Across industries—from technology and finance to entertainment and real estate—more HNWIs are bypassing traditional financial institutions in favor of Family Offices. This shift is reshaping private markets, signaling a transition toward independence, privacy, and bespoke financial strategies that are redefining global wealth management.

| THE EXPANDING ROLE OF FAMILY OFFICES AMIDST THE GREAT WEALTH TRANSFER

The move toward Family Offices is not just about wealth management—it reflects a fundamental restructuring of private capital at a time when the largest transfer of wealth in history is underway.

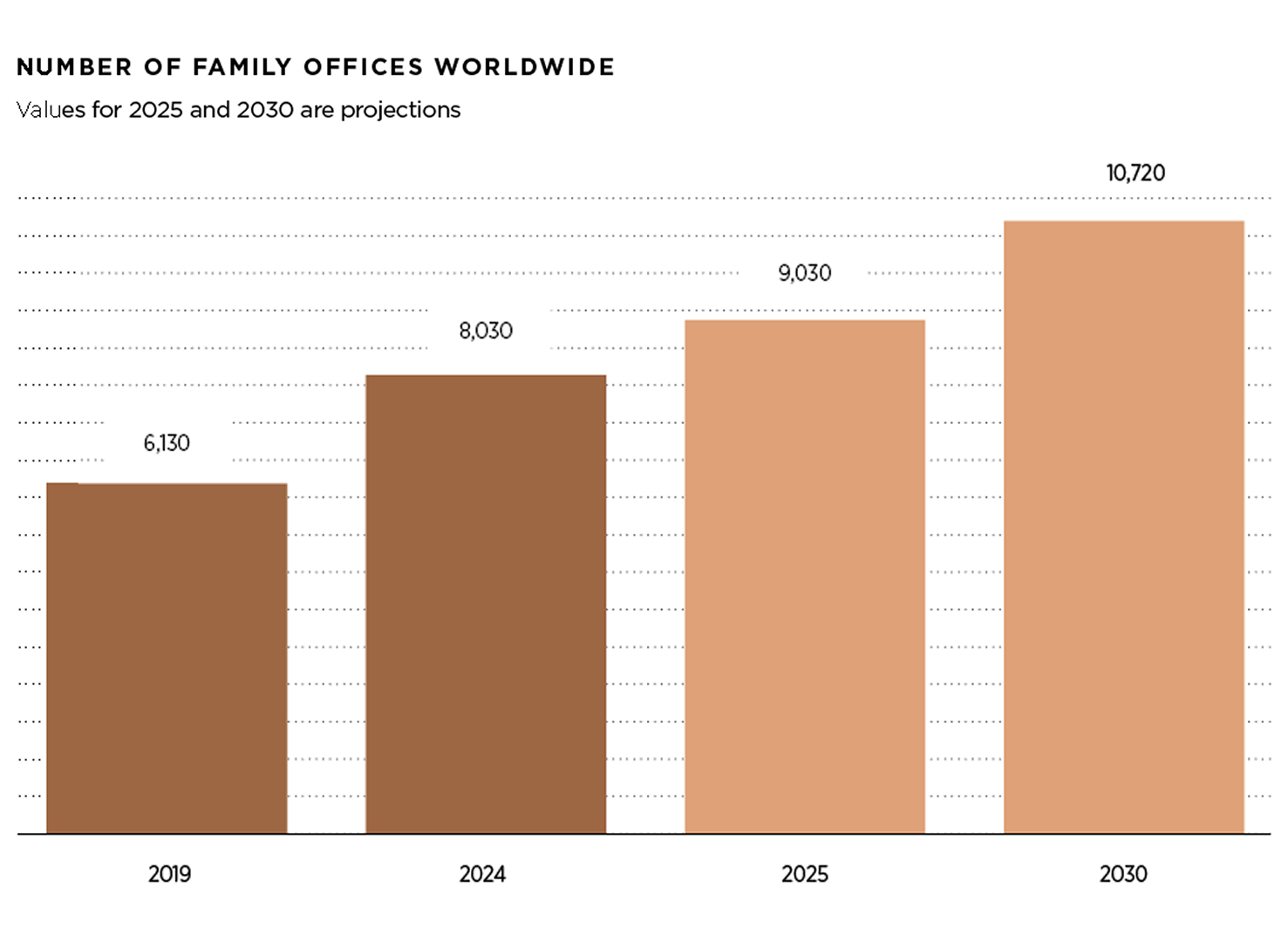

According to Deloitte's "Defining the Family Office Landscape, 2024" report, there are now over 8,000 single-family offices globally, up 31% since 2019. That number is expected to surpass 10,000 by 2030, with assets under management projected to grow from $3.1 trillion today to $5.4 trillion within the next six years.

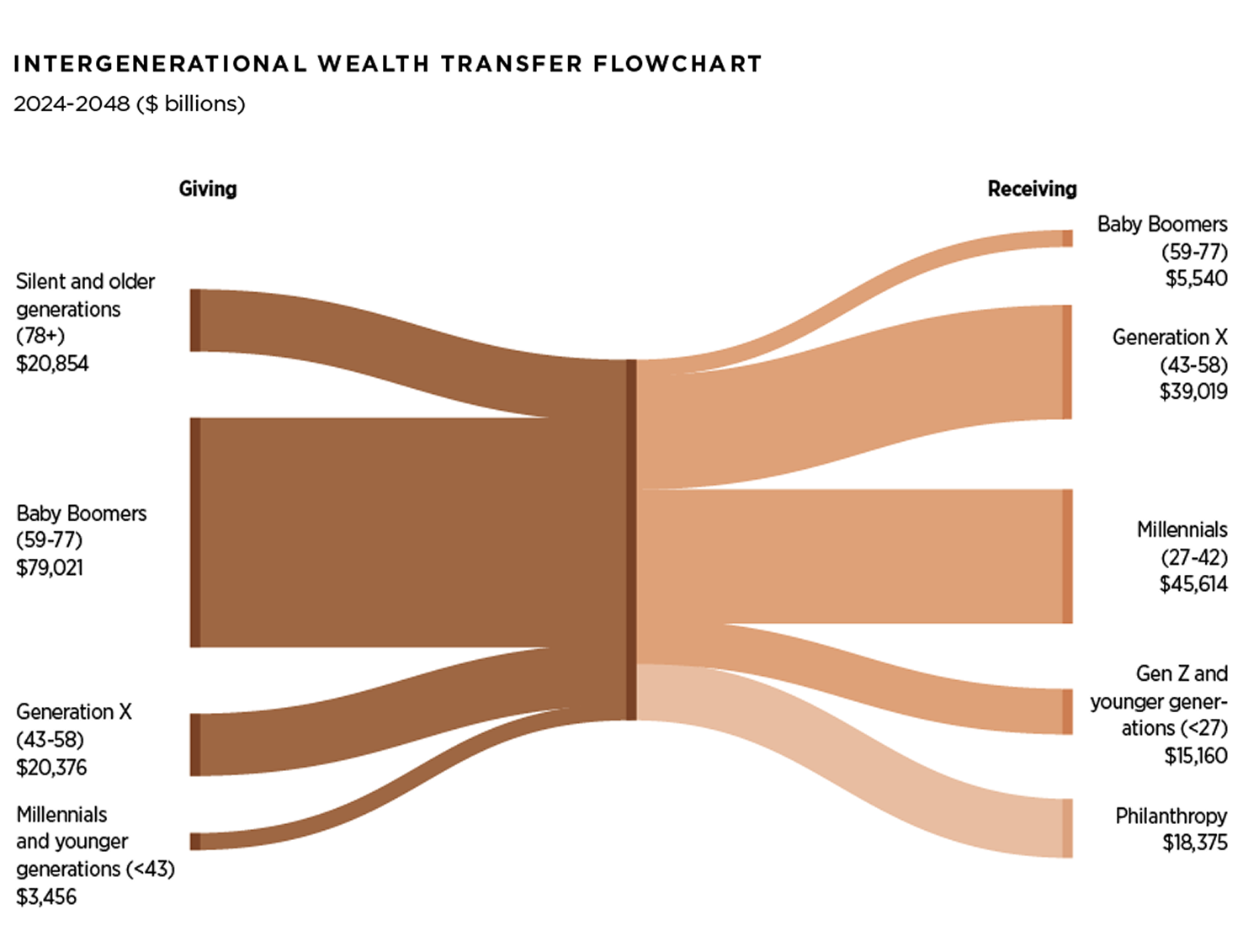

At the same time, Cerulli projects that $124 trillion will change hands through 2048, with $105 trillion flowing to heirs and $18 trillion allocated to philanthropy. Nearly $100 trillion will be transferred from Baby Boomers and older generations, accounting for 81% of all wealth transfers. The chart, included later in this article, visually highlights how these funds are expected to be distributed across generations and charitable giving.

This unprecedented shift presents both opportunities and challenges for wealth managers, asset managers, and financial institutions. Firms that fail to adapt to the evolving needs of next-generation investors risk losing a significant share of the assets they currently oversee.

| WHY FAMILY OFFICES ARE BECOMING THE PREFERRED MODEL

Several key factors are driving HNWIs to move away from traditional financial institutions in favor of Family Offices:

1 Privacy and Control Over Wealth

Traditional banks and wealth management firms operate within rigid regulatory structures, often promoting one-size-fits-all strategies. Family Offices, by contrast, allow individuals to oversee their wealth on their own terms, ensuring financial strategies remain private and tailored to long-term objectives.

2 A Push Toward Private Markets

Public markets have become less attractive, leading to a rise in private equity, direct investments, and alternative assets. Deloitte’s report highlights that Family Offices are increasing allocations to private equity, prioritizing investments that offer more control over capital deployment.

3 Regulatory Pressures and Legal Risks

Governments are applying stricter oversight to high-growth industries like crypto and technology. Family Offices offer a structured, compliant way to manage assets while reducing unnecessary exposure to legal risk.

4 The Impact of the Great Wealth Transfer

As $124 trillion in wealth moves between generations, Family Offices are uniquely positioned to manage multigenerational assets. Cerulli’s research shows that nearly $100 trillion will transfer from Baby Boomers and older generations, with Gen X and Millennials poised to inherit a combined $85 trillion.

With shifting generational priorities, Family Offices provide flexibility for heirs who prefer direct investing, impact-driven portfolios, and control over their financial legacy.

5 Reputation and Legacy Building

For HNWIs facing legal or reputational challenges, Family Offices provide a pathway to rebuilding influence and shaping a long-term impact strategy. A focus on philanthropy, governance, and structured giving helps transition away from short-term speculation.

6 Declining Trust in Traditional Institutions

Many HNWIs, particularly younger entrepreneurs, no longer trust traditional financial institutions. Financial crises, scandals, and bank failures have led to a rise in self-directed wealth management. Family Offices allow individuals to retain full control over financial decisions without relying on institutions that prioritize their own interests.

7 The Growth of Family Offices in Asia

Hong Kong is emerging as a dominant Family Office hub. The South China Morning Post reports that Hong Kong’s financial sector, deep network of global investment opportunities, and access to top-tier financial professionals have positioned the city as a preferred destination for UHNWIs establishing private wealth structures.

8 The Rise of Direct Investing

Traditional asset allocation no longer meets the expectations of today’s ultra-wealthy. Family Offices are now leading private deals, bypassing hedge funds and venture capital firms. CNBC’s Robert Frank reports that Family Offices have become some of the most active players in private company transactions, often outbidding institutional investors for key deals.

9 Firms Restructuring to Serve Family Offices

It’s not just individuals making this shift—entire financial firms are reorienting their business models to cater to Family Offices. In January 2025, KKR Financial Services Company rebranded as Kaliber & Company, signaling a commitment to serving multigenerational wealth. This move highlights a larger trend where firms recognize that Family Offices are shaping the future of private wealth management.

10 Preparing the Next Generation

With trillions in wealth transitioning to heirs, Family Offices play a crucial role in educating and preparing the next generation for responsible financial stewardship. According to Cerulli, nearly $40 trillion of intergenerational transfers will first pass through spouses, particularly Baby Boomer women, before eventually reaching younger heirs.

Financial firms that establish relationships with heirs early will be best positioned to retain assets and guide the next generation’s financial strategies.

| FAMILY OFFICES ARE EXPANDING ACROSS THE GLOBE

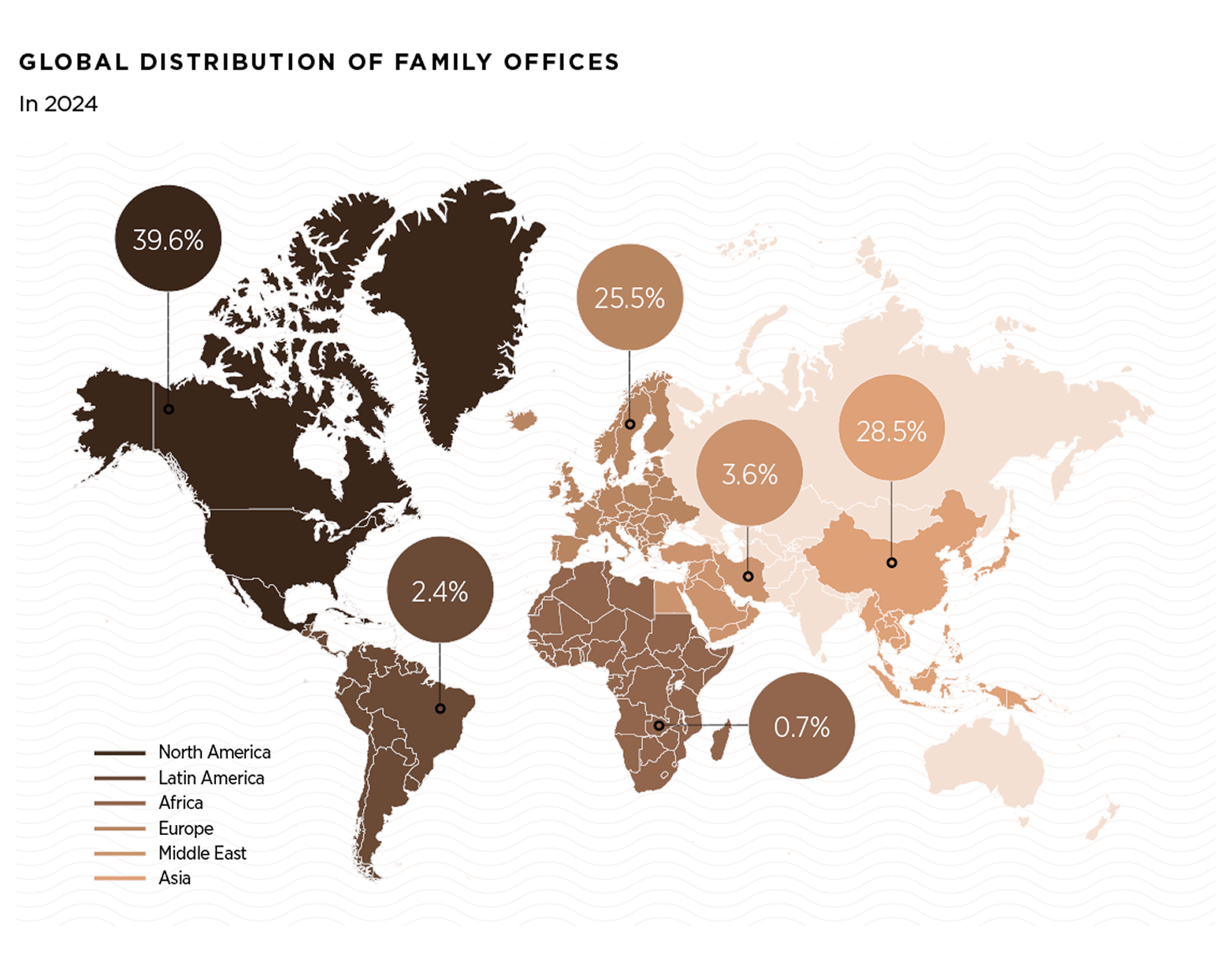

Family Offices are no longer concentrated in just a handful of financial hubs. The global distribution of Family Offices shows North America leading at 39.6%, followed by Asia (28.5%) and Europe (25.5%). Latin America (2.4%) and Africa (0.7%) remain underrepresented but show growth potential.

Each region is experiencing unique trends that are shaping the way Family Offices operate:

● North America

Dominates due to its robust financial ecosystem and high UHNWI concentration, with cities like New York, Los Angeles, and Miami serving as key hubs.

● Asia

Is experiencing rapid wealth acceleration, particularly in China and India, with Singapore and Hong Kong emerging as major Family Office centers due to tax incentives and access to fast-growing economies.

● Europe

Maintains its stronghold, especially for sustainability-focused investments, as countries like Switzerland, Germany, and Scandinavia lead in ESG-driven strategies.

● Latin America

Is growing in significance, especially in renewable energy investments, with Brazil, Chile, and Mexico at the forefront of solar and wind projects.

● Africa

Is gaining attention for its untapped resources, particularly in agriculture and infrastructure, with Kenya and South Africa leading the charge in investment opportunities.

The continued expansion of Family Offices worldwide suggests that they are becoming key players in shaping investment strategies, wealth preservation, and philanthropy across the globe.

| WHAT THIS MEANS FOR THE FINANCIAL INDUSTRY

Family Offices are reshaping private markets, investment strategies, and global wealth management at an unprecedented scale. As UHNWIs shift toward Family Offices, financial institutions must adapt by offering more personalized, flexible solutions that align with the priorities of next-generation wealth holders.

With direct investing and private equity gaining momentum, Family Offices are becoming powerful players in private markets, influencing capital flows and deal structures. Their focus on long-term wealth preservation, impact investing, and alternative assets is redefining how global capital is deployed.

The continued expansion of Family Offices worldwide suggests that traditional wealth management firms will need to adjust their business models to remain competitive. Institutions that fail to recognize this shift risk being left behind as Family Offices take a leading role in shaping investment strategies, philanthropic initiatives, and wealth sustainability for future generations.

Ronald Diamond

Chairman and CEO of Diamond Wealth.

diamondwealthstrategies.com