In the past few years, there have been countless articles about China’s growing investment in Mexico. Most of the articles have a similar headline, something along the lines of “China Companies Bypass US Duties By Going Via Mexico" (Bloomberg) or “How Chinese goods dodge American tariffs'' (BBC). The story reported is that the primary (and presumably only) reason for an increase in Chinese investments in Mexico is as a backdoor into the U.S.

Since the Trump administration implemented tariffs on Chinese goods in 2018, Chinese companies have been forced to pay a 25% levy on direct exports to the U.S. “Nearshoring” is a term frequently used to describe the recent trend of U.S. manufacturing moving from China and Southeast Asia to Mexico. To counter the effects of nearshoring on their export economy, Chinese companies have increased production in Mexico for products that are destined for the U.S. For Chinese car manufacturers, this strategy can reduce tariffs to as low as 2.5% for car exports and 0-6% for auto parts.

Since the tariffs were announced, Chinese investments in Mexico have increased considerably, with direct investment from companies rising from 38 million USD in 2011 to 386 million USD in 2021. This trend is likely to continue, as Chinese companies announced plans for more than 41 manufacturing and logistics projects in Mexico during the first quarter of 2024 alone. The pathway into the U.S. that Mexico offers Chinese companies is certainly a big part of why investment in Mexico has increased, but it is not the only rationale behind the growing Mexican-Chinese partnership.

| THE STORY NOT TOLD - CHINA’S INTEREST IN MEXICO’S DOMESTIC MARKET

Often omitted from these articles is the developing story of China's interest in Mexico’s domestic market, now the 12th largest in the world and home to over 129 million people. If China was merely interested in Mexico as a “backdoor” into the U.S., this partnership would be more threatened by increasing U.S. scrutiny of Chinese-produced exports from Mexico. Given their interest in contributing to a developing and diversified domestic market with a growing middle class, China seems poised to invest in Mexico for the long-term. For Chinese companies and investors, there are numerous parallels between the two countries that suggest a strong long-term partnership.

Like Mexico, China rose to economic prominence through investing in manufacturing. Once an underdeveloped country, liberalization reforms by China in the 1980s led to an industrial revolution. With a huge rural population, China had access to a large low-cost labor force and quickly became one of the world’s leading exporters. While some other Asian countries stayed with low-cost manufacturing, China’s increased emphasis on quality and technological innovations helped it surpass the U.S. by 2010 as the leading manufacturer in the world.

China’s rise has facilitated the exponential growth of its middle class, from an estimated 39.1 million people or 3.1% of the population in 2000 to over 707 million or 50% of the population by 2018, according to the Pew Research Center. Unlike countries in Europe and North America, which grew into economic powers long before the internet, China’s industrial transformation happened in parallel with its digital transformation. This parallel transformation accelerated the positive impact for the middle class: rising manufacturing wages translated into disposable income, and these were matched with a wide variety of digital solutions in fintech, ecommerce, and O2O (online to offline) services by companies like Tencent, Didi, Meituan and Alibaba. These digital solutions were frequently superior in price and quality, and created a virtuous cycle of productivity and purchasing power in the economy.

"Unlike countries in Europe and North America, which grew into economic powers long before the internet, China’s industrial transformation happened in parallel with its digital transformation. This parallel transformation accelerated the positive impact for the middle class"

Mexico had fallen behind China over the last decades in growth; but today, there is strong momentum behind Mexico again and important parallels to China’s story. While China dwarfs Mexico in terms of GDP size with 18.5 trillion USD compared to 2 trillion USD, Mexico has actually surpassed China in terms of GDP per capita based on purchasing power parity (PPP) with the IMF reporting figures of 25,960 USD for Mexico in April 2024 compared to 25,020 USD for China. For nominal GDP per Capita, China still outperforms Mexico with around 13,136 USD compared to 8,742 USD for Mexico.

In Mexico, modern manufacturing skyrocketed after the 1994 NAFTA agreement, with huge factories appearing in border cities like Tijuana and Ciudad Juarez. Like China, Mexico has also invested in technological innovations to gradually develop a skilled labor force and offer high-quality products. The biggest industries include auto manufacturing, electronics and, in recent years, medical devices. As with China, the rise of manufacturing is actively producing a growing middle-class and a growing number of SMEs. While inflation mitigates the impact, wages have mostly outpaced inflation in the past several years and rose by as much as 12% in 2023. Mexico’s middle class has started adopting digital technology, especially after the pandemic, in the same domains of fintech, e-commerce and O2O, following the trajectory that happened in China a decade ago.

Mexico has developed a strong economic foundation, but the trend of “nearshoring” gives it a chance to rise to another level. To do so, Mexico must explore partnerships with both American and Chinese players. Since the mid-19th century, the U.S. has been Mexico's biggest trade partner and while this is unlikely to change anytime soon, Chinese-Mexico trade and collaboration is steadily increasing.

| THE GROWING PARTNERSHIP BETWEEN MEXICO AND CHINA

Automobiles

While much has been said about China’s auto production in Mexico, most reports focus on the export economy to the U.S. and leave out information on the growing domestic market for Mexico, in which they tend to import more affordable vehicles. Domestic vehicle sales increased by 24.4% in 2023 and are on track to rise again by 10-15% in 2024. While the dominant brands are Nissan, GM and VW, Chinese companies are growing their presence in the Mexican market. Last year, Mexico imported 273,592 units from China, and sales by SAIC Motor, Chery Automobile and Anhui Jianghuai Automobile Group (JAC) increased by 61.5%. Chinese manufactured cars collectively accounted for 19.5% of the national market in sales.

Additionally, electric vehicles only represent 0.5% of domestic scales, while hybrids represent 4.5%, indicating a potential blue ocean for EV manufacturers in Mexico. Sure enough, Chinese companies like BYD, MG, Chirey and the American giant Tesla all have plans to build EV and battery factories in Mexico. BYD has also deployed 20 electric buses in Mexico City in December 2023, with 35 more electric buses on the way.

| E-COMMERCE

China has also penetrated the exuberant e-commerce market in Mexico. With a 25% growth rate in online sales in 2023, Mexico is the fastest growing country globally for e-commerce, while Latin America is the industry’s fastest growing region, with a 16% growth rate in 2023. In Mexico alone, e-commerce is projected to be worth 29 billion USD in 2024 and expected to grow to 54 billion USD by 2029.

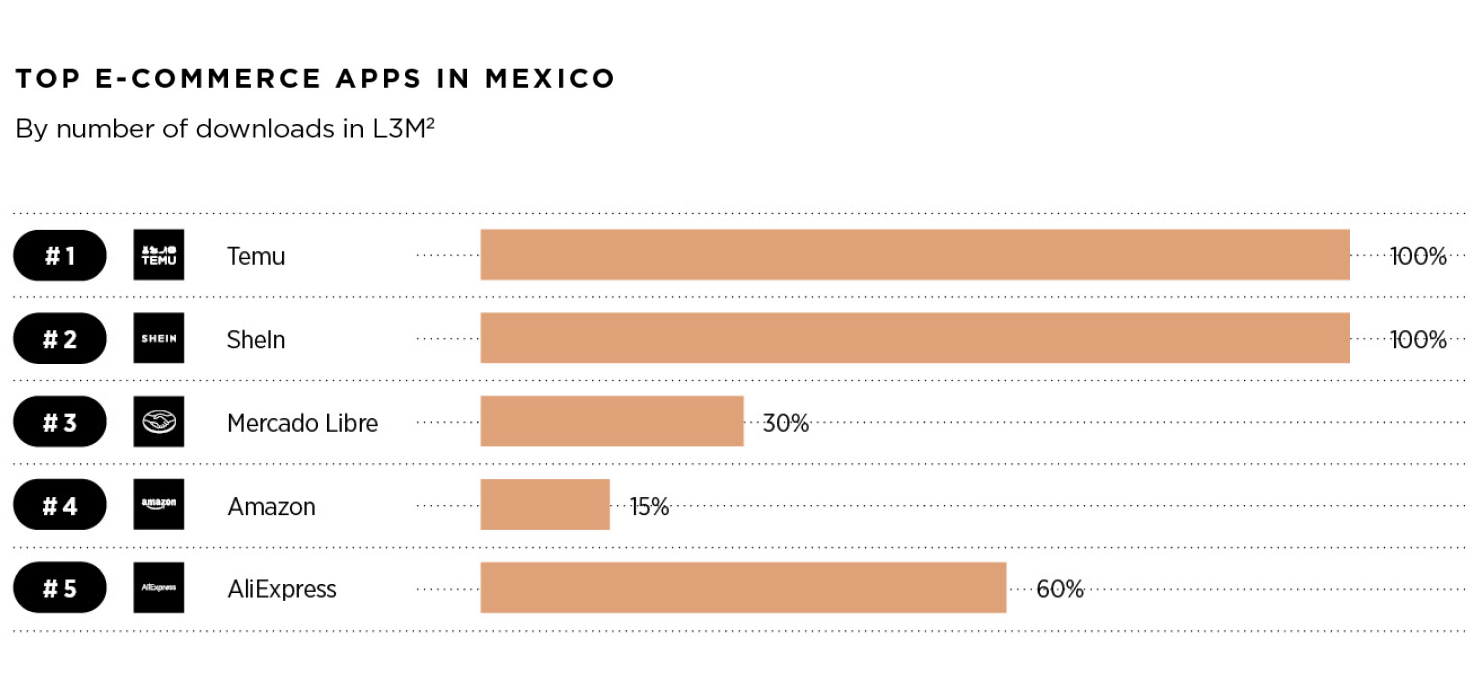

While the biggest companies in this sector are still Amazon, Mercado Libre and Walmart, Chinese competitors like Shein, AliExpress and Temu are catching up.

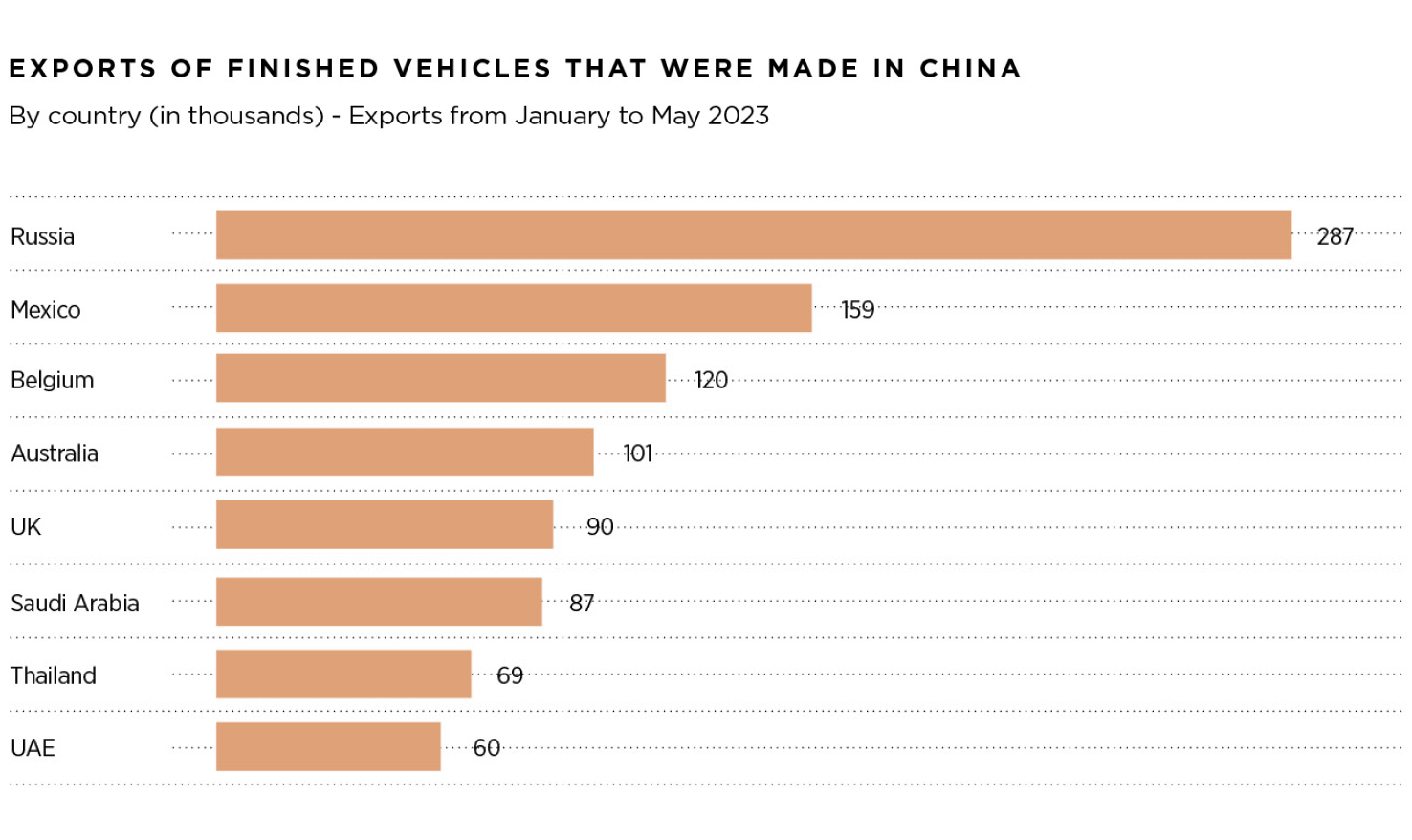

Seen from the Chinese perspective, the combined story of export to the US and domestic Mexican sales is even more compelling. In 2022, Mexico became the largest export market for Chinese auto manufacturers. In 2023, Russia overtook Mexico as the largest market given the aftermath of the Ukraine war, but Mexico continues to be solidly in second place.

While Walmart and Mercado have been in Mexico for decades and Amazon entered in 2015, Shein entered more recently in 2019 and Temu entered just last year. The growth of Chinese e-commerce companies is driven by a strategy of affordable pricing, aggressive marketing via social media, selling through various channels including WhatsApp, and alignment with Mexican culture. Currently, both Shein and Temu have an estimated 100% annual growth rate for gross merchandise value in Latin America, while AliExpress (part of Alibaba) has a 60% growth rate, compared to rates of 30% for Mercado Libre and 15% for Amazon. In the first half of 2024, app traffic in Mexico surged by 20% from the previous year with Chinese companies Temu, AliExpress and Shein logging 15 million, 11.2 million and 10.1 million respectively compared to 28 million for Mercado Libre and 24.5 million for Amazon.

"The growth of Chinese e-commerce companies is driven by a strategy of affordable pricing, aggressive marketing via social media, selling through various channels including WhatsApp, and alignment with Mexican culture"

These Chinese platforms are not simply taking advantage of a likely temporary tax advantage for cross-border ecommerce, they are investing in Mexico for the long term. Shein already runs two distribution centers outside of Mexico City and is scouting for a third warehouse of at least 35,000 square meters. Temu is setting up a huge warehouse north of Mexico City and considering launching a manufacturing facility to localize production.

Interestingly, Mexican e-commerce only represented 14% of total retail sales in the country compared to 47% in China, 32% in Indonesia, and 30% in South Korea. This suggests that there is significant potential for future e-commerce growth in Mexico. Until now, e-commerce has mostly been used by younger Mexicans in urban areas with a higher disposable income and level of tech savviness. Chinese platforms have a huge competitive advantage in deepening this e-commerce adoption in Mexico given the problems that they have learned to solve with respect to selection, marketing, payments, and logistics in China – a larger, more rural, older population with similar income levels to Mexico. The digital transformation of retail is an industry change that will benefit all parties - as Chinese platforms achieve success, they build the infrastructure that grows the entire e-commerce market, and helps both international and local players.

| TECH AND VC

Tech giants like Didi, Alibaba and Tencent (owner of WeChat) are all expanding their operations in Mexico. Didi, the Chinese ridesharing and delivery unicorn, entered Mexico in 2018 and has outperformed Uber since then, capturing over 56% of the ride-sharing market in sales. Currently, they operate in more than 100 cities and employ over 350,000 drivers and delivery personnel. The main reason for their success is that they offer more competitive prices than Uber; the average Didi trip in Mexico costs 65 Mexican pesos compared to 94 pesos per Uber trip. In addition, Didi has built a successful fintech business that offers credit cards and loans to Mexican consumers. Didi is deeply committed to Latin America, and plans to continue investing in both in-house ventures and third-party tech companies that support their ecosystem.

Alipay and Wepay, the two largest mobile payment providers in China, are also in Mexico. Alipay and Wepay belong to the two largest Chinese tech giants, Alibaba and Tencent, respectively. In China, these two companies enabled the middle-class and SMEs to leapfrog credit cards and avoid credit card processing fees in the process (fees that cost businesses 2% of gross sales on average). They have since moved into financing for SMEs that traditional banks deem too risky. As of 2020, they have financed over 10 million SMEs in China. With the high use of cash and low bank penetration in Mexico, there is tremendous potential in the country for Alibaba, Tencent and the companies with whom they partner or in which they invest.

The fintech company Stori is one of the 8 Mexican unicorns (private companies valued at 1 billion USD or more). Founded in 2018 by a team of Chinese and Mexican entrepreneurs with the mission of expanding credit card access to Mexico’s subprime population, Stori raised a Series A round of 10 million USD in 2019 from two Chinese venture capital firms, Source Code Capital and BAI Capital. These two groups also invested in the subsequent rounds worth 32.5 million USD, 200 million USD, 60 million USD and 212 million USD respectively. Today, Stori is the second largest neobank after Nubank in Mexico, reaching over 2.5 million accounts, and serving a much more underbanked population than Nubank.

The playbook used by Chinese e-commerce companies, tech giants and venture capitalists in Mexico show some consistent trends. These companies believe in the future of the Mexican middle class, because of its parallels with the historical rise of the middle class of China. Compared to US investors, who are often deterred by the subprime nature of the largest pool of potential customers, Chinese companies in Mexico have been more willing to tackle the un(der)banked problem. The past 5 years shows many examples of Chinese companies expanding their business models to Mexico and, upon finding profitability and in some cases blue ocean markets, deepen their commitment in the country for the long-term via core operations and investments in adjacent businesses or startups.

The developing Chinese tech strategy for Mexico aligns perfectly with what the economy needs. The Mexican tech ecosystem is in its nascency and needs capital, know-how, and large partners who can drive volume to a startup business. The emerging Mexican middle class has been traditionally underserved and needs better value products and services, which are much more likely to be provided by digital disruptors.

The adoption of Chinese car manufacturers, the growth of Chinese e-commerce players and tech giants in Mexico, and the commitment of investors in startups like Stori demonstrate that Chinese businesses have successfully penetrated Mexico’s market and are constantly improving in serving the needs of its middle class.

| WHAT MEXICAN ENTREPRENEURS AND INVESTORS SHOULD KNOW

With some of the world’s best experience in relevant verticals like fintech, e-commerce, supply chain, social media, and O2O, Chinese investors believe that they can offer Mexican entrepreneurs first-hand knowledge and expertise. The same tech giants that facilitated China’s digital transformation in the last 20 years are looking to expand into new geographies, and in Mexico they see a developing country that models China’s past trajectory.

In addition, these investors, whether corporates or institutional VCs, can bring a significant part of the Chinese ecosystem with them, facilitating significant follow-on investment and potential exits. They also have significant experience with leading these types of companies to IPOs. Helping create a more virtuous cycle of transactions can bring important dynamism and a healthy recycling of capital to the Mexican early and growth-stage capital markets.

As with any newer relationship, a Chinese-Mexican partnership will need to deal with cultural adjustment, and trust will need to be built through time and success. In export-oriented industries, U.S. pressure will continue to be a factor for Chinese-Mexican endeavors. However, as many companies have already shown, there is much to gain from working with experienced Chinese companies and investors, and in the years to come, these partnerships will likely multiply and flourish as Mexico continues on a path that China knows quite well.

Wenyi Cai

Founder & CEO, Polymath Ventures and Venture Partner of BAI Capital.

polymathv.com

Daniel Marion

Venture Capital Analyst, Polymath Ventures.

polymathv.com