Families are like trees. Over time, their branches grow and their roots deepen. Some grow tall and strong for hundreds of years, sending seeds to far-flung fields. Others stay small, stifled by shallow ground and a lack of sun. But even the sturdiest tree can fall prey to an unexpected storm.

Your family, like a tree, is precious. It needs nurturing and protecting. But how can you make sure your family stays strong for generations? Let’s be clear. It’s challenging – especially if your family has grown to take on many new family members, each with different views on its future. But it’s possible to stack the odds in your favor.

How? By having a family strategy. Maybe you’ve heard about them and want to know more. Perhaps you’ve started setting up a family strategy but got stuck along the way. Or you might be wondering how you can keep your strategy alive for years to come.

Of course, there’s a lot to keeping your family and its wealth on track. But it all boils down to one simple thing: family members of all generations working together to develop and sign up to a successful family strategy.

“Strategy” is a word much used but often misunderstood. In a nutshell, it’s a plan that aims to achieve a goal. So a family strategy is a plan that aims to nurture and secure the family and its wealth for generations. It includes definitions, structures, policies and agreements focused on achieving those goals. It also defines the family’s members and their shared values, purpose, vision and mission – which then guide their roles in the family. And it covers all family assets like businesses, real estate, finances and collections – plus shared activities that aim to bring the family closer together.

The family strategy starts working long before it’s signed and sealed. The very act of creating it can unite the family. Family members often emerge from the questions, discussions and emotions that arise better understanding their relatives, each other’s goals, and their place in the family. From there, families can build on these foundations and work to preserve and grow everything they stand for.

| HOW FAMILIES WORK TOGETHER

An operating business might be some families’ main source of wealth. For others, the family business might be long gone. Whether or not your family has a company, over time, your family is likely to grow, change and become more complex. To keep it successful, happy and united, it’s important to focus on “family dynamics” – the ways family members interact with each other.

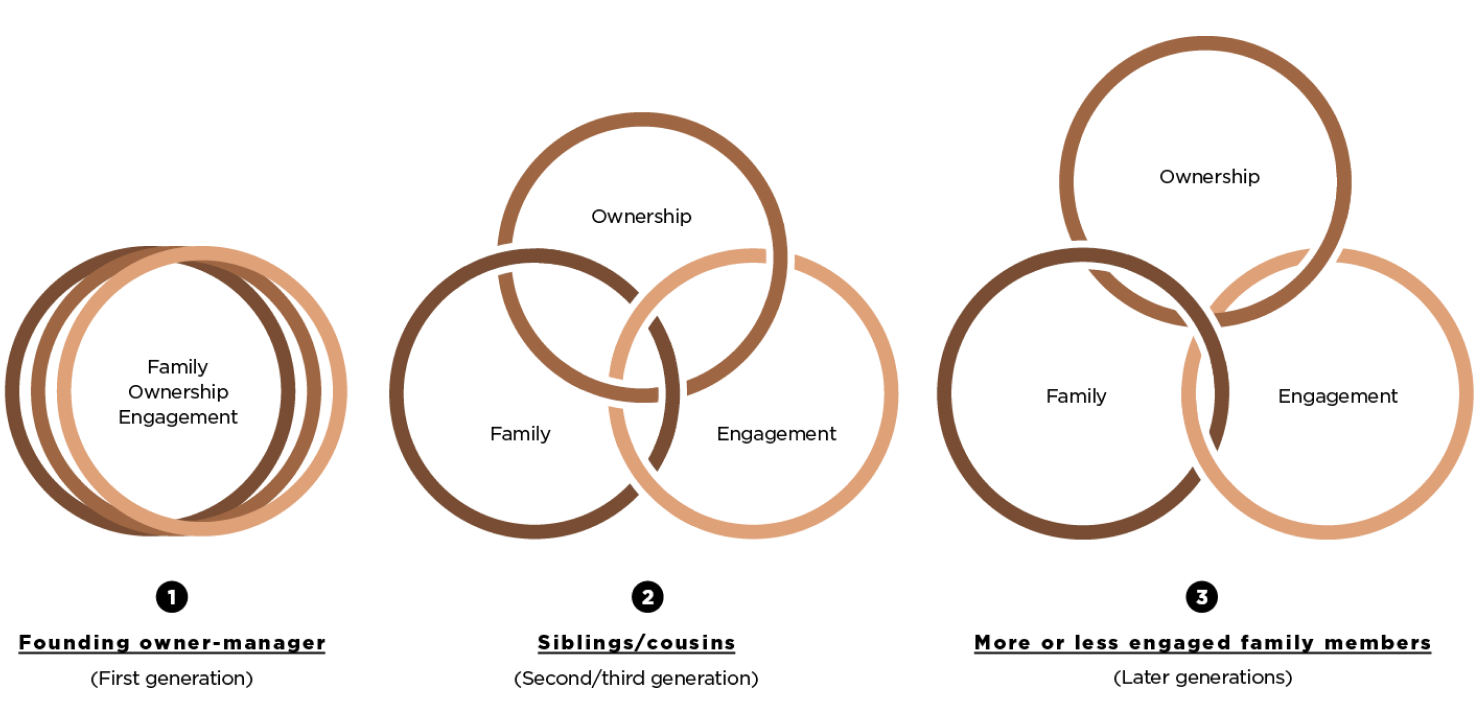

But there’s much more to nurturing family dynamics than talking about a family business. It embraces many factors, which is brought together in a model called the “family enterprise system”. The model builds on the traditional family business system seen regularly in family governance literature, and includes all family members, assets, activities and ownership rights.

| THE ENTERPRISE FAMILY SYSTEM

Here’s what the three circles mean for family members.

Family membership

These are all members of the family. Some might find it easy to define who belongs to the family, and their rights and roles in the family enterprise.

"A family strategy is a plan that aims to nurture and secure the family and its wealth for generations"

— UBS Family Advisory

Enterprise engagement

This covers all the wealth a family owns where a family member might have a role. For example, families may or may not be involved in an operating business. But there are many more ways they might engage, such as in financial assets, real estate, collections or assets reserved for family philanthropy.

Enterprise ownership

This refers to family members’ legal ownership of assets in the family enterprise. Such ownership gives them controlling power – or at least the power to influence decisions – within all or some parts of the family enterprise.

| WHERE DO I FIT IN THE FAMILY ENTERPRISE?

The family enterprise system model lets everyone know where they fit in the enterprise, and what that means for them – for example, how they can interact and influence the rest of the family. It also helps families balance everyone’s interests and ambitions (such as young people who see themselves as future leaders), and avoid discontent.

Let’s look at each area:

➊ The central position. A family member in this position will have control and influence over the whole family enterprise. For example, a family member, who founded the operating business, is a majority shareholder of the family business and has an executive role in it.

➋ Family members and owners of family enterprise assets. These are family members who are owners of family enterprise assets. For example, someone who receives dividends from the business, but isn’t involved in running the business.

➌ Family members who don’t own any part of the family enterprise but are involved in running it. These family members work for the family enterprise but don’t receive any dividends or profit shares. For example, a younger family member who’s an employee of the family business but not yet a shareholder.

➍ People from outside the family who work for the family enterprise and have ownership. These might be non-family shareholders and employees of a family business. For example, a senior executive from outside the family who holds shares in the family business.

➎ Family members only. These are family members who don’t work for or own assets in the family enterprise. For example, those who are too young to get involved in the family enterprise or in some families the spouses.

➏ Enterprise owners only. These are non-family and non-employee shareholders of any family businesses. For example, a CEO of the company that still holds a small percentage of the shares.

➐ Enterprise engagement only. These are non-family employees in the family enterprise who don’t own any parts of it. For example, an employee from outside the family who works in the family office.

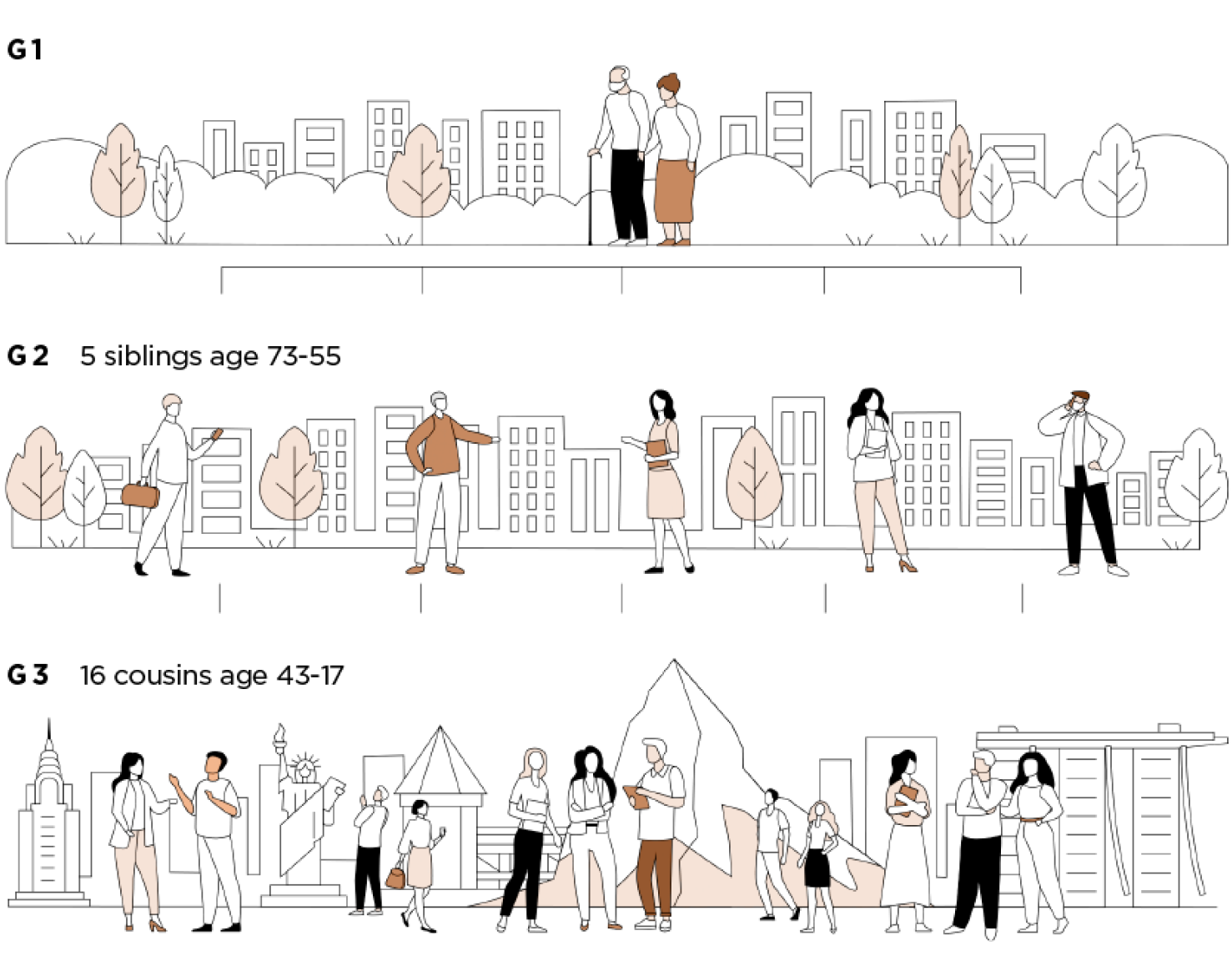

| THE CHALLENGES OF CHANGE

Family enterprises are always changing – especially when wealth passes between generations, for example, when members become adults and, in turn, owners or employees of the family business. Communications and decisions also become increasingly complex when families grow and new members join.

At UBS, we see family enterprises drifting apart over time. To keep everything in balance, it’s important to establish the right governance processes.

Concentrated power

When family businesses start out, the first-generation founder often leads the company and family, and makes the big decisions. Family members also tend to be close, living in the same household or meeting regularly.

This can lead everyone to believe that they understand the family, its business and its goals. That may be true. But it’s not always the case. Even in these early stages, to keep the peace, families often avoid tricky discussions on topics like:

● The roles family members assume or expect to have in the family business.

● Where the family business is headed.

● How the family reinvests money into its business, or shares it among family members.

● Who will own the family business in the future.

● The longer families avoid discussing topics like these, the bigger the threat to the entire family enterprise.

When the cracks start to show

As figure 5 shows, families diverge when wealth transfers between generations. This is often due to:

● Family members having different priorities and interests, such as ambitions outside the family enterprise. For example, a son that the family expects to be a future CEO might prefer an academic career in a university. Or an entrepreneurial daughter might want to pursue her dreams elsewhere, beyond the family business.

● Poorly matched responsibilities, causing discontent and resentment. For example, a family member might become an owner of the family business – and as such, gain new rights and powers to decide on the family enterprise’s future. However, that person might lack the experience and qualifications necessary to wield that power wisely. Take the case of a 14-year-old who inherits the company shares of her recently deceased parents. Because she is so young, a legal guardian might need to fulfil her roles until she turns 18. Even then, other owners of the business might not agree or feel comfortable with this approach.

● Emotionally and geographically distant relatives, with vastly different opinions, values, lifestyles and plans that are tricky to agree on. It can be hard enough for siblings to agree on such matters. But when the family gains even more family members – such as spouses and cousins in different countries – unifying the family can feel like an impossible task.

Knowing about these risks upfront can help you plan for them in your family strategy. For example, in the “first generation” phase of your family, major parts of your strategy might involve topics like:

● Defining who collectively owns the family business.

● Setting up proper governance for the business, such as a board of directors in a privately owned company and formal processes for making decisions.

● Defining the future leaders of the family business.

"You will never truly understand your relatives until you have to share an inheritance"

— Mark Twain

In the “later generations” phase, your family strategy might focus on matters including:

● Managing the family’s investment portfolio.

● Family members selling or buying shares in the family business.

● Reviewing the family’s values and communication channels.

Your family strategy can also prepare your family for another major risk that’s often overlooked: losing a key person in part of the family enterprise. With training, a family member might be a perfect replacement. Or you might consider someone from outside the family to be a better fit.

William Kirst

International Private Wealth Advisor, UBS - Nuval Wealth Partners.

ubs.com

UBS

Global firm providing financial advice and solutions to wealthy, institutional and corporate clients worldwide.

ubs.com