to 3.0% in 2028. The expected FED rate for the end of 2025 will be between 3.75% and 4.0% and 3.25% and 3.5% at the end of 2026. However, as the situation is very fluid a sharp rise in long-term expecations would signal a loss of faith in the FED’s ability to bring inflation back to the 2% target.

On October 12, 2022 the S&P index reached a low of 3,577 trading at a P/E of 15x. The 10-year US Treasury Note hit a 16-year high of 4.99% in October 19, 2023. The three major US indexes S&P 500, NASDAQ & RUSSELL confirmed a bear market on June 13, 2022 and the DOW confirmed a bear market until September 30, 2022, often a bear market precedes a recession. After US’s main indexes entered into bear market territory in 2022, most US stocks, in particular the so-called “Magnificent 7” have rallied in 2023 and 2024 as signs of easing inflation, a more accommodative monetary policy stand, earnings growth and technological transformation. Strong performance by MSFT, NVDA, AAPL, GOOG, AMZN and META has contributed around 44% of the index return. However, it is difficult to predict which companies will be the top performers tomorrow, as market conditions are consistently changing.

In general, long-term equity returns are driven by the earnings growth of the asset and the change in valuation. In 2023, the S&P 500 EPS closed at USD $223 and USD $246 in 2024, and is expected grow 3% to USD $253 in 2025 and 6% to USD $269 in 2026.

On April 8, 2025 the S&P index reached 4,982 points, has fallen 15.3% year to date, is trading at a P/E of 18.5x and has declined by 19% from its record high on February 19, 2025 where the index reached a new all-time high of 6,144 points. The two other major US indexes NASDAQ & RUSSELL 2000 confirmed a bear market on April 4, 2025, both have fallen 20.9% and 21.0% respectively year to date. The 10-year US Treasury Note yielded 4.35%. Not all bear markets are the same and we are likely experiencing an event-driven bear market triggered by a one-off tariff shock. Event-driven bear markets duration is shorter and have a faster recovery profile. However, event-driven bear markets can morph into a cyclical bear market given growing recession risk, sharp rise in inflation expecations and the cost of US government debt, a growing deficit and general erosion of trust and reliance as a result of the uncertainty created around misguided economic policies. On April 9, 2025 we experienced a bear market rally where the S&P index reached 5,457 points, has declined 7.2% year to date and is trading at a P/E of 20.3x. The NASDAQ & RUSSELL 2000 both have fallen 11.3% and 14.2% respectively year to date. The 10-year US Treasury Note yielded 4.4%. When the credit spreads are widening, particlulary in the US government bond market, the dollar weakens, the stock market drops, volatility spikes, consumer and business sentiments start freezing this is not “noise” is a “signal” and the Trump administration must read the room and back off from some of the policies that have been announced.

According to Goldman Sachs the outlook for global growth will slow from 3.0% in 2022 to 2.8% in 2023, 2.7% in 2024 and expected 2.1% in 2025, well below the 3.8% historic average of the past two decades. Global inflation is forecast to decline, from 6.5% in 2022 to 4.3% in 2023, 3.2% in 2024 and expected 3.0% in 2025. The growth rate for China, the world’s second-largest economy, reached 5.4% in 2023, 5.0% in 2024 and is expected to grow 4.0% in 2025 and 3.5% in 2026. China’s economy is facing growing headwinds because of the ongoing trade war with the US, declines in real estate investment, housing prices, weak consumer sentiment and ongoing demographic deterioration. The Euro Area is expected to slow from 3.4% in 2022 to 0.5% in 2023, in 2024 0.7 yet the growth rate forecast for 2025 is 0.7% and 1.0% in 2026, as a result is likely to avoid a recession according to Goldman Sachs.

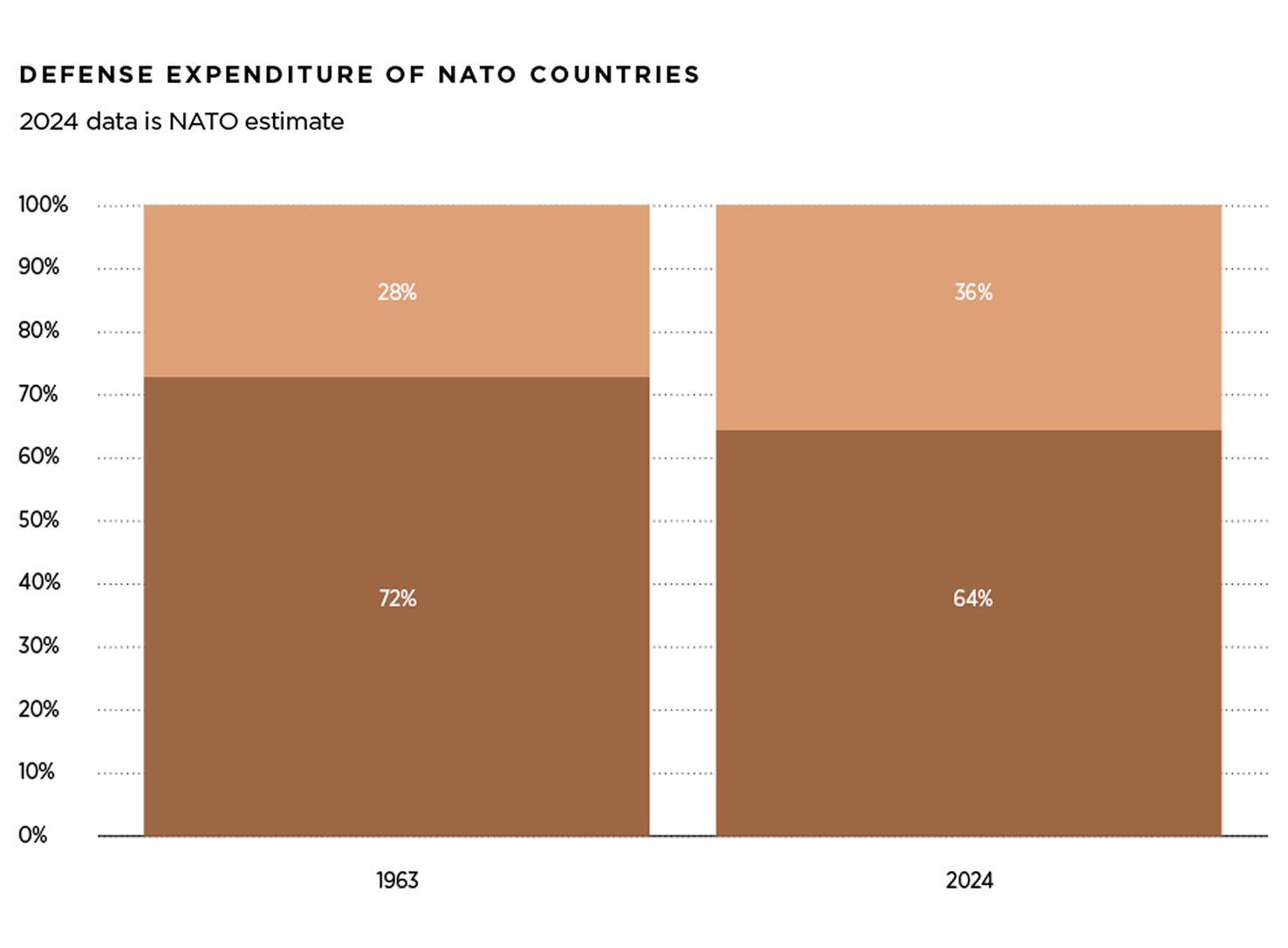

While the US remains the prodiogus economic and military power, its ability and willingness to maintain its role as the policeman of the global order it created has significantly diminished. The second Trump administration’s attempts to turn the Post-Cold War security landscape have prompted European allies to reassess and strengthen their defense and military capabilities in response to the ongoing Ukraine conflict. In particular, the European Comission proposed “ReArm Europe”, a comprehensive plan aim to boost defense spending by up to USD $900 billon. As of 2024, the EU member states collectively allocated approximately USD $350 billon to defense, representing roughly 1.9% of the EU’s GDP. The objective to pressure NATO countries to raise their defense expenditures is not the same as the US turning its back on NATO. The US share of NATO defense expenditures stood at 72% in 1962 when President Kennedy told the Europeans: “NATO states are not paying their fair share and living off the “fat of the land.” We have been very generous to Europe, and it is now time for us to look out for ourselves.” Sixty-two years later, the number has decreased to 64%, a decline of just 8%. The dramatic shift in Europe’s defense policy have led to rising optimism around European growth and strong outperformance of European assets.

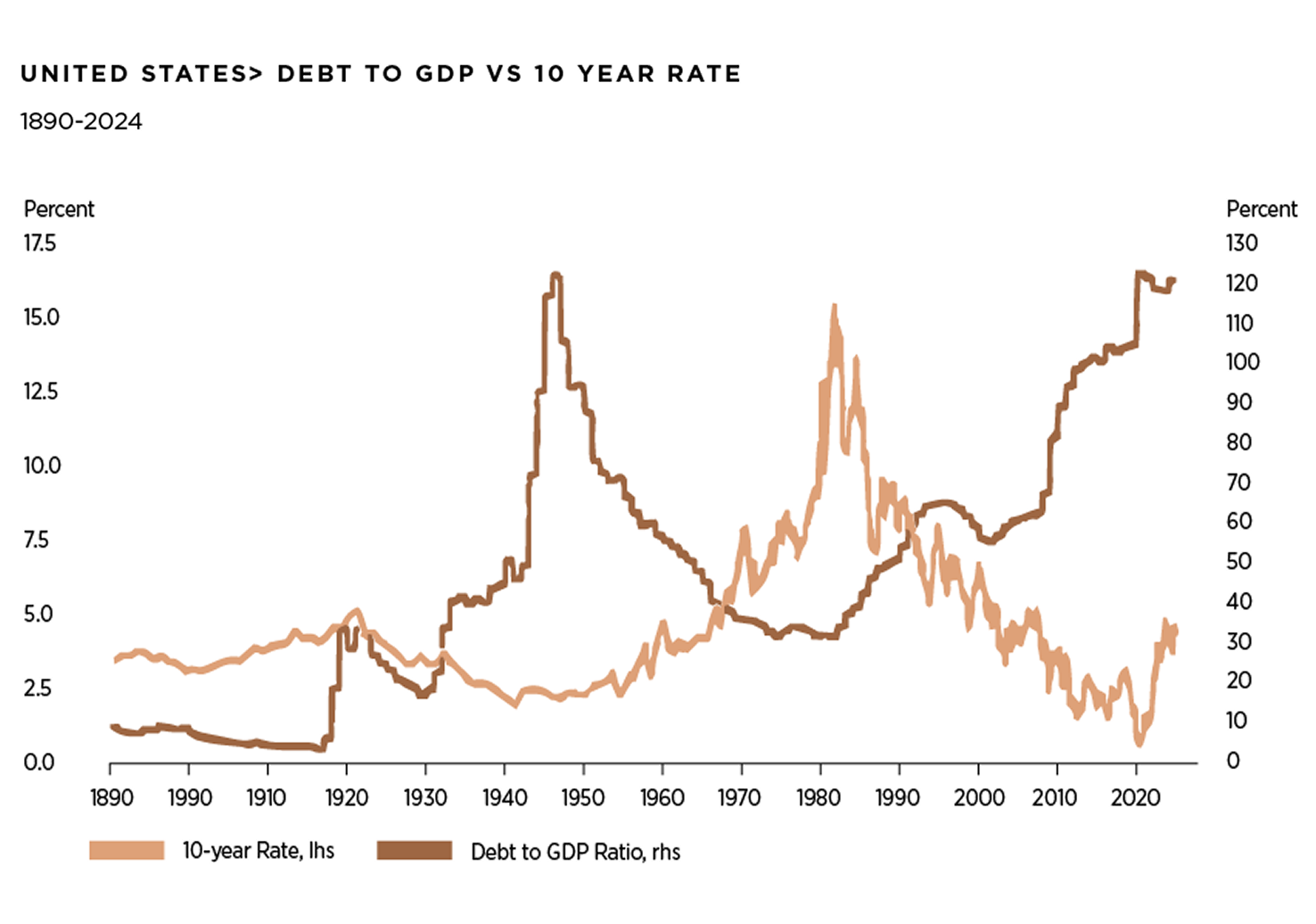

The US Federal government debt reached USD $35 trillion dollars at the end of 2024. The debt-to-GDP ratio has increased from a pre-GFC low of 35% in 2007 to 123% in 2024 and is likely to increase over the next decade unless the US is able to grow its economy, decrease its debt and reduced its fiscal deficit. Otherwise, this debt trajectory is not sustainable and is uncertain where the tipping point might be. The US debt limit crisis in 2011 ended with a compromise that averted default but prompted downgrades by S&P Global Ratings as it stripped the US from its top score and sent the S&P 500 down 17%. In August 2023, Fitch Ratings downgrade the US debt to AA+ from AAA and in November 2023, Moody’s lowered the US sovereign outlook to negative from stable while affirming the rating of Aaa, the highest investment-grade notch. US policy-making has become less stable, less effective and less predictable as intensifying polarization and dysfunction in the decision-making process is evident among US elected officials.

“...event-driven bear markets can morph into a cyclical bear market given growing recession risk, sharp rise in inflation expecations and the cost of US government debt, a growing deficit and general erosion of trust and reliance as a result of the uncertainty created around misguided economic policies”

The US government runs persistent budget deficits as it spends more than it collects in revenue. According to the US Treasury, fiscal deficit is expected to reach USD $1.9 trillion at the end of 2024 around 6.5% of GDP, almost double the USD $984 billon level in 2019. Net interest payments due on federal debt are around USD $900 billon per year, around 3.1% of GDP. The second Trump Administration has demonstrated a willingness to cut government spending and as a result has appointed billionaire entrepreneur Elon Musk to the newly created US Department of Government Efficiency (DOGE). In an interview on March 2025, Elon Musk said he plans to cut 15%, about USD $1 trillion, of the government’s annual spending – which amounted USD $6.75 trillon in fiscal year 2024 – by the end of May 2025 without affecting any of the critical government services.

During the summer of 2024, oil prices fluctuated back and forth in the range of USD $75-90 per barrel as market focus on geopolitical risks to oil supply and concerns about the health of consumption in the West and China. WTI is now trading at USD $63 per barrel, Brent at USD $66.5 per barrel and natural gas at USD $3.7 per million of BTU. According to Goldman Sachs estimates, WTI prices are expected to average USD $59 in the remainder of 2025 and to range USD $55-50 per barrel in 2026, as a result OPEC 8+ commitment to unwind 2.2mb/d of voluntary production cuts. OPEC formation occurred in 1960 by five founding members: Iran, Iraq, Kuwait, Saudi Arabia and Venezuela at a time of transition in the international economic and political landscape. While oil markets are not currently pricing a worst-case scenario of the Middle East crisis as it did in the 1970s (Arab-Israeli war/Oil embargo), 1980s (Iran-Iraq war) and 1990s (invasion of Kuwait), the tail risk of a very large oil price spikes remains as a result of rising geopolitical, oil supply disruptions and the escalation of two ongoing wars.

The Basel Committee on Banking Supervision was set up in 1974 by central banking governors of the Group of Ten countries in order to maintain oversight of global banking standards and higher levels of capital adequacy. The new Basel III Accords, implemented across various regions since 2021, treat gold held in vaults as a zero-risk asset and classifies it as a Tier 1 Asset, a status previously reserved for cash. These rules mean banks must hold more high-quality assets like gold to safeguard against financial crisis. This regulatory shift is expected to influence gold demand significantly, driving prices up and reaffirming gold’s role a secure and stable investment. On April 11, 2025, the gold price reached a new all-time high of USD $3,245 per ounce and the 2025 year-end gold forecast to USD $3,700 per ounce with a projected range of USD $3,650-3,950 per ounce as stronger-than-expected central bank demand and increased recession risk is expected according to Goldman Sachs.

Ever since the GFC and even more pertinent in the face of the Covid-19 crisis, goverments and central banks have lanunched vast stimulus and rescue programs to bailout financial institutions and the economy. In 2009 someone identified as Satoshi Nakamoto succesfuly launched Bitcoin, a peer-to-peer payment network that operates without intermediaries, consensus mechanisms, smart contract capability and no need for bailouts. The Bitcoin protocol permanently caps the total supply of bitcoin (BTC) at 21 million coins, and has never been hacked. As a result of its scarcity and security, Bitcoin is often referred to as “digital gold”. Since the launch of Bitcoin, its underlying bockchain technology has inspired an entire new ecosystem of plataforms and protocols with a wide range of applications.

“The US government runs persistent budget deficits as it spends more than it collects in revenue. According to the US Treasury, fiscal deficit is expected to reach USD $1.9 trillion at the end of 2024 around 6.5% of GDP, almost double the USD $984 billon level in 2019. Net interest payments due on federal debt are around USD $900 billon per year, around 3.1% of GDP”

On November 8, 2021, Bitcoin reached a record high of USD $67,000 and the marker value of cryptoassests peaked at around USD $3 tillion. However, the bubble burst in early 2022, tigerred by the collapse of the then third largest stablecoin TerraUSD. In November 2022, the bankruptcy of FTX, one of the world’s largest crypto exchange platforms sent shockwaves through the ecosystem. However, the FTX blowup has not destroyed all faith in the industry, in particular Bitcoin. On January 21, 2025, Bitcoin reached a new all-time high of USD $106,789 and year-to-date Bitcoin has decline about -15%. The approval of spot Bitcoin ETFs on January 2024 represented a resounding institutional validation as an asset class. In addition, on March 7, 2025, US President Donald Trump signed an executive order and directed the US Treasury to establish a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile” that can serve as a secure account for orderly and strategic management of tokens already owned by the government without increasing the federal budget or burdening taxpayers.

The Bretton Woods Agreement of 1944 which pegged other currencies to the dollar, established the US dollar as the dominant currency and the foundation of the international monetary system. Although the gold standard was abandoned in 1971, for the past 80 years, the US dollar has remained the most widely held currency for central banks reserves. To date, over 80% of global trade is conducted in US dollars, about 70% of foreign currency debt is denominated in US dollars and it remains the currency of choice for oil, commodities, exchange transactions and international loans. In times of uncertainty and stress, the US dollar is proving to be the world’s safe haven asset and king. However, the second Trump administration’s policy of slapping punishing tariffs on US trading partners is eroding investor, consumer and business confidence in the US dollar as the cornerstone of the global financial system. In addition, is important to acknowledge that a new cycle of innovation is shaping the future of finance particularly in the aftermath of the GFC. Traditional financial institutions are increasingly vulnerable to the rise of newcomers in the financial technology (FinTech), digital assets and decentralized finance (DeFi).

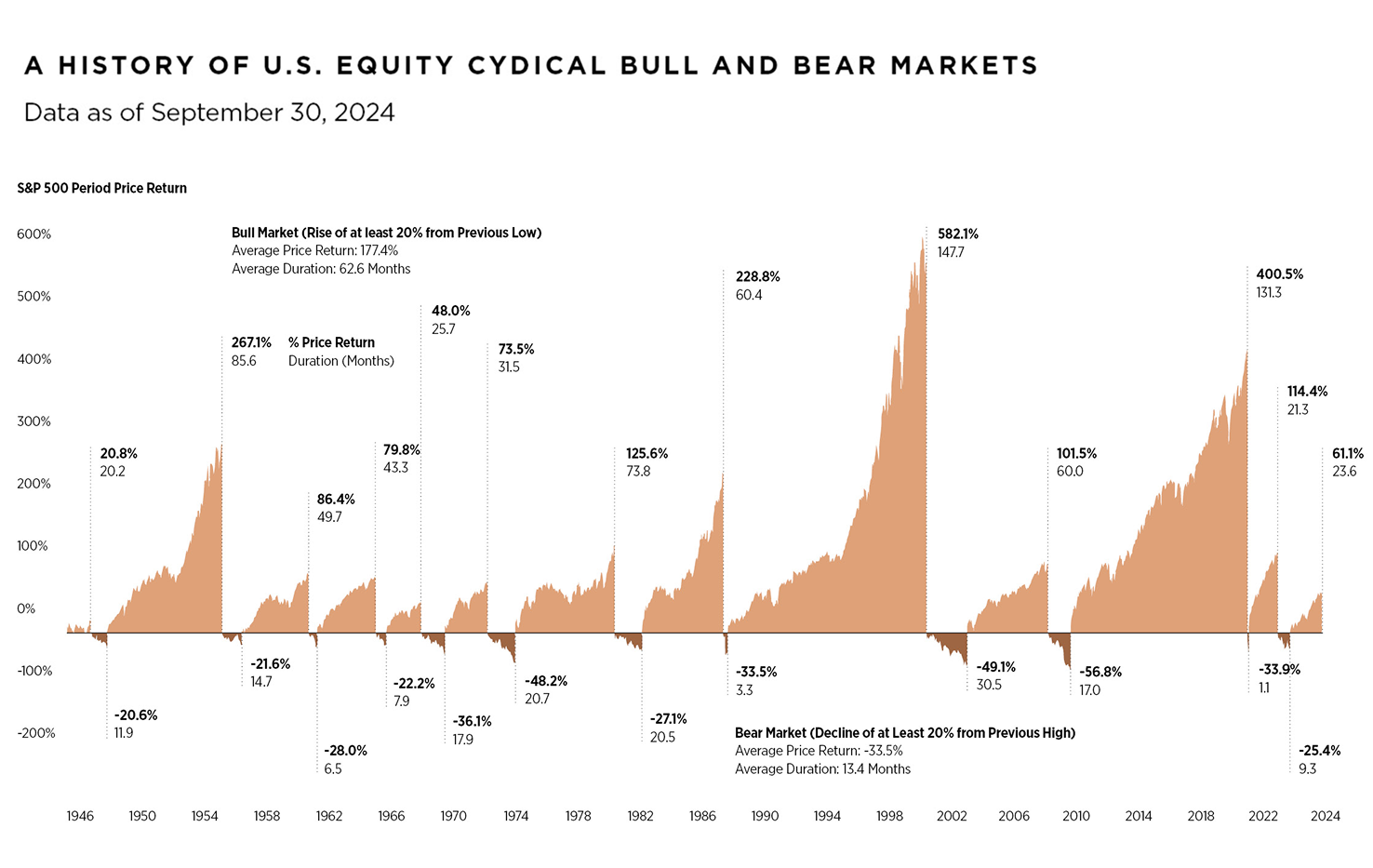

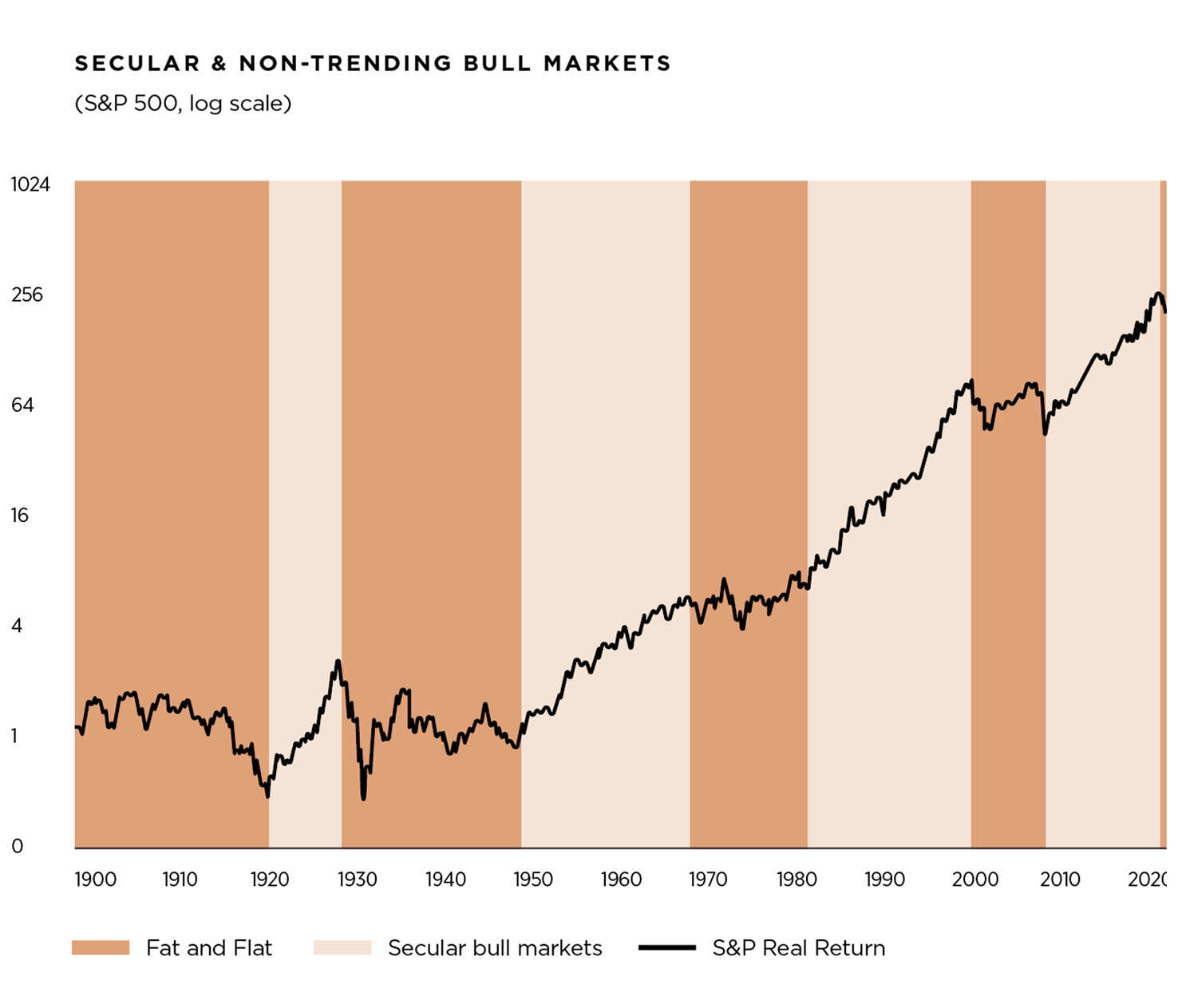

Capital markets are cyclical in nature. Since the late 1920s, the S&P 500 has experienced 29 bear markets and on average bear markets in the US last 26 months. Fortunately, as proven by history, for every bear market, a bull market follows. The start of the bull market almost always begins during recessions when the economy contracts and bad news abound. Since 1946, bull markets last on average 63 months and bear markets 13 months.

While recessions are fairly common, no one knows when the next recession might occur. The US equity market’s domination has accelerated dramatically in recent years particularly since the GFC and have had one of the longest and strongest periods in history of outperformance relative to non-US equities, bonds and cash.

To maintain its exceptional status and hegemony, the US must continue to serve as a becon of democracy, education, rule of law, checks & balances, economic stability and a leader in the international order. We believe the factors that underpin US preeminence and exceptionalism will continue to persist into the foreseeable future.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com

Homero Elizondo

Head of Research, Regius Magazine.

regiusmagazine.com