| THE GENESIS OF BITCOIN AND THE RISE OF ALTCOINS

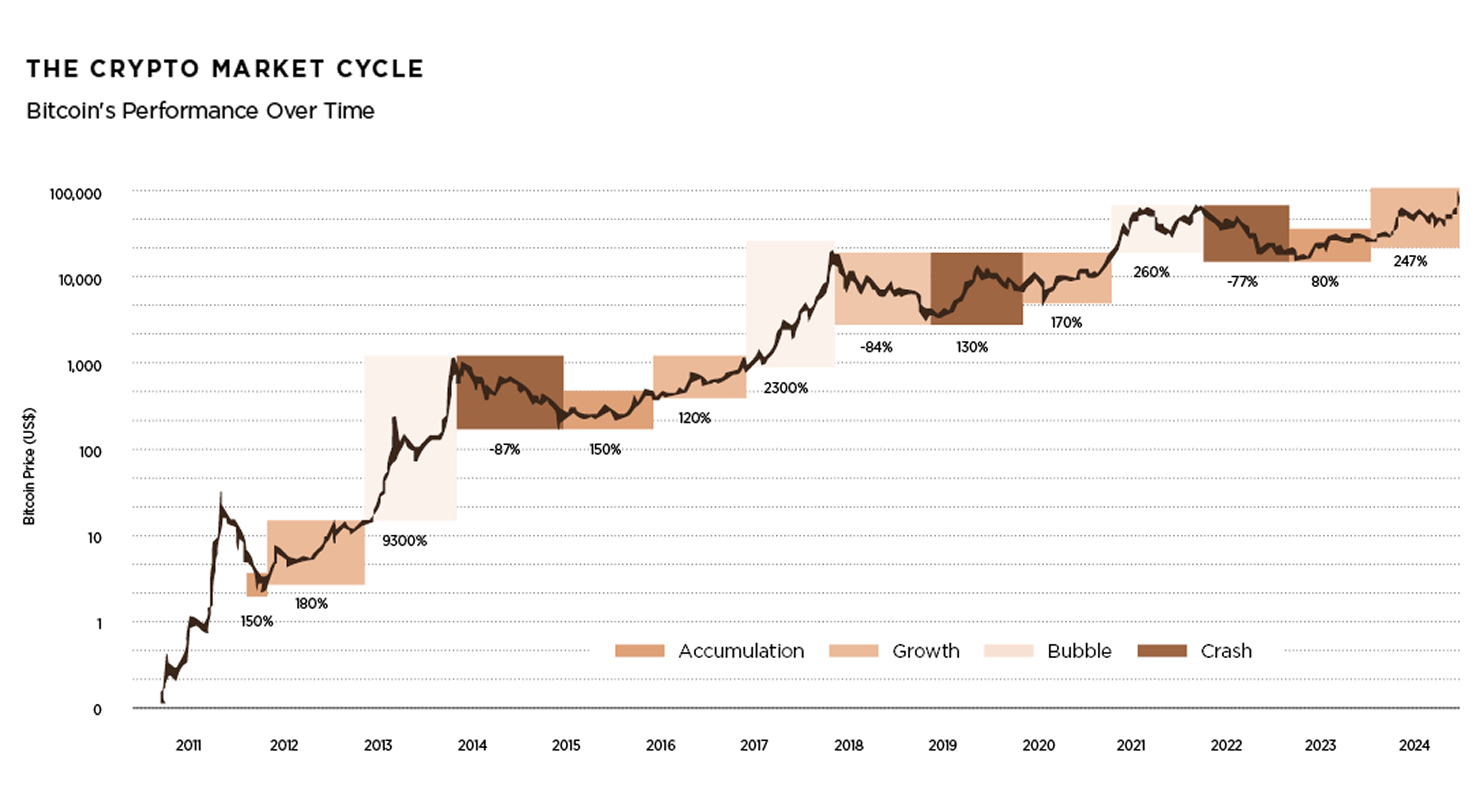

Whether risk assets will rise or fall tomorrow is anybody’s guess, but as crypto traders might jokingly suggest, “the only certainty is that the chart moves forward”. The volatility of cryptocurrency over the last decade has not been for the faint-hearted, with euphoric rises of several orders of magnitude that occur as frequently as wipeouts that can erase nearly 100% of an investment in a matter of hours. But now with clear regulation and institutional interest, the most recent thought that is making its way into the crypto investors’ mindset is that “this time it’s different”. It might be true that the scale of computing power supporting the crypto space, its technology, adoption, and functional tools have seen significant progress from the initial promise of digital currencies, but I believe that there will be a short-term reckoning just like there has been with every 4-year cycle.

Bitcoin’s creation in 2009 laid the foundation of a secure peer-to-peer transactions in a distributed ledger, envisioned as a decentralized, censorship-resistant form of digital money. But the narrative soon expanded beyond Bitcoin and its store-of-value promise in a consistent progression:

● 2011.

Litecoin (LTC) offered faster block generation and a “digital silver” analogous to Bitcoin’s gold.

● 2012.

Ripple (XRP) targeted efficient cross-border payments via a streamlined ledger.

● 2013.

Dogecoin (DOGE) began as a meme but gained traction through tipping communities.

● 2014.

Stablecoin Tether (USDT) is launched to mirror the price of the US Dollar without having to withdraw the assets from the crypto-space.

● 2015.

Ethereum (ETH) introduced programmable smart contracts and decentralized applications (dApps).

"The volatility of cryptocurrency over the last decade has not been for the faint-hearted, with euphoric rises of several orders of magnitude that occur as frequently as wipeouts that can erase nearly 100% of an investment in a matter of hours"

Litecoin was created to challenge or improve upon the limitations of block generation, thus improving transaction speeds and possibly offering the possibility of allowing real-time payments. XRP has enjoyed success in speeding up transactions for financial institutions. DOGE was the first meme coin, which successfully achieved staying power, secured mining capacity globally, and proved that a joke can become a serious currency as long as enough people trade and invest in it. USDT has become the largest de-facto digital currency that is tied to the US Dollar, thus providing liquidity and interchangeability to a fiat reality that coexists with legacy financial applications. Finally, Ethereum ignited an arms race of usability with smart contracts; applications built on top of said networks and a parallel exchange, credit and investment system to democratize and complement the needs of modern connected investors, traders, and speculators.

And yet, the combined market capitalization of these coins and the thousands of crypto coin projects cannot rival the market capitalization that Bitcoin presently commands. Even “improved” or “more useful” currencies have been unable to displace Bitcoin and the gigantic computing capacity supporting its network. As Michael Saylor would be quick to point out: “There is no second best”. This sort of innovation can coexist in the space, but anyone who ventures to invest in cryptocurrencies needs to remember that any altcoin project still swims in an ocean of Bitcoin.

These examples are relevant because each one of these 5 coins were the first of their kind to perform a specific function beyond Bitcoin’s abilities. These coins each represent an initial iteration of the technological evolution and innovation that would continue over the next 15 years. These cryptocurrencies diversified the market, bringing utility and broader appeal, but also sowed seeds for speculative mania.

The 2017 ICO Frenzy

Fueled by optimism and easy liquidity, 2017 witnessed an explosion of Initial Coin Offerings (ICOs) that echoed the euphoric exuberance of the 1990s internet company IPO boom. Throughout the year 2017, we witnessed the introduction of countless crypto projects that promised anything from reward/loyalty schemes, digital real estate, utility tokens, on-chain gaming, “improved” networks, to name a few. Ethereum’s ERC-20 standard enabled virtually anyone to launch a token – many lacking tangible fundamentals. Speculative capital flowed freely into projects promising revolutionary technology without regulation, though many lacked substance.

By early 2018, the bubble had burst and the vast majority of the freshly minted ICOs were failing or fizzling. The crypto market retraced more than 80% of its value, exposing investors to rampant fraud, exit scams, and unregulated excesses.

The 2021 DeFi and NFT Frenzy

Fast forward to 2021, and crypto experienced another speculative surge: this time centered on Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). DeFi protocols like AAVE or Uniswap offered bank-like functionality: lending, leveraging, and yield farming. These protocols operated without requiring any documentation from investors and were mostly transparent in their function and outcome. While many were genuinely innovative, the space was also rife with clones, opportunistic liquidity mining, and "rug pulls" where anonymous developers disappeared with funds after unloading worthless tokens upon unsuspecting investors.

"...the thousands of crypto coin projects cannot rival the market capitalization that Bitcoin presently commands. Even 'improved' or 'more useful' currencies have been unable to displace Bitcoin and the gigantic computing capacity supporting its network. As Michael Saylor would be quick to point out: “There is no second best"

Likewise, NFTs captivated mainstream culture, with digital art, collectibles, and virtual items selling for eye-popping sums. Seemingly every other new token in the space had “NFT capability” and would automatically fetch high valuations by the mere inclusion of this description. Platforms like OpenSea saw historic volume, peaking at $2.7 billion in daily trading, but these figures soon evaporated when investors tried to offload their NFTs to little demand.

By 2022, the decline was stark: NFT trading volumes collapsed by 97%: from $17 billion at the start of 2022 to just $466 million in September of the same year. DeFi’s Total Value Locked (TVL) plummeted, after having risen from $15B and peaking at $180B in 2021, it dropped roughly 70% to under $39B by Q4 2022. NFT art sector also saw a decline: sales fell by over 90%, from $2.9 billion in 2021 to about $23.8 million by Q1 2025.

Not surprisingly, the crypto space suffered some significant setbacks during 2022. This was the year when the Terra/Luna protocol and its “algorithmic” stablecoin failed and wiped $40B of capital. A few months later, Celsius exchange also collapsed from fraudulent behavior, in which $11.8B in investors’ funds were used to fund risky investments. And finally, the Superbowl ad-featured and private equity favorite exchange FTX, with active daily trading volumes of up to $10B and a valuation of $32B, collapsed after engaging in fraudulent behavior similar to what brought down Celsius.

| ECHOES OF PRIORBUBBLES: DOT-COM, FINANCIAL CRISIS, AI RUN-UP

Crypto’s pattern is not unprecedented: The dot-com bubble though the late 1990s and peaking in the year 2000 saw sky-high valuations for Internet startups without profits. The 2008 financial crisis followed excessive leverage and a liquidity crunch when investment grade mortgage-backed securities lost value. Similarly, the recent AI-related hype observes speculative investments in unprofitable tech ventures.

Together, these dynamics—halving-induced supply shocks, broad liquidity cycles, and fiat weakness—set the tempo for crypto’s boom-and-bust performance. Both the 2017 ICO era and the 2021 DeFi/NFT boom followed the same four-step cycle:

➊ Bitcoin halving causes a supply squeeze, causing the price to rapidly increase. As investors take profits, the speculative capital fuels renewed interest in altcoins as novel utility captures investor fascination.

➋ Success stories breed illusions of inevitability and a “this time it’s different” mentality.

➌ Leverage, hype, and fraudulent schemes become prevalent. Excesses become unsustainable when the correction inevitably arrives.

➍ A contraction in valuations and confidence follows, triggered by tightened liquidity and a rush for the exits.

Across these episodes, the pattern repeats: hype and narratives drive valuations beyond fundamentals, followed by painful correction.

| UNDERSTANDING CRYPTO’S BOOM-AND-BUST CYCLES: HALVING, LIQUIDITY, AND DOLLAR WEAKNESS

But how is Bitcoin dominance related to the innovation that pushes altcoin projects into euphoric bubble territory? I believe there are 3 primary factors that influence the meteoric rise of Bitcoin and other cryptocurrencies:

● The Bitcoin Halving has historically been the initial spark that fuels all Bitcoin rallies. Roughly every four years, Bitcoin’s block reward halves, thus reducing new supply. Historically, these halving events have preceded sharp price rallies, as demand stays steady or rises against constrained issuance.

● Not coincidentally, crypto thrives when global monetary conditions are loose. Expansive money supply (M2) and low interest rates fuel speculative flows. And when liquidity tightens through rate hikes or policy shifts, risk assets like crypto often bear the brunt. This was evident during the near-zero rate policy that began during the Financial Crisis in 2008-2009 and until 2016 when rates started increasing. Likewise, after the pandemic in 2020, rates remained near-zero until 2022.

● Finally, as fiat currencies, notably the U.S. dollar, lose purchasing power, investors gravitate toward perceived hedges like gold, the Swiss Franc, and more recently, Bitcoin. With capped supply and global accessibility, Bitcoin fits the narrative of inflation-resistant value, amplifying speculative inflows during periods of debasement.

| A NEW REGULATORY DAWN: TRUMP’S CRYPTO EMBRACE AND INSTITUTIONAL APPETITE

Recent introduction of rules and regulations for crypto ownership and investment have driven the industry towards mainstream acceptance:

● A 2025 Executive Order set up a federal Working Group on Digital Assets, while barring a U.S. CBDC.

● The GENIUS Act imposed stablecoin requirements: full backing in liquid assets and transparency.

● A Strategic Bitcoin Reserve was established using seized cryptocurrencies. Valued in the tens of billions, symbolic of institutional endorsement.

● Institutional investment avenues widened, crypto allocations are entering retirement accounts, 401(k)s, and other traditional investing structures.

Crypto has shed much of its fringe status. Both retail and institutional wallets hold exposure. But does legitimacy eliminate boom-bust cycles? Not necessarily.

| WHY “THIS TIME IT’S DIFFERENT” RINGS HOLLOW

Despite broader adoption, the core vulnerabilities remain. The entrenched four-year boom-bust rhythm has yet to be broken. Speculative excess remains and investors still chase unprofitable, meme stocks and coins, or hype-driven projects. Even with the clear benefits of regulatory clarity, there are numerous structural impediments that could result in systemic fragility: euphoria, fraud risk, excessive leverage, and token-level volatility. As in past speculative cycles, once the fervor fades, undercapitalized or unsound ventures will feel the collapse. My personal belief is that the next bear market will begin when one (or more) overleveraged crypto treasury companies will be forced to liquidate when the price of their holdings starts losing value.

"Not coincidentally, crypto thrives when global monetary conditions are loose. Expansive money supply (M2) and low interest rates fuel speculative flows. And when liquidity tightens through rate hikes or policy shifts, risk assets like crypto often bear the brunt"

| CONCLUSION: NAVIGATING CRYPTO’S ENDURING DANCE

Crypto’s journey is shaped by a consistent triad: supply constraints (halving), liquidity cycles, and fiat depreciation. Its rhythmic booms and busts echo earlier financial episodes. Even though regulators and institutional players now stand center stage, I believe we are still a few 4-year cycles away from a meaningful reduction in Bitcoin volatility and in turn, altcoin volatility. For savvy finance professionals and investment managers, the lesson is timeless: rejecting the “this time it’s different” mentality pays off. Deep due diligence, discipline, and cautious skepticism, especially toward speculative hype, are vital. Markets may rise on narrative and liquidity, but only fundamentals and prudent risk management can stand the test of time. My advice? Don’t buy the hype and instead have a dollar-cost-averaging strategy, or even better, wait for the 2026 crypto bear market and buy the dip.

Alejandro Paredes

Chief Investment Officer, PICO Family Office.