The Year 2021 witnessed the rise of a new class of collectibles – digitacollectibles – more broadly known as non-fungible tokens or NFTs. This article reviews key categories among NFTs and the state of the market.

After a stabilization phase in early 2022, we expect the NFT sector to continue growing in diversity and popularity, albeit with a more fundamental basis as opposed to the past year’s speculative growth.

| THE NFT MARKET

There are five categories of NFTs: crypto art, collectibles, gaming, metaverses and utilities. The biggest category per total outstanding volume in US dollars is the collectibles category, representing USD 8.47 billion as of end-2021 according to industry data tracker NonFungible.com. Collectibles include avatars, animals, aliens or any other type of digital items with the aim of being collected and used for video games or forming part of a community. The sports segment makes up a large part of collectibles. For example, famous football clubs tokenize their players’ cards, which can be used in interactive football games.

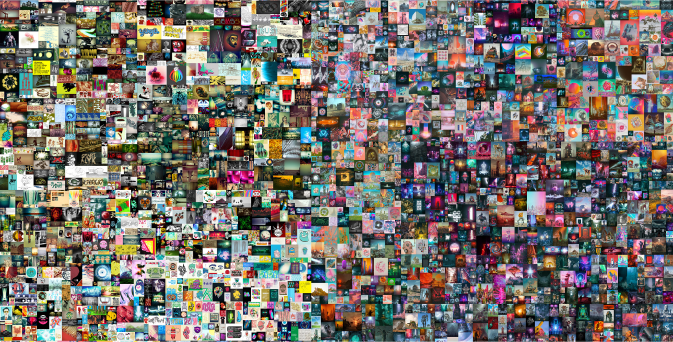

Gaming NFTs come next with a total outstanding volume of USD 5.17 billion. Examples of NFTs used for gaming purposes are weapons or equipment for role playing games (RPGs), or unique skins for weapons or characters. Art comes in third place, with NFTs created around artistic projects. For example, the famous crypto artwork by Beeples – “Everydays: The first 5000 Days” – sold at Christie’s for USD 69 million in March 2021. Metaverses and utilities are smaller markets each valued at about half a billion US dollars. Metaverses are a set of interconnected virtual worlds, where NFTs represent mainly virtual “land” in this segment, but also wearables and accessories to personalize avatars in these worlds. Utilities cover different digital useables like domain names or concert tickets or badges as well as access codes to exclusive content.

Beeple | The First 5000 Days

In May 2007, the digital artist known as Beeple set out to create and post a new work of art online every day. He hasn’t missed...

The most liquid of all NFTs in terms of the number of owners, wallets and number of sales is by far the gaming segment. The average price of a gaming NFT is around USD 200 according to NonFungible.com. The most expensive segments are art and metaverse tokens with average prices of around USD 3,500. The key enabling blockchains are Ethereum (about 3/4 of all NFT transactions) and Ronin (about 1/5 of all transactions) followed by Flow and Immutable X.

| COOLING OFF AFTER STRONG GROWTH IN 2021

With a total volume of nearly USD 17 billion in the first quarter of 2022 for nearly USD 8 billion in qualified volume, the NFT market experienced a stabilization phase in early 2022 after rapid growth in 2021.

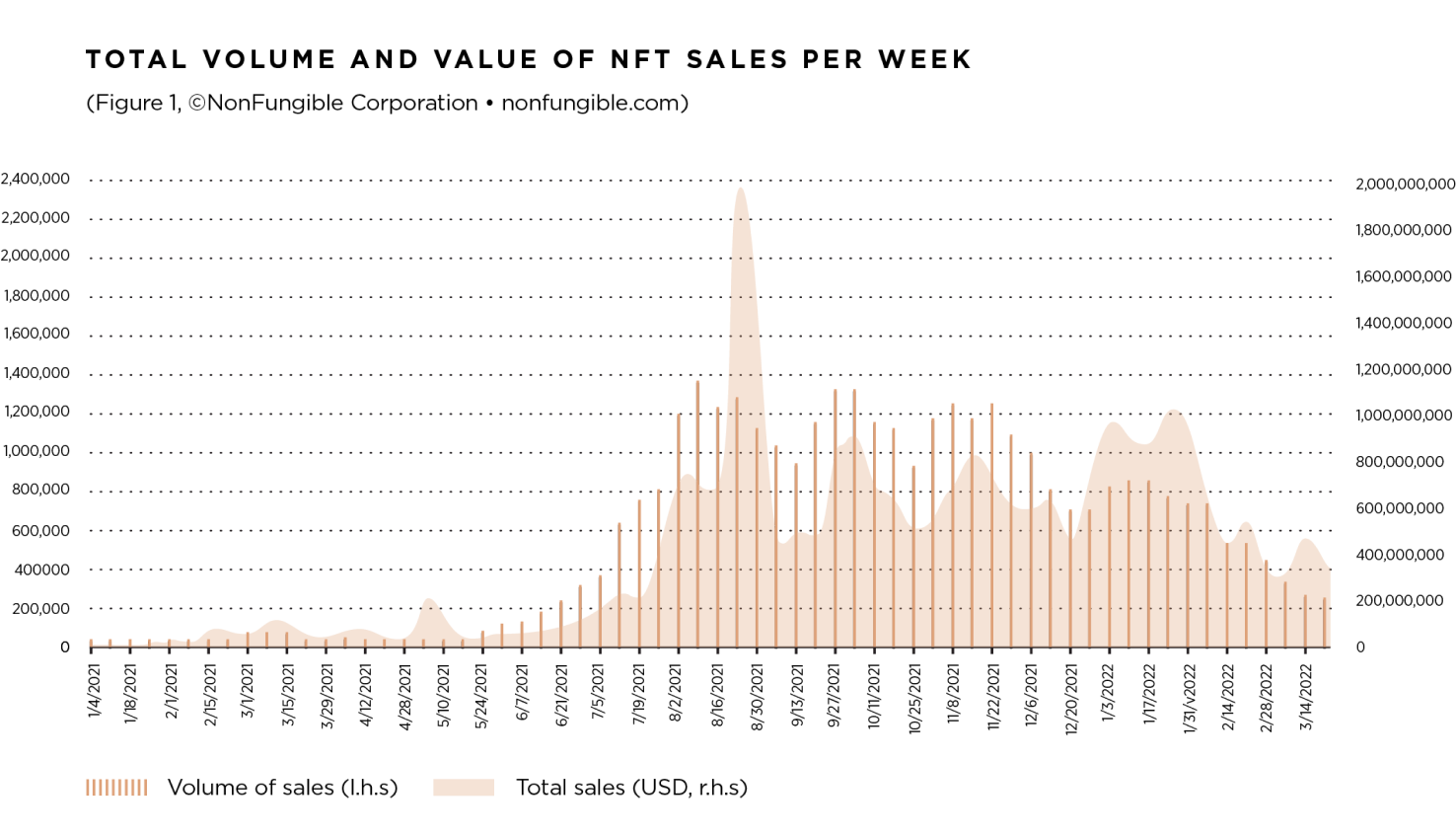

Although end-Q1 2022 volume has largely declined from the peaks of August/September 2021, it remains very high compared to Q1 2021, with average volume close to USD 600 million per week. The drop from USD 1 billion in sales at the beginning of the year to USD 300 million (see Figure 1) is explained in particular by a drop in speculative investors and a climate of global geopolitical uncertainty, which translated into a decline in interest in NFTs.

Sales numbers have also declined steadily since the end of the Q3 2021, reaching approximately 250,000 sales per week down from more than a million transactions per week for most of 2021. Collectibles or social media profile pictures (PFPs) were the only NFTs still on the rise, despite the relative saturation of the market in the second half of 2021 (see Figure 1).

The Bored Ape Yacht Club in particular has become the benchmark for collectibles, with a volume of more than USD 1.2 billion traded in the first quarter. Bored Ape Yacht Club is one of the most iconic collection of NFTs. This collection of 10,000 profile pictures representing drawn apes is the flagship of the collectibles segment. Dozens of stars from around the world own a Bored Ape Yacht Club NFT and advertise it. CryptoPunks (a collection of 10,000 algorithmically generated tokenized and pixelated art images) is now third in the rankings with just USD 349 million traded.

The Axie Infinity phenomenon (Axie Infinity is a game centering around digital creature NFTs that can be purchased in the marketplace or “bred” in-game) also seems to have lost steam, following the slowdown in the play-to-earn model (where players can earn in-game cryptocurrencies by completing challenges in the game) in the second half of 2021, and more recently the historic Ronin blockchain hack where hackers stole USD 540 million from the Ronin cryptocurrency and NFT platform (the majority of which was owned by customers who won digital coins playing Axie Infinity).

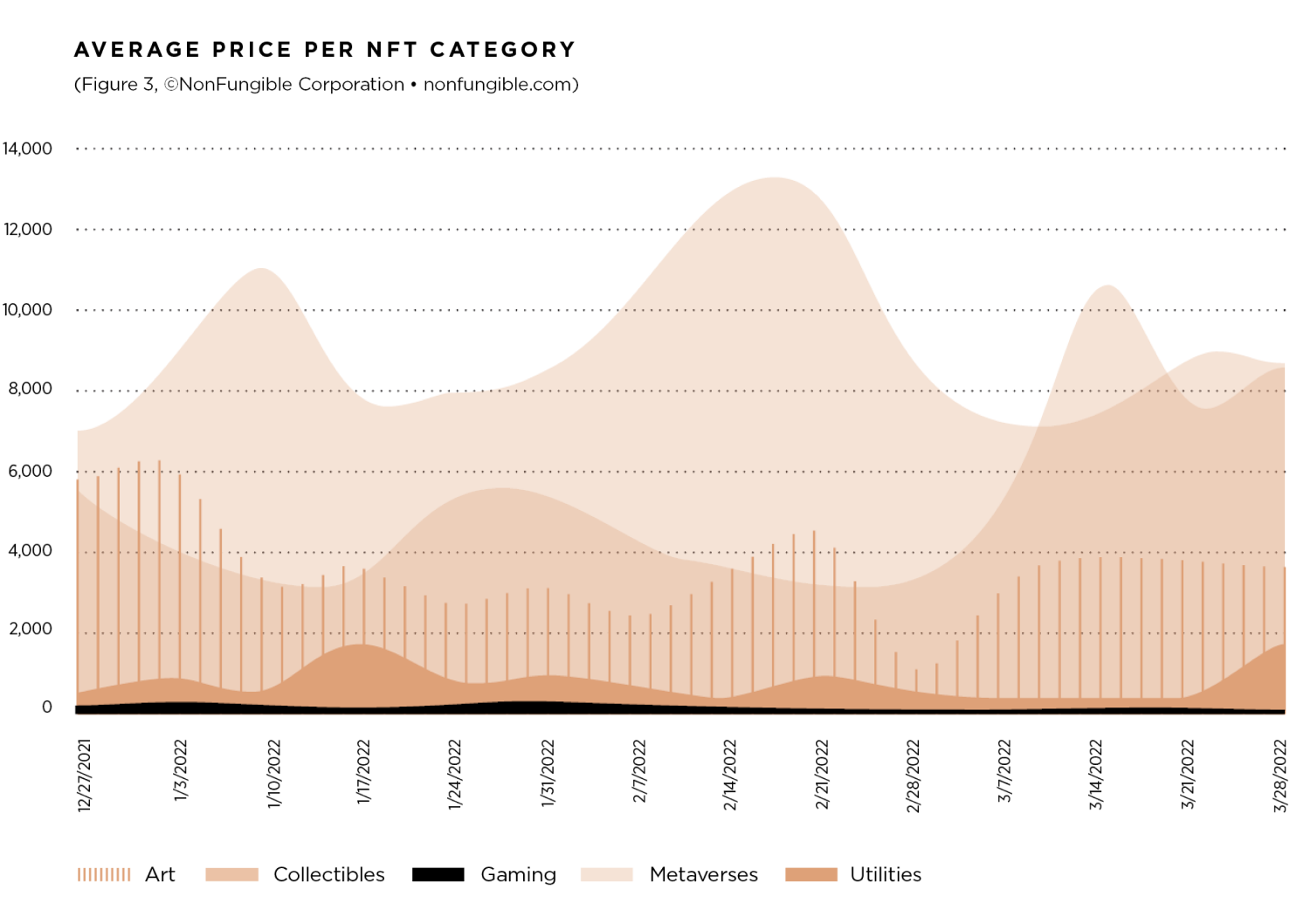

New metaverse projects are relatively small in terms of volumes traded compared to those of established projects like The Sandbox (USD 141 million) or Decentraland (USD 62 million). If we look at the average prices per segment, we observe that the fluctuations in the two major segments – metaverses and collectibles – are quite significant (see Figure 3). The metaverses peaked at nearly USD 13,000 in mid-February 2022 before falling back to USD 9,000 at the end of the quarter, which remains well above the average price at the start of the year at USD 6,900 on average for a metaverse plot. On the other hand, collectibles surged in a matter of weeks, going from an average price of USD 3,500 to over USD 10,500 in mid- March. This can be explained by the interest around collectibles, and specifically the new trendy collections (Azuki, Invisible Friends...) where the assets were quickly traded for over USD 10,000 each.

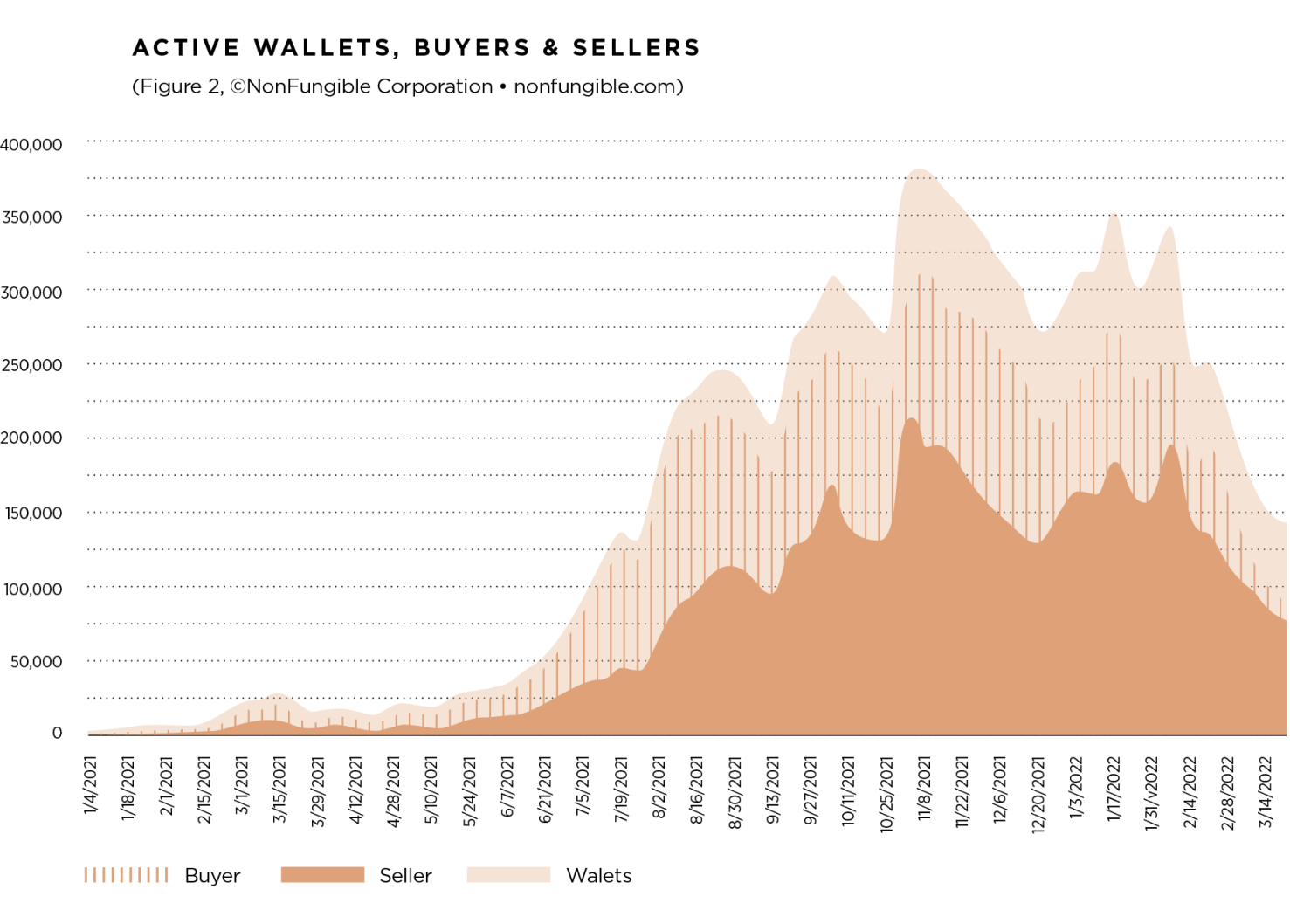

From the point of view of active wallets, a decline can be observed over the last few months, with a floor at 150,000 active wallets at the end of the quarter (see Figure 2). It should be noted, however, that this floor remains well above the number of active wallets over the same period last year (around 14,000 active wallets in Q1 2021). The number of buying wallets is still higher than the volume of selling wallets, which remains a sign of good health and growth in the industry despite the relative slowdown in the markets. However, the convergence of the buying and selling curves at the end of the quarter needs to be monitored closely going forward.

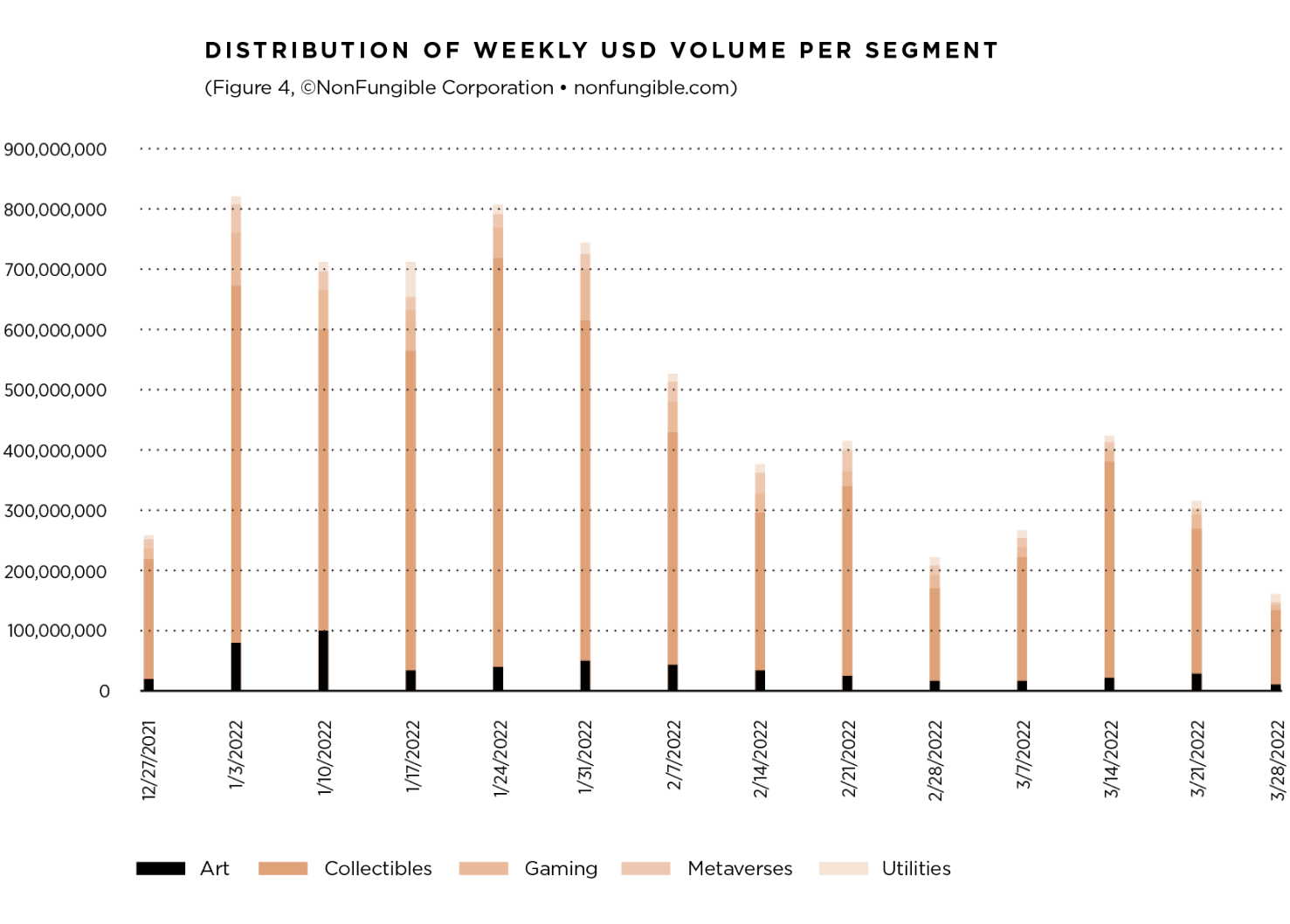

The weekly volume by segment is largely dominated by the collectibles segment (see Figure 4). At the end of the first quarter, collectibles represented up to 87% of NFT market activity, largely due to the rise of projects such as Bored Ape Yacht Club, Azuki, Invisible Friends, Doodles, CloneX, CyberBrokers and soon. Metaverses represented just under 5% of activity in Q1 2022, while art represented around 6% of volume. Quarterly volumes and their distribution per quarter can fluctuate significantly from one quarter to the next.

| AUCTION HOUSES AND NFTS

Traditional auction houses (Christie’s, Sotheby’s and Phillips) have made a remarkable entry into the crypto art market. These three auction houses now represent almost 10% of crypto art sales. Furthermore, metaverse engagement by auction houses like Sotheby’s, for example, is growing considerably. Apart from digital art, Sotheby’s distinguishes luxury and rare objects, as well as sport, luxury and fashion among its NFTs.

| OUTLOOK

Like many other collectibles, NFTs benefit from a general increase in wealth, strong investor sentiment and ample liquidity. The year 2022 started with a more challenging backdrop than 2021. The Russia-Ukraine war has unleashed a stagflationary shock for a number of economies that generally speaking translates into weaker investor sentiment. Central banks are tightening monetary policy and withdrawing liquidity. The tech sector altogether is challenged.

Investors should therefore expect a temporary consolidation in the NFT sector. Eventually, however, the trend toward metaverses and the exploration of these platforms for business and entertainment should continue to move forward with a more fundamental basis rather than the past year’s speculative growth.

The generational demographic transition from baby boomers to new generations more attuned to digital assets, social media, gaming and other online activities, will likely see NFTs continue to grow.

As in traditional collectibles, where Asian demand has played catch-up with the rest of the world due to the fast pace of wealth creation in this region, we expect Asian users and collectors to shape much of coming trends in digital assets. China and India represent the bulk of the world’s population and the penetration of e-commerce (especially in China) is much higher than in other regions. This may well lay the foundation for an increasing engagement and growth of metaverses by this region going forward, with Asian-oriented collectibles (including sports), games and utilities.

More difficult international relations in the wake of the current Russia-Ukraine crisis could also accelerate and enhance digital business and transactions, leading to a spread of NFTs.

Gauthier Zuppinger

Co-Founder and COO, NonFungible.com.

nonfungible.com