Most SFOs draw on the expertise of a variety of outside advisors, including lawyers, accountants, bankers, insurance providers, investment advisors, philanthropic consultants, and information technology specialists, among others. Seeking advice when needed, contracting for services, and coordinating the efforts of these specialists is a major responsibility of the SFO.

A well-run SFO will have a clear process for selecting and vetting advisors. While many members of the SFO team will have experience working with various service providers, it is important for the team to have clear procedures for selecting advisors to avoid conflicts of interest or playing favorites. Many SFOs establish budgets for advisor-related expenditures on an annual or more frequent basis, thereby prioritizing needs and giving SFO staff clear parameters for defining the scope of each project with advisory team members.

Performance of existing advisors should be reviewed frequently to ensure the services they provide are of high quality and appropriate to the problems the SFO faces.

Important questions to ask on a regular basis include:

➊ Is family privacy and confidentiality respected?

➋ Are fees appropriate to the work accomplished?

➌ Are the advisor’s services relevant, comprehensive, and delivered on a timely basis?

➍ Does the advisor alert SFO staff to newly arising or unexpected issues or opportunities?

➎ Does the advisor coordinate with other service providers working on the same issues?

While many SFOs seek to develop in-house expertise in certain areas, many SFO activities can be outsourced, which may offer the family greater access to expertise at lower cost. An extreme example of this trend is the virtual SFO, an entity without an office or even dedicated staff of its own; rather, SFO services are provided by a group of advisors on a contract basis, quarterbacked by one of those advisors.

The advantages of having an in-house, dedicated team to manage the SFO are clear:

➊ The team's focus will be undivided; its skills will be matched to the needs and requirements of the family, and the SFO’s specific assets rather than those of each team member's own general client base.

➋ The family's privacy and confidentiality will be maintained, and the expertise will be on-call and available whenever needed. Highly confidential and mission-critical services should be the first priority when determining which activities will be handled in-house.

➌ Generally speaking, in-house professionals will tend to be more focused on and responsive to the family’s needs, and their work will be under the sole control of the family.

Having said that, the advantages of outsourcing SFO services are also significant:

➊ Lower cost, exposure to a broader range of advice and the perspective and experience gained from serving multiple similarly situated families.

➋ Economies of scale and access to higher-level expertise, particularly in areas where the SFO’s investments or needs don't justify the expense of a full-time individual or bespoke service.

➌ Highly complex services requiring substantial capital investment and delivered in rapidly changing environments and circumstances should be the first priority when determining which activities will be outsourced.

➍ Generally speaking, outsourced service providers tend to have better access to a wider range of information and are subject to the discipline and best practices of the wider marketplace.

| STRATEGY AND GOVERNANCE

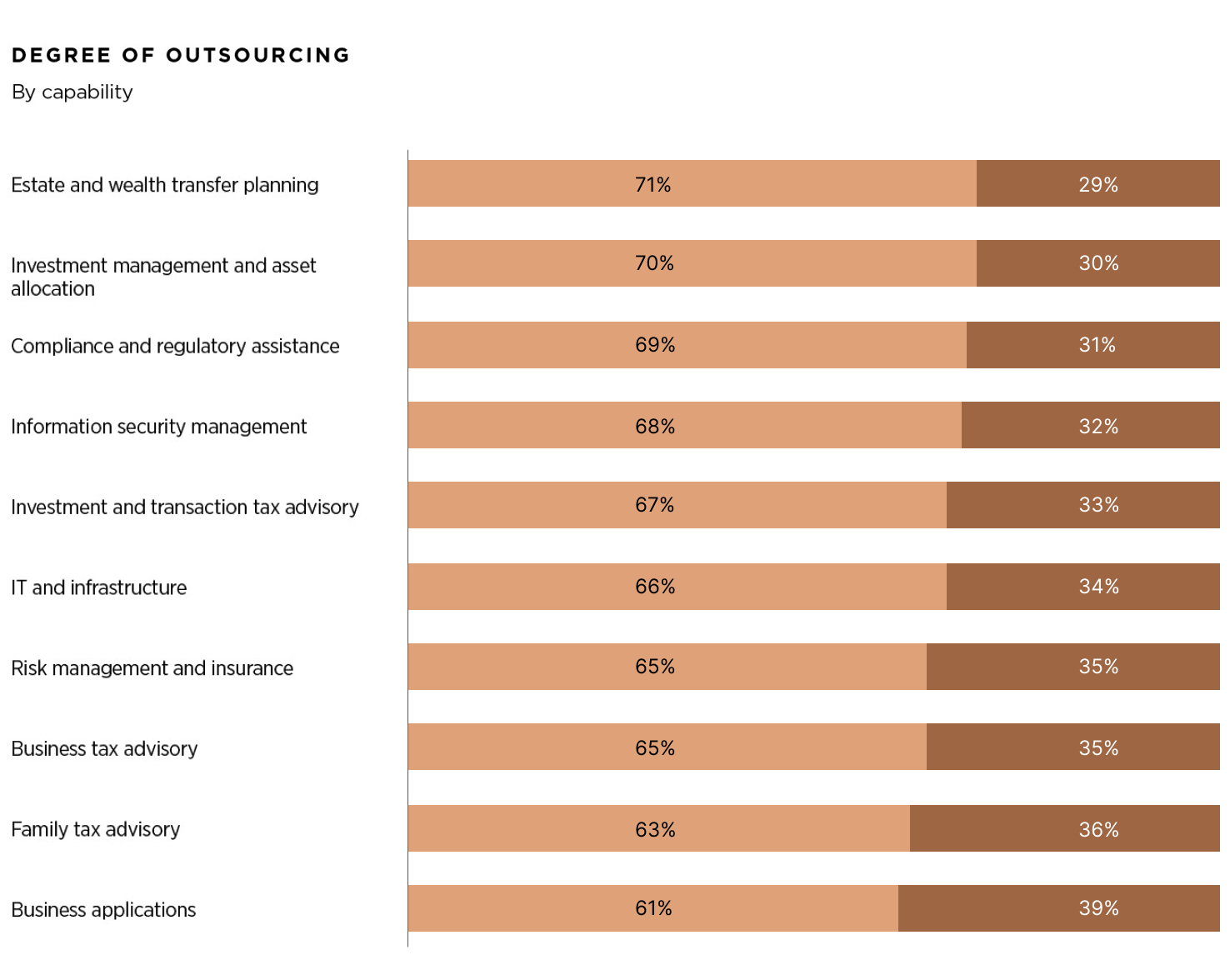

To address a multitude of external demands and pressures, family offices are considering outsourcing to strengthen their tax, risk management, investment and technology capabilities.

On average, 67% of family offices are either currently outsourcing or considering outsourcing in some area. This highlights that, whatever aspects they are leading class in, family offices are generally still considering the outsourcing of at least some aspects rather than building capabilities.

While only a minority currently outsource, the fact that a majority of family offices are now considering doing so may suggest a shift in the approach to dealing with growing challenges.

Marc Sharpe

Founder, The Family Office Association (TFOA).

tfoatx.com