As the financial landscape evolves and market dynamics shifts, investors are constantly on the lookout for the next set of stocks that could deliver exceptional returns. While predicting the future with certainty is impossible, with thorough fundamental analysis and deep MegaTrends insight, we identify a set of companies with promising growth potential.

In this article, we unveil the next Magnificent 7 stocks poised for success in 2024 and beyond.

2023 was a great year for equities as the S&P 500 had a return of 24.2% driven by the Technology Sector. Media acronyms have changed over time from FANG (Facebook, Amazon, Netflix and Google) to FAAMG (Facebook, Amazon, Apple, Microsoft and Google) and now to Magnificent 7 (Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta and Tesla). Regardless of changing acronyms over time, the key question we want to answer in this article is: Should investors continue allocating capital into the Magnificent 7? The second question is: What stocks are more likely to deliver exceptional returns in the next five years and as a result should be included into the Magnificent 7 list?

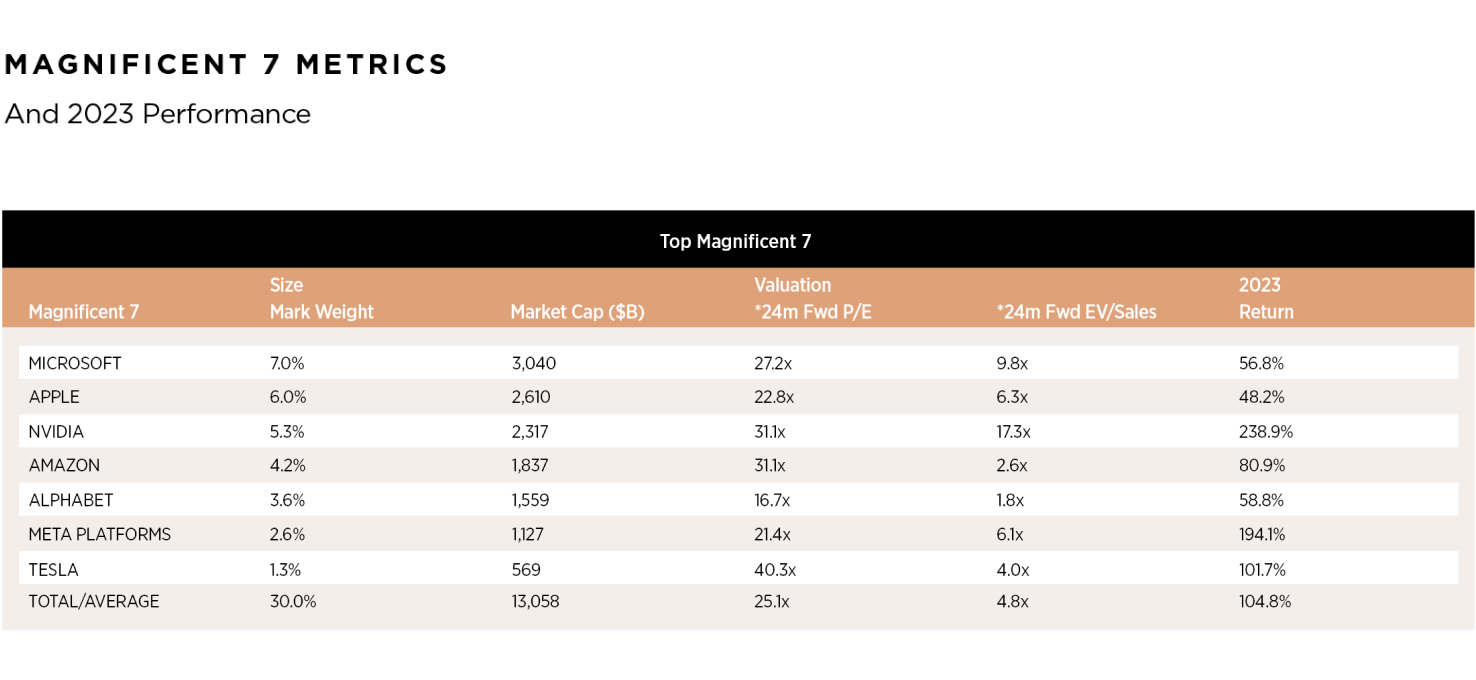

Today, the Magnificent 7 make up nearly 30% of the total market cap and collectively accounted for over 60% of the total return of the S&P 500 in 2023. The outperformance of the Magnificent 7 stocks has lifted US equity market concentration to the highest level in decades. Further, the Magnificent 7 accounted for 26% of the S&P 500 stock buybacks in 2023. In the last four years, the Magnificent 7 have increased their annual buyback spend by USD $83 billion as compared with the remaining 493 S&P 500 companies’ buyback spend declining by USD $17 billion over the same period. The robust growth in buybacks for the Magnificent 7 has been fueled by their earnings growth.

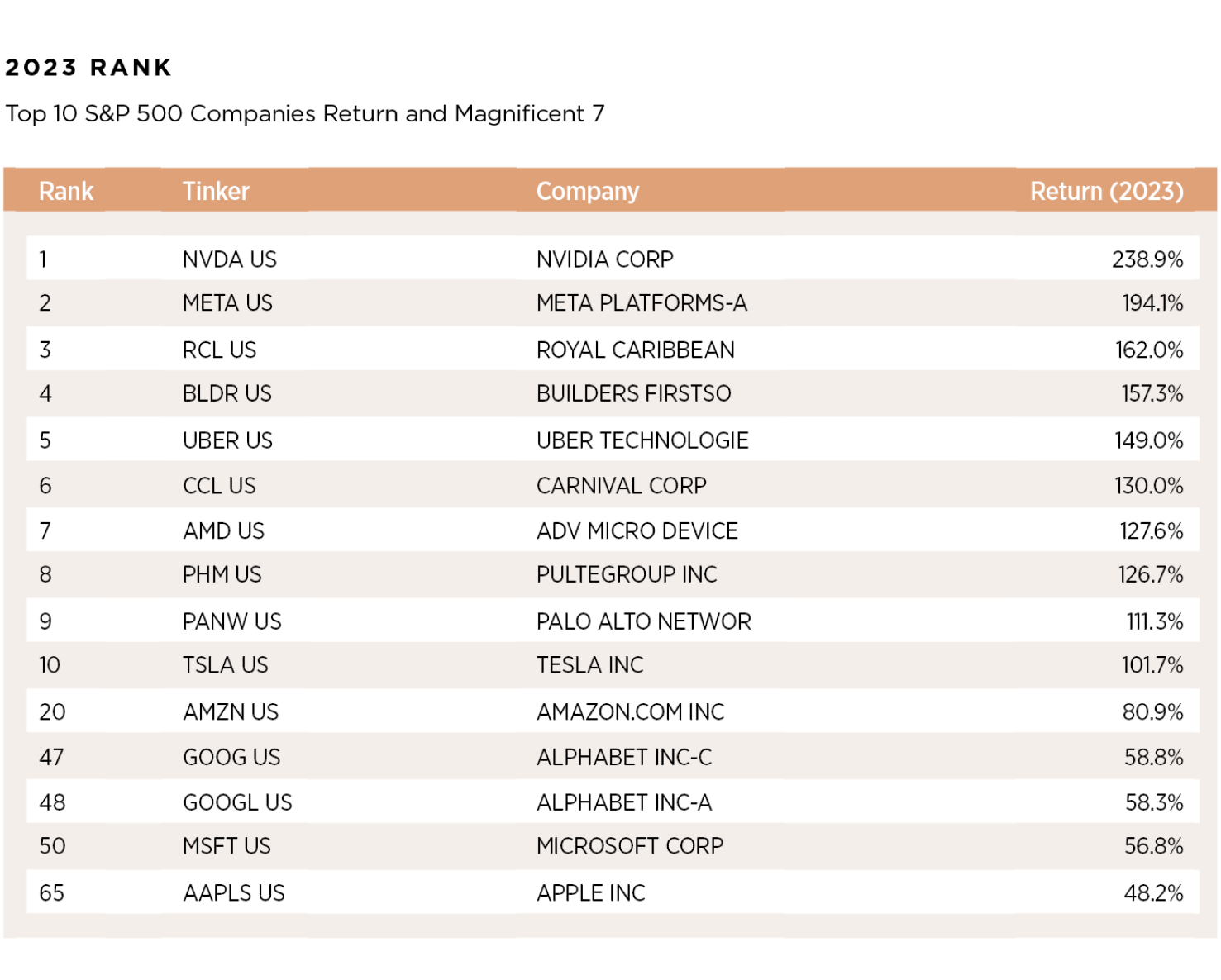

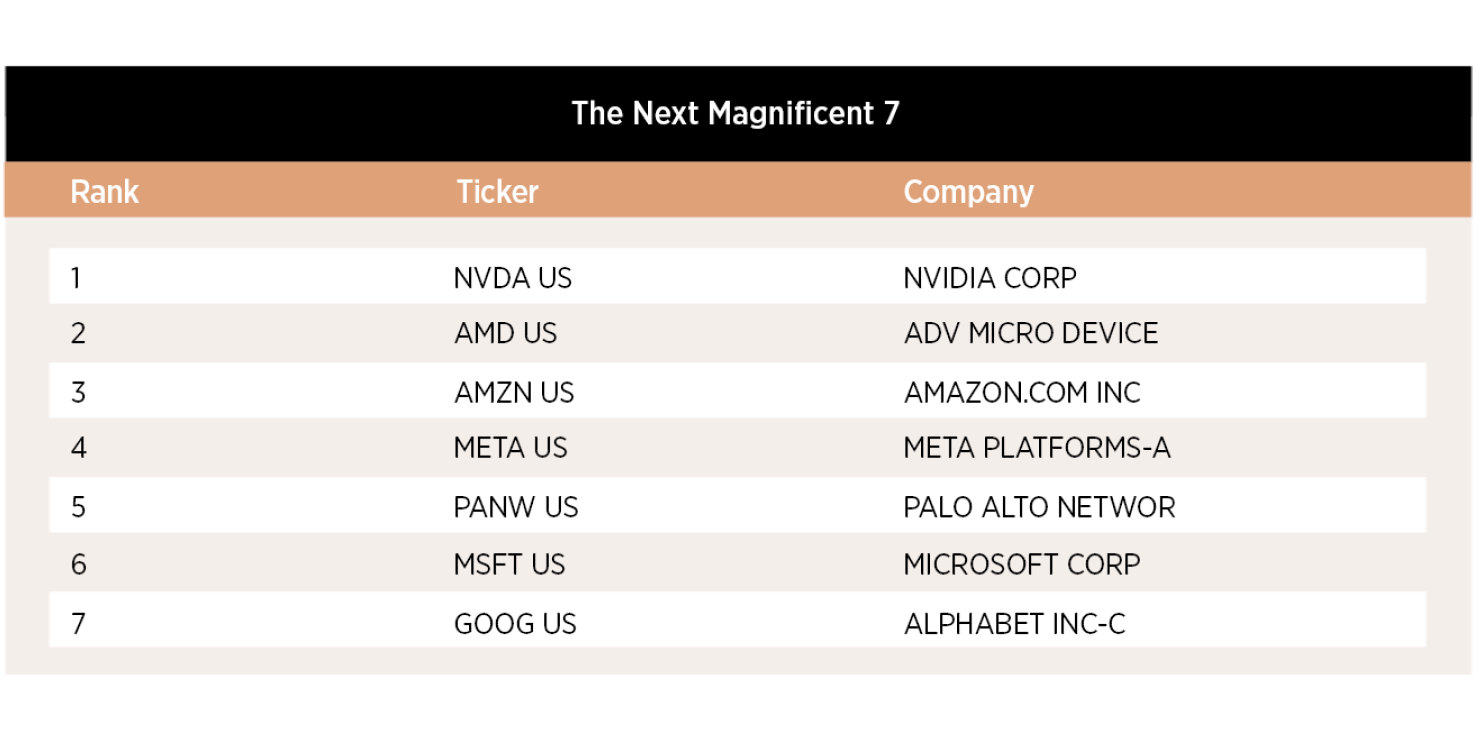

Let’s start by showing the returns of the Magnificent 7 and how they compare among the S&P 500 companies. During 2023, Nvidia and Meta were the two top performers with a return of 239% and 194%, respectively. Tesla finished in 10th place with 101% return, Amazon in 20th place with an 81% return, Google in 47th place with a return of 58% and Microsoft in 50th place with a 57% return and so on. The key point is that between Meta and Tesla rankings, there are other 7 top performing companies where two of them are technology companies: Advance Micro Devices (AMD) and Palo Alto Networks (PANW) which are at the center of AI and cyber security innovation, two key MegaTrends. In our analysis, AMD and PANW should replace AAPL and TSLA in the Next Magnificent 7.

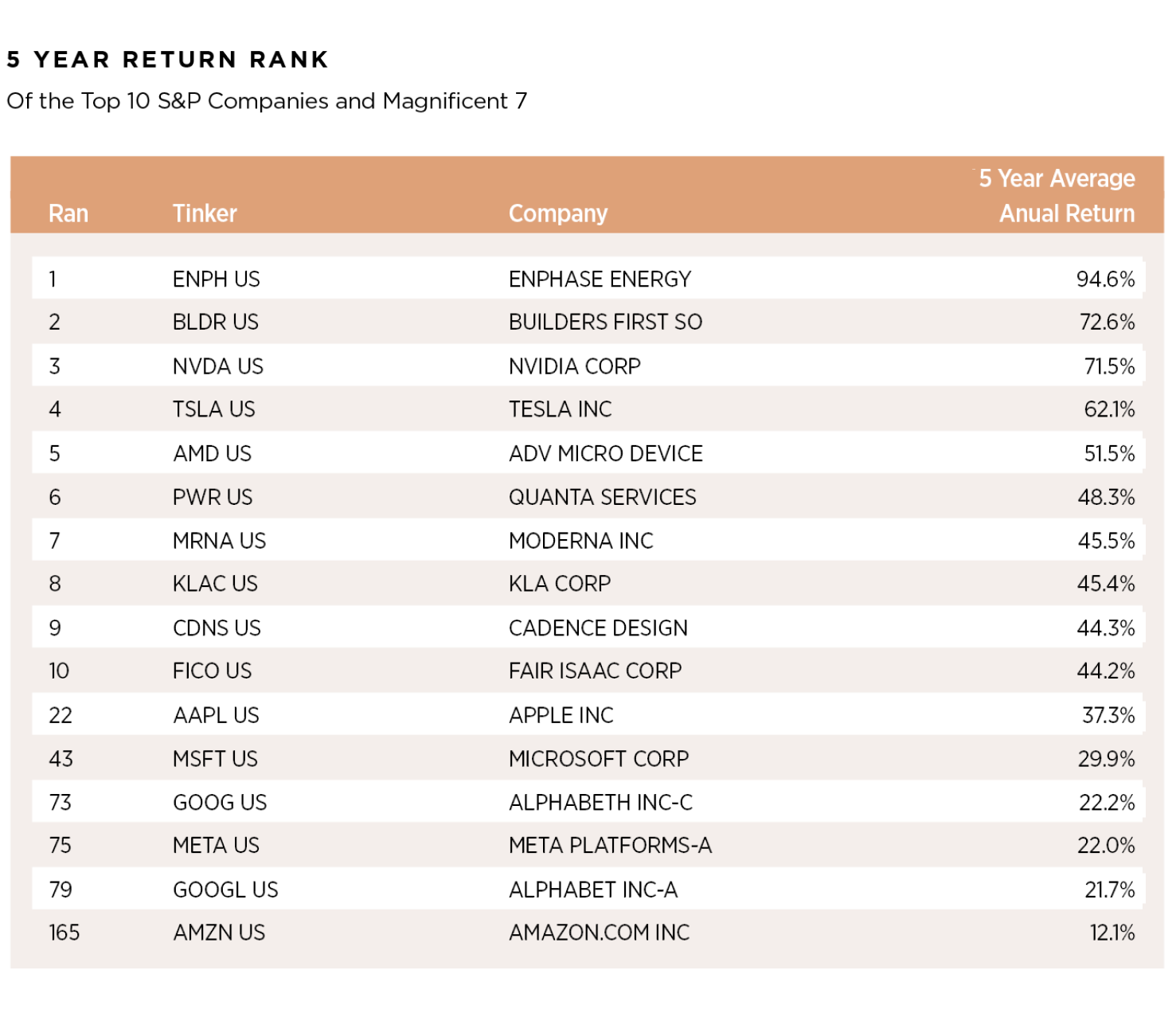

If we think of Magnificent companies, we should look for top 5% returns or companies that consistently have managed to deliver excess returns. These companies should be among the top 25 companies with returns for at least 5 years. The following table shows that Enphase Energy and Builders First are the top performers with 94.6% and 72.6% average annual returns, respectively. Nvidia and Tesla rank in the third and fourth positions with 71.5% and 62.1%, respectively. Also, AMD appears in fifth place with 51.5% annual average return. The rest of the Magnificent 7 appear in 22 to 165 places which, although are above average, many other companies have generated great returns on average.

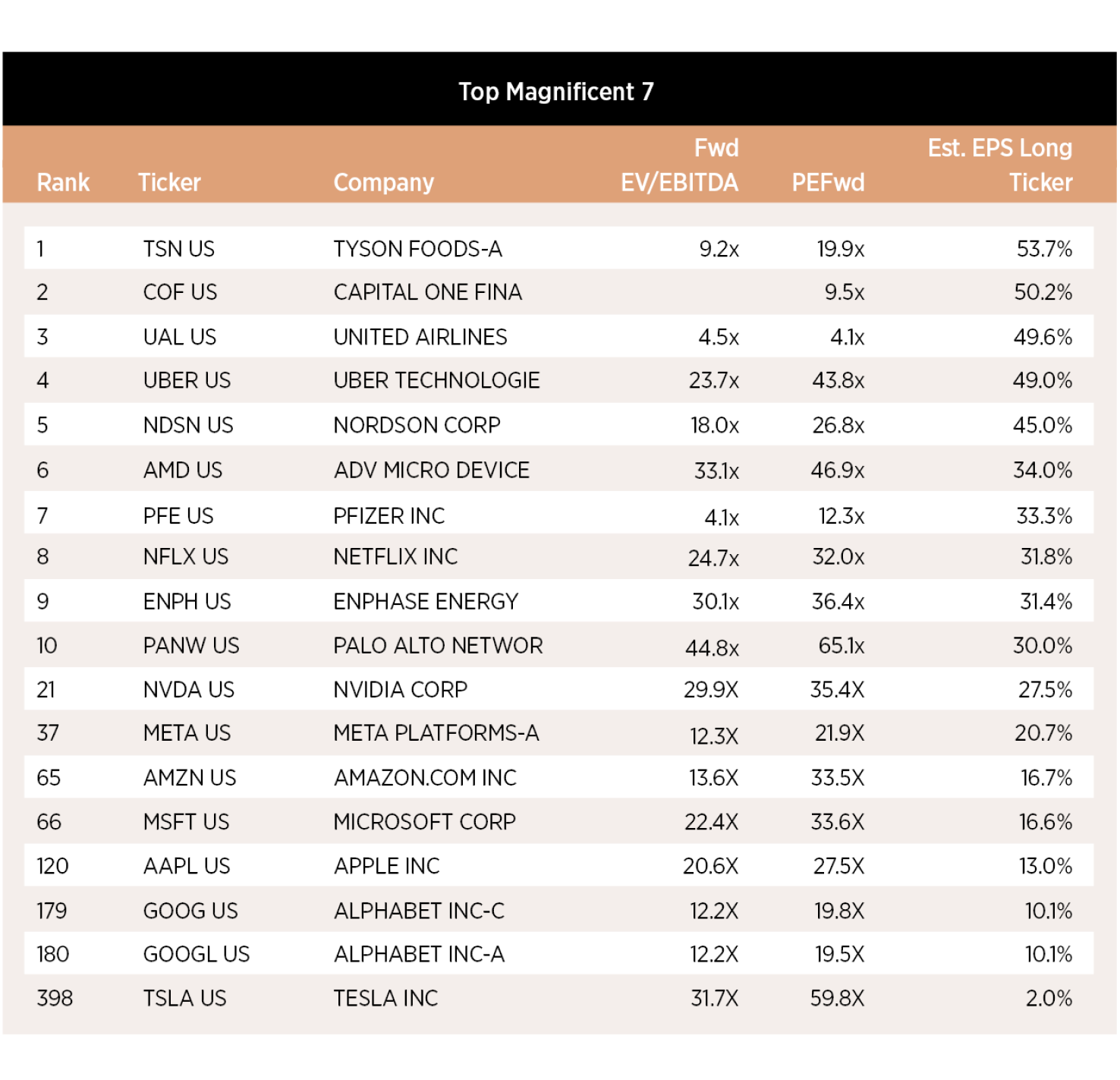

Another analysis we could include to determine which companies should be the Magnificent 7 during the next few years is the Estimated Long-Term Growth. Using this metric, AMD and PANW are among the Top 10 companies with the expected highest EPS growth potential. Another that has returned the most in the past 5 years is Enphase Energy. Now, the Magnificent 7 ranks well, but Tesla is a significant lagger with an expected return of 2.0%. Nvidia and Meta are among the top two within the Magnificent 7 group. Also, if we compare the valuation of the different companies, Tesla is the richest in valuation with the lowest expected growth, while Google, Amazon, and Meta are the cheapest in terms of EV/EBITDA and Alphabet and Meta in terms of PE multiple.

In conclusion, our assessment indicates that AAPL and TSLA should be removed from the Magnificent 7 list and in exchange AMD and PANW should be added to the list. Compared to other leading technology companies it feels, at least for now, that AAPL has been behind the curve when it comes to AI investment and development. AAPL recently abandoned a decade-long multibillion-dollar effort to make electric cars in order to focus on generative AI. The undisputed king of the technology world, is playing catch-up in AI as oppose to leading the AI revolution by seeking a partner to do the heavy lifting of generative AI. AAPL is in active negotiations to let Google’s Gemini AI engine power the iPhone software this year and is also in conversations with OpenAI as it is considering using its model as well. If these deals close, it may benefit AAPL in the short term but if AAPL is unable to deliver in a sound AI strategy with homegrown models it will likely affect the performance of the company in the long-term. AAPL generates about 52% of its revenue from iPhones which is highly dependent on purchases driven by upgrades. Although AAPL’s suppliers have a global footprint, the majority of final assembly occurs in China. Increased US-China tensions may result in disruptions in the supply chain. AAPL is losing market share in China, the world’s second biggest economy, is facing more regional competition particularly from Huawei. Last but not least APPL have been subject to intense regulatory scrutiny in all major markets that it operates in. Recently the US Department of Justice filed a civil antitrust lawsuit against AAPL alleging it monopolized the smartphone market by discouraging innovation. Adverse regulatory outcomes could result in weakening AAPL’s competitive advantages.

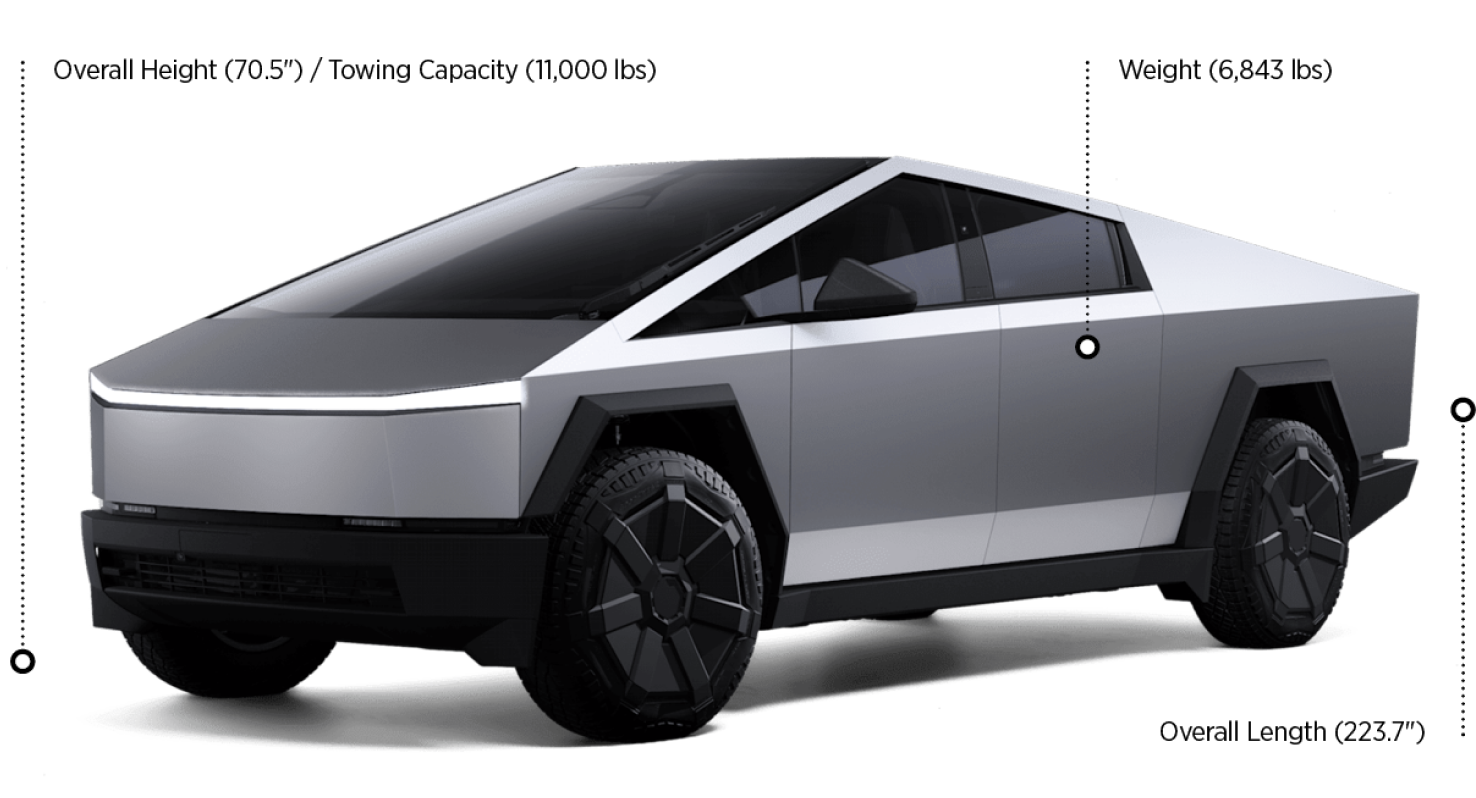

Tesla, growth perspective is slowing down both in the US and worldwide. TSLA faces increasing competition in the US now and already intense competition from BYD Co in China. Margins are likely to continue to be under pressure as more competitors enter the EV race. The key question is, can TSLA dominate the EV and AI industry in the long term? Given its current valuation it certainly looks like TSLA is going to outperform the AI giants and the global auto industry. TSLA is currently trading at 54.8x forward P/E with low 14.7% EPS growth expected in the next 12 months. Today TSLA mark cap is still roughly the same as that of Toyota Motors, Mercedes Benz and BMW. We acknowledge that Elon Musk possesses an extraordinary ability to envision the future and is one of the few entrepreneurs that is able to transform his vision into reality. We believe history is on TSLA side and the long-term thesis is likely to be intact. However, the next couple of years may be a challenging time for the EV adoption story as a result of demand headwinds and industry consolidation. TSLA exposure to China is significant, China accounts for over 20% of Tesla’s revenue and about 40% of Tesla’s production. The outcome in the US Presidential elections and increasing geopolitical risks may have a material consequence on the US auto industry and in particular on TSLA. The TikTok ban or forced sale in the US leaves the door open for the Chinese government to retaliate against US firms, both AAPL and TSLA are highly vulnerable to any China action. Finaly, Elon Musk said in a post on X, that he was “uncomfortable” about expanding the EV company’s AI and robotics capabilities without controlling 25% of the TSLA votes. Although Elon Musk AI initiative is independent to the EV company, we are assuming that the technology developed in the AI company will be used by TSLA. It is important to note that in the long run we believe both AAPL and TSLA should emerge stronger in both absolute and relative terms.

We believe both AMD and PANW have a much compelling story as they are among the top 10 EPS growth in the S&P 500. Although PANW is rich in its valuation, the growth perspectives at 30% is significant so that the multiple will decline over time. AMD has significantly substituted the Intel processors for personal computers, is growing in the server processors and is among the few that is trying to compete with Nvidia in the video and AI chips.

While the stock market is inherently unpredictable, investing in companies with strong fundamentals, innovative offerings, and robust growth prospects can enhance the likelihood of long-term success. The Next Magnificent 7 stocks highlighted in this article represent a blend of resilience, innovation, and market leadership, making them compelling investment opportunities for 2024 and beyond. However, investors should conduct through research and exercise prudence when making investment decisions and be mindful of potential risks and market volatility. In choosing stocks for a portfolio, investors must understand that is a time-consuming task and must look beyond performance as qualitative factors are important too. Investors should discuss and consult their financial goals including: risk tolerance, investment horizon and diversification needs with their trusted financial advisors. This article is for illustrative purposes and we are not recommending to hold, buy or sell any security.

Pedro David Martínez

CEO, Regius Magazine.

regiusmagazine.com

Homero Elizondo

Head of Research, Regius Magazine.

regiusmagazine.com