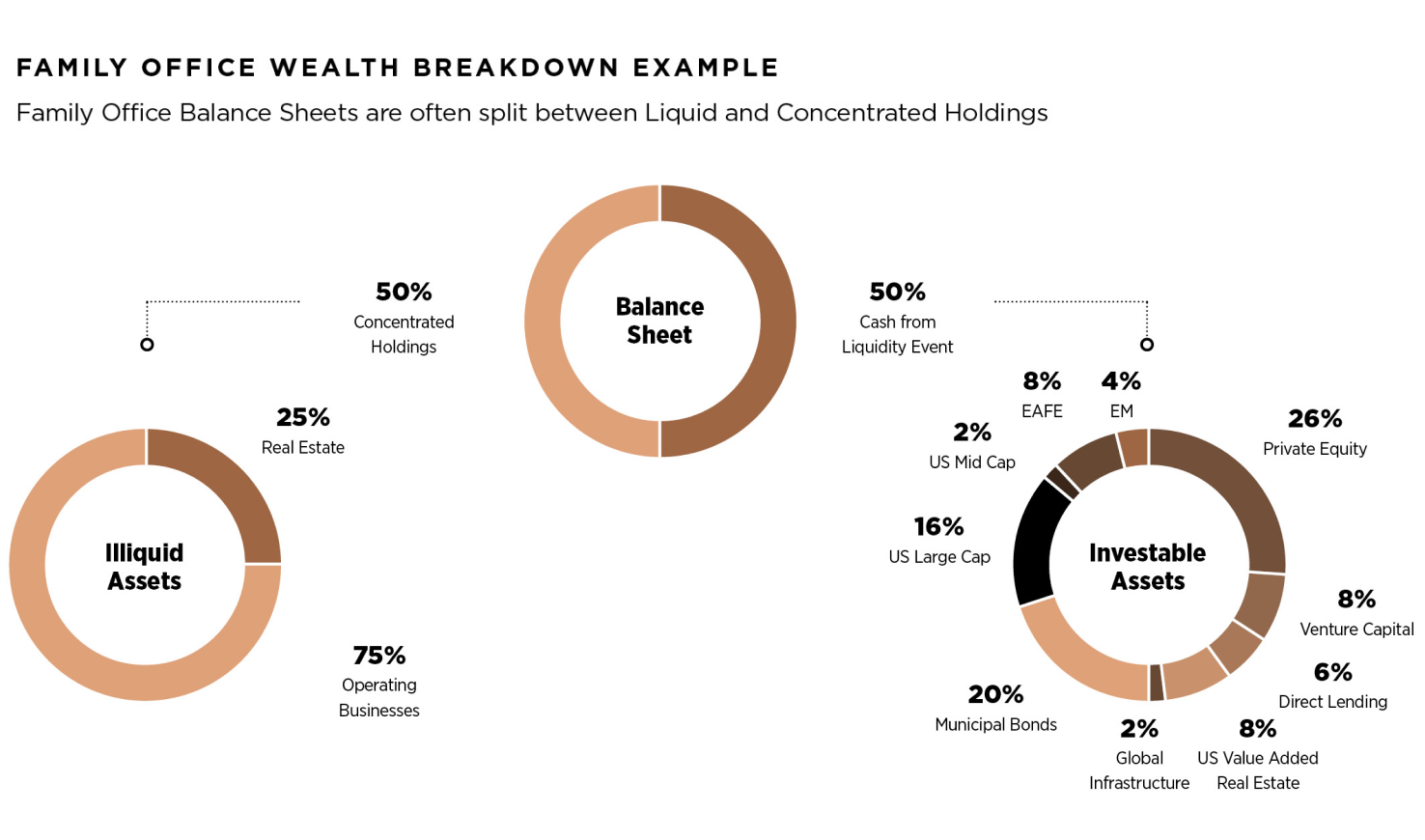

Family Office Investing – The Road to An Endowment Family offices are often seeded with liquidity derived from the sale of an operating business or a stream of dividends from family-owned operating business. How a family office manages their wealth will determine its longevity.

Family offices whose wealth has been generated through successful concentration, tend to maintain a high return profile even with regards to the complementary risk assets, which can be accomplished through alternative investments and less dependance on fixed income and public equity investments. Even family offices with notable distribution needs from the portfolio may choose not to not tailor the investments around fixed income given that between public equities, a modest fixed income allocation, and even distributions off alternative assets, there is more than enough distributable assets to meet most income requirements typically seen. These investments in alternative assets are commonly achieved through vehicles such as private equity, direct investing, while maintaining a higher emphasis on active management in areas that are similar to their successful operating asset strategy.

This approach naturally mimics the so-called Endowment Model of investing which incorporates the investment principles and building blocks of one of the most successful approaches to long-term investing over the past 30 years.

| THE ENDOWMENT MODEL OF INVESTING

This style of investing, initially developed by David Swensen and Dean Takahashi at Yale University, is now employed by many of the world’s largest nonprofits and family offices. It has been widely discussed and to an extent mimicked, but rarely beaten over longer-term timeframes. “Mindset” may be the best way to describe the overall investment philosophy, since asset allocation, diversification and vehicle selection can be applied by any investor without the same investment success, suggesting there is more to the thought process than meets the eye.

Based on our experience working with sophisticated family offices and large endowments around the world, the endowment approach has the following characteristics at its core:

➊ A long-term investment horizon.

➋ Acceptance of increased risk to achieve a potential higher return.

➌ Diversification through uncorrelated assets.

Critical to the success of the approach are the resources and skills required for effective implementation, including:

➊ Efficient portfolio construction.

➋ Access to some of the best-performing investment managers.

If there is a formula for success required by long-term, higher-return-seeking investors, such as multigenerational families, diversification and allocations are the starting point. The effort to fully embrace appropriate risks in order to maximize the benefit of a well- diversified investment portfolio, must include the savvy to choose investment managers whose incentives are aligned with the interests of the family. These investment managers must also be disciplined to the styles that generated their track records of investment success and, of course, skillful in their execution. An ordinary description to be sure, but this basic formula produces the widest dispersion of investment success across the capital markets.

The importance of execution selection is often overlooked as a critical component of the historical success of the endowment model (i.e., the ability to access managers in the top quartile of their peer group). Materially optimal returns versus the average manager, together with an allocation that maximizes diversification, are the key ingredients. Maybe the simplest expression of the endowment mindset is diversify thoroughly, execute well.

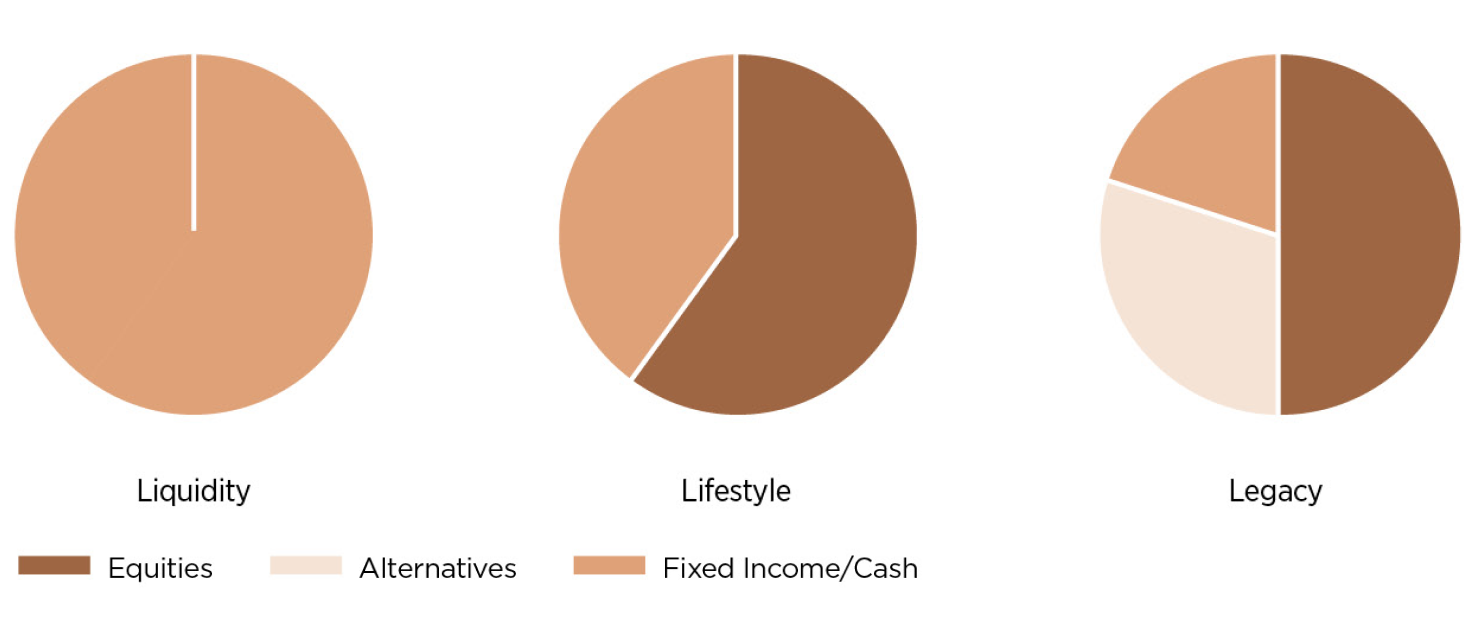

| PRINCIPLES FOR STRATEGIC ASSET ALLOCATION

Once the intentions have been well defined for the family’s assets, as discussed above, the natural next step is to create a long-term or strategic asset allocation for each that is aimed at generating a return (with a commensurate level of risk) that is expected to achieve the aligned intent of that ‘bucket’. We believe strategic asset allocation accounts for over 90% of portfolio performance over time. In our view, setting an appropriate Strategic Asset Allocation strategy, that is aimed towards achieving a family’s long-term objectives is, the most important investment decision they will undertake.

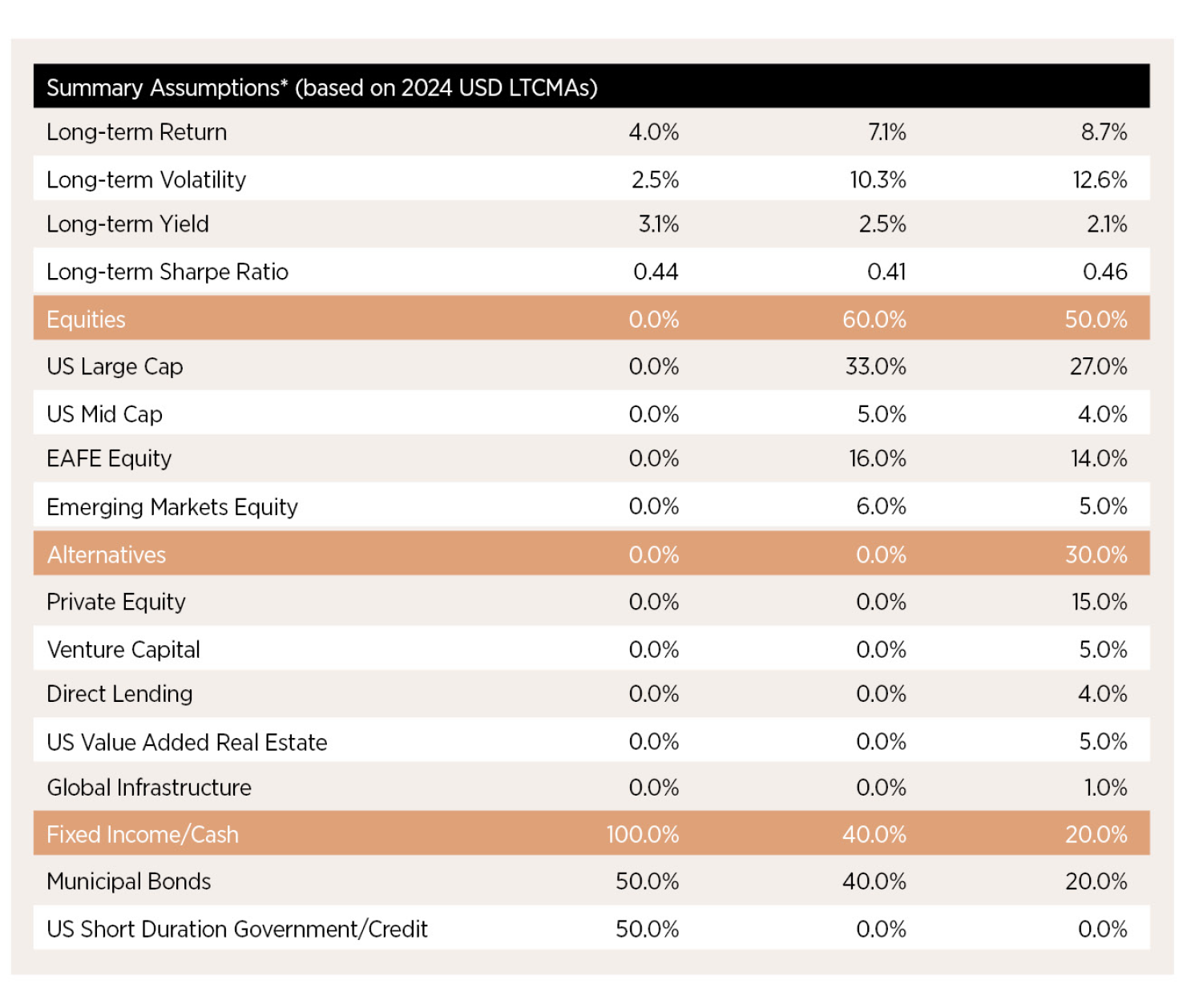

Having access to an informed set of long-term assumptions like J.P. Morgan Asset Management’s Long-Term Capital Market Assumptions (“LTCMAs”) to use as a reference point, can serve as a building block to inform strategic asset allocation decisions and building more resilient portfolios for the long term.

These assumptions can help establish reasonable expectations for risk and return over a longer period of time for various asset classes. This visualizes, on a strategic timeframe, the incremental return achievable through active management and through asset classes that may be in particular focus like fixed income or other diversifying pieces of the portfolio to complement a concentrated asset.

There is going to be some level of differentiation across family office investment strategies, but having an informed set of assumptions is the first step to guide the decision-making process. These assumptions can help weigh, across asset classes, the base return from beta to the incremental return from alpha with liquidity considerations. The ability to meet a return target is heavily premised upon the access and capabilities of the family office. To understand the strategies, to be comfortable with the strategies and to have access to the strategies that will make an impact on the portfolio over the long run, you must have an objective point-of-view and a subjective point-of-view to help you create the best portfolio construction.

Using the LTCMAs as a reference, it pays to have a positive acceptance of risk and to lean into active investment opportunities. The top quartile for alternative asset classes have been able to consistently maintain their premium over the average execution, making the incremental risk of being more active worth it on both a relative and absolute basis if executed in the top quartile. This holds less true for lower risk assets, like fixed income. History has shown that taking on active risk, even on a probability-adjusted basis accounting for the unlikelihood of consistently executing in the top quartile, will likely generate exponential returns over time. Most family offices have adopted this mindset and have embraced the risk, seeking that incremental return in exchange for the illiquidity.

The case for a dedicated, strategic fixed income portfolio in a family office’s investment strategy can be made. Exposure to this asset class helps in the event of sizeable distributions needs, establishing general risk management for the overall portfolio, or simply keeping enough reserve to manage cash flows comfortably through periods of heightened market volatility.

For family offices with notable distribution needs, allocating to an asset class that can generate consistent returns, with an ample amount of liquidity, would make sense and would avoid the need to sell down risk assets to make a distribution. There is certainly a greater argument to be made today following the aggressive rate hiking cycles that have been undergone by central banks globally, making the return aspect of that asset class more attractive in relative terms. The liquidity in fixed income can also help serve some purpose as general risk management in the event of a market downturn, as seen over recent years with the global pandemic and the most recent geopolitical conflicts. On average, most years there is a correction in equity markets that is sufficient enough to shake even long-term investors’ confidence. This argues the case for having assets that are safely ensconced in low volatility and low risk, offering investors the ability to tactically reallocate to attractive investment opportunities in times of broader market stress.

Fixed income can also serve the purpose of acting as a “bunker asset”. This means that, from time to time, there are events that cause large standard deviation moves in the market. Many family offices tend to set aside a certain portion of assets for near- to medium-term distribution and lifestyle needs in order to immunize some assets to risk and then gainfully employ to assets. These would generally be excluded when calculating the return of the balance sheet. These tend to be some of the primary dynamic that guide the decision making for the appropriate scaling and sizing of the liquidity needs needed to be achieved through fixed income assets.

| HOW TO BENCHMARK PERFORMANCE

Former US President Jimmy Carter utilized a process called zero-based budgeting. This advocates for regularly, periodically siting down to have an open and honest conversation where you really challenge all of your original assumptions and make sure that it’s still valid. They start with questions such as: ‘what did we get right’, ‘what did we get wrong’, ‘who did we use that gave us the best information’, ‘what is the risk profile that we thought was apropos when we started this exercise, is it still operative’ and all of these non-incremental thoughts to reestablish expectations going forward. Benchmarking performance can be a complicated exercise. Even the most sophisticated endowments recognize the difficulty of establishing a micro-benchmark for a diverse set of long-term investments. The ultimate reference point, even for the most sophisticated investors, is often the standard universal long-term strategic reference point of 60% Equities, 40% Fixed Income. That may sound like a little bit of a low hurdle, but it is the one many institutions and endowments use for its simplicity, reliability, and standardization. Given the premise that strategic asset allocations ultimately determine the bulk of a portfolio’s results over time, one can easily compare those allocation decisions to a standard 60/40 reference point over time as well as over isolated periods of time.

Family offices, whose diverse assets may require a more nuanced approach, might look at benchmarking in a two-pronged way:

➊ The long-term philosophy of 60/40 equities to bonds, is something that needs to be considered. If your only benchmarks are stocks and bonds, you’re going to be missing assets that could help you outperform when both stocks and bonds are doing poorly.

➋ Periodically, sitting down and challenging all your assumptions about your risk- tolerance, your abilities, your distribution needs, is critical. Occasionally, we need to start from scratch. In a new investing era, where interest rates are off the 0% levels seen over the past decade, it’s time to reassess.

Risk-return assumptions for multiple asset classes, including asset classes like commodities, taken together with a family office’s ability to execute are all part of a coherent benchmarking process and portfolio construction process. These are the primary components of how best to construct a portfolio given internal constraints. They also serve to highlight areas where the internal resources may be insufficient. Honestly recognizing potential areas of weaknesses, provide the opportunity to correct or amend those potential deficiencies and improve long-term outcomes.

A simple example based on the fundamental premises of the Endowment Model above is the ability to access managers, particularly those with liquidity limitations, such as Private Equity. If a family office finds that the performance of their allocations in the area are not in the highest quartile, it should be a high priority to address. Comparing the portfolio’s overall return to the simple 60/40 standard of a traditional allocation would highlight this effect relatively easily.

Another case in point for establishing an easy-to-follow benchmark would be a prolonged period of heightened market uncertainty where the many viewpoints that could be taken would certainly make a difference on what your asset allocation would be. (For example, a directional view on recession probabilities or inflationary expectations).

"The ultimate reference point, even for the most sophisticated investors, is often the standard universal long-term strategic reference point of 60% Equities, 40% Fixed Income. That may sound like a little bit of a low hurdle, but it is the one many institutions and endowments use for its simplicity, reliability, and standardization"

Many investors hold these discussions on an annual basis, but certainly it should be done every three years. Ultimately, if those assumptions aren’t valid, you will likely end up doing the wrong thing at the wrong time - either putting money to work (incremental risk) at the wrong time or quite frankly taking money out at the wrong time. Having an informed set of assumptions, a truly subjective but hard reckoning of capabilities that will help come up with the right portfolio construction.

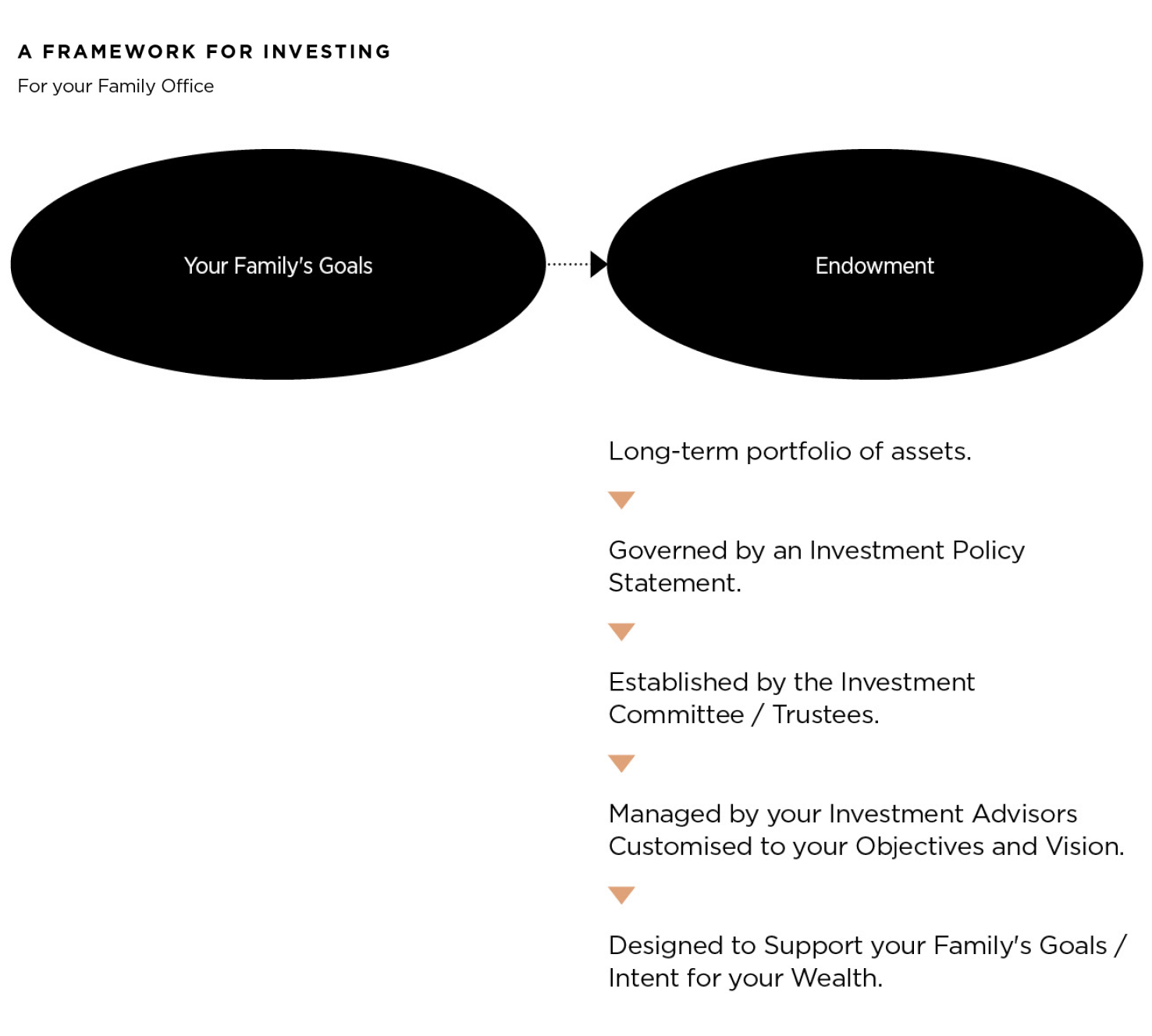

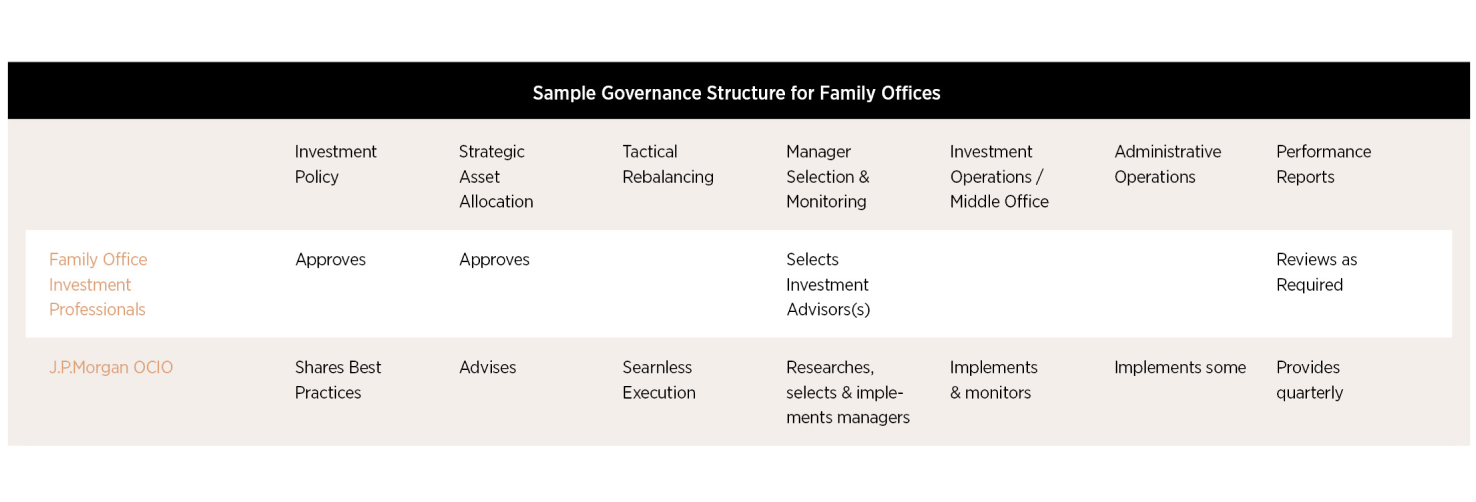

| INVESTMENT GOVERNANCE AND RISK MANAGEMENT

There is often a disconnect between the how the family offices define their purpose and the ways that they manage their enterprises in service of these goals. While investing is often the backbone of how a family office views their activities, to grow and preserve their wealth for multiple generations to come means that governance needs to be at the core. In fact, the processes, procedures, and oversight frameworks that could best manage the litany of both investment and non-investment risks, should be tackled with as much rigor as possible. The importance of governance is often overlooked and could be detrimental over the long-term.

For business owners, navigating the transition towards being a steward of wealth often requires advice from a trusted partner, a function JP Morgan often performs. Successful entrepreneurs are often keen learners who often glean best practices from their peers. With the evolution of family offices globally, the collective wisdom of wealthy families is more available to leverage as governance practices are established. An important lesson for all founders making this transition from business owner to steward of wealth (if that is what their goal is) is that there can be very different ways of leading and owning an operating business and a family office.

As family offices have collectively professionalized over the last two decades in service of their owners, we have seen the emergence of non-executive boards and investment committees to support decision making. Furthermore, while we find most family offices have long tenured non-related staff (usually in the back office or investment professionals) they do not have any formal leadership succession plan in place. Lack of formal governance structures is still commonplace. Recognizing that these decisions are difficult, beginning these discussions is a pivotal step in a family office’s evolution.

The family office can play a core role in the continuity of the family’s financial wealth to the rising generation if that is defined as one of the family’s goals. This requires prudent stewardship of the financial assets and also ensuring that the family’s human capital feel equipped and empowered to make strategic financial decisions.

Family offices must therefore invest time in learning programs and design and set up a governance structure that best serves the interests of its members. Family offices change over time, more members join, interests expand, purpose evolves, opportunities are taken, and sound and unwise decisions can be made. The governance fabric must be adapted to the changing nature of the family and its aims. Within the family and between the family and family office, a lack of proper communication, mismanagement of expectations, and loose investment disciplines can create risks.

| COMMUNICATION IS CRITICAL

Setting up and running a family office is expensive. One of the first conversations needs to be, “what resources do we need?” Without this conversation, there is risk of operational risk exposure. Family offices typically start as a vehicle to manage the dividends of an operating business or after a liquidity event. The most basic form of family office leverages part of the staff of the operating business to handle family affairs, saving on operational costs but increasing its risk if the right internal controls are not in place. As the family office evolves into a standalone vehicle, having the personnel with the suitable skillset, level of experience and cultural mindset aligned with the family is critical.

A framework to study and make decisions on investment opportunities, together with a process to look at their risk contribution to the overall portfolio, is crucial. Family offices typically invest across a wide range of asset classes from real estate, to emerging markets, to start-ups, to private equity, and to hedge funds to name a few. Investment committees are becoming the norm to evaluate and finalize investment decisions.

"Family offices typically start as a vehicle to manage the dividends of an operating business or after a liquidity event. The most basic form of family office leverages part of the staff of the operating business to handle family affairs, saving on operational costs but increasing its risk if the right internal controls are not in place"

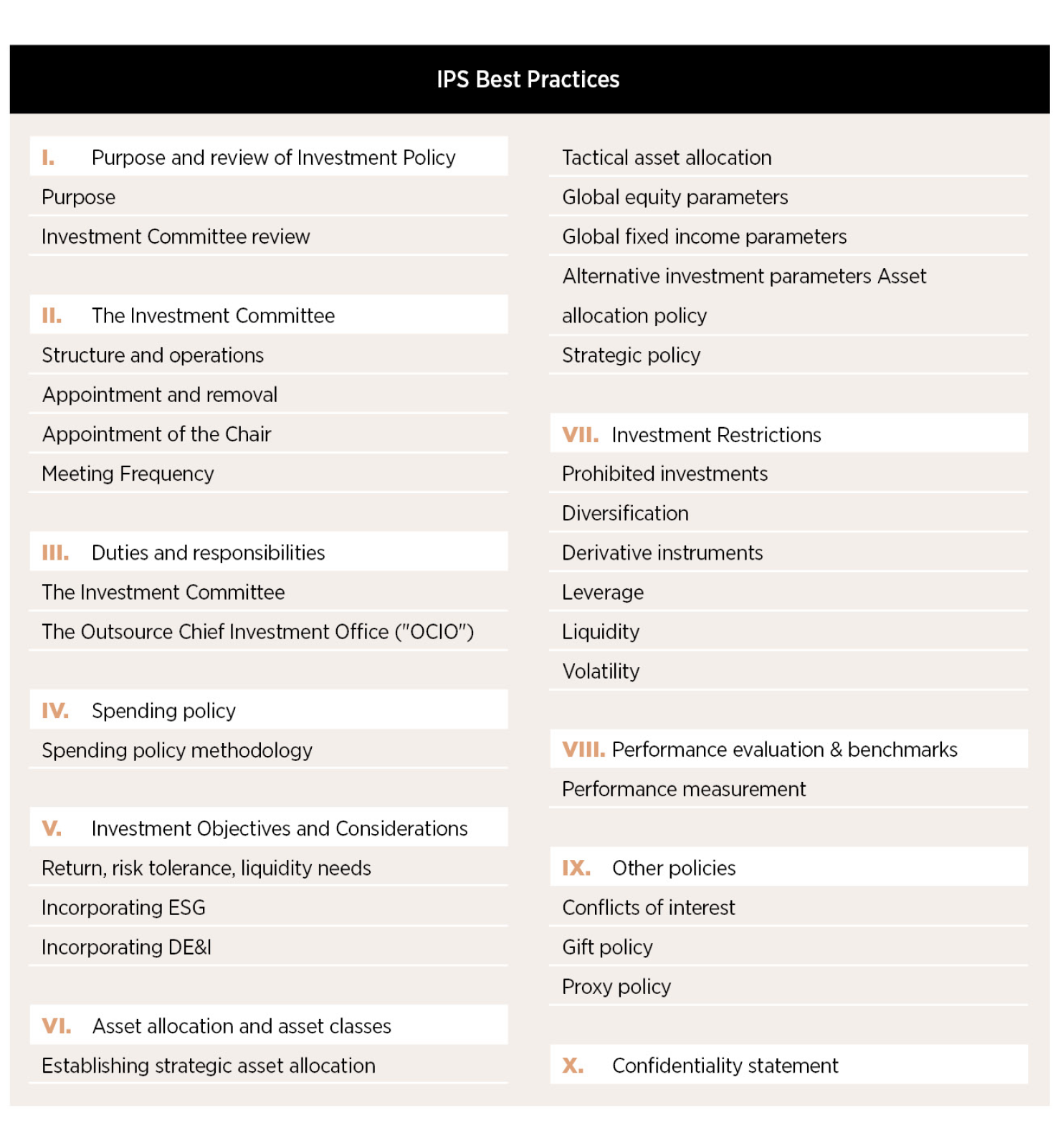

Investment Committees are formed to make clear and thoughtful investment decisions, set, dictate, and implement the overall investment allocation strategy, determine the instruments and nature of investments allowed, and calibrate a risk management scheme of the portfolio according to the financial goals of the family office. Investment Committees can consist of Family Office staff, family members and advisers. It is also good practice for family office staff to ensure that the family members feel well educated on investments – even if they are not serving on the Investment Committee. The Investment Committees may create an Investment Policy Statement – this is best created as a process of discussion with key stakeholders regarding their aims and priorities.

| DIGITAL RISK

Family offices are generally the result of successful and prominent wealth creators. They are often household names.

Interest in the investments, private matters, and communications of family members, make family offices the target of cyber and fraud attacks. Putting in place a cyber security protocol around the operating systems and network architecture is expensive, and for the most part family offices rely on the security of their providers and increasing the risk of hacking and an online access of their communications.

There are several ways to reduce digital risk in a family office:

➊ Data and communications can be stored using the services of a cloud provider that has implemented tight security measures to protect data.

➋ Educate staff on how to identify when they are being subject to fraud and conduct random assessments.

➌ Put several layers of security controls to access information.

➍ Conduct random fraud and cyber tests to identify vulnerable areas of the family office.

➎ Have a framework to respond to data breach incidents or cyberattacks to contain the damage and rectify the situation to normalize activities and prevent future recurrence.

| REPORTING

Family offices tend to have multiple portfolios that share the same objective, doubling risk and bringing unnecessary inefficiency in the implementation and oversight. There are many third-party software options and service providers that can consolidate reporting services to family offices and thereby simplify oversight.

| CONCLUSION

If not approached with clarity of purpose, establishing a robust long term investment program for a family office can be a complex and daunting task. It is an achievable objective, however, if approached through a methodical process which takes into account the true objectives of the family. Aligning different pools of capital to serve these objectives in a targeted way, as institutional investors with similar timelines have long done, is a time-proven method for success over the long-term.

Mónica Fuentes

Head of LatAm Outsourced Chief Investment Office, Latam J.P. Morgan.

J.P. Morgan

Leading global financial services firm with a legacy dating back to 1799.

jpmorgan.com