As investors navigated the heavy fog of uncertainties including inflationary pressures, geopolitical tensions, two ongoing wars and recession risks, 2023 was a resilient year with positive economic growth, solid consumer demand, strong labor conditions and record equity market returns across developed markets.

The US, the world’s largest economy, was able to avoid a recession in 2023 as the GDP grew 2.5% and is expected to grow 2.8% in 2024 and 2.2% in 2025 according to Goldman Sachs. Consumer spending in the US continues to be robust, business investment remains relatively strong, inflation is declining, but remains stubborn and above the FED 2.0% objective, and labor market continues to expand at a strong pace without a notable rise in unemployment. US workers continue to benefit from very favorable job prospects, real wages are rising and currently has an unemployment rate of 3.9%. During 2023, the US labor market added 3,019,000 jobs and average hourly earnings grew at a moderate pace.

The 11 FED rate hikes (525bps) since March 2022 have put the US economy on track for a Goldilocks scenario of a soft-landing. However, Fed Chair Jerome Powell reiterated on March 2024 to the House Financial Services Committee that the central bank has plans to cut rates this year but there is no rush until they have gained greater confidence that inflation is moving sustainably toward 2% target. The annual Consumer Price Index (CPI) in the US reached 7.0% at the end of 2021, 6.5% at the end of 2022, 3.4% at the end of 2023 and is expected to reach 2.3% in 2024 and 2.1% in 2025, according to the US Bureau of Labor Statistics & Goldman Sachs.

Market participants are expecting 3 cuts in 2024 and 4 cuts in 2025 forecasting the federal funds target rate to range between 4.50% and 4.75% at the end of 2024 and 3.25% and 3.5% at the end of 2025. On recession risk, Powell mentioned “there’s no reason to think the economy is in some kind of a short-term risk of falling into recession and I don’t think the possibility of recession is elevated right now”.

On March 21, 2024, the S&P 500 index hit an all-time high of 5,242 and traded at a P/E of 19x and on October 12, 2022 the index reached a low of 3,577 trading at a P/E of 15x. The 10-year US Treasury Note yield hit a 16-year high of 4.99% in October 19, 2023. The three major US indexes S&P 500, NASDAQ & RUSSELL confirmed a bear market on June 13, 2022 and the DOW confirmed a bear market until September 30, 2022, often a bear market precedes a recession.

However, after US’s main indexes entered into bear market territory in 2022, most US stocks, in particular the so-called “Magnificent 7” have rallied in 2023 as signs of easing inflation, a more accommodative monetary policy stand, earnings growth and AI-driven innovation. The outperformance of mega-cap tech stocks has lifted US equity market concentration to the highest level in decades.

"The annual Consumer Price Index (CPI) in the US reached 7.0% at the end of 2021, 6.5% at the end of 2022, 3.4% at the end of 2023 and is expected to reach 2.3% in 2024 and 2.1% in 2025, according to the US Bureau of Labor Statistics & Goldman Sachs"

According to Goldman Sachs the 10 largest stocks now account for 33% of S&P 500 market cap, well above the 27% share reached at the peak of the Tech Bubble in 2000. However, compared with the peak of the Tech Bubble, the 10 largest stocks today trade at elevated valuations, 25x P/E in 2024 but not at record multiples, 43x P/E in 2000. As of March 22, 2024, the S&P 500 index is up 9.7%, the NASDAQ is 9.4%, RUSSELL 3000 is 9.0%, the DOW is 4.7% and the 10 year US Treasury Note yielded 4.2%.

According to Goldman Sachs the outlook for global growth will slow from 3.0% in 2022 to 2.7% in 2023 and 2.7% in 2024, well below the 3.8% historic average of the past two decades. Global inflation is forecast to decline, from 6.5% in 2022 to 4.3% in 2023, 3.1% in 2024 and 2.5% in 2025. The growth rate forecast for China, the world’s second-largest economy, is expected to reach 5.2% in 2023, 4.8% in 2024 and 4.2% in 2025. China’s economy is facing growing headwinds because of declines in real estate investment, housing prices, weak consumer sentiment and ongoing demographic deterioration. However, the 2024 GDP growth and fiscal targets laid out by top China officials reiterated policymakers continued focus on bolstering economic growth during 2024. The Euro Area is expected to slow from 3.4% in 2022 to 0.5% in 2023, yet the growth rate forecast for 2024 is 0.7% and 1.4% in 2025, as a result is likely to avoid a recession.

The outlook for 2024 and beyond, looks challenging and uncertain. Geopolitical risk posed by two ongoing wars, elections, polarization and trade conflict have inevitable knock-on effects on the economy. While the US military and economy remain exceptionally strong, the US political system is currently more dysfunctional than any other advanced industrial democracy. As the general election approach in a Trump-Biden rematch, it is expected that trade, immigration and border security policy to continue tightening. Global trade boomed in the 1990s and early 2000s as the World Trade Organization (WTO) was created in 1995 and has helped facilitated multilateral trade agreements and dispute settlement mechanisms. However, as a result of rising geopolitical tensions, trade has stabilized after a level of “hyperglobalization” between 1986 and 2008. In particular, trade openness slowed following the global financial crisis (GFC) a trend that may be pointing to a possible reversal of globalization. However, China share of global trade continues to increase rapidly after it joined the World Trade Organization (WTO) in 2001.

The US Federal government debt reached USD $34.5 trillion dollars and the share of debt to GDP exceeds 120% at the end of 2023 and will continue to rise over the next decade. This debt trajectory is not sustainable and is uncertain where the tipping point might be. According to Goldman Sachs, fiscal deficit is expected to reach USD $1.9 trillion by 2025, nearly double the USD $984 billon level in 2019. The US debt limit debate in 2011 ended with a compromise that averted default but prompted downgrades by S&P Global Ratings and sent the S&P 500 down 17%. In August 2023, Fitch Ratings downgrade the US debt to AA+ from AAA, leaving Moody’s Investors Service as the only major credit-rating firm applying its top credit ratings to the US. US policy-making has become less stable, less effective and less predictable as intensifying polarization and dysfunction in the decision-making process is evident among US elected officials.

"While mega oil shocks now appear less likely than in the 1970s, the tail risk of a very large oil price spikes remains. According to Goldman Sachs estimates, Brent is expected to rise to USD $90 per barrel by the fourth quarter of 2024"

WTI is trading at USD $80.5 per barrel, Brent at USD $85.6 per barrel and natural gas at USD $1.66 per million of BTU. Oil prices are likely to increase on the back of China’s reacceleration, Russia output cuts, likely reduction in Iran supply, potential Red Sea disruptions, OPEC pricing policy and international travel continues to recover. While mega oil shocks now appear less likely than in the 1970s, the tail risk of a very large oil price spikes remains. According to Goldman Sachs estimates, Brent is expected to rise to USD $90 per barrel by the fourth quarter of 2024. The dollar, gold and Treasuries will likely gain from further safe-haven flows in more adverse escalation scenarios in the Middle East. Gold price reach a record high of USD$ 2,210.

On November 8, 2021, Bitcoin reached a record high of USD $67,000. The collapse of cryptocurrency exchange FTX on November 2022 has sent shockwaves through the crypto ecosystem. However, the FTX blowup has not destroyed all faith in the industry, in particular Bitcoin. On March 14, 2024, Bitcoin reached a new all-time high intraday of USD $73,835 and year-to-date Bitcoin has surged 56%. The rally was likely triggered by market participant hopes of strong economic outlook, rapid reversal in US monetary policy, the turmoil in the US banking industry and the January 2024 SEC approval of eleven physically backed spot Bitcoin ETFs in the US. The approval of spot Bitcoin ETFs represents a resounding institutional validation as an asset class.

The US dollar has been the dominant currency for more than 75 years, since the Bretton Woods System was established in 1944. In times of uncertainty and stress, the US dollar is proving to be the world’s safe haven asset and king. However, is important to acknowledge that a new cycle of innovation is shaping the future of finance particularly in the aftermath of the Great Financial Crisis in 2008-2009. Traditional financial institutions are increasingly vulnerable to the rise of newcomers in the financial technology (FinTech), digital assets and decentralized finance (DeFi).

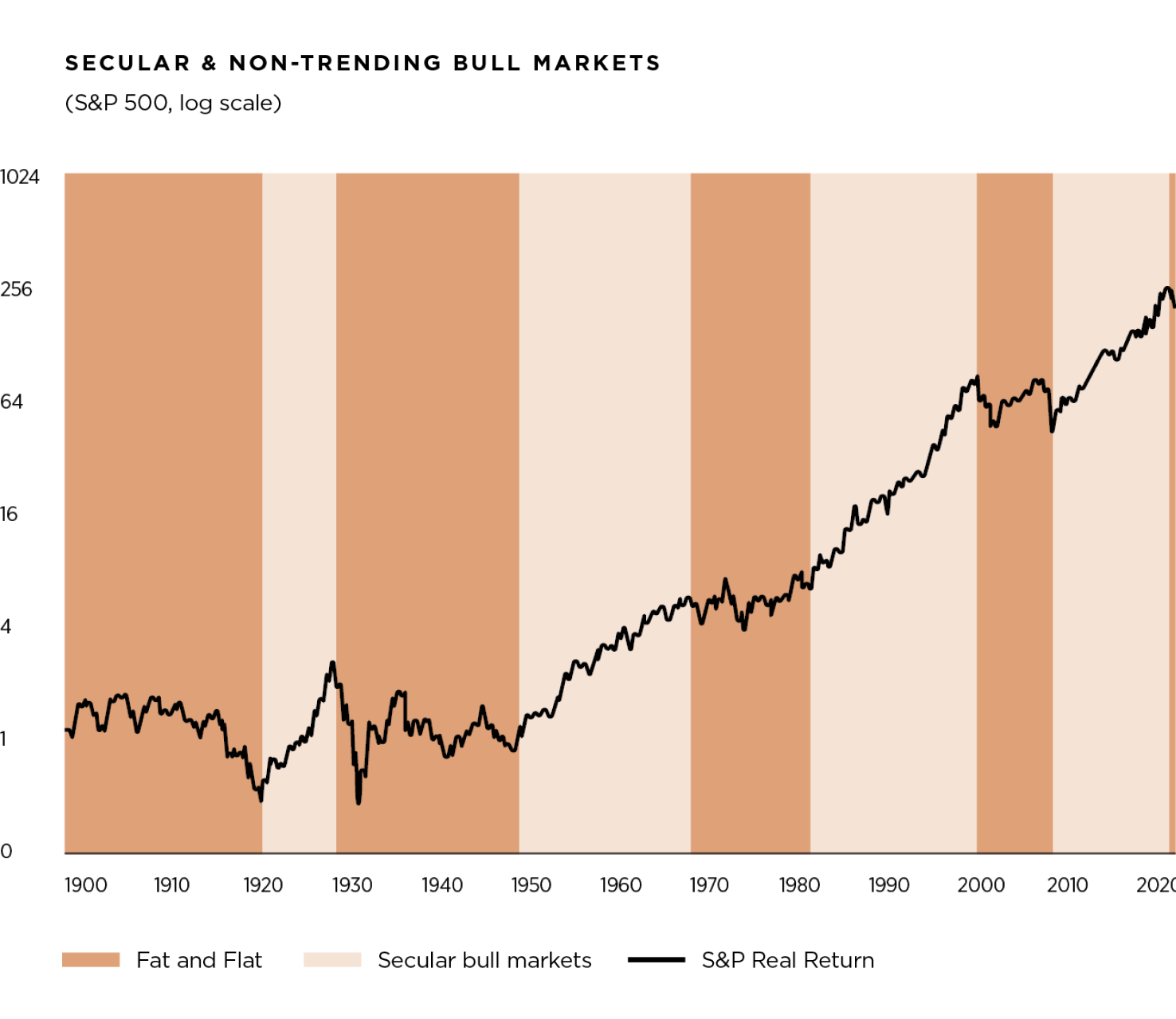

Capital markets are cyclical in nature. Since the 1800s, the S&P 500 has experienced 29 bear markets and on average bear markets in the US last 26 months. Fortunately, as proven by history, for every bear market, a bull market follows. The start of the bull market almost always begins during recessions when the economy contracts and bad news abound. On average recession in the US last 13 months from peak to through. While recessions are fairly common, no one knows when the next recession might occur. The US equity market’s domination has accelerated dramatically in recent years particularly since the global financial crisis (GFC) and have had one of the longest and strongest periods in history of outperformance relative to non-US equities, bonds and cash.

For end of 2024, the S&P 500 base case is 5,400 and bull case 5,700 points. In the current environment, the forward paths of inflation, economic growth, interest rates, earnings, valuations and geopolitical outcomes are difficult to predict.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com

Homero Elizondo

Head of Research, Regius Magazine.

regiusmagazine.com