As 2025 unfolds, Europe’s private equity and private credit markets are drawing increased attention from global investors. The continent is emerging as a uniquely attractive destination for institutional investors looking to diversify their portfolios during uncertain times, and GPs are re-focusing their investment efforts on the continent in expectation of more attractive opportunities. Both asset classes demand attention from institutional investors that have become overallocated to the US, and Europe is commonly the next step in portfolio diversification given its standing as the most developed private market ecosystem outside of the US.

| EUROPEAN PRIVATE EQUITY

Large Market Made of Small Businesses

Europe as a whole is an economic powerhouse, despite a reputation for modest growth. The continent’s GDP reached approximately $27.9 trillion in April 2025, placing it as the world’s second largest economic bloc, ahead of China and trailing only the United States (per IMF data). What distinguishes Europe is its composition of small and medium-sized enterprises (SMEs), which collectively account for about half of the region’s GDP. Many of these companies are family-owned and lack access to institutional capital, presenting a ripe opportunity for private equity partners to provide much-needed resources and expertise in business optimization, digital transformation, international expansion, and capital efficiency.

"Europe as a whole is an economic powerhouse... the continent’s GDP reached approximately $27.9 trillion in April 2025, placing it as the world’s second largest economic bloc, ahead of China and trailing only the United States (per IMF data)"

Navigating Attractive Opportunities

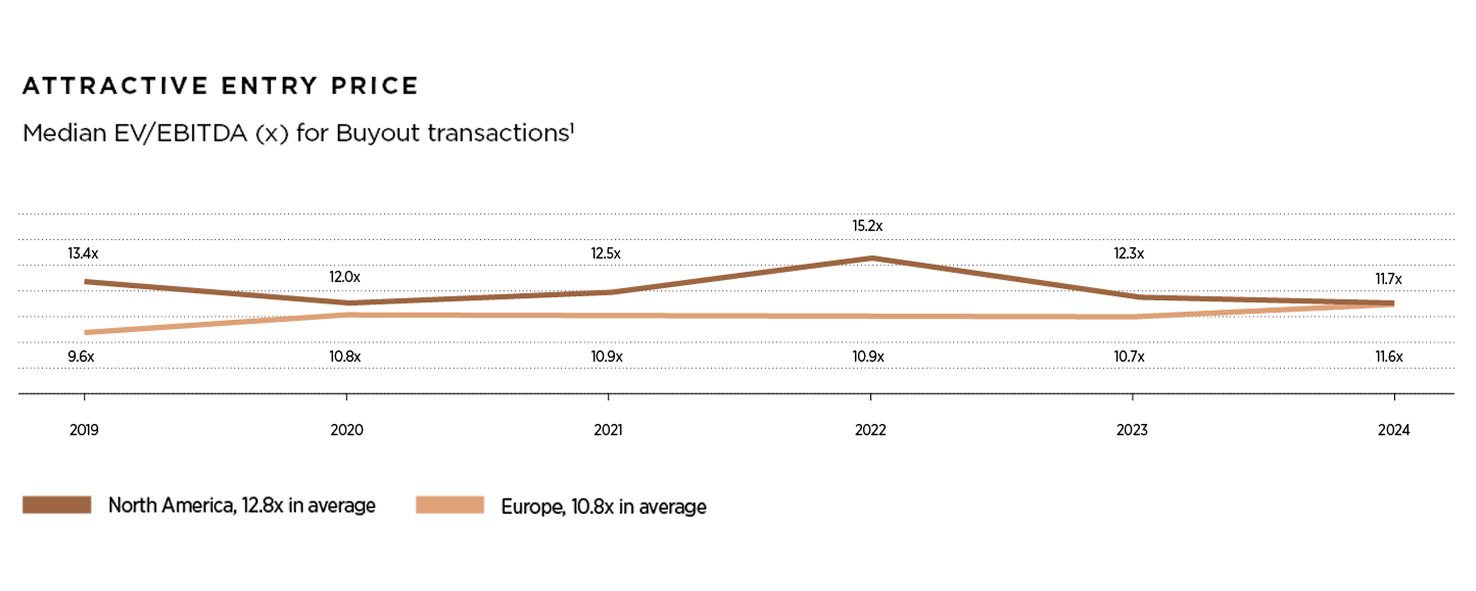

Unlike the highly mature and saturated US market, where mega-funds crowd the mid-market, Europe’s fragmentation and less developed private equity ecosystem means less competition for deals, and average purchase multiples in Europe reflect this. Since 2019, purchase multiples have been two turns lower on average compared to the US, meaning not only can managers purchase quality companies at a discount relative to the US, but they can also develop these companies and then sell them to US managers at a premium.

Local Relationships Are Key

As a patchwork of countries and cultures, Europe’s business practices and norms vary greatly across the continent. Therefore, a local presence is a must-have for private fund managers looking to build a pipeline in Europe and get access to quality deals. Given the prevalence of SMEs across the region and the highly local dynamics of each country, building trust across management teams, sponsors, and intermediaries is key. A proven, long-term dedication to the continent is quite important and differentiating, as European entrepreneurs have often encountered US and London-based investors entering their market, only to see these groups withdraw during difficult times.

Creating Value for Investors

As mentioned previously, many European businesses are smaller in size – the mid-market and lower-mid market dominate the European landscape. As such, the European landscape is quite fragmented, creating ample opportunities for managers to execute accretive acquisitions. Value creation through consolidation is one of the leading playbooks in the European mid and lower-mid market, helping businesses expand their product and geographical footprint. Of course managers also build value through providing resources to optimize the business, but the scale of these resources in the lower-mid market is typically less given the smaller firm size.

Sectors of Interest

Digitization and technology-enabled services are expanding rapidly in Europe, supported by regulatory initiatives, a skilled and highly educated workforce, and a continent-wide push for digital transformation. Consolidation is also reshaping fragmented industries such as logistics, professional services, and financial services, where local champions can be transformed into continental and even global leaders.

| EUROPEAN PRIVATE CREDIT

Where European Credit Stands Today

In a higher-for-longer interest rate world, the appeal of senior secured private debt is clear: recurring cash yields, robust covenant protection, and downside resilience. Europe is at the epicenter of this structural shift. Post-financial crisis banking regulation (Basel III) has constrained traditional banks, forcing them to retreat from mid-market lending. As a result, private lenders have stepped in, capturing 60% of mid-market issuance in 2023 versus just 38% in 2017.

Comparing European Credit to US Credit

The US market is much more competitive than Europe, as alternative sources of financing account for the majority of deals in the US, versus less than 25% in Europe (per Apollo). As a result, European opportunities tend to price 25-50 bps higher than in the US due to this competitive dynamic, plus regulatory, legal, and currency complexities with the region (per Kroll and Valuation Research Corporation). These complexities drive away competitive, yet are what make the European credit opportunity attractive for those that understand how to navigate it. European businesses also tend to be more conservative in their use employ less leverage, and employ less relative to their US peers.

| WHERE TO PLAY THE EUROPEAN CREDIT MARKET SIZE SEGMENTS

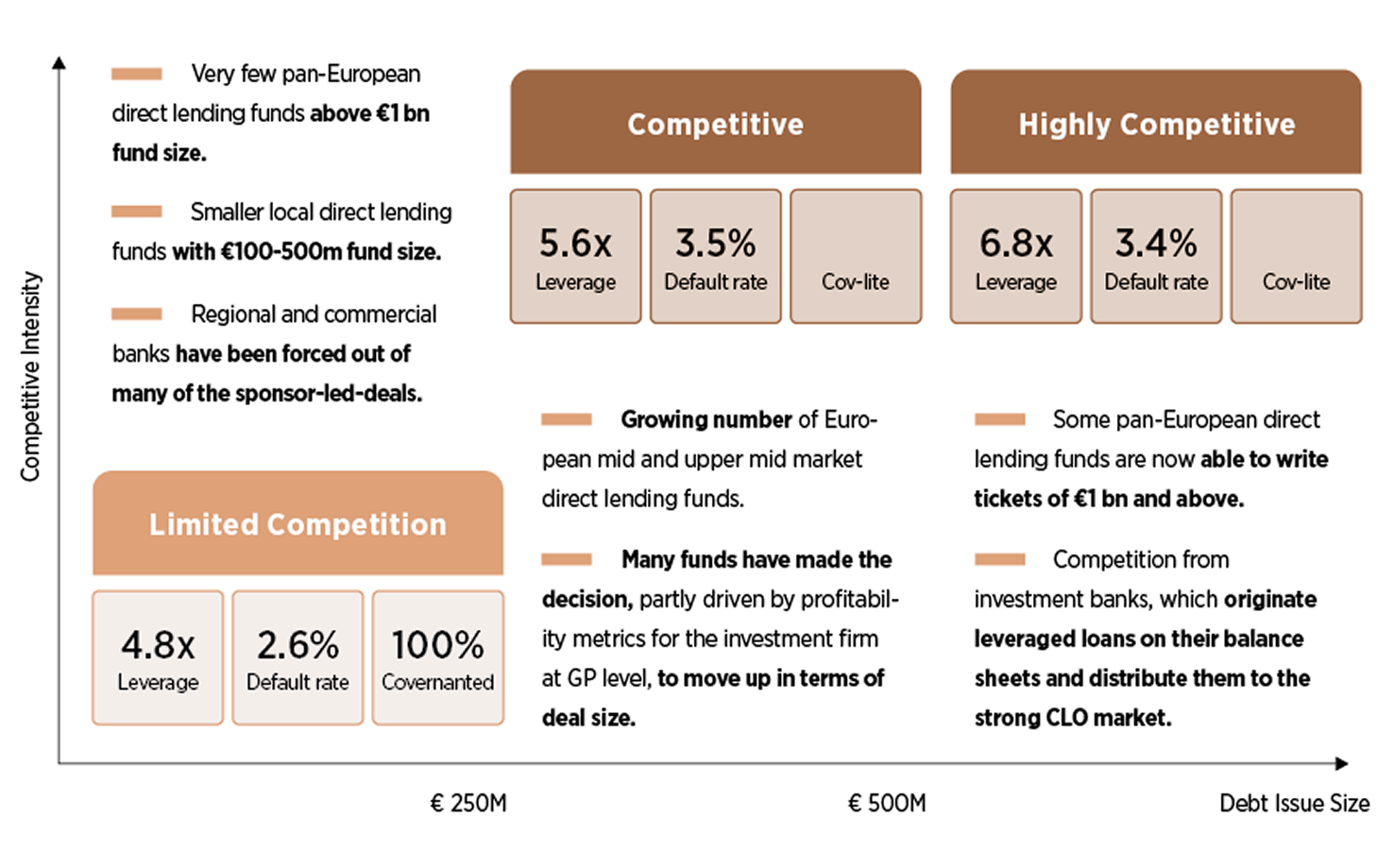

Just as in the US, the European upper-mid market and core mid-market are quite competitive and spreads are naturally lower as a result. Deals in the upper-end of the market are typically club deals with looser covenants and documentation. However, there is value to be found in the lower-mid market, where there is less competition and more attractive deals for lenders, with higher spreads, lower default rates, and stronger creditor protections.

European lower-mid market participants are primarily regional private credit funds and some regional banks, though they are not as active as in the upper-mid/middle-market. There are only a few pan-European funds in the lower-mid market that have the scale to support the M&A that are critical to sponsor’s value creation playbooks in Europe.

| EURAZEO’S UNIQUE POSITIONING IN EUROPE

Eurazeo has built a legacy as a leading European alternative asset investor, with a long-term dedication to Europe with a localized presence across the continent and a focus on Europe’s mid/lower-mid markets.

Eurazeo’s buyout teams have been investing in Europe for over 20 years and are based locally across several offices in Europe where Eurazeo has boots on the ground to meet management teams and sponsors prior to deals coming to an auction process. The buyout team focuses on quality assets in high-growth tech and services sectors, where the firm can partner with management teams to capitalize on international growth ambitions. As one of the most well-known investors in Europe and the large-cap resources the firm brings to bare with smaller businesses, Eurazeo is often a partner of choice for European operators.

Eurazeo’s private credit team has also been active for over 20 years and is one of the leading lenders in Europe. The team focus on the attractive lower-mid market segment, where it is one of the only lenders of scale. Eurazeo’s credit team is spread across Europe locally in five offices, and has established a deep sourcing network to ensure the team sees the full pipeline of opportunities across the continent. The team is highly focused on conservative underwriting and maintaining pricing discipline to create an attractive risk/reward profile for investors, which has proven a valuable differentiation in a competitive market.

Eurazeo

French private equity firm and investment group headquartered in Paris.

eurazeo.com