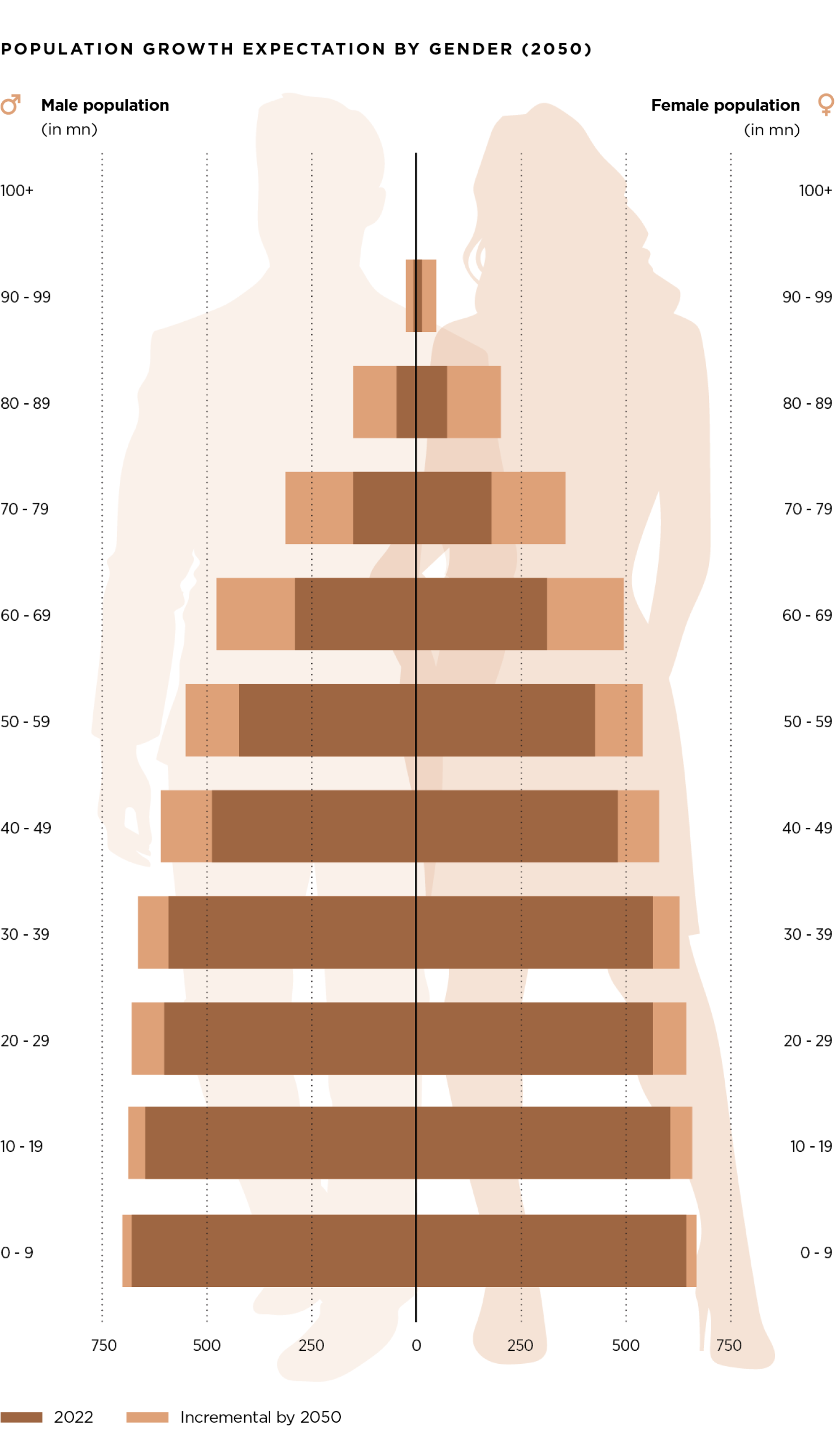

At the heart of our Supertrend Silver economy lies the projection that the world’s senior population will double to more than two billion by 2050. This shift will create demand but also unearth challenges that call for innovative solutions – in the healthcare, insurance, consumer and property markets. And while today’s seniors play an important role for companies that are currently catering to this population, the long-term trajectory will be underpinned by the younger cohorts of today as they age.

As we look back at the accelerated adoption of new behaviors, solutions and technologies – including in the digital space – we expect that they should remain in place going forward.

| ONES TO WATCH

➊ Biopharmaceutical, medical technology and life sciences companies that address conditions affecting the elderly through innovative products, such as RNA therapies or antibody-drug conjugates.

➋ Providers and operators of well-managed senior housing, managed care organizations and telemedicine operators that can direct patients to the most efficient care setting.

➌ Health and life insurance companies, private wealth advisors and asset managers with strong pricing capabilities.

➍ Consumer companies focusing on basic needs, as well as the more discretionary wishes of senior consumers, such as tourism and beauty product companies, or manufacturers of prescription glasses and hearing aids.

| THERAPEUTICS AND DEVICES

Backlog burden

Healthcare remains the sector most profoundly affected by an aging population in the long term, but pandemic-induced changes have altered the near and medium term perspective. Many patients have missed medical check-ups, appointments and diagnostic procedures due to the prioritization of COVID-19 patients, combined with a reluctance on the part of many patients to seek care amid concerns around infection risk on healthcare premises. In the UK, for example, a House of Commons report in December 2021 pointed to close to six million people waiting for care – the highest level on record – with 300,000 patients waiting more than a year22. Similar developments can be seen in other countries and regions. As a delay in care can lead to unnecessary disease progression, healthcare providers will need to tackle this backlog of patients over the next couple of years, with respective volume implications for the producers of therapeutics and medical devices.

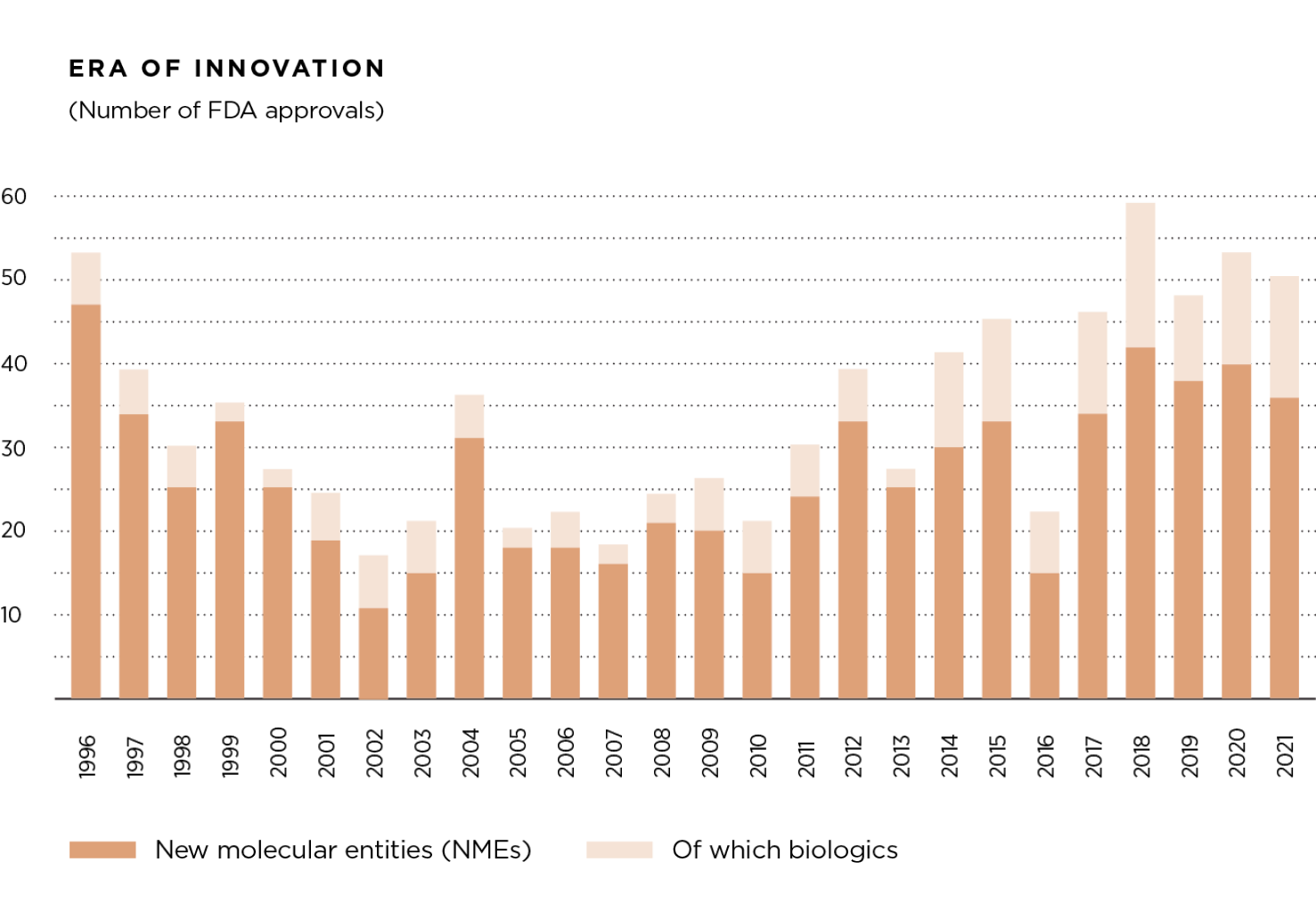

In terms of the bigger picture, we note that the incidence of many chronic diseases increases with age, with co-morbidities (i.e., patients having several diseases concurrently) being a common occurrence. While disease-modifying drugs for some of the most burdensome age-related diseases such as Alzheimer’s remain elusive, with the advent of new biotechnologies, notably nucleic acid therapies, antibody-drug conjugates and cell and gene therapies, we think the industry could deliver therapy breakthroughs in diseases with significant unmet needs, helping to sustain the innovation trajectory for years to come. For example, the rapid uptake of mRNA technology for certain COVID-19 vaccinations should help to instill confidence about other mRNA applications in innovators, regulators and patients.

The flip side of the coin of such innovation is the cost. Based on the historical trajectory, healthcare costs are expected to continue to rise at a rate of several hundred basis points above gross domestic product (GDP) growth. Solutions are needed to contain these costs, and we think technology will play an increasingly important role in terms of prevention, (early) diagnosis and treatment. Disease prevention is highly cost-efficient. Where prevention is not feasible, experience shows that earliest-possible diagnosis – enabled by technological leaps in liquid biopsies (an application of genetic sequencing) or medical imaging, for example – improves the survival of patients and typically mitigates costs. Finally, we cannot imagine a future in which patients still trade in handwritten doctors’ notes for prescription medications – making it a question of when e-prescriptions and deliveries by online pharmacies will finally go mainstream.

We believe that the focus on value-creating innovation is critical, as it gives pharmaceutical, biotech and medtech companies some negotiating leverage in the face of steepening healthcare costs. We thus focus on companies that have demonstrated strength in innovation historically, or with regard to the technologies outlined above and/or are cost leaders in their respective geographical markets.

| CARE AND FACILITIES

The future is choice

An aging population requires dedicated care options and facilities. Today’s senior cohort often live a healthier and more active life than earlier generations, which enables them to live independently for longer and they seek to maintain this lifestyle as long as possible. The one-size-fits-all retirement home of the past will no longer satisfy the diverse demands of this cohort. Builders and operators of dedicated senior housing concepts, ranging from assisted living facilities and shared (senior) housing to care-intensive nursing homes, will therefore play a critical role in meeting this demand. Having said that, we acknowledge the fine line that publicly-traded companies will need to tread when trying to satisfy two very important – and different – stakeholders: care home residents and shareholders. Those companies that do not get it right can find themselves mired in controversy, as is the case of a French care home operator that was recently accused in a book of mistreating elderly residents to save costs.

Beyond the physical infrastructure, we have seen examples of highly accelerated digital adoption during the pandemic. Take the acceptance of telemedicine by both patients and providers as a normal course of daily life. The most innovative telemedicine operators are cognizant of the value proposition that comes from broadening their offering from urgent care toward chronic care, opening up a vastly bigger market. In fact, a recent McKinsey study suggested that by 2025, up to 25% of the cost of care for Medicare patients in the USA could shift from the clinic to the home23 – a development in which telemedicine, complemented by remote diagnostics, would act as a critical enabler.

Within the field of care lies a problem: a shortage of nurses. This issue will likely deteriorate in the future, particularly as healthcare systems work through the pandemic-related medical procedure backlog. We are cognizant of surveys indicating that a quarter to half of the nurse workforce are reconsidering their career due to factors such as fatigue, compensation and a lack of recognition. While this development warrants political action, it nevertheless presents both challenges and opportunities for private healthcare providers and specialized companies, such as healthcare staffing solution providers.

| HEALTH AND LIFE INSURANCE

Pandemic highlights importance of safety net

Seniors have found themselves in the eye of the storm when it comes to the COVID-19 pandemic. Besides their vulnerability to a severe course of disease, the International Monetary Fund (IMF) suggests that the pandemic could force more people to retire early given poor labor market conditions, thereby lowering pension levels and increasing the risk of old-age poverty24. The IMF also sees the pandemic hitting pension systems structurally: disability claims might increase while funding suffers from a contracting wage base and/or a temporary lowering of contribution rates. On the asset side, financial market volatility might weigh on pension funds’ balance sheet positions. Finally, extensive state support measures during the pandemic put further pressure on public finances, which could affect state-funded or state-guaranteed pension systems in the long term. In our view, these trends reinforce our view that there is a growing need for private sector pension solutions.

The pandemic’s strain on private sector health insurance businesses has been rather limited until now. In developed economies, public health systems (ultimately the taxpayers) are poised to absorb the majority of COVID-19-related costs, with many local differences. Depending on the region, however, temporarily elevated death rates could weigh on life insurance earnings. In the USA, the National Center for Health Statistics (NCHS) reported that overall life expectancy decreased to 77.0 years in 2020 vs. 78.8 years in 2019. COVID-19 ranked third in terms of causes of death (after heart disease and cancer) in the USA in 2020. According to the Swiss Re Institute’s sigma report26, Latin America and in particular Brazil and Mexico also face high loss ratios on life insurance. However, excess mortality should fade as the adoption of COVID-19 vaccines is reflected in the statistics.

Nevertheless, we believe that the need for life and health insurance is still on the rise. Moreover, we believe that the pandemic has increased general awareness regarding health risks. The above-mentioned sigma study confirms this view, citing higher risk awareness as a boost to global life premium growth, which is expected to increase by 2.9% and 2.7% in 2022 and 2023, respectively – above their historical trends. The strongest growth contribution is expected to come from protection products. Overall, we see further scope for insurers to expand in underpenetrated markets, especially via online distribution.

| SENIOR CONSUMER CHOICES

Ready to spend

Despite the above-mentioned challenges with regard to future seniors’ finances, we note that today’s cohort are a powerful consumer group with high spending power, reflecting the accumulation of wealth over the course of their life coupled with inheritances received around retirement age – another effect of increasing longevity.

A (nascent) trend we are closely watching is the return of travel and the consumption of experiences as we tentatively emerge from the pandemic. Travel came to a near standstill at the height of the pandemic, which put many private travel-related companies without a sufficient safety net out of business and created existential crises for publicly-traded ones. Now people are ready to hit the road once again. Given the pent-up demand, coupled with a high savings rate throughout the pandemic, we expect a big initial boost to bookings. The medium-term trajectory will in all likelihood depend on the presence and level of continued mobility restrictions, inflationary pressures on travel prices and the potential resurgence of COVID-19 or other pathogens. We see asset-light businesses and offerings that are largely free of mobility restrictions as relatively advantaged, as more asset-heavy business such as cruise lines had to increase their indebtedness during the pandemic, which could potentially weigh on their financial profile against the backdrop of rising yields.

Residual healthcare items also fall under this subtheme, given the fact that they are to a large extent typically covered out-of-pocket by a patient (e.g., hearing aids or teeth implants). Finally, we think it is important to understand the consumer preferences in emerging markets given the significant proportion of future senior populations located there. While we – based on sources such as the Credit Suisse Emerging Consumer survey and multinational corporations’ presentations – acknowledge the sustained brand equity of developed markets’ brands in emerging markets, we are aware of the possibility of changes to such consumer behavior, which could create downside risks for incumbents.

Credit Suisse

Global investment bank and financial services firm, based in Switzerland.

credit-suisse.com