The world of investing in crypto assets has been driven in part by a view that the decentralization and trustless transaction basis of distributed ledgers and cryptographic verification of anonymous trades would allow finance to escape the oversight of government, empower individual savers/investors, and supplant traditional money.

A new idyll was achievable, the proverbial pot of gold at the end of the rainbow. That belief, though, is based on too narrow an understanding of monetary history and of how crucial the public’s expectations are to currency values. It also underplays the benefits that governments derive from issuing fiat currency and the public from governments regulating financial markets.

| INTEREST RATES, EXPECTATIONS AND CURRENCY PEGS: A SHIFTY RELATIONSHIP

One of the key relationships currency market players use in managing currency is uncovered interest parity: the principle that the expected change in the exchange rate between two currencies over a given period will be governed by the difference in interest rates on offer over that period adjusted for any difference in the perceived risk of the two currencies. The principle is grounded in arbitrage.

To illustrate, assume that the two currencies are the US dollar (USD) and the euro (EUR). Assuming free capital flows, if one currency, say USD, offers an interest rate higher than the investor’s expectation of the change in the exchange rate, the investor will buy USD and sell EUR leading to a spot depreciation of the EUR against the USD. With no intervention from either central bank, the shrinking EUR money supply generated by the higher USD demand will increase EUR interest rates. At the same time, the spot depreciation of the EUR will increase expectations of future EUR appreciation. Both forces would increase the attractiveness of holding EUR versus the USD. The act of taking advantage of a perceived arbitrage, would eliminate that arbitrage.

The story gets even simpler if exchange rates are credibly believed to have a fixed exchange rate that will persist. Then the arbitrage relies only on the interest differential and any factor that might change perceived relative risks. To maintain a credible peg of a cryptocurrency against a fiat currency, then, one need only allow the interest rate available on cryptocurrency to rise or fall commensurate with the relative demand for the cryptocurrency against the fiat currency.

This is what Terra stable coins offered: an algorithmic model that the developers claimed, through interest arbitrage and shifting relative supplies of cryptocurrency, would maintain a fixed, one-for-one exchange rate for Terra tokens against their respective fiat currencies.

Despite reliance on what seems fundamental laws of supply and demand, Terra stable coins collapsed in May 2022 along with the crypto token designed to stabilize it, Luna. Investors saw the value of their coins drop by 98%, wiping out some $40 billion in market capitalization in just a few days and shocking the cryptocurrency world. What happened?

Two fallacies scuttled the arbitrage strategy that Terra relied on to maintain a fixed exchange rate between its tokens and their respective fiat currencies. The first was the idea that Luna, the token created by Terra and freely convertible into Terra tokens with a fixed one-to-one exchange rate against each fiat currencies, would always have some intrinsic value independent of Terra. The arbitrage structure Terra’s developers designed “burned” Terra tokens when they were swapped for Luna tokens, shrinking the supply Terra tokens. Luna tokens, meanwhile, carried interest rates that rose or fell with the demand for Terra tokens against their fiat counterparts. But besides granting rights in the governance of the Terra blockchain environment, Luna offered little in the way of services. Any of those services were only of use in the Terra ecosystem. That creates a problem when interest on an intrinsically worthless coin is used to back a coin that in theory can be converted to a valuable currency, during a time in which that convertibility is under pressure.

The inherent instability of the value of Luna is not unique. The value of both crypto and fiat currencies is determined by social convention and societal expectations—the willingness of others to use the currency based on their expectations of future events and of the future value of the currency. But the future is uncertain, and expectations can be ephemeral.

The second, and perhaps more pernicious, fallacy embodied in the Terra arbitrage scheme was that a higher interest rate always elicits a higher demand for the currency offering that higher interest rate. But in times of panic, the normal “laws” of supply and demand reverse. Investors take a higher interest rate to be a sign that the currency in question will depreciate more quickly in the future and must be sold. A moments reflection on the irrational stockpiling of food based on the expectation of a future shortage, illustrates the point well. In a panic, higher rice prices don’t elicit lower demand and higher supply, but just the opposite. For the public, the rising price is confirmation that future prices will be higher still spurring demand today. Meanwhile for suppliers, the higher price is confirmation that withholding supply today will yield them more profits tomorrow. This pernicious price dynamic ensures that interest arbitrage is not a stabilizing, but rather a destabilizing, force during a panic. When needed most, your stabilization mechanism works in reverse!! This dynamic is one of the key reasons that fixed exchange rate schemes in fiat or crypto currency rarely persist.

What’s the way around panic dynamics? Governments have used three strategies. One relies on backing a fixed exchange rate with holding of assets denominated in foreign currency one-for-one in value outstanding local currency at the fixed exchange rate. In the fiat world, this is termed a currency board and is how Hong Kong operates its exchange rate system. It is the same principle that exchanges typically use to ensure themselves against customer runs.

The second way to thwart a panic is to involve a player in the market with the credibility and the balance sheet big enough meet the panicked demand for fiat/foreign currency. The complication here is that the large balance sheet must have an adequate supply of fiat/foreign currency, something cryptocurrency developers of stable coin rarely do. In the fiat world, this is the role played by the International Monetary Fund (IMF) and by central banks that pledge credit lines to one another to assuage market fears of shortages.

A stable coin built on a stability mechanism reliant on interest arbitrage in another cryptocurrency is not a stable coin. It’s a token that whose value will evaporate if expectations of panic set in. In economic literature, that panic is called a speculative attack. It is what broke the Bank of England’s peg against European currencies in the early 1990s, the Mexican peso in 1994, the Thai baht, Korean won, Indonesian rupiah, Malaysian ringgit, and Philippine peso in 1997, the Argentine peso in 2002. Need I go on?

The third way to thwart a panic is to close the market completely (think banking holidays to stop bank runs) or to heavily condition who and how transactions can be made. Capital account restrictions, long holding periods, demands for documentation to support demand for an asset, restrictions on which institutions can carry out trades are examples of the ways in which governments have sought to limit or extinguish panicked transactions.

In the decentralized world of cryptocurrencies altering who has access tokens and how would require generating a quorum to alter the design rules of the ecosystem, a feat that is complicated by the fact that these systems are generally designed to only allow changes that the majority of those with voting right. But in a panic, there is a conflict between the interests of the individual and of the community. Any individual wants the right to exit, but only by limiting exit can the overall value of the communities holding avoid being valued at fire-sale prices. A small group of holders would need to dominant voting for individual and collective interests to align. But such a concentration would expose those without large voting rights to exploitation, a drag on growing the ecosystem in normal times. Again, there is a strong divergence between the actions/structure needed in normal times and that needed to confront panic.

| TAKING ON A QUASI-MONOPOLIST WHO SETS MARKET RULES IS NOT A WINNING STRATEGY

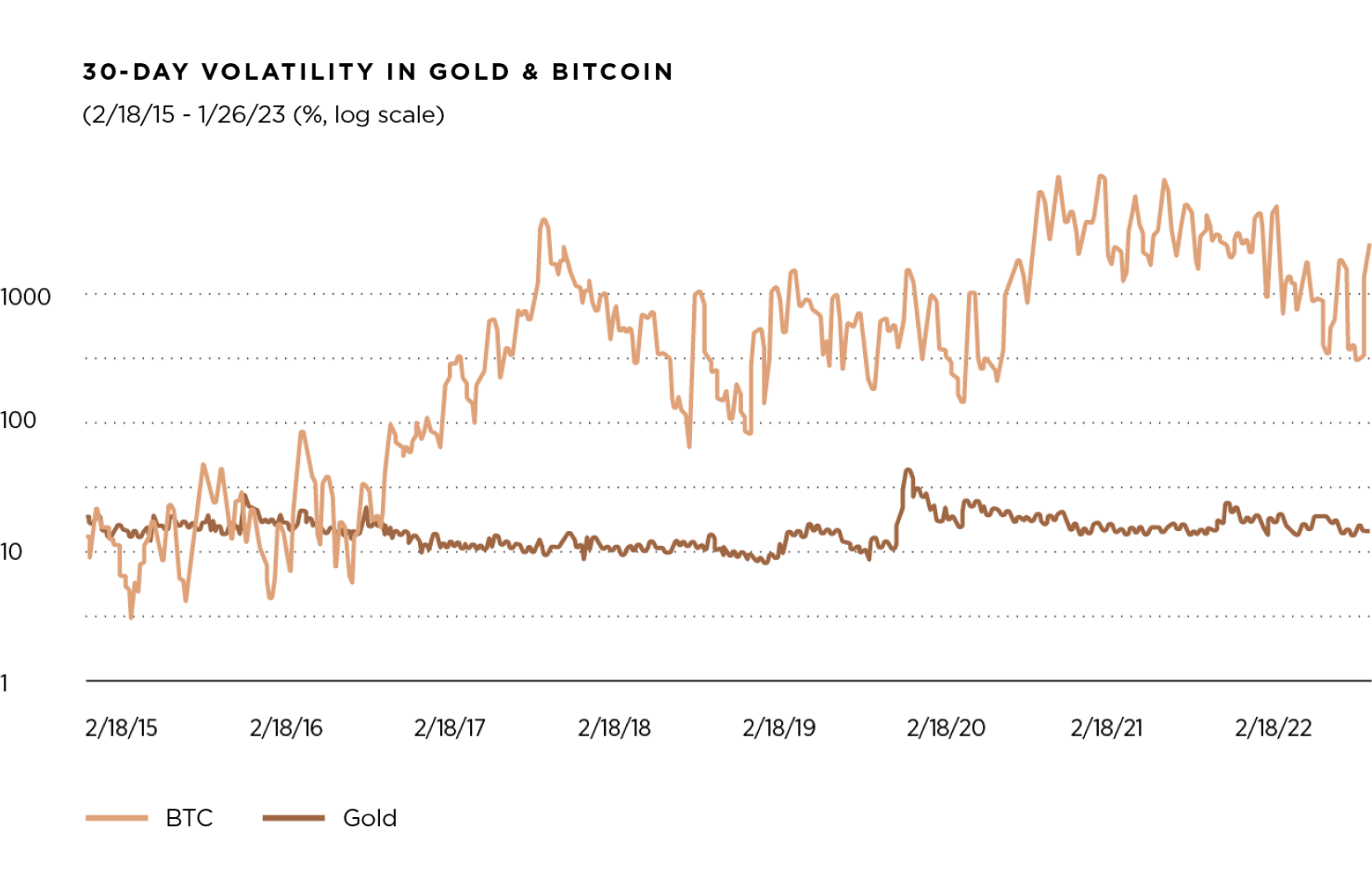

Proponents of cryptocurrencies can side-step the entire morass of maintaining a stable coin’s value by simply letting the market determine the value of a token against fiat as is the case with Bitcoin or Ethereum—in effect floating the exchange rate. That will not avoid panics, but it will not entice investors into a cryptocurrency based on a fixed value against a fiat currency. The problem with this solution, though, is that the underlying volatility of cryptocurrencies is orders of magnitude higher than assets seen as alternative to fiat currencies like gold or housing (see Figure 1). That volatility retards peoples’ willingness to use cryptocurrencies as a store of value—one of the three core uses of a money. Indeed, it was to avoid that volatility that stable coins were proposed.

"That volatility retards peoples’ willingness to use cryptocurrencies as a store of value—one of the three core uses of a money. Indeed, it was to avoid that volatility that stable coins were proposed”

But even if the thorny issue of managing panics could be overcome, whether for a stable coin or an unanchored cryptocurrency, replacing the role of fiat currencies on a large scale would be a difficult target to reach. Decentralized blockchain environments with native cryptocurrencies face challenge from the centralized governments that earn significant revenue from the issuance of fiat currency, and which set the rules that govern market transactions. In most markets, disruptive technologies have successfully taken on profitable established players, but not to my knowledge when those players also set the rules for the market. And certainly not when the technology behind their disruption is not proprietary (witness the plethora of tokens created in the last decade, but especially up to 2021).

The revenues governments gain from issuing fiat currency can be substantial. Paper, or increasingly plastic, money generally costs but a small proportion of the value of the bills produced, giving margins above 90%. Meanwhile, in economies where inflation is reasonably managed (the vast majority), the demand for money rises with income at a ratio greater than one. In real terms (corrected for inflation), the value of this margin, dubbed seigniorage by economists, can run from one percent to five percent of national income each year. With government’s incomes ranging from 12-30 percent in middle to upper-middle income countries, seigniorage is a substantial revenue source.

But if seigniorage is an important revenue source, why haven’t governments already stepped in to curtail or prohibit cryptocurrencies? The answer is two-fold. First, most cryptocurrencies were too small in value to warrant concern. Second, when some became more common governments have stepped in to curtail their use. China is a case in point. Proponents will counter with the example of El Salvador, but this is a better example of a nation hoping to capture revenue gains from the income that could accrue to becoming a cryptocurrency service hub along the lines of the earlier efforts of some states to become offshore money centers/tax shelters.

In the wake of the substantial rise in the value of cryptocurrencies that peaked in 2021, reinforced by the spectacular demise of Terra/Luna and more recently the exchange house/investment house FTX/Alameda, regulators are fashioning tighter controls over cryptocurrencies. At the same time, central banks are forging plans to offer their own digital currencies. China introduced its digital yuan in 2021. The Bank for International Settlements issued a series of papers on establishing central bank digital currencies in 2021 . Taking on a monopolist who can replicate aspects of your product because the technology is non-rival is a Promethean task.

None of the above should cloud investors to the benefits that attach to the improvements that come from digital finance, among them far great access and inclusivity to financial systems. It should however warn investors away from the Siren song of supplanting today’s major fiat currencies. That is a goal that the very logic of decentralization and hundreds of years of monetary history point to as a bridge too far, one that does not end with the rainbow at a pot of Bitcoin.

Donald Hanna

Lecturer, University of California, Berkeley, Haas School of Business.

haas.berkeley.edu